By Ted Mann

LOUISVILLE, Ky. -- The new owners of General Electric Co.'s

sprawling appliance factory here say they have to slash the cost of

producing refrigerators and stoves in the face of tough, new

competitors, especially fast-growing entrants from Asia.

Those new owners: China's Haier Group.

The Asian appliance maker, which paid $5.6 billion for one of

GE's most storied businesses in early 2016, secured a tentative

labor deal this week that could avert a strike at the 6,000-worker

plant.

What remains to be seen is whether GE Appliances can thrive

without a wide-ranging conglomerate to lean on, and how deeply the

fates of workers here will change in the process.

Haier's purchase gave it access to GE's brand and catapulted it

to No. 2 in the U.S. appliance market behind Whirlpool Corp. It

also took over Appliance Park, a nearly 1,000-acre complex that

annually produces 4 million washing machines, air conditioners and

other appliances.

But the management of GE Appliances -- predominantly GE veterans

who stayed on after the sale to Haier -- say the park is losing

hundreds of millions of dollars a year, and must tighten its belt

to compete with overseas rivals like LG Electronics Inc. and

Samsung Electronics Co. that are pushing into the U.S. market.

GE Appliances and the IUE-CWA Local 83761, which represents

about 4,000 workers across the five factories at Appliance Park,

reached a tentative agreement on a new contract Monday. Union

members are expected to vote on the deal this week. It comes a

little more than one month after members handily rejected a

previous five-year deal.

"On average, when you vote a contract down, you end up with less

than what you had," said Dana Crittendon, president of Local 83761.

"We were very fortunate. It was important to get this first

contract under our belt."

Besides cutting labor costs, the company is also working to make

its factories more efficient, among steps to stem losses at the

Louisville facility.

Workers objected to some terms in the first contract agreement,

including language that would have limited bumping rights, the

ability for workers who get laid off to bump co-workers with lesser

seniority from lower positions. Company managers say the practice

is disruptive and drives up costs.

In the new agreement, which kept some of employees' bumping

rights, the company won new restrictions on overtime pay and a

lower entry wage. New full-time workers will start at $14 an hour,

compared with the current rate of $15.51. A new category of

temporary workers will begin at $12 an hour.

Haier is determined to cut costs because it paid a premium to

secure GE's business and expand its reach in the U.S. market, said

David MacGregor, an analyst with Longbow Research. "If you're

manufacturing appliances in Kentucky in dollar-denominated labor,

you've got to offset that somewhere," he said.

Having a manufacturing and distribution presence in the U.S.

gives Haier more flexibility than companies that produce goods

overseas and ship them in, he said. It avoids import tariffs and

helps the company more quickly react to changes in demand from U.S.

customers than overseas competitors.

Some Appliance Park employees with more than 20 years of service

can make as much as $25 to $40 an hour, said Bill Good, the

company's vice president of supply chain.

Over the years, wages grew out of proportion to competitors like

Whirlpool, Mr. Good said, because GE's business was effectively

hidden in its conglomerate structure. In some cases, national union

contracts with the parent helped boost wages for appliance workers

whose business wasn't doing as well as other GE units.

"We just got way out of balance," said Mr. Good, who previously

worked for Whirlpool. "I know exactly what our competitors were

doing."

He said the company planned to address personnel costs

gradually, as the older, better paid employees leave the company.

"Then we can get our wage structure right over the course of time,"

he said.

Some workers say they have been here before. Jerry Carney a

former union leader, recalled meeting with GE Chief Executive Jeff

Immelt in 2009. Mr. Immelt agreed to bring a production line back

from China if the union would agree to a wage freeze and the

introduction of a lower wage tier for new hires.

As a result, Mr. Carney and GE Appliances executives said, the

parent company eventually agreed to invest roughly $1 billion in

Louisville and expand several production lines.

But the wage tiers "divided us," said Steve Bobby, a 22-year

veteran of Appliance Park who was having a beer at a nearby pub

after a shift in Building 2, where hotel air conditioning units are

made.

Mr. Bobby said Appliance Park wages had helped him put two

children through private school. After Haier bought the company,

Mr. Bobby said, he cashed out a 401(k) account and paid off his

credit cards, truck and boat -- so he would have financial security

to vote against a deal, and risk a strike, if the company came

after senior workers for more cuts. "We're throwing the bone in

with the beans right now," he said.

He voted no on the November contract, but said he was planning

to support the deal this time around rather than risk a layoff by

voting no. "Don't need to start over at the bottom," he wrote in a

text message this week.

Executives such as Mr. Good say they think they can keep the

plant's fortunes strong if they can swing more legacy employees to

Mr. Bobby's view and bring along the lower-paid workers. "I love

American manufacturing," he said. "But I need them to kind of help

themselves a little bit."

Write to Ted Mann at ted.mann@wsj.com

(END) Dow Jones Newswires

January 12, 2017 11:22 ET (16:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

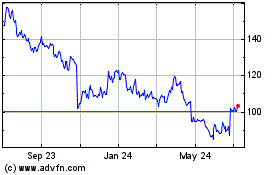

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

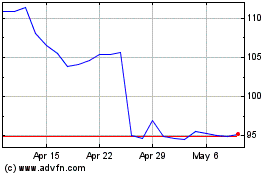

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024