China Slows as Stimulus Impact Wanes

August 12 2016 - 2:10AM

Dow Jones News

BEIJING—A swath of economic activity—from factory output to

investment and retail sales—slowed last month, reflecting renewed

weakness in China's economy as the effects of earlier government

stimulus wane.

Industrial production, long a rough proxy for growth in the

world's second-largest economy, rose 6.0% in July from a year

earlier, according to government data released Friday. The pace was

slower than the 6.2% growth recorded in June—a rate economists

expected would be sustained in July.

Investment in factories, buildings and other fixed assets in

nonrural areas climbed 8.1% on year in the January-July period,

decelerating from the 9% increase in the first six months of the

year and again lower than the 8.9% predicted by economists.

"The Chinese economy is definitely on the downward trend. That

hasn't changed," said Ma Xiaoping, an economist with HSBC.

Ms. Ma said demand from both home and abroad is still weak and

investors are downbeat about China's economic outlook.

July's snapshot of China's economy shows how broad the slowdown

is becoming and how vexing that is becoming for the government.

Growth of private investment, which accounts for around 60% of

total fixed-asset investment, slipped to a record low of 2.1% in

the first seven months, shrugging off recent official efforts to

slash red tape and reduce market barriers to encourage more

spending.

As companies hold off spending, government officials and

economists have warned that China is falling into a liquidity

trap—when investors hoard cash rather than invest despite

government moves to put more money into the economy.

Sheng Laiyun, a spokesman for the National Bureau of Statistics,

acknowledged at a briefing Friday that many private businesses are

reluctant to expand amid cooling growth.

"Economic performance in July was indeed slower as the domestic

and global economies are still undergoing deep adjustment," Mr.

Sheng said at a briefing. He said the government still has room to

expand infrastructure investment in the coming months to bolster

growth.

Meanwhile, retail sales, which has been a bright spot in the

economy, also showed signs of softness, growing 10.2% in July from

a year earlier, down from 10.6% in June. That was short of the

10.5% rise expected by economists.

After rolling out many stimulus measures—including flooding the

economy with record-high credit and speeding up government spending

on infrastructure investment—China's policy makers have started to

rethink the growth model for the economy. At a policy meeting late

last month, the Politburo, the Communist Party's top

decision-making body, cautioned against debt-fueled growth and

rising asset bubbles.

The central bank suggested in its latest monetary policy report

released last week that it may refrain from adopting aggressive

easing measures out of concern that freeing up more funds for

lending would put more pressure on the Chinese currency to

depreciate.

"The government is cautious on rolling out large stimulus

package. However, targeted and small stimulus will reduce the

downside of the economy, but only provides limited and short-lived

support as well," said Zhou Hao, an economist with CommerzeBank

AG.

Grace Zhu and Liyan Qi contributed to this article.

(END) Dow Jones Newswires

August 12, 2016 01:55 ET (05:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

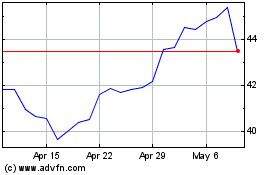

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

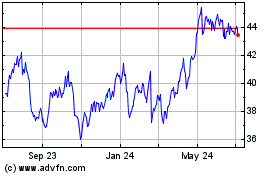

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024