TIDMSDVZ TIDMSDV

CHELVERTON SMALL COMPANIES ZDP PLC

ANNUAL FINANCIAL REPORT FOR THE YEARED 30 APRIL 2017

The full Annual Report and Accounts can be accessed via the Investment

Manager's website at www.chelvertonam.com or by contacting the Company

Secretary on telephone 01245 398960.

This Report and Accounts should be read in conjunction with the Report and

Accounts of Chelverton Small Companies Dividend Trust PLC ("SCDT").

Strategic Report

The Strategic Report has been prepared in accordance with Section 414A of the

Companies Act 2006 (the "Act"). Its purpose is to inform members of the Company

and help them understand how the Directors have performed their duty under

Section 172 of the Act to promote the success of the Company.

Chairman's Statement

My report on the Group's activities for the year ended 30 April 2017 is

contained within the Annual Report of SCDT. A copy of the full SCDT Annual

Report can be found on the Investment Manager's website, www.chelvertonam.com

or is available for inspection at the National Storage Mechanism ("NSM") which

is situated at www.morningstar.co.uk/uk/nsm.

Lord Lamont of Lerwick

Chairman

14 July 2017

Investment Manager's Report

For details of the Group's activities, development and performance during the

year to 30 April 2017 shareholders should refer to the Annual Report of SCDT,

which can be found on the Investment Manager's website, www.chelvertonam.com or

is available for inspection at the NSM, which is situated at

www.morningstar.co.uk/uk/nsm.

David Horner

Chelverton Asset Management Limited

14 July 2017

Other Statutory Information

Company Activities, Strategy & Business Model

Chelverton Small Companies ZDP PLC ("SCZ" or the "Company") was incorporated on

13 July 2012 as a wholly owned subsidiary of SCDT, together referred to as the

"Group". SCZ was especially formed for the issuing of Zero Dividend Preference

("ZDP") shares. It raised GBP8,500,000 before expenses on 28 August 2012 by a

placing of 8,500,000 ZDP shares, which are listed on the UK Official List and

admitted to trading on the London Stock Exchange.

On 1 August 2016, SCZ changed its name from Small Companies ZDP PLC.

On the 24 March 2017 GBP1,146,150 was raised before expenses by placing an

additional 849,000 ZDP shares, which are listed on the UK Official List and

admitted to trading on the London Stock Exchange.

Pursuant to a loan agreement between SCZ and SCDT, SCZ has lent the proceeds of

these placings to SCDT. The loan is non-interest bearing and is repayable three

business days before the ZDP share redemption date of 8 January 2018, or if

required by SCZ, at any time prior to that date in order to repay the ZDP share

entitlement. The funds are to be managed in accordance with the investment

policy of SCDT.

SCZ investment objective & policy

The objective of SCZ is to provide the final capital entitlement of the ZDP

shares to the holders of the ZDP shares at the redemption date of 8 January

2018. The proceeds of the placing of the ZDP shares have been lent to SCDT

under a loan agreement and the funds are managed in accordance with the

investment policy of SCDT.

SCZ has a capital structure comprising unlisted Ordinary shares and ZDP shares

listed on the Official List and traded on the London Stock Exchange by way of a

standard listing. SCZ is a wholly owned subsidiary of SCDT which is a

closed-ended investment company. On 28 August 2012, SCZ placed 8,500,000 ZDP

shares at 100p per share and this raised a net total of GBP8.3 million. The

expenses of the placing were borne by SCDT. On 24 March 2017, SCZ placed an

additional 849,000 ZDP shares at 135p per share and this raised a net total of

GBP1.1 million. The expenses of the placing were borne by SCDT.

A contribution agreement between SCDT and SCZ has also been made whereby SCDT

will undertake to contribute such funds as would ensure that SCZ will have in

aggregate sufficient assets on 8 January 2018 to satisfy the final capital

entitlement of the ZDP shares of 136.70p per share, being GBP12,780,083 in total.

This assumes that the parent company and the Company have sufficient assets as

at 8 January 2018 to repay the ZDP shares. To this extent the Company is

reliant upon the investment performance of the parent company and subject to

the principal risks as set out in the Annual Report of SCDT.

To protect the interests of ZDP shareholders, the loan agreement contains a

restriction on the Group incurring any other borrowings (other than short-term

indebtedness in the normal course of business, such as when settling share

transactions) except where such borrowings are for the purpose of paying the

final capital entitlement due to holders of ZDP shares.

Based on the value of the Group's assets as at 30 April 2017 they would have to

fall at a rate of 29.5% per annum for the Company to be unable to meet the full

capital repayment entitlements of the ZDP shares on the scheduled repayment

date of 8 January 2018.

The proceeds of the ZDP issue are being invested by SCDT in accordance with the

investment objective and policy of SCDT, which is as follows (as extracted from

the Annual Report of SCDT):

* The Company's assets comprise investments in equities in order to achieve

its investment objectives. It is the aim of the Company to provide both

income and capital growth predominantly through investment in mid and

smaller capitalised UK companies admitted to the Official List of the UK

Listing Authority and traded on the London Stock Exchange Main Market or

traded on AIM.

* The Company will not invest in preference shares, loan stock or notes,

convertible securities or fixed interest securities or any similar

securities convertible into shares; nor will it invest in the securities or

other investment trusts or in unquoted companies.

* There is no set limit on the Company's gearing.

Performance

The Board reviews performance by reference to a number of key performance

indicators ("KPIs") and considers that the most relevant KPI is that which

communicates the financial performance and strength of the Company as a whole

being:

* Total return per ZDP share

This is set out below:

2017 2016

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Return per ZDP share - 7.37p 7.37p - 7.02p 7.02p

Further KPIs for the parent company can be found in SCDT's Annual Report.

Principal Risks and Uncertainties Facing the Company

Due to the Company's dependence on SCDT to repay the loan and provide a

contribution to meet the capital entitlement of the ZDP shareholders other

risks faced by the Company are considered to be the same as for SCDT and these

are defined in note 24 of SCDT's Annual Report.

Employees, Environmental, Human Rights and Community Issues

The Board recognises the requirement under Section 414C of the Act to detail

information about employees, human rights and community issues, including

information about any policies it had in relation to these matters and the

effectiveness of these policies. The Company has no employees and the Board is

comprised entirely of non-executive Directors. Day-to-day management of the

Company and SCDT is delegated to the Investment Manager (details of the

respective management agreements are set out in the Director's Report of SCDT's

Annual Report). The Company itself has no environmental, human rights or

community policies. However in carrying out its activities in relationships

with suppliers, by way of SCDT, the Company aims to conduct itself responsibly,

ethically and fairly.

Current and Future Developments

The current and future developments of the Company can be reviewed as part of

the Group's activities for the year ended 30 April 2017 by reference to the

Annual Report and financial statements of SCDT.

Dividends

The Directors do not recommend the payment of a final dividend in respect of

the year ended 30 April 2017.

Gender Diversity

The Board of Directors of the Company comprised four male Directors during the

year to 30 April 2017. While the Board recognises the benefit of diversity the

key criteria for the appointment of new directors will be the appropriate

skills and experience in the interest of shareholder value. The Directors are

satisfied that the Board currently contains members with an appropriate breadth

of skills and experience. No new appointments to the Board have been made or

are contemplated at present.

On behalf of the Board

Lord Lamont of Lerwick

14 July 2017

Board of Directors

The Directors are:

The Rt Hon. Lord Lamont of Lerwick* (Chairman), was Chancellor of the Exchequer

between 1990 and 1993. Prior to his appointment, Lord Lamont was Chief

Secretary to the Treasury between 1989 and 1990. Following his retirement from

acting as a Member of Parliament in 1997, he has held numerous positions as a

director of various organisations and funds including, NM Rothschild and Sons

Limited. He is an adviser to BC Partners and Stanhope Capital.

Lord Lamont was appointed to the Board of SCZ on 27 July 2012 and has been a

director of the parent company, SCDT since 2006.

David Harris* is chief executive of InvaTrust Consultancy Limited. The company

specialises in marketing issues relating to the investment and financial

services industry. He writes regular articles for the national and trade press

on investment matters. From 1995 to 1999 he was a director of the AIC with

specific responsibility for training and education of independent financial

advisers. He is a non-executive director of the Character Group PLC, Aseana

Properties Limited, F&C Managed Portfolio Trust PLC and Manchester and London

Investment Trust PLC.

Mr Harris was appointed to the Board of SCZ on 27 July 2012 and has been a

director of the parent company, SCDT since 2000.

William van Heesewijk began his career with Lloyds Bank International in 1981,

working for both the merchant banking and investment management arms. He has

been involved in the investment trust industry since 1987 in various

capacities. During his tenure with Fidelity Investments International, Gartmore

Investment Management PLC and BFS Investments PLC; he managed several launches

of onshore and offshore investment funds, including a number of roll-overs and

reconstructions involving complex capital structures and across several

geographic regions. His roles involved business development, project

management, sales and marketing. He is Business Development Director of

Chelverton Asset Management Limited. He is a member of the Association of

Investment Companies Managers Forum.

Mr van Heesewijk was appointed to the Board of SCZ on 13 July 2012 and has been

a director of the parent company, SCDT since 2005.

Howard Myles* was a partner in Ernst & Young from 2001 to 2007 and was

responsible for the Investment Funds Corporate Advisory team. He was previously

with UBS Warburg from 1987 to 2001. Mr Myles began his career in stockbroking

in 1971 as an equity salesman and in 1975 joined Touche Ross & Co where he

qualified as a chartered accountant. In 1978 he joined W Greenwell & Co in the

corporate broking team and in 1987 moved to SG Warburg Securities, where he was

involved in a wide range of commercial and industrial transactions in addition

to leading Warburg's corporate finance function for investment funds. He is now

a non-executive director of Lazard World Trust Fund, Aberdeen Private Equity

Fund Limited, Baker Steel Resources Trust Limited, JPMorgan Brazil Investment

Trust PLC and BBGI SICAV S.A.

Mr Myles was appointed to the Board of SCZ on 13 July 2012 and has been a

director of the parent company, SCDT since 2011. He is Audit Committee Chairman

of SCDT.

* Independent of the Investment Manager

Investment Manager, Secretary and Registrar

Investment Manager: Chelverton Asset Management Limited ('Chelverton')

Chelverton was formed in 1998 by David Horner, who has considerable experience

of analysing investments and working with smaller companies. Chelverton is

largely owned by its employees.

Chelverton is a specialist fund manager focused on UK mid and small companies

and has a successful track record. At 31 May 2017, Chelverton had total funds

under management of approximately GBP650 million including two investment trust

companies and two OEICs. The fund management team comprises David Horner, David

Taylor and James Baker.

Chelverton is authorised and regulated by the FCA.

Administrator and Corporate Secretary: Maitland Administration Services Limited

Maitland Administration Services Limited provides company secretarial and

administrative services for the Group. The Maitland group provides

administration and regulatory oversight solutions for a wide range of

investment companies.

Registrar: Share Registrars Limited

Share Registrars Limited is a CREST registrar established in 2004. The Company

provides registration services to over 220 client companies.

Directors' Report

The Directors present their Report and the financial statements of the Company

for the year ended 30 April 2017. The Company's registered number is 08142169.

Directors

Directors who served during the year ended 30 April 2017, all of whom are

non-executive were as follows:

Lord Lamont

D Harris

W van Heesewijk

H Myles

Biographical details of the Directors are given on page 6.

Under the Company's Articles of Association, Directors are required to retire

at the first Annual General Meeting ("AGM") following their appointment, and

thereafter at three-yearly intervals.

The forthcoming Annual General Meeting ("AGM") will be SCZ's fifth AGM. In

accordance with the Articles of Association all Directors stood for re-election

at the first AGM in 2013 and at the AGM held in 2016. Therefore, in accordance

with the Articles of Association, Mr van Heesewijk will be the only director

required to stand for re-election at the 2017 AGM due to his non-independence

by virtue of his employment by Chelverton.

None of the Directors nor any persons connected with them had a material

interest in any of the Company's transactions, arrangements or agreements

during the period, except Mr van Heesewijk who by virtue of his employment with

Chelverton is interested in the Investment Management Agreement with the parent

company. None of the Directors has or has had any interest in any transaction

which is or was unusual in its nature or conditions or significant to the

business of the Company, and which was effected by the Company during the

current financial period.

There have been no loans or guarantees from the Company to any Director at any

time during the year or thereafter.

The Company's Articles of Association provide the Directors of the Company,

subject to the provisions of UK legislation, with an indemnity in respect of

liabilities which they may sustain or incur in connection with their

appointment. Save for this, there are no qualifying third party indemnities in

place.

Formal performance evaluation of the Directors and the Board has been carried

out and the Board considers that all of the Directors contribute effectively

and have the skills and experience relevant to the future leadership and

direction of the Company.

The rules concerning the appointment and replacement of Directors are contained

in the Company's Articles of Association.

Corporate Governance

A formal statement on Corporate Governance is set out on pages 9 and 10 below.

Share Capital

At the year-end and at the date of this report, the issued share capital of the

Company comprised of 50,000 Ordinary shares and 9,349,000 ZDP shares.

50,000 Ordinary shares of GBP1, each partly paid as to 25p (and each of which

have been issued to SCDT), represent 0.53% of the total share capital. Holders

of Ordinary shares are entitled to receive notice of, attend and vote at

General Meetings of the Company. Ordinary shares of the Company are not

admitted to trading on a regulated market.

8,500,000 ZDP shares of GBP1 each were issued on 28 August 2012, pursuant to the

placing ZDP shares represent 99.42% of the total share capital. 849,000

additional ZDP shares for a total consideration of GBP1.35 each were issued on 24

March 2017.

Holders of ZDP shares are entitled to receive notice of, attend and vote at

those General Meetings where ZDP shareholders are entitled to vote. They are

not entitled to attend or vote at any General Meeting of the Company unless the

business includes any resolution to vary, modify or abrogate any of the special

rights attached to the ZDP shares.

Shareholders' funds and market capitalisation

At 30 April 2017 the Company had a market capitalisation of GBP12,714,640 (2016:

GBP10,837,500) and total net assets amounted to GBP13,000 (2016: GBP13,000).

ISA status

The ZDP shares are eligible for inclusion in ISAs.

Management agreements

The Group's assets are managed by Chelverton under an agreement ('the

Investment Management Agreement') dated 30 April 2006 (effective from 1

December 2005) with the parent company. A periodic fee is payable quarterly in

arrears at an annual rate of 1% of the value of the gross assets under

management of the Group.

These fees are met entirely by the parent company.

The Investment Management Agreement may be terminated by twelve months' written

notice. There are no additional arrangements in place for compensation beyond

the notice period.

Under another agreement ('the Administration Agreement') dated 1 January 2015,

company secretarial services and the general administration of the Group are

undertaken by Maitland Administration Services Limited. Their fee is subject to

review at intervals of not less than three years. The Administration Agreement

may be terminated by six months' written notice.

Management fee

The management fee for the Group is charged to and paid in full by SCDT.

Company Information

* The Company's capital structure and voting rights are summarised on pages 8

and 9.

* SCZ is a wholly-owned subsidiary of SCDT.

* The rules concerning the appointment and replacement of Directors are

covered by Article 22 of the Company's Articles of Association.

* There are no restrictions concerning the transfer of securities in the

Company; no special rights with regard to control attached to securities;

no agreements between holders of securities regarding their transfer known

to the Company; and no agreements which the Company is party to that might

affect its control following a successful takeover bid.

* There are no agreements between the Company and its Directors that provide

compensation for loss of office or as a result of a takeover.

Viability Statement

The Board reviews the performance and progress of the Company over various time

periods and uses these assessments, regular updates from the Investment Manager

and a continuing programme of monitoring risk, to assess the future viability

of the Company. The Directors consider that a period until the maturity of the

ZDPs on 8 January 2018 is the most appropriate time horizon to consider the

Company's viability and after careful analysis, the Directors believe that the

Company is viable over this time period.

The Board has reviewed the viability statement of SCDT and has assessed that

SCDT has the necessary financial strength to fulfil the obligations to SCZ

under the loan agreement. SCDT has a liquid investment portfolio invested

predominantly in readily realisable smaller capitalised.

The Directors have a reasonable expectation that the Company will be able to

continue in operation and meet its liabilities as they fall due over the period

of the assessment.

Going concern

The Company has adopted the going concern basis in preparing the financial

statements consistent with the parent company. The parent company has adequate

financial resources to ensure SCZ will have in aggregate sufficient assets to

satisfy the accrued capital entitlement and future capital entitlement of the

ZDP shares.

Global Greenhouse Gas Emissions

The Company has no greenhouse gas emissions to report from its operations, nor

does it have any responsibility for any other emission-producing sources under

the Companies Act 2006 (Strategic Report and Directors' Report) Regulations

2013.

Statement on Corporate Governance

The Company is committed to maintaining high standards of corporate governance

and the Directors are accountable to shareholders for the governance of the

Company's affairs.

As set out in the Prospectus dated 1 August 2012, SCZ, as a company with a

standard listing, is not required to comply with the UK Corporate Governance

Code and does not intend to do so. In the Directors' opinion, the interests of

SCZ and SCZ shareholders are adequately covered by the governance procedures

applicable to SCDT. For example SCDT's Audit Committee considers the financial

reporting procedures and oversees the internal control and risk management

systems for the Group as a whole and the Directors see no benefit in convening

a separate Audit Committee for SCZ.

Auditor

The Auditor, Hazlewoods LLP, has indicated their willingness to continue in

office until such time as the audit tender process for the 2018 audit is

completed, and a resolution proposing their re-appointment and authorising the

Directors to determine their remuneration for the ensuing year will be

submitted at the forthcoming Annual General Meeting on 7 September 2017.

The Directors who were in office on the date of approval of these financial

statements have confirmed, as far as they are each aware, that there is no

relevant audit information of which the Auditors are unaware. Each of the

Directors have confirmed that they have taken all the steps that they ought to

have taken as Directors in order to make themselves aware of any relevant audit

information and to establish that it has been communicated to the Auditor. The

Directors consider that the accounts taken as a whole are fair, balanced and

understandable.

Annual General Meeting

A formal Notice convening the second Annual General Meeting to be held on 7

September 2017 can be found on page 26.

On behalf of the Board

Lord Lamont of Lerwick

Chairman

14 July 2017

Directors' Remuneration Report

The Board has prepared this report, in accordance with the requirements of

Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and

Reports) (Amendments) Regulations 2013. Ordinary resolutions for the approval

of this report and the Directors' Remuneration Policy shall be put to

shareholders at the forthcoming AGM.

The law requires the Group's Auditor, Hazlewoods LLP, to audit certain

disclosures provided. Where disclosures have been audited, they are indicated

as such. The Auditor's opinion is included in their report on pages 14 to 16.

Report from the Company Chairman

As set out in the Directors' Report, the Company has a standard listing and is

not required to comply with the UK Corporate Governance Code and does not

intend to do so. The Board of the SCDT considers the Directors' remuneration

for the Group as a whole.

Directors' Remuneration Policy

The Remuneration Policy for the Company is that no fees are payable to the

Directors in connection with their duties to SCZ. An Ordinary resolution was

put to shareholders to approve this Policy at the AGM held on 17 September

2014. It is intended that in accordance with the regulations, an ordinary

resolution to approve the Directors' remuneration policy will be put to

shareholders at least once every three years. Accordingly, a resolution to

approve the Remuneration Policy will be considered at the AGM on 7 September

2017.

Directors are also not eligible for bonuses, pension benefits, share options,

long-term incentive schemes or other benefits, as the Board does not consider

such arrangements or benefits necessary or appropriate.

The Directors do receive fees relating to their duties to the parent company,

SCDT. This policy will continue for future years and is set out in full in the

Directors' Remuneration Report of SCDT.

Directors' service contracts

None of the Directors has a contract of service with the Company or the parent

company, nor has there been any contract or arrangement between the Company and

any Director at any time during the period. The terms of their appointment

provide that a Director shall retire and be subject to re-election at the first

AGM after their appointment, and at least every three years after that. A

Director's appointment can be terminated in accordance with the Articles and

without compensation.

Directors' emoluments for the year (audited)

No fees are payable to the Directors regarding their duties to SCZ.

Directors' beneficial and family interests (audited)

30 April 2017 30 April 2016

ZDP shares ZDP shares

Lord Lamont 10,000 10,000

D Harris Nil Nil

H Myles Nil Nil

W van Heesewijk Nil Nil

The Directors' interests in the shares of the parent company are shown in the

Annual Report of SCDT.

Your Company's performance

The objective of SCZ is to provide the accrued capital entitlement to the ZDP

shareholders. The Company has lent all of its assets to SCDT and therefore the

performance of the Company is best reflected by looking at the performance of

SCDT. The Directors' remuneration report within the Annual Report of SCDT

contains a graph comparing the total return (assuming all dividends are

reinvested) to SCDT Ordinary shareholders, compared to the total shareholder

return of the MSCI UK Small Cap Index. A copy of SCDT's Annual Report can be

found on the Investment Manager's website www.chelvertonam.com or is available

for inspection at the NSM, which is situated at www.morningstar.co.uk/uk/nsm

http:///.

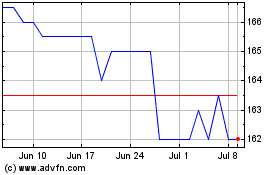

The graph below compares the return to ZDP shareholders with the MSCI UK Small

Cap Index. The MSCI UK Small Cap Index has been selected as it is considered to

represent a broad equity market index against which the performance of the

SCDT's assets may be adequately assessed.

Click here for graph.

There has been no demonstration of relative importance of spend on pay for the

Company as no remuneration is payable to Directors.

Approval

The Directors' Remuneration Report was approved by the Board on 14 July 2017.

On behalf of the Board of Directors

Lord Lamont of Lerwick

Chairman

14 July 2017

Statement of Directors' Responsibilities

in respect of the Annual Report and the financial statements

The Directors are responsible for preparing the Annual Report and the financial

statements in accordance with applicable law and regulations. The Directors

have elected to prepare financial statements in accordance with International

Financial Reporting Standards ('IFRSs') as adopted by the European Union

("EU"). Company law requires the Directors to prepare such financial statements

in accordance with IFRSs and the Companies Act 2006.

Under company law the Directors must not approve the financial statements

unless they are satisfied that they present fairly the financial position,

financial performance and cash flows of the Company for that period.

In preparing the Company's financial statements, the Directors are required to:

* select suitable accounting policies in accordance with International

Accounting Standard ("IAS") 8: 'Accounting Policies, Changes in Accounting

Estimates and Errors' and then apply them consistently;

* present information, including accounting policies, in a manner that

provides relevant, reliable, comparable and understandable information;

* provide additional disclosures when compliance with specific requirements

in IFRSs is insufficient to enable users to understand the impact of

particular transactions, other events and conditions on the Company's

financial position and financial performance;

* state that the Company has complied with IFRSs, subject to any material

departures disclosed and explained in the financial statements; and

* make judgements and estimates that are reasonable and prudent.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and

enable them to ensure that the Company's financial statements comply with the

Companies Act 2006 and Article 4 of the IAS Regulation. They are also

responsible for safeguarding the assets of the Company and hence for taking

reasonable steps for the prevention and detection of fraud and other

irregularities.

The Directors are responsible for ensuring that the Directors' Report and other

information included in the Annual Report is prepared in accordance with

applicable company law. They are also responsible for ensuring that the Annual

Report includes information required by the Listing Rules of the Financial

Conduct Authority.

The Directors are responsible for the integrity of the information relating to

the Company on the Investment Manager's website. Legislation in the UK

governing the preparation and dissemination of financial statements differs

from legislation in other jurisdictions.

The Directors confirm that, to the best of their knowledge and belief:

* the financial statements, prepared in accordance with IFRSs as adopted by

the EU, give a true and fair view of the assets, liabilities, financial

position and profit of the Company;

* the Annual Report includes a fair review of the development and performance

of the Company, together with a description of the principal risks and

uncertainties faced; and

* the Annual Report is fair, balanced and understandable and provides the

information necessary for shareholders to assess the Company's performance,

business model and strategy.

On behalf of the Board of Directors

Lord Lamont of Lerwick

Chairman

14 July 2017

Independent Auditor's Report

to the members of Chelverton Small Companies ZDP PLC

We have audited the financial statements of the Company for the year ended 30

April 2017 which comprise the Statement of Comprehensive Income, the Balance

Sheet and the related notes. The financial reporting framework that has been

applied in their preparation is applicable law and IFRSs as adopted by the EU.

This report is made solely to the Company's members, as a body, in accordance

with chapter 3 of part 16 of the Companies Act 2006. Our audit work has been

undertaken so that we might state to the Company's members those matters we are

required to state to them in an audit report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume responsibility to

anyone other than the Company and the Company's members as a body, for our

audit work, for this report or for the opinions we have formed.

Respective responsibilities of Directors and Auditor

As explained more fully in the Statement of Directors' Responsibilities set out

on page 13, the Directors are responsible for the preparation of the financial

statements and for being satisfied that they give a true and fair view. Our

responsibility is to audit and express an opinion on the financial statements

in accordance with applicable law and International Standards on Auditing (UK

and Ireland). Those standards required us to comply with the Auditing Practices

Board's ('APB's') Ethical Standards for Auditors.

Scope of the audit of the financial statements

An audit involves obtaining evidence about the amounts and disclosures in the

financial statements sufficient to give reasonable assurance that the financial

statements are free from material misstatement, whether caused by fraud or

error. This includes an assessment of: whether the accounting policies are

appropriate to the Company's circumstances and have been consistently applied

and adequately disclosed; the reasonableness of significant accounting

estimates made by the Directors; and the overall presentation of the financial

statements. In addition, we read all the financial and non-financial

information in the Strategic Report and the Directors' Report to identify

material inconsistencies with the audited financial statements and to identify

any information that is apparently materially incorrect based on, or materially

inconsistent with the knowledge acquired by us in the course of performing the

audit. If we become aware of any apparent material misstatements or

inconsistencies we consider the implications for our report.

Opinion on financial statements

In our opinion the financial statements:

* give a true and fair view of the state of the Company's affairs as at 30

April 2016 and of its net return and comprehensive income for the year then

ended;

* have been properly prepared in accordance with IFRSs as adopted by the EU;

* have been prepared in accordance with the requirements of the Companies Act

2006 and Article 4 of the IAS regulations.

Our assessment of risks of material misstatement

Without modifying our opinion, we highlight the following matter that is, in

our judgement, likely to be most important to users' understanding of our

audit. Our audit procedures relating to this matter were designed in the

context of our audit of the financial statements as a whole, and not to express

an opinion on individual transactions, balances or disclosures.

Management override of financial controls

The Company operates a system of financial controls to mitigate its

vulnerability to fraud and its financial statements to material error and is

reliant upon the efficacy of these controls to ensure that its financial

statements present a true and fair view. The financial statements contain a

number of significant accounting estimates that require an element of judgement

on behalf of management and that are, therefore, potentially open to

manipulation. Our audit work included, but was not restricted to, a review of

all significant management estimates and detailed consideration of all material

judgements applied during the completion of the financial statements. We also

reviewed material journal entries processed by management during the period.

The Company's principal accounting policies are included in note 2.

Our application of materiality

We apply the concept of materiality in planning and performing our audit, in

evaluating the effect of any identified misstatements and in forming our

opinion. For the purpose of determining whether the financial statements are

free from material misstatement, we define materiality as the magnitude of a

misstatement or an omission from the financial statements or related

disclosures that would make it probable that the judgement of a reasonable

person, relying on the information would have been changed or influenced by the

misstatement of omission. We also determine a level of performance materiality

which we use to determine the extent of testing needed to reduce to an

appropriately low level the probability that the aggregate of uncorrected and

undetected misstatements exceeds materiality for the financial statements as a

whole.

We established materiality for the financial statements as a whole to be GBP

123,000, which is 1% of the value of the Company's total assets. For income and

expenditure items we determined that misstatements of lesser amounts than

materiality for the financial statements as a whole would make it probable that

the judgement of a reasonable person, relying on the information would have

been changed or influenced by the misstatement or omission. Accordingly, we

established materiality for revenue items within the income statement to be GBP

31,000.

An overview of the scope of our audit

Our audit approach was based on a thorough understanding of the Company's

business and is risk-based. The maintenance of the Company's accounting records

is outsourced to third-party service providers. Accordingly, our audit work is

focused on obtaining an understanding of, and evaluating, internal controls at

the Company and the third-party service providers. We undertook substantive

testing on significant transactions, balances and disclosures, the extent of

which was based on various factors such as our overall assessment of the

control environment, the effectiveness of controls over individual systems and

the management of specific risks.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion:

* the part of the Directors' remuneration report to be audited has been

properly prepared in accordance with the Companies Act 2006;

* the information given in the Strategic Report and the Directors' Report for

the financial year for which the financial statements are prepared is

consistent with the financial statements; and

* the Strategic Report and Directors' Report have been prepared in accordance

with applicable legal requirements.

In the light of our knowledge and understanding of the Group and its

environment obtained in the course of the audit, we have not identified

material misstatements in the Strategic Report and the Directors' Report.

Matters on which we are required to report by exception

We have nothing to report in respect of the following:

Under the ISAs (UK and Ireland), we are required to report to you if, in our

opinion, information in the Strategic Report and the Directors' Report is:

* materially inconsistent with the information in the audited financial

statements; or

* apparently materially incorrect based on, or materially inconsistent with,

our knowledge of the Company acquired in the course of performing our

audit; or

* is otherwise misleading.

In particular, we are required to consider whether we have identified any

inconsistencies between our knowledge acquired during the audit and the

Directors' Statement that they consider the Annual Report is fair, balanced and

understandable and whether the Annual Report appropriately discloses those

matters that we communicated to the Audit Committee which we consider should be

disclosed.

Under the Companies Act 2006 we are required to report to you if, in our

opinion:

* adequate accounting records have not been kept, or returns adequate for our

audit have not been received from branches not visited by us; or

* the financial statements and the part of the Directors' remuneration report

to be audited are not in agreement with the accounting records and returns;

or

* certain disclosures of directors' remuneration specified by law are not

made; or

* we have not received all the information and explanations we require for

our audit.

Under the Listing Rules we are required to review:

* the Directors' statement, set out on page 10 in relation to going concern;

Scott Lawrence (Senior Statutory Auditor),

For and on behalf of Hazlewoods LLP, Statutory Auditor

Cheltenham

14 July 2017

Statement of Comprehensive Income

for the year ended 30 April 2017

2017 2016

Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Income - - - - - -

- 633 633 - 597 597

Provision for

contribution from SCDT

regarding the capital

entitlement of the ZDP

shares

Return before finance - 633 633 - 597

costs and taxation 597

Appropriations in - (633) (633) - (597) (597)

respect of ZDP shares

- - - -

Net return after - -

finance costs and

before taxation

Taxation on ordinary 2 - - - - - -

activities

Net return after - - - - - -

taxation

Return per ZDP share 4 - 7.37p 7.37p - 7.02p 7.02p

The total column of this statement is the Statement of Comprehensive Income of

the Company, prepared in accordance with IFRSs, as adopted by the EU. All

revenue and capital return columns in the above statement derive from

continuing operations. No operations were acquired or discontinued during the

year. All of the net return for the period is attributable to the shareholders

of the company. The supplementary revenue and capital columns are presented

for information purposes as recommended by the Statement of Recommended

Practice issued by the AIC.

Balance Sheet

as at 30 April 2017

Note 2017 2016

GBP'000 GBP'000

Non-current assets

Loans and receivables 5 12,308 10,529

Current assets

Trade and other receivables 6 13 13

Total assets 12,321 10,542

Current liabilities

ZDP shares 8 (12,308) (10,529)

Net assets 13 13

Represented by:

Share capital 7 13 13

Equity shareholders' funds 13 13

These financial statements were approved by the Board of Chelverton Small

Companies ZDP PLC and authorised for issue on 14 July 2017 and were signed on

behalf of the Company by:

Lord Lamont of Lerwick,

Chairman

14 July 2017

Company Registered No: 08142169

Notes to the Financial Statements

as at 30 April 2017

1. General information

SCZ is a company incorporated and registered in England and Wales on 13 July

2012 with limited liability under the Companies Act 2006. All of its Ordinary

shares are held by SCDT. It is not regulated by the Financial Conduct Authority

or any commission.

The financial information of the Company for the year ended 30 April 2017 and

the year ended 30 April 2016 has also been consolidated into the results of

SCDT.

2. Accounting policies

Basis of preparation

The financial statements of the Company have been prepared in conformity with

IFRSs issued by the International Accounting Standards Board (as adopted by the

EU), and Interpretations issued by the International Financial Reporting

Interpretations Committee, and applicable requirements of UK company law, and

reflect the following policies which have been adopted and applied

consistently.

The accounting policies adopted in the preparation of the financial statements

are consistent with those of the previous financial year. There were no IFRS

standards or IFRIC interpretations adopted for the first time in these

financial statements that had a material impact on these financial statements.

At the date of authorisation of the financial statements, the following

Standards which have not been applied in these financial statements were in

issue but were not yet effective:

* IFRS 7 Financial Instruments: Disclosures - Amendments requiring disclosures

about the initial application of IFRS 9 (effective 1 January 2015 or otherwise

when IFRS 9 is first applied)

* IFRS 9 Financial Instruments - Classification and measurement of financial

assets (effective 1 January 2018)

* IFRS 9 Financial Instruments - Classification and measurement of financial

liabilities and de-recognition requirements from IAS 39 Financial Instruments

Recognition and Measurement (effective 1 January 2018)

The Directors do not expect that the adoption of the Standards listed above

will have a material impact on the financial statements of the Company in

future periods.

Convention

The financial statements are presented in Sterling, rounded to the nearest GBP

'000. The financial statements have been prepared on a going concern basis.

Where presentational guidance set out in the Statement of Recommended Practice

regarding the Financial Statements of Investment Trust Companies and Venture

Capital Trusts ('SORP'), issued by the AIC in January 2009, is consistent with

the requirements of IFRSs, the Directors have sought to prepare the financial

statements on a consistent basis compliant with the recommendations of the

SORP.

Segmental reporting

The Company does not engage in any business activities from which it can earn

revenues and therefore segmental reporting does not apply.

Loans and receivables

The Company holds a non-interest bearing secured loan in SCDT. Under IAS 39

'Financial Instruments: Recognition and Measurement' the loan is carried at

amortised cost using the effective interest method. Amortised cost represents

the initial cost of the loan plus a proportion of the expected surplus on

redemption. The expected surplus on redemption is allocated to capital at a

constant rate over the life of the loan.

Expenses

All operating expenses of the Company are borne by SCDT.

ZDP shares

ZDP shares issued by the Company are treated as a liability under IAS 32

'Financial Instruments: Disclosure and Presentation', and are shown in the

Balance Sheet at their redemption value at the Balance Sheet date. The

appropriations in respect of the ZDP shares necessary to increase the Company's

liabilities to the redemption values are allocated to capital in the Statement

of Comprehensive Income. This treatment reflects the Board's long-term

expectations that the entitlements of the ZDP shareholders will be satisfied

out of gains arising on SCDT investments held primarily for capital growth.

Cash flow statement

The Company is a wholly-owned subsidiary of SCDT and the cash flows of the

Company are included in the consolidated cash flow statement of the parent

undertaking. There were no cash flows during the year ended 30 April 2017 or 30

April 2016 therefore no cash flow statement is presented within the financial

statements. In the year ended 30 April 2017, the receipt of loan funding from

the issue of ZDP shares was received directly by SCDT.

Taxation

There is no charge to UK income taxation as the Company does not have any

income. There are no deferred tax assets in respect of unrelieved excess

expenses as all expenses are borne by SCDT.

3. Directors' remuneration/Management fee

The Directors and Manager are remunerated by SCDT and the amounts in respect of

their services as Directors and Manager of SCZ are not separately identifiable.

4. Return per share

ZDP shares

The capital return per ZDP share is based on appropriations of GBP633,000 (2016:

GBP597,000) and on 8,586,063 (2016: 8,500,000) ZDP shares, being the weighted

average number of ZDP shares in issue during the year.

5. Loans and receivables

The Company has entered into a loan agreement with SCDT whereby the Company

lent SCDT the gross proceeds of GBP8,500,000 raised from the placing on 28 August

2012 of 8,500,000 ZDP shares at 100p. The loan is non-interest bearing and is

secured on SCDT's total assets by a floating charge debenture entered into

between the Company and SCDT. The loan is repayable three business days prior

to the ZDP share redemption date of 8 January 2018 or, if required by the

Company at any time prior to that date in order to repay the ZDP share

entitlement.

On 24 March 2017, the company lent SCDT the gross proceeds of GBP1,146,150 raised

from the additional placing of 849,000 ZDP shares at 135p each. The loan is

non-interest bearing and is secured on SCDT's total assets by a floating charge

debenture entered into between the Company and SCDT. The loan is repayable

three business days prior to the ZDP share redemption date of 8 January 2018

or, if required by the Company at any time prior to that date in order to repay

the ZDP share entitlement.

A contribution agreement between the Company and SCDT has also been entered

into whereby SCDT will undertake to contribute such funds as would ensure that

the Company will have in aggregate sufficient assets on 8 January 2018 to

satisfy the final capital entitlement of the ZDP shares.

2017 2016

GBP'000 GBP'000

Loan opening book value 10,529 9,932

Issue of 849,000 ZDP shares 24 March 2017 1,146 -

Amount receivable from SCDT under the contribution 633 597

agreement

12,308 10,529

Loans and receivables

6. Trade and other receivables

2017 2016

GBP'000 GBP'000

Intercompany account 13 13

7. Share capital

Allotted, issued:

2017 2017 2016 2016

Number of GBP'000 Number of GBP'000

shares shares

Ordinary shares of 100p each -

issued and partly paid as to 50,000 12,500 50,000 12,500

25p each

ZDP shares of 100p each 8,500,000 8,500,000 8,500,000 8,500,000

ZDP shares of 135p each 849,000 1,146,150 - -

The Company was incorporated on 13 July 2012 with 50,000 ordinary shares in

issue partly paid as to 25p each. All of the ordinary shares are held by SCDT.

On 28 August 2012, 8,500,000 ZDP shares were issued at 100p each. The share

issue costs were borne by SCDT.

On 24 March 2017, 849,000 additional ZDP shares were issued at 135p each. The

share costs were borne by SCDT.

As to dividends

Ordinary shares are entitled to any revenue profits which the Company may

determine to distribute as dividends in respect of any financial period. It is

not expected that any such dividends will be declared.

The holders of ZDP shares are not entitled to dividends or other distributions

out of the revenue or any other profits of the Company.

As to capital on a winding up

On a winding up, and after payment of SCZ's liabilities in full, holders of ZDP

shares are entitled to a payment of an amount equal to 100p per share,

increased daily from 28 August 2012 at such compound rate as will give an

entitlement to 136.70p for each ZDP share at 8 January 2018, GBP12,780,083 in

total.

Following payment of the capital entitlement to the ZDP shareholders, Ordinary

shareholders are entitled to any surplus assets of the Company.

As to voting

Holders of Ordinary shares are entitled to receive notice of, attend and vote

at General Meetings of the Company.

Holders of ZDP shares are entitled to receive notice of, attend and vote at

those general meetings where ZDP shareholders are entitled to vote. They are

not entitled to attend or vote at any general meeting of the Company unless the

business includes any resolution to vary, modify or abrogate any of the special

rights attached to the ZDP shares.

Commitment to contribute to the capital entitlement of the ZDP shares

The Company has entered a contribution agreement with its parent company, SCDT,

pursuant to which SCDT will undertake to contribute such funds as would ensure

that SCZ will have in aggregate sufficient assets on 8 January 2018 to satisfy

the final capital entitlement of the ZDP shares or, if required by the Company,

the accrued capital entitlement at any time prior to that date. This assumes

that SCDT has sufficient assets to repay the capital entitlement of the ZDP

shares. As at 30 April 2017, the Group had total assets less current

liabilities available for repayment of the ZDP shares of GBP54,031,154 (2016: GBP

45,606,258). The value of the Group's assets would have to fall at a rate

of 29.3% (2016: 30.0%) per annum for it to be unable to meet the full

capital repayment entitlement of the ZDP shares on the scheduled repayment date

of 8 January 2018.

Duration

The Articles of Association provide that the Directors shall convene a general

meeting of the Company to be held on 8 January 2018 or, if that is not a

business day, on the immediately following business day, at which a special

resolution will be proposed requiring the Company to be wound up unless the

Directors shall have previously been released from their obligations to do so

by a special resolution of the Company (such special resolution having been

sanctioned by any necessary class approval). If no variation of such date is

approved and the Company is not wound up on such date, any holder of more than

1,000 ZDP shares shall have the right to requisition a general meeting of the

Company to consider a resolution to wind it up.

At the general meeting, those shareholders present, in person or by proxy or by

duly authorised representative who vote in favour of the resolution to wind up

the Company will collectively have such total number of votes on a poll as is

one more than the number of votes which are required to be cast for the

resolution to be carried. The vote will be taken on a poll.

8. Net asset value per share

The net asset value per ZDP share and the net assets attributable to the ZDP

shareholders are as follows:

Net asset Net asset

value per Net assets value per Net assets

share attributable share attributable

2017 2017 2016 2016

pence GBP'000 pence GBP'000

ZDP shares 131.65 12,308 123.87 10,529

9. Ultimate parent undertaking

The Company is a wholly owned subsidiary of SCDT which is registered in England

and Wales under company number 03749536.

10. Related party transactions

The funds lent to SCDT are managed by Chelverton, a company in which Mr van

Heesewijk, a Director of the Company, has an interest. The Investment Manager

is remunerated by SCDT and the amounts in respect of its services as Investment

Manager of SCZ are not separately identifiable.

11. Financial instruments

Investment objective and investment policy

The objective of SCZ is to provide the final capital entitlement of the ZDP

shares to the holders of the ZDP shares at the redemption date of 8 January

2018.

The Company will fulfil its investment objective through the contribution

agreement it has with SCDT, as detailed in note 5 and 7. The contribution from

SCDT will provide the capital entitlement of the ZDP shareholders. The

principal risk the Company faces is therefore, that SCDT would not have

sufficient assets to repay the loan and to make a contribution to fulfil the

amount of the capital entitlement due to the ZDP shareholders. Covenants are in

place between SCDT and the Company that ensure that SCDT will not undertake

certain actions in relation to both itself and the Company.

Due to the Company's dependence on SCDT to repay the loan and provide a

contribution to meet the capital entitlement of the ZDP shareholders other

risks faced by the Company are considered to be the same as for SCDT and these

are defined in note 24 of SCDT's Annual Report.

SCDT has considerable financial resources and therefore the Directors believe

that the Company is well placed to manage its business risks and also believe

that SCDT will have sufficient resources to continue in operational existence

for the foreseeable future.

Directors and Advisers

Directors

Lord Lamont of Lerwick (Chairman)

David Harris

William van Heesewijk

Howard Myles

Principal Group Advisers

Investment Manager Secretary and Registered Office

Chelverton Asset Management Limited Maitland Administration Services

Limited

12b George Street Springfield Lodge

Bath BA1 2EH Colchester Road, Chelmsford

Tel: 01225 483030 Essex CM2 5PW

Tel: 01245 398950

Registrar and Transfer Office for the ZDP Auditor

shares

Share Registrars Limited Hazlewoods LLP

Suite E, First Floor Windsor House

9 Lion and Lamb Yard Bayshill Road

Farnham Cheltenham GL50 3AT

Surrey GU9 7LL

Tel: 01252 821390

www.shareregistrars.uk.com

Shareholder Information

Sources of further information

The Company's ZDP shares are listed on the London Stock Exchange.

The Company's ZDP NAV is released to the London Stock Exchange on a weekly

basis and published monthly via the AIC.

Information about the Company and SCDT can be obtained on the Manager's

website: www.chelvertonam.com. Any enquiries can also be emailed to

cam@chelvertonam.com.

Share registrar enquiries

The register for the ZDP shares is maintained by Share Registrars Limited. In

the event of queries regarding your holding, please contact the Registrar on

01252 821390. Changes of name and/or address must be notified in writing to the

Registrar.

Chelverton Small Companies ZDP PLC

Notice of Annual General Meeting

NOTICE IS HEREBY GIVEN that the ANNUAL GENERAL MEETING of the Company will take

place at 11.30am (or as soon thereafter as the Annual General Meeting of the

parent company, Chelverton Small Companies Dividend Trust PLC has concluded) on

Thursday, 7 September 2017 at the offices of Chelverton Asset Management, 3rd

Floor, 20 Ironmonger Lane, London, EC2V 8EP for the following purposes:

Ordinary Business: Ordinary Resolutions

1. To receive the Report of the Directors and the audited financial

statements for the period ended 30 April 2017.

2. To receive and approve the Directors' remuneration report for the period

ended 30 April 2017.

3. To re-elect Mr van Heesewijk as a Director.

4. To re-appoint Hazlewoods LLP as Auditor and to authorise the Directors to

determine their remuneration.

Special Business

To consider, and if thought fit to pass the following Resolution which will be

proposed as an Ordinary Resolution

5. To receive and approve the Directors' Remuneration Policy as set out in

the Directors' Remuneration Report.

6. THAT the Directors be and are hereby generally and unconditionally

authorised pursuant to Section 551 of the Companies Act 2006 ('the Act') to

exercise all the powers of the Company to allot shares and to grant rights to

subscribe for, or to convert any security into, shares in the Company ('the

Rights') up to an aggregate nominal value equal to GBP3,166,333, being one-third

of the issued ZDP share capital as at 30 April 2017, during the period

commencing on the date of the passing of this resolution and expiring (unless

previously renewed, varied or revoked by the Company in general meeting) at the

conclusion of the Annual General Meeting of the Company to be held in 2017, or

fifteen months from the passing of this resolution, whichever is earlier (the

'Period of Authority').

The Directors may, at any time prior to the expiry of the Period of Authority,

make offers or agreements which would or might require shares to be allotted

and/or Rights to be granted after the expiry of the Period of Authority and the

Directors may allot shares or grant Rights in pursuance of such offers or

agreements as if the authority had not expired.

By order of the Board

Registered office:

Maitland Administration Services Ltd Springfield Lodge

Secretary Colchester Road,

Chelmsford

14 July 2017 Essex CM2 5PW

Explanatory Notes to the Notice of Annual General Meeting

1. The holders of the Ordinary shares have the right to receive notice,

attend, speak and vote at the Annual General Meeting. Holders of ZDP shares

have the right to receive notice of general meetings of the Company but do not

have any right to attend, speak and vote at any general meeting of the Company

unless the business of the meeting includes any resolution to vary, modify or

abrogate any of the special rights attached to ZDP shares.

2. A member entitled to attend, vote and speak at this meeting may appoint

one or more persons as his/her proxy to attend, speak and vote on his/her

behalf at the meeting. A proxy need not be a member of the Company. If multiple

proxies are appointed they must not be appointed in respect of the same

shares. To be effective, the enclosed form of proxy, together with any power

of attorney or other authority under which it is signed or a certified copy

thereof, should be lodged at the office of the Company Secretary, Maitland

Administration Services Limited, Springfield Lodge, Colchester Road,

Chelmsford, CM2 5PW not later than 48 hours before the time of the meeting. The

appointment of a proxy will not prevent a member from attending the meeting and

voting and speaking in person if he/she so wishes. A member present in person

or by proxy shall have one vote on a show of hands and on a poll shall have one

vote for every Ordinary share of which he/she is the holder.

3. A person to whom this notice is sent who is a person nominated under

Section 146 of the Companies Act 2006 to enjoy information rights (a "Nominated

Person") may, under an agreement between him/her and the shareholder by whom he

/she was nominated, have a right to be appointed (or to have someone else

appointed) as a proxy for the Annual General Meeting. If a Nominated Person has

no such proxy appointment or does not wish to exercise it, he/she may, under

any such agreement, have a right to give instructions to the shareholder as to

the exercise of voting rights. The statements of the rights of members in

relation to the appointment of proxies in Note 2 above do not apply to a

Nominated Person. The rights described in that Note can only be exercised by

registered members of the Company.

4. As at July 2017 (being the last business day prior to the publication of

this notice) the Company's issued voting share capital and total voting rights

amounted to 50,000 Ordinary shares of 100p partly paid as to 25p each, all of

which are held by the parent company. In addition, there are 9,349,000 ZDP

shares of 100p each in issue with no voting rights attached.

5. The Company specifies that only those Ordinary shareholders registered on

the Register of Members of the Company as at 11.30am on 5 September 2017 (or in

the event that the meeting is adjourned, only those shareholders registered on

the Register of Member of the Company as at 11.30am on the day which is 48

hours prior to the adjourned meeting) shall be entitled to attend in person or

by proxy and vote at the Annual General Meeting in respect of the number of

shares registered in their name at that time. Changes to entries on the

Register of Members after that time shall be disregarded in determining the

rights of any person to attend or vote at the meeting.

6. Any question relevant to the business of the Annual General Meeting may be

asked at the meeting by anyone permitted to speak at the meeting. You may

alternatively submit your question in advance by letter addressed to the

Company Secretary at the registered office.

7. In accordance with Section 319A of the Companies Act 2006, the Company

must cause any question relating to the business being dealt with at the

meeting put by a member attending the meeting to be answered. No such answer

need be given if:

a. to do so would:

i. Interfere unduly with the preparation for the meeting, or

ii. involve the disclosure of confidential information;

b. the answer has already been given on a website in the form of an answer to

a question; or

c. it is undesirable in the interests of the Company or the good order of the

meeting that the question be answered.

8. Shareholders should note that it is possible that, pursuant to requests

made by shareholders of the Company under section 527 of the Companies Act

2006, the Company may be required to publish on a website a statement setting

out any matter relating to: (i) the audit of the Company's accounts (including

the auditor's report and the conduct of the audit) that are to be laid before

the Annual General Meeting; or (ii) any circumstances connected with an auditor

of the Company ceasing to hold office since the previous meeting at which

annual accounts and reports were laid in accordance with section 437 of the

Companies Act 2006. The Company may not require the shareholders requesting any

such website publication to pay its expenses in complying with sections 527 or

528 of the Companies Act 2006. Where the Company is required to place a

statement on a website under section 527 of the Companies Act 2006, it must

forward the statement to the Company's auditor not later than the time when it

makes the statement available on the website. The business which may be dealt

with at the Annual General Meeting includes any statement that the Company has

been required under section 527 of the Companies Act 2006 to publish on a

website.

9. A person authorised by a corporation is entitled to exercise (on behalf of

the corporation) the same powers as the corporation could exercise if it were

an individual member of the Company (provided, in the case of multiple

corporate representatives of the same corporate shareholder, they are appointed

in respect of different shares owned by the corporate shareholder or, if they

are appointed in respect of those same shares, they vote those shares in the

same way). To be able to attend and vote at the meeting, corporate

representatives will be required to produce prior to their entry to the meeting

evidence satisfactory to the Company of their appointment. Corporate

shareholders can also appoint one or more proxies in accordance with Note 2. On

a vote on a resolution on a show of hands, each authorised person has the same

voting rights to which the corporation would be entitled. On a vote on a

resolution on a poll, if more than one authorised person purports to exercise a

power in respect of the same shares:

a. if they purport to exercise the power in the same was as each other, the

power is treated as exercised in that way;

b. if they do not purport to exercise the power in the same way as each

other, the power is treated as not exercised.

10. Members satisfying the thresholds in Section 338 of the Companies Act 2006

may require the Company to give, to members of the Company entitled to receive

notice of the Annual General Meeting, notice of a resolution which those

members intend to move (and which may properly be moved) at the Annual General

Meeting. A resolution may properly be moved at the Annual General Meeting

unless (i) it would, if passed, be ineffective (whether by reason of any

inconsistency with any enactment or the Company's constitution or otherwise);

(ii) it is defamatory of any person; or (iii) it is frivolous or vexatious. A

request made pursuant to this right may be in hard copy or electronic form,

must identify the resolution of which notice is to be given, must be

authenticated by the person(s) making it and must be received by the Company

not later than six weeks before the date of the Annual General Meeting.

11. Members satisfying the thresholds in Section 338A of the Companies Act 2006

may request the Company to include in the business to be dealt with at the

Annual General Meeting any matter (other than a proposed resolution) which may

properly be included in the business at the Annual General Meeting. A matter

may properly be included in the business at the Annual General Meeting unless

(i) it is defamatory of any person or (ii) it is frivolous or vexatious. A

request made pursuant to this right may be in hard copy or electronic form,

must identify grounds for the request, must be authenticated by the person(s)

making it and must be received by the Company not later than six weeks before

the date of the Annual General Meeting.

END

(END) Dow Jones Newswires

July 14, 2017 10:08 ET (14:08 GMT)

Chelverton Uk Dividend (LSE:SDV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chelverton Uk Dividend (LSE:SDV)

Historical Stock Chart

From Apr 2023 to Apr 2024