Chicago Business Barometer Indicates Notably Slower Growth In April

April 29 2016 - 6:10AM

RTTF2

Indicating a slow start to the second quarter, MNI Indicators

released a report on Friday showing that growth in Chicago-area

business activity slowed by much more than expected in the month of

April.

MNI Indicators said its Chicago business barometer slumped to

50.4 in April after surging up to 53.6 in March.

While a reading above 50 indicates continued growth, the

barometer had been expected to show a much more modest drop to

53.4.

The bigger than expected drop by the barometer was led a

decrease by the new orders index, which fell to its lowest level

since last December.

The order backlogs also saw a double-digit decline, while the

employment index moved back into contraction after indicating

growth in the previous month.

On the other hand, the production index saw a small increase,

and the supplier deliveries index jumped to its highest level since

October of 2014.

The prices paid index also saw a significant jump, climbing back

into expansion for the first time in nine months.

The increase reflected a recovery in the oil price as well as

higher prices for some raw materials such as plastic and paper

products

Chief Economist of MNI Indicators Philip Uglow said, "This was a

disappointing start to the second quarter, with the Barometer

barely above the neutral 50 mark in April."

"Against a backdrop of softer domestic demand and the slowdown

abroad, panelists are now more worried about the impact a rate hike

might have on business than they were at the same time last year,"

he added.

In a special question, MNI Indicators found that 28.6 percent on

panelists believe an interest rate hike in the next months will

have an impact on business.

Only 21.2 percent said they expected to see a rate hike impact

business activity when the same question was asked last April.

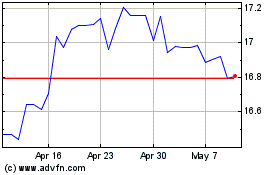

US Dollar vs MXN (FX:USDMXN)

Forex Chart

From Mar 2024 to Apr 2024

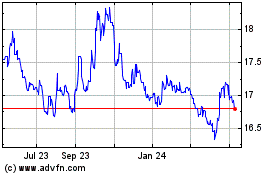

US Dollar vs MXN (FX:USDMXN)

Forex Chart

From Apr 2023 to Apr 2024