China Bank Lending Rises on Home Buyer Borrowing

September 14 2016 - 9:20AM

Dow Jones News

BEIJING—Bank lending soared last month in China from a two-year

low in July, with a large share of the new credit going to people

buying new homes, according to central bank data.

The figures released Wednesday by the People's Bank of China

confirmed trends in the economy that economists say point to

weakness and could be troubling in the months ahead. Much of the

lending is going into a housing market that economists have said is

showing signs of overheating in some cities, and demand from

companies remains anemic.

Over all, Chinese financial institutions issued 948.7 billion

yuan ($142.19 billion) of new yuan loans in August, more than

double July's 463.6 billion and well above the level expected by

economists.

New lending to households reached 675.5 billion yuan last month,

a nearly 50% increase from July, according to the data. Of that

sum, medium- and long-term household loans, predominantly mortgage

lending, stood at 528.6 billion yuan, accounting for more than half

of the new loans issued in August. In July, almost all of the new

credit was mortgage lending.

Meanwhile, medium- and long-term loans to nonfinancial corporate

borrowers dropped 8 billion yuan last month, compared with an

increase of 151.4 billion yuan in July, the data showed.

Economists said the outsize mortgage lending and the weak

corporate demand continued a pattern of recent months and portrayed

an economy that, while growing, may not be doing so in a

sustainable way.

"The pattern in new credit over the past few months is

unchanged," said Ma Xiaoping, an economist with HSBC Bank. What

investment there is outside the property market is mainly being led

by the government, said Ms. Ma.

A series of indicators released earlier this month—from factory

output to retail sales—showed rebounding economic activity in

August largely sustained by government infrastructure spending and

property sales.

Ms. Ma and other economists said the latest central bank data

showed that credit remains widely available as the government tries

to prop up growth in an economy that has been gliding downward in

recent years.

"Today's data suggest that loose monetary conditions are still

supporting credit growth," said Julian Evans-Pritchard, an

economist of Capital Economics. He said the supply of credit was

likely to slow in the coming quarters as the central bank tries to

rein in financial risks.

Total social financing, a broad measure of credit in the economy

that includes nonbank financing, came to 1.47 trillion yuan in

August, three times July's level.

Corporate bonds increased to 330.6 billion yuan in August, over

50% more than the tally in July. Economists have said that a

sizable portion of that comes from special purpose companies backed

by local governments to fund infrastructure and other public

projects.

China's broadest measure of money supply, M2, was up 11.4% at

the end of August from a year earlier, higher than the 10.2% rise

at the end of July.

Another measure, M1, which covers liquid assets such as cash and

demand deposits, grew 25.3% year over year in August, compared with

a 25.4% pace posted a month earlier.

A surge in M1 in recent months has been interpreted by

economists as another sign that companies and individuals would

rather hoard cash than spend it as they wait out uncertain economic

times.

Liyan Qi

(END) Dow Jones Newswires

September 14, 2016 09:05 ET (13:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

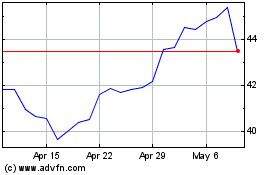

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

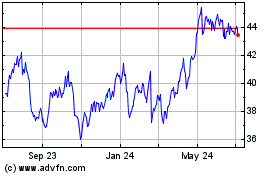

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024