By Kathy Chu

HONG KONG -- Luxury watches are losing much of their luster.

Blame a sluggish global economy and changing consumer tastes.

Hong Kong, the top market for Swiss-watch exports, has been

particularly hard hit. Luxury-watch sales have been so slow here

that the makers of Cartier, Tag Heuer and other luxury brands are

buying back possibly thousands of timepieces from dealers, analysts

estimate.

Worldwide, Swiss watch exports dropped 16.1% in June from the

year before. But exports to Hong Kong plummeted 29%, which

retailers say is largely the result of a strong Hong Kong dollar

and the Chinese government's crackdown on gifting.

A few years ago, lines of China mainland tourists eager to take

advantage of Hong Kong's tax-free sales policy formed outside

luxury watch and jewelry shops. Now, high-end watch stores in the

city sit empty for much of the day.

"I don't need another luxury watch," said David Werner, a Hong

Kong resident who owns four luxury watches -- two Dunhills, a

Chopard and a Movado. "The ones I have will last a long time."

Smartwatches are also emerging as another threat to sales of

high-end timepieces.

"This is more practical for me," said Jai Ignacio of Hong Kong,

indicating the Apple smartwatch on his wrist. "I can change the

bracelet to steel links when I need to dress up."

Tellingly, the TAG Heuer unit of LVMH Moët Hennessy Louis

Vuitton SE has launched a smartwatch line.

Retailers say that gaudy designs are generally losing favor to

simpler luxury watches, loosely defined as timepieces costing at

least $3,000 U.S.

"The market right now is very, very quiet," said Alain Lam,

executive director of Oriental Watch Holdings Ltd., one of the

largest luxury watch dealers in Hong Kong. "The more expensive and

the shinier the watch, the slower it moves."

Meanwhile, middle-income consumers "have adjusted downward their

ambitions and buy cheaper watches because they have less money in

their pockets," said Luca Solca, a luxury goods analyst at Exane

BNP Paribas.

Against this backdrop, luxury brands are buying back up to

thousands of watches from dealers to make room for newer -- and

often lower-priced -- high-end models, said Erwan Rambourg, global

co-head of consumer and retail for HSBC.

Watch brands may dismantle the gold and precious metals before

junking watches that are no longer selling, analysts say. Watch

models could also be taken from one market and sold in another part

of the world if there is demand.

"If you don't destroy these old watches, then you have loads of

inventory that won't sell," Rambourg said.

While luxury brands have strict rules over what dealers can do

with unsold merchandise, the fear is that excess inventory could

end up on the black market -- often at steeply discounted

prices.

In the ballroom of a Hong Kong hotel this week, hundreds of

traders haggled over prices for new and old luxury watches

including Rolex, Audemars Piguet and Patek Philippe. Glass cases

displayed thousands of watches and advertised discounts of 32% to

45%.

Watch trader Eric Bossart sold a new steel-and-gold luxury watch

to an Egyptian dealer for $135,000 Hong Kong dollars, a 35%

discount to its retail value.

"The brands don't really want us to offer discounts, but if we

don't, [the watches] don't sell," said Mr. Bossart, who splits his

time between Hong Kong and Switzerland.

Mr. Solca, the Exane BNP Paribas analyst, predicts that more

watch brands will need to take steps to help dealers in Hong Kong

clear high levels of inventory.

In May, the chief executive of Cie. Financière Richemont SA

announced that it would buy back its Cartier brand watches

following a global sales decline of 18% the month before. CEO

Richard Lepeu called it an "exceptional measure" for "exceptional

circumstances."

Since then, Richemont has also agreed to buy back other brands

including Piaget, Montblanc and IWC Schaffhausen, according to some

luxury dealers in Hong Kong, who say this is being done on a

case-by-case basis.

"This kind of buyback offer...hasn't happened in the last 20

years," said Mr. Lam of Oriental Watch.

Richemont declined to comment. Mr. Lam says that LVMH is also

buying back older models of its Tag Heuer, Bulgari and Zenith

watches from Oriental, and giving dealers credit to use for new

models.

A LVMH spokeswoman said the luxury house isn't doing anything

"outside of the brand's normal commercial practices to create room

for new items in the assortment."

In a recent call with analysts, LVMH chief financial officer

Jean-Jacques Guiony acknowledged that the buyback of Tag Heuer

watches has been "pretty painful." But bringing down the price

point will help sales, he said. LVMH posted a 4% sales increase for

its watch and jewelry unit in the first six months of this

year.

Hong Kong watch dealers also say they've talked to luxury houses

from Chopard to Swatch Group -- which owns brands including Omega,

Brequet and Blancpain -- about the possibility of buybacks to clear

the inventory.

Chopard declined to comment. Swatch Group said it has no plans

to buy back watches. "Why should we?" a Swatch Group spokesman

said. "Our products aren't food products that have a date of

expiration."

Waning demand for luxury watches has even affected the

used-watch market in Hong Kong.

Rolexes are largely holding their value, but consumers who pawn

Cartier and Franck Muller watches are getting 20% to 30% less cash

than they did a few years ago, said Edward Chan, chief executive of

Oi Wan Pawnshop Credit Holdings Ltd.

"For luxury watches, we really have to check out the amount we

can sell it for before we offer customers a price these days," said

Mr. Chan. "We expect a further drop in the luxury market."

Kimaya de Silva contributed to this article.

Write to Kathy Chu at kathy.chu@wsj.com

(END) Dow Jones Newswires

August 08, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

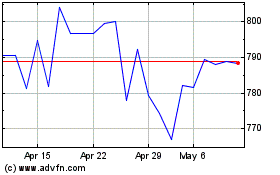

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

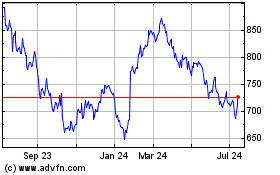

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024