By Sean McLain

TOKYO -- Toyota Motor Corp.'s latest Prius hybrid has a problem:

gasoline prices.

When the Prius first went on the U.S. market in the late 1990s,

it was a hit among celebrities like actor Leonardo DiCaprio who

flaunted their environmental bona fides with the hybrid

gas-electric car.

The latest version, which hit roads in December last year, is

more fuel-efficient than ever, getting 54 miles to the gallon. In

Toyota's home market of Japan, it tops the sales charts. But sales

are down in the U.S., as cheap gasoline dent the car maker's

strategy of presenting itself as the leader of an

environmentally-friendly future -- with the Prius as the

vanguard.

U.S. sales of the Prius are down 26% this year through

August.

At Longo Toyota in El Monte, Calif., the largest Toyota

dealership in the U.S. by volume, Prius sales have fallen by 11%

compared with last year. "But that's not because of the car," said

Brendan Harrington, Longo Toyota's president. "The entire market

has dramatically shifted to light trucks and SUVs with gas under $3

a gallon."

Americans are now more likely to trade in a hybrid or an

electric vehicle for an SUV than they are another hybrid or

electric vehicle, according a survey conducted by automotive

research firm Edmunds.com in April.

"There is a direct correlation in the price of gasoline and the

interest of consumers in hybrids," said Brian Maas, head of the

California New Car Dealers Association, which represents over 1,000

dealers in the biggest U.S. market for the Prius. "When gas was $4

[a gallon], the Prius was No. 1. Gas is $2.50," Mr. Maas said.

It is especially frustrating for Toyota because its strategy is

generally a success in Japan. Through August, the new Prius and a

smaller related model -- called Aqua in Japan and the Prius c in

the U.S. -- sold 304,000 units in Japan, tops in the nation and

three times the U.S. sales even though the U.S. car market is far

bigger.

One reason is higher gasoline taxes, which make the price of a

gallon of gas in Japan around $4.50.

"The sense of value is different in the U.S. and Japan toward

eco-friendly cars," said Hisashi Nakai, head of Toyota's technology

communications group. In the U.S., people want larger cars because

they drive more, he said, while in Japan, "hybrids sell well

regardless of the gas prices."

Despite fuel efficiency improvements and reduced hybrid system

costs, global Toyota hybrid sales are slowing after having peaked

at around 1.3 million units in 2013.

Toyota's U.S. August sales were down 5% in a month where rivals

General Motors Co. and Ford Motor Co. saw their sales fall more

sharply.

Toyota isn't the only manufacturer facing difficulties selling

hybrids in the U.S. Sales of Nissan Motor Co.'s Leaf electric car

are off 36% this year through August. Sales for the vehicles

overall are down 14.4% for the year, according to Hybridcars.com

and market-research firm Baum and Associates.

The weak market for hybrids and electric cars, except from Tesla

Motors Inc., also doesn't bode well for GM's fourth quarter launch

of its Chevrolet Bolt electric car.

Still, even accounting for the overall decline in the market,

Prius sales are sputtering in the U.S. Sales of the flagship Prius

sedan are down 9.6% for the year, compared with a 50% decline for

the seven-seater Prius v and a 45% decline in sales for the Prius

c.

Toyota is trying to compensate for the shift in consumer tastes

by selling more pickup trucks, but the factories that produce those

vehicles are running out of space. The company builds Tacoma and

Tundra trucks at factories in San Antonio, Texas, and Baja

California in Mexico.

"The San Antonio factory is the most capacity-constrained Toyota

factory in the world," said Christopher Richter, a Tokyo-based auto

analyst at brokerage firm CLSA.

Toyota's Mr. Nakai said the company believes that eventually

Americans will want to buy the same cars as its Japanese customers,

pointing to U.S. government efforts to tighten fuel emissions

standards.

But even in Japan, fuel efficiency alone isn't enough to move

cars off the lot anymore.

Despite the Prius' position in Japan, "our honest feeling is

that it could have sold better," said Yasutomo Kato, head of new

car sales promotion at Toyota dealer Tokyo Toyopet. It wasn't until

Toyopet focused its Prius sales pitch on new safety technologies

like automatic braking and collision warning sensors that buying

started to pick up, Mr. Kato said.

Toyota's Prius is partly a victim of its own success. These days

there are plenty of hybrids and other environmentally friendly cars

from rivals, including all-electric models from Tesla. Toyota sells

a hybrid Camry and RAV 4 SUV, and for those who want to show off

the latest technology it has the hydrogen fuel cell-powered Mirai

sedan.

Despite last year's redesign which gave the Prius a sportier

profile -- Toyota calls the car "daring" and "edgy" in its brochure

-- some say it is starting to look a little dated.

"The Prius is a great concept, but Toyota has really put more

energy in to the mechanics of the hybrid vehicle rather than the

styling," said Chris Redl, who runs the Japan-focused hedge fund

Siena Carnico Capital LLC.

"The people with money buy a Tesla," he said.

Write to Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

September 07, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

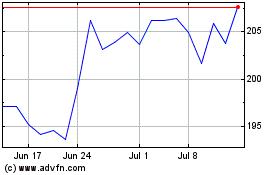

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Apr 2023 to Apr 2024