A Chinese state-owned firm tasked with building the country's

semiconductor sector is retesting U.S. waters by buying a small

stake in a chip maker whose exports to China are restricted due to

their military applications.

Tsinghua Unigroup Ltd. said in a U.S. regulatory filing on

Wednesday that it has accumulated a roughly 6% stake in Portland,

Ore.-based Lattice Semiconductor Corp. through share purchases on

the open market. It comes after Tsinghua Unigroup made an

unsuccessful attempt last year to acquire U.S. memory-chip maker

Micron Technology Inc., according to people familiar with the

matter.

Lattice makes low-power programmable microprocessors that can be

customized to run high-tech systems such as data centers and

telecommunications networks, as well as military gear such as

missile guidance systems.

While Tsinghua's investment is modest at $41.6 million, it

suggests Chinese interest in this technology. China's recent

semiconductor investments have focused on more mainstream

technologies such as smartphone processors and flash memory chips,

as the country seeks to build a competitive chip sector.

China's leaders have promised as much as 1 trillion yuan, or up

to $154 billion, in funding for chip development and it has

encouraged companies like Tsinghua Unigroup to pursue overseas

investments.

For Tsinghua Unigroup, the Lattice investment appears to be a

test to see if a modest investment would be allowed without running

afoul of the Committee on Foreign Investment in the U.S. on

national security grounds. The committee, known as CFIUS, is

charged with determining whether any foreign acquisitions or

investments pose a security threat—and if it decides that it does,

the transaction could be blocked.

In a telephone interview Thursday, Tsinghua Unigroup Chairman

Zhao Weiguo said he didn't expect the investment would require

review due to the small stake size and the fact that Tsinghua

Unigroup isn't obtaining access to Lattice technology.

"This is purely a financial investment," he said. "We don't have

any intention at all to try to acquire Lattice."

Two larger U.S. investment attempts by Mr. Zhao last year were

derailed in part because of concerns about a potential review from

CFIUS. Tsinghua Unigroup's $23 billion attempt to acquire Micron

would have been the largest Chinese overseas takeover if it had

gone through. In February, the company also backed out of a $3.78

billion deal to invest in disk drive maker Western Digital Corp.,

citing a decision by U.S. authorities to investigate the

transaction on national security grounds.

CFIUS reviews cases when foreign entities buy control of a U.S.

business, and the threshold for control could be a small minority

stake, unless the acquirer is a passive investment fund.

The Treasury Department, which leads CFIUS, declines to comment

on cases that may be before the committee, citing confidentiality

rules.

U.S. officials have said they believe foreign companies are

working in coordinated fashion to acquire strategic U.S.

technology. People close to CFIUS have said officials are looking

closely at the sale of semiconductor assets, which have been

tightly monitored for decades.

Mr. Zhao said Tsinghua Unigroup may increase its stake or sell

it based on Lattice's performance. He said he hasn't been in

contact with Lattice executives, although he said he would be

interested in other partnerships with the U.S. company.

Lattice representatives didn't immediately respond to requests

for comment on Thursday.

It isn't the first time Chinese parties have taken interest in

Lattice. In 2011, the Federal Bureau of Investigation charged two

Chinese residents with setting up a fake company to circumvent U.S.

export restrictions to purchase Lattice chips. In the indictment,

prosecutors said that the two men sought to buy the military

version of a Lattice chip that could be used for applications such

as missile guidance and radar systems. The commercial version of

the chip could be used for tasks like controlling mining

equipment.

According to court records, those charges remain

outstanding.

Lattice is a smaller provider of an expensive type of chip

called a field-programmable gate array, or FPGA. Unlike regular

microprocessors, which are hard-wired during manufacturing, FPGAs

can be programmed by the end user. This niche chip market is

dominated by two other U.S. companies: Altera Corp., which was

acquired last year by Intel Corp., and Xilinx Inc.

The 2015 global market for FPGA chips was $4.4 billion according

to data from Gartner.

Mr. Zhao said Tsinghua Unigroup aims to break ground next year

in Shenzhen on a memory chip plant announced last year. Analysts

have questioned how the Chinese company will move forward with the

plant after the investment in Western Digital fell through, as

Tsinghua Unigroup doesn't itself have the know-how to make memory

chips.

Mr. Zhao said his company now has a team of 200 researchers to

develop dynamic random access memory chips, after acquiring another

Chinese chip maker, Tongfang Guoxin Electronics Co., last year.

DRAM chips are widely used in personal computers.

The Lattice investment shows a strategic shift at Tsinghua

Unigroup after several unsuccessful overseas acquisition attempts

last year, said Mark Li, an analyst at Bernstein Research. The

company is now taking a more cautious, longer-term approach to

investment, he said.

"They are trying to be more careful, more discreet," Mr. Li

said.

The global FPGA market is niche compared to other types of

semiconductors like microprocessors and memory chips, but it

commands high margins, he said.

William Mauldin, Robert McMillan and Kate O'Keeffe contributed

to this article.

Write to Eva Dou at eva.dou@wsj.com

(END) Dow Jones Newswires

April 14, 2016 13:55 ET (17:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

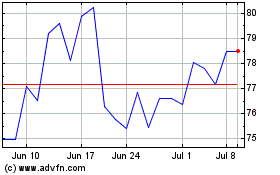

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

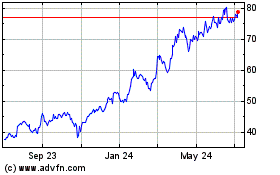

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024