Chemours Says Market Conditions Will Dent Profit

December 17 2015 - 9:34AM

Dow Jones News

By Anne Steele

Chemours Co., the performance-chemicals company spun off from

DuPont Co. this summer, said Thursday that market conditions for

two of its products are weaker than expected in its fourth quarter,

which will hurt a measure of profit.

The company said titanium dioxide pricing is deteriorating on a

stronger U.S. dollar, and it anticipates more than a 3% decline in

the average global price. This is expected to dent the company's

Titanium Technologies profit. Additionally, continued soft demand

conditions for certain fluoropolymers combined with seasonal

weakness are expected to hurt Fluoroproducts' profitability.

As a result, Chemours expects its adjusted earnings before

interest, taxes, depreciation and amortization to be lower than the

previous quarter.

Chief executive Mark Vergnano said the company is on track to

cut costs by about $100 million in the second half of 2015 and $350

million through 2017.

Earlier this month, Chemours said it would lay off about 7% of

its workers and contractors and shut down its reactive metals

business as part of broader cost-cutting moves. The maker of Teflon

and Ti-Pure said it would book a charge of $45 million in the

fourth quarter tied to the elimination of roughly 400 jobs in 2016

and estimated it will save about $50 million a year.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

December 17, 2015 09:19 ET (14:19 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

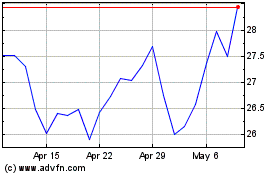

Chemours (NYSE:CC)

Historical Stock Chart

From Mar 2024 to Apr 2024

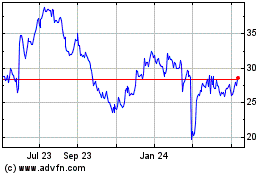

Chemours (NYSE:CC)

Historical Stock Chart

From Apr 2023 to Apr 2024