TIDMCWR

RNS Number : 0970H

Ceres Power Holdings plc

11 March 2015

11 March 2015

Ceres Power Holdings plc

Interim results for the six months ended 31 December 2014

Ceres Power Holdings plc ("Ceres", "Ceres Power", "the Company"

or "the Group") announces its interim results for the six months

ended 31 December 2014.

Highlights:

-- Successful fundraising of GBP20 million from leading

institutional investors provides the balance sheet strength to

engage with commercial partners for the next stages of joint

development and commercialisation of the Ceres Steel Cell

technology

-- Deepening relationship with a global Japanese power system

company as Joint Development Agreement signed and underway with

first stages meeting performance targets

-- Achieved 40% improvement in power output of the technology -

further validating the route to affordable fuel cell products

-- Ongoing testing in South Korea nearing completion - meeting all targets

-- Further evaluation of the technology by several new Japanese

OEMs and potential manufacturing partners

-- Aidan Hughes, ex-Finance Director of the Sage Group plc,

appointed as Non-Executive Director and Chairman of Audit

Committee

-- James Falla appointed as COO to drive the delivery of both customer and internal programmes

Financial Highlights:

Six months Six months end

ended 31 December 31 December

2014 2013

(Unaudited) (Unaudited)

GBP'000 GBP'000

------------------- ---------------

Total revenue, comprising 133 895

- release of deferred revenue - 740

- underlying revenue (1) 133 155

Other operating income 294 177

Total underlying revenue and other

operating income 427 332

Operating costs (5,741) (4,867)

Operating loss (5,314) (3,795)

Equity free cash flow (2) (4,528) (2,863)

Net cash and short-term investments 22,735 12,576

(1 Underlying revenue is all revenue excluding the release of

deferred revenue to the income statement which relates to legacy

agreements)

(2 Equity free cash flow is the movement in net cash and cash

equivalents and short-term investments in the period, excluding

cash flows from financing activities)

Alan Aubrey, Chairman of Ceres Power, commented:

"I am very pleased with the company's progress, particularly the

significant technical advances made over the past six months. We

are well positioned for the future and I am confident that we will

soon see this progress further advancing our current commercial

opportunities."

Chairman's statement

The global energy markets continue to change significantly and

the traditional model of centralised power generation is gradually

being disrupted. A clear example of this is E.ON's recent decision

to split its business in two, spinning off its fossil fuel and

nuclear business to focus on renewables and distributed generation.

Johannes Teyssen, E.ON's CEO, said the traditional business model

for utilities has "broken apart" and cited the main reason for this

change as new technology, which has lowered the barrier of entry to

the energy market, undermining the traditional role of the

utility.

In the US, the Energy Information Administration expects

centralised generation to produce less power in 2015 than in 2007

despite significant economic growth, due to the impact of energy

efficiency and an increase in distributed generation. This

reduction is due to new technologies enabling a combination of

demand-side management and distributed generation, which is

predominantly from solar PV, whose cost has dropped significantly

with volume in recent years.

As the energy markets change, security of supply and the ability

to generate power in a highly efficient way from the reliable

existing gas infrastructure will drive the adoption of new

technologies such as fuel cells. Japan has seen rapid growth of

fuel cell systems generating power from natural gas. By the end of

2014 the number of installations of residential fuel cells in Japan

exceeded 138,000 in line with government targets to have 1 million

homes powered by fuel cells by 2020, rising to 5 million by

2030.

The recent drop in fuel prices has resulted in natural gas

prices falling in recent months in sync with oil prices and in most

regions this has widened the so-called spark gap between

electricity and gas prices, improving the economic payback for fuel

cells. The long term forecast from DECC in the UK and in other

countries suggests that this trend will continue regardless of fuel

price which will help drive the adoption of the technology. I am

convinced that distributed generation will continue to grow as

costs fall and the market opportunity for the Ceres Steel Cell is

as large as ever.

In the two years I have been involved with Ceres Power we have

laid the right foundations both technically and commercially for

the future success of the business. We are continuing to build the

management team around Phil Caldwell our CEO, including the recent

appointments of James Falla as Chief Operating Officer and Aidan

Hughes as Non-Executive Director. Aidan brings considerable

experience of growing technology companies, is a significant

addition to the Board and will chair the Audit Committee. James

Falla brings a clear track record of operational delivery,

particularly in Asia.

I am delighted with the progress made by Ceres Power and am

excited about the Company's prospects. We are well positioned for

the future and will soon begin to reap the benefits from the good

work that the team has put in over the past few years.

Alan Aubrey

Chairman

Chief Executive's statement

Over the past six months we have made significant progress

against our core strategy of being a technology provider of the

Ceres Steel Cell to leading power systems companies across

different applications and geographies. The execution of this

strategy has focused on three key areas:

i) giving ourselves a strong financial platform and commercial

pipeline for the business for the next few years,

ii) continuing to develop the core technology performance,

increasing power, efficiency and lifetime, and

iii) making sure we are able to scale the business in future,

both through process development in Horsham and working with

manufacturing partners in key regions such as Asia.

Commercial Progress

Considering the size of our target customers for the Steel Cell

and to give our existing partners confidence in the future of the

business, it was important that we gave the Company sufficient

funding to support our growth over the next few years. We achieved

this through the GBP20 million raise in the summer, which was

backed by leading institutional investors.

Since then we have continued to work with existing partners such

as KD Navien in South Korea and Cummins in North America and

brought in new customers with a particular focus on the Japanese

market. Of these three target markets we have made most progress in

Japan, where there is a drive to meet the target of installing 1

million fuel cell systems in homes by 2020 and 5 million by 2030.

In order to accomplish this, the power system companies need to

achieve a significant step down in cost without compromising

performance, hence their interest in the Ceres Steel Cell, a

low-cost and robust fuel cell technology.

In October 2014 we signed a Joint Development Agreement (JDA)

with a leading Japanese Power System company after a successful

period of testing of the technology both in the UK and Japan. This

validation, in the most advanced fuel cell market in the world, is

a huge endorsement of the Steel Cell technology. This non-exclusive

agreement has enabled both companies to start to combine their

respective engineering and R&D expertise with the aim of

producing a jointly developed Steel Cell SOFC stack for various

applications within the Japanese company's product portfolio. The

first results from this JDA have met the initial performance

targets and the two companies are currently discussing further

stages in extending the relationship further.

In order to support this activity we are also actively engaged

with manufacturing partners to look at the potential production of

the Steel Cell technology in Asia. Although this is still at an

early stage, we have had several organisations validating our

process methods and costs at our manufacturing facility in

Horsham.

Testing with KD Navien, South Korea's largest domestic boiler

manufacturer, has continued to progress well and is meeting all of

the required targets. We expect to conclude this in the next few

months and provide an update in due course. We also continue to

have a good relationship with US power giant Cummins exploring

different applications for the Steel Cell at higher power levels

for prime power applications, which is a rapidly growing

market.

Although progress to follow-on development programmes in the US

and South Korea has taken longer than originally expected, we

continue to grow the commercial pipeline, particularly in Japan.

Our near term focus for the remainder of this financial year will

be on securing next stage agreements in the Asian market.

Technology Progress

Over the past 6 months we have made significant technical

progress having increased our net electrical efficiency to 47%

which is equivalent to the highest performance achieved for SOFC in

the Japanese market and superior to the existing offerings from PEM

technology providers. Our target for the next period is to

demonstrate that our Steel Cell technology enables net efficiency

exceeding 50%, which would enhance the already significant benefit

to the residential consumer in terms of economic payback and also

enables prime power for commercial applications.

We have invested significantly in the technology team and test

infrastructure to further validate the reliability and performance

of the technology. We have already demonstrated the ability of the

Steel Cell to turn on and off in different conditions, which is

still a big issue for many SOFC companies and, in addressing steady

state performance we now consistently achieve degradation rates

equivalent to a 5-7 year stack life, which is the entry level

requirement for good economic payback.

Since the period end, I am very pleased to note that, in early

test results, we have also increased the overall power density by

greater than 40% through a variety of both mechanical and material

improvements to cell and stack design and will bring these forward

from R&D to customer programmes later this year. This excellent

progress by our scientists and engineers was achieved ahead of time

against our internal roadmap and will have a direct and positive

impact on the cost of Ceres Steel Cell products.

Our focus on the core technology has shown there is significant

upside in performance still to come. This year we intend to

increase efficiency still further and also start advanced

engineering programmes to show applicability of the technology to

larger scale power generation, such as for the data centre and

prime power markets.

The Steel Cell is a disruptive technology compared with that

used by existing fuel cell offerings in Japan and the US markets

and we are consistently demonstrating the potential of this

technology both internally and at customer sites. The combination

of increasing overall efficiency, cell power and low degradation

rates all contribute to an improved economic payback for the end

user at an affordable price point.

Manufacturing and Operations

Having established high standards of technical performance, we

are demonstrating our ability to live up to the low cost promise of

the technology in high volume to our potential OEM partners. There

is considerable value in licensing the manufacturing of the Steel

Cell in the future and we have started to have exploratory

discussions with several companies capable of making the Steel Cell

in high volume for the Asian market.

We are now working on optimising our processes for volume,

reducing processing time and costs. The work with ASM Assembly

Systems (formerly DEK) is a good example of this and is backed by

Innovate UK (formerly the Technology Strategy Board) in a GBP0.7

million funded project to take high-speed PV printing machines from

the solar industry and adapt them for our fuel cell

manufacture.

I am also very pleased to welcome James Falla to the business as

COO. In the next phase of Ceres' growth, execution and delivery are

crucial. James brings expertise in international operational

delivery from the automotive sector such as establishing and

running manufacturing facilities in Asia.

Financial

Although we have not yet seen commercial progress coming through

to significant revenue, total underlying revenue and other

operating income has increased to GBP0.43m (2013: GBP0.33m). This

is due to an increase of UK Government grants recognised from

GBP0.18m to GBP0.29m while underlying revenue remained broadly

flat. The underlying revenue position is flat predominantly due to

progress taking longer than anticipated to reach follow-on

agreements in the US and South Korea. Overall revenue has declined

to GBP0.13m (2013: GBP0.90m) as in 2013 the Group released GBP0.74m

of deferred revenue to the income statement (deferred revenue being

cash received relating to a contract but not recognised as revenue)

due to the ending of a legacy product and supply agreement with

Bord Gais Eirann.

The Group's operating loss increased as planned to GBP5.31m in

2014 (2013: GBP3.80m). This was driven by the reduction in total

revenue, as detailed above, as well as the planned-for increase of

GBP0.87m in recurring operating costs to GBP5.74m in the period

(2013: GBP4.87m). This increase in recurring operating costs is due

to the continued rebase and focus on development and

'productionisation' of the technology, which reflects an increased

average number of employees in the period and the drive to improve

the Company's test and manufacturing capability.

Ceres ends the calendar year 2014 with GBP22.74m in cash and

cash equivalents and short-term investments, having started the

period with GBP7.70m. This movement in funds was influenced by cash

inflows from financing activities of GBP19.56m, being net funds

received from the equity fundraise in July 2014 (2013: GBPnil), and

equity free cash outflow (EFCF) in the period of GBP4.53m (2013:

2.86m). The EFCF was principally a reflection of net cash used in

operations of GBP3.92m (2013: GBP3.71m), an increase of GBP0.21m as

the business has grown, and investment in property, plant and

equipment of GBP0.85m (2013: GBP0.18m) as the Company has invested

in expanding its test facilities. Since the period end the Company

received GBP1.05m of income tax credit relating to the financial

year ended 30 June 2014 (2013: the Company received GBP1.0m income

tax credit during the period).

Summary

We have made good technical and commercial progress over the

past six months, continuing to hit our key technical performance

milestones and bringing through more companies to evaluate our

technology. I am confident that we will start to see this reflected

in commercial progress this year, as more partners evaluate the

technology and we continue to demonstrate increasing performance

against our roadmap. In the remainder of this year we expect to

continue our investment in development and see more OEMs moving

into next stage agreements.

Ceres is well positioned to become one of the leading companies

in the fuel cell sector and the level of interest in our unique

Steel Cell technology from the world's leading power system and

manufacturing companies shows that we have a significant business

opportunity.

Phil Caldwell

Chief Executive Officer

For further information contact:

Ceres Power Holdings plc Tel. +44 (0)1403 273 463

Phil Caldwell, CEO

Richard Preston, CFO

N+1 Singer (Nominated Adviser and Broker) Tel: +44 (0) 20 7496 3000

Ben Wright / Alex Wright

Tavistock Communications Tel: +44 (0) 20 7920 3150

Mike Bartlett/James Collins

www.cerespower.com

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 December 2014

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

Note GBP'000 GBP'000 GBP'000

Revenue 133 895 1,224

Operating costs 2 (5,741) (4,867) (10,393)

Other operating income 294 177 581

Operating loss (5,314) (3,795) (8,588)

Interest receivable 58 42 73

Loss before income tax (5,256) (3,753) (8,515)

Income tax credit 550 400 1,122

Loss for the financial

period / year and total

comprehensive loss (4,706) (3,353) (7,393)

================== ================== ================

Losses per GBP0.05 ordinary

share expressed in pence

per share:

Basic and diluted loss

per share 3 (0.64)p (0.62)p (1.38)p

The accompanying notes are an integral part of these interim

financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2014

31 December 31 December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 1,998 1,771 1,657

Other receivables 53 53 58

------------------ ------------------ ----------------

Total non-current assets 2,051 1,824 1,715

Current assets

Trade and other receivables 885 642 1,219

Current tax receivable 1,550 444 1,166

Short-term investments 6 12,000 - -

Cash and cash equivalents 6 10,735 12,576 7,699

------------------ ------------------ ----------------

Total current assets 25,170 13,662 10,084

Liabilities

Current liabilities

Trade and other payables (1,317) (1,585) (1,143)

Provisions for other liabilities

and charges (326) - (242)

------------------ ------------------ ----------------

Total current liabilities (1,643) (1,585) (1,385)

------------------ ------------------ ----------------

Net current assets 23,527 12,077 8,699

Non-current liabilities

Other payables (1,146) (1,157) (1,175)

Provisions for other liabilities

and charges (966) (1,107) (1,166)

------------------ ------------------ ----------------

Total non-current liabilities (2,112) (2,264) (2,341)

Net assets 23,466 11,637 8,073

================== ================== ================

Equity

Share capital 4 7,725 5,369 5,369

Share premium account 90,115 72,907 72,907

Capital redemption reserve 3,449 3,449 3,449

Other reserve 7,463 7,463 7,463

Profit and loss account (deficit) (85,286) (77,551) (81,115)

Total equity 23,466 11,637 8,073

================== ================== ================

The interim financial statements were approved by the Board of

Directors on

10 March 2014 and were signed on its behalf by:

Philip Caldwell Richard Preston

Director Director

The accompanying notes are an integral part of these interim

financial statements

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 December 2014

Profit

Share Capital and loss

Share premium redemption Other account

capital account reserve reserve (deficit) Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2013 8,817 72,906 - 7,463 (74,578) 14,608

Comprehensive

loss

Loss for the period - - - - (3,353) (3,353)

------------- ------------- -------------- ------------- ------------- -------------

Total comprehensive

loss - - - - (3,353) (3,353)

------------- ------------- -------------- ------------- ------------- -------------

Transactions with

owners

Issue of shares,

net of costs 1 1 - - - 2

Cancellation of

deferred shares,

net of costs (3,449) - 3,449 - - -

Share-based payments

charge - - - - 380 380

------------- ------------- -------------- ------------- ------------- -------------

Total transactions

with owners (3,448) - 3,449 - 380 382

------------- ------------- -------------- ------------- ------------- -------------

At 31 December

2013 5,369 72,907 3,449 7,463 (77,551) 11,637

------------- ------------- ------------- ------------- -------------

Comprehensive

loss

Loss for the period - - - - (4,040) (4,040)

Total comprehensive

loss - - - - (4,040) (4,040)

------------- ------------- -------------- ------------- ------------- -------------

Transactions with

owners

Share-based payments

charge - - - - 476 476

Total transactions

with owners - - - - 476 476

------------- ------------- -------------- ------------- ------------- -------------

At 30 June 2014 5,369 72,907 3,449 7,463 (81,115) 8,073

------------- ------------- -------------- ------------- ------------- -------------

Comprehensive

loss

Loss for the period - - - - (4,706) (4,706)

------------- ------------- -------------- ------------- ------------- -------------

Total comprehensive

loss - - - - (4,706) (4,706)

------------- ------------- -------------- ------------- ------------- -------------

Transactions with

owners Issue of

shares, net of

costs 2,356 17,208 - - - 19,564

Share-based payments

charge - - - - 535 535

Total transactions

with owners 2,356 17,208 - - 535 20,099

------------- ------------- -------------- ------------- ------------- -------------

At 31 December

2014 7,725 90,115 3,449 7,463 (85,286) 23,466

------------- ------------- -------------- ------------- ------------- -------------

The accompanying notes are an integral part of these interim

financial statements.

CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 December 2014

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

Note GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 5 (3,917) (3,710) (8,252)

Income tax received 166 1,000 1,000

------------------ ------------------ ----------------

Net cash used in operating

activities (3,751) (2,710) (7,252)

------------------ ------------------ ----------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (848) (184) (520)

Movement in short-term investments (12,000) 6,207 6,207

Finance income received 53 31 75

------------------ ------------------ ----------------

Net cash (used in) / generated

from investing activities (12,795) 6,054 5,762

------------------ ------------------ ----------------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 20,035 2 2

Expenses of shares issued (471) - -

------------------ ------------------ ----------------

Net cash generated from financing

activities 19,564 2 2

------------------ ------------------ ----------------

Net increase/(decrease) in

cash and cash equivalents 3,018 3,346 (1,488)

Exchange gains/(losses) on

cash and cash equivalents 18 - (43)

------------------ ------------------ ----------------

3,036 3,346 (1,531)

Cash and cash equivalents

at beginning of period 7,699 9,230 9,230

------------------ ------------------ ----------------

Cash and cash equivalents

at end of period 10,735 12,576 7,699

------------------ ------------------ ----------------

Reconciliation to net funds

Opening net funds 7,699 15,437 15,437

Net increase/(decrease) in cash

and cash equivalents 3,036 3,346 (1,531)

Increase/(decrease) in short-term

investments 12,000 (6,207) (6,207)

Closing net funds (note 6) 22,735 12,576 7,699

------- -------- --------

The accompanying notes are an integral part of these interim

financial statements.

Notes to the interim financial statements for the six months

ended 31 December 2014

1 Basis of preparation

The financial information has been prepared in accordance with

all IFRS and IFRS Interpretations Committee ("IFRIC")

interpretations that had been published by 31 December 2014 as

endorsed by the European Union (EU).

This interim report, which comprises the consolidated statement

of comprehensive income, the consolidated statement of financial

position, the consolidated statement of changes in equity, the

consolidated cash flow statement and the related notes, is

unaudited and does not constitute audited accounts within the

meaning of the Companies Act 2006. The accounts for the year ended

30 June 2014, on which the auditors gave an unqualified audit

opinion, have been filed with the Registrar of Companies.

The accounting policies adopted are consistent with those of the

financial statements for the year ended 30 June 2014, as described

in those financial statements. As at the date of signing the

interim financial statements, there are no new Standards likely to

affect the financial statements for the year ending 30 June

2015.

The Company is continuing to develop and commercialise its core

Steel Cell fuel cell system technology. The Company raises finance

for its activities in discrete tranches and further funding will be

raised as and when required.

The directors prepare annual budgets and cash flow projections

that extend beyond 12 months from the date of this report. On the

basis of these forecasts, the directors believe that the going

concern basis is appropriate for the preparation of the financial

statements.

2. Operating costs

Operating costs are split as follows:

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

GBP'000 GBP'000 GBP'000

Research and development costs 4,056 3,366 7,403

Administrative expenses 1,685 1,501 2,990

------------------ ------------------ ----------------

5,741 4,867 10,393

================== ================== ================

3. Loss per share

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

GBP'000 GBP'000 GBP'000

Loss for the financial period

/ year attributable to shareholders (4,706) (3,353) (7,393)

================== ================== ================

Weighted average number of

shares in issue 735,388,547 536,831,794 536,831,883

================== ================== ================

Loss per GBP0.01 ordinary

share (basic & diluted) (0.64)p (0.62)p (1.38)p

================== ================== ================

4. Share capital

Ceres Power Holdings plc has called-up share capital totalling

772,537,841 GBP0.01 ordinary shares as at 31 December 2014

(536,831,973 ordinary shares of GBP0.01 each at 30 June 2014, as

disclosed in the statutory financial statements of Ceres Power

Holdings plc for the year ended 30 June 2014).

During the period 235,705,868 ordinary shares of GBP0.01 each

were issued as a placing on AIM for cash consideration of

GBP20,035,000. Expenses of the issue were GBP471,000.

5. Cash used in operations

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

GBP'000 GBP'000 GBP'000

Loss before income tax (5,256) (3,753) (8,515)

Adjustments for:

Other finance income (58) (42) (73)

Depreciation of property, plant

and equipment 486 597 1,069

Share-based payments charge 535 380 856

Operating cash flows before

movements in working capital (4,293) (2,818) (6,663)

Decrease/(increase) in trade

and other receivables 344 (179) (773)

Increase/(decrease) in trade

and other payables 148 (527) (670)

Decrease in provisions (116) (186) (146)

------------------ ------------------ ----------------

Decrease/(increase) in working

capital 376 (892) (1,589)

Cash used in operations (3,917) (3,710) (8,252)

================== ================== ================

6. Net cash and cash equivalents and short-term investments

31 December 31 December 30 June

2014 (Unaudited) 2013 (Unaudited) 2014 (Audited)

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 1,256 1,843 982

Short-term bank deposits less

than 3 months 5,029 9,021 -

Money market funds 4,450 1,712 6,717

Cash and cash equivalents 10,735 12,576 7,699

Short-term investments (bank

deposits greater than 3 months) 12,000 - -

------------------ ------------------ ----------------

22,735 12,576 7,699

------------------ ------------------ ----------------

The Group typically places surplus funds into pooled money

market funds and bank deposits with durations of up to twelve

months. The Group's treasury policy restricts investments in

short-term sterling money market funds to those which carry

short-term credit ratings of at least two of AAAm (Standard &

Poor's), Aaa/MR1+ (Moody's) and AAA V1+ (Fitch) and deposits with

banks having a minimum long-term rating of A/A-/A3 and short-term

rating of F-1/A-2/P-2 for banks which the UK Government holds less

than 25% ordinary equity.

-ends-

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUUGWUPAPUU

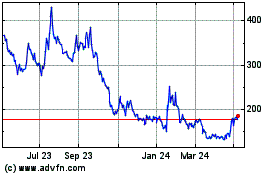

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

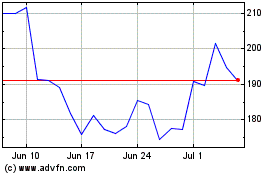

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024