TIDMCWR

RNS Number : 5529O

Ceres Power Holdings plc

08 November 2016

8 November 2016

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Ceres Power Holdings plc

Final results for the year ended 30 June 2016

Ceres Power Holdings plc ("Ceres Power", the "Company" or the

"Group") (AIM: CWR.L) announces its final results for the year

ended 30 June 2016.

Financial Highlights:

Year Ended Year Ended

30 June 30 June

2016 2015

GBP'000 GBP'000

----------- -----------

Total revenue and other operating

income, comprising: 1,668 945

Revenue (1) 1,113 324

Other operating income 555 621

Operating loss (12,694) (11,722)

Equity free cash flow (2) (11,291) (9,084)

Net cash and short term investments

(3) 6,947 18,184

Commercial and operational highlights:

During the reporting period

-- Substantial commercial progress including agreements with

Honda R&D for power system applications and Nissan for range

extenders for Electric Vehicles

-- Excellent technical progress with increasing SteelCell

performance and manufacturing scale up

After the year end

-- First significant US commercial success with Cummins & US

Dept. of Energy to develop multi-kW systems for Data Centre and

commercial scale applications

-- UK residential field trials begun for home system application

with British Gas as part of European ene.field demonstration

programme

-- GBP20 million fundraising in October 2016 secures the Group's financial strength

-- Formal release of SteelCell version 4 to customers and continued performance improvements

______________________________________________________________

(1 Revenue includes the release of GBP0.6 million of deferred

revenue in respect of contracted work completed for British

Gas)

2 Equity free cash outflow (EFCF) is the net change in cash and

cash equivalents in the year (-GBP6.2 million) less net cash

generated from financing activities (GBP0.1 million) less the

movement in short term investments (GBP5.0 million)

(3 This does not include the net GBP19.4 million equity raised

since the year end at a placing)

Phil Caldwell, CEO, commented:

"I'm delighted with our progress this year, having secured three

new partnerships with world-leading customers operating in high

growth markets. This puts Ceres Power in an excellent position for

commercial growth in the year ahead as we develop these

relationships further and add new partners for our SteelCell

technology"

Alan Aubrey, Chairman, added:

"In October the Company successfully raised equity funding of

GBP20 million. We are looking forward to another year of

significant commercial progress as we continue to establish Ceres

Power as a leading player in the clean energy sector."

For further information contact:

Ceres Power Holdings plc Tel. +44 (0)1403 273 463

Dan Caesar, Communications Director

Zeus Capital Ltd (Nominated Adviser and Broker) Tel: +44 (0)20 3829 5000

Phil Walker/Andrew Jones/Hugh Kingsmill Moore

Tavistock Tel: +44 (0)20 7920 3150

Mike Bartlett/James Collins

www.cerespower.com

Chairman's statement

New technology is changing the way we heat and power our homes,

businesses and transportation. Alongside this, changing lifestyles

and circumstances are adding to the pressure on our energy system.

For example, our increasing reliance on data and cloud computing

now accounts for around 2% of the world's electrical power

generation, a figure set to rise significantly. Poor air quality in

cities is leading to a desire to reduce carbon and harmful

emissions and adopt cleaner, electric vehicles. Our desire to

comply with the COP21 Paris Agreement and meet targets on climate

change, is creating a need to decarbonise our heat and power

networks, and generate power more efficiently. All of which places

yet more demand on our ageing power grid.

The existing system of centralised energy generation is no

longer appropriate, and this represents a huge opportunity for a

business such as ours.

Last year we set out our Company strategy to broaden the

applications for the SteelCell. I am pleased to say that this year

we have shown very strong progress against this strategy, and are

working with leading power system OEMs on a number of these huge

market opportunities. Honda, Nissan and Cummins are market leaders

in their respective fields, and we are engaged with them all in

developing different applications using the SteelCell.

We now aim to move our partners on from the development stage,

and negotiate commercial terms for the production and

commercialisation of products using the SteelCell technology.

I am delighted to say that in October, the Company successfully

raised equity funding of GBP20 million from a combination of new

and existing institutional investors. This was essential in

providing us with the financial strength to engage with partners of

size and quality. It also provided further funding for maintaining

the leadership position of our SteelCell technology, and investing

further in its higher power development capability.

The Board and Executive team has remained unchanged throughout

the year, as we now have a strong and balanced team with a range of

complementary skills. As a board, we aim to establish a governance

structure which provides effective control and oversight of the

business as it grows, to enhance shareholder value. This year, we

have taken further steps to comply as appropriate with the latest

guidelines for small and mid-cap companies - there are further

details in the corporate governance section of this year's annual

report.

I'd like to thank the Board and employees for their dedication

and hard work over the past year, in achieving our strategy and

getting the Company to such a strong position.

We are looking forward to another year of significant commercial

progress with existing and new partners as we continue to establish

Ceres Power as a leading player in the rapidly growing clean energy

sector.

Alan Aubrey

Chairman

Chief Executive's statement

The Company's substantial technical progress in recent years has

formed a solid foundation for the significant commercial headway we

have made this year. We have been able to show real progress in our

strategy of developing new applications for the SteelCell

technology, aimed at high growth markets such as transportation and

the commercial and light industrial sectors, in addition to our

residential offering.

Our vision of a fuel cell in every home and business can only

truly become a reality if we work with world-leading companies with

the engineering capability and market access to bring these

products to market. This year we have been able to engage with some

of these companies, which is a testament to the quality and

professionalism of the team at Ceres Power. Last year I stated that

our target was to have five OEMs working on development programmes

with the SteelCell technology within two years. We are on track to

meet this, with three significant relationships secured this year,

putting us on the path to commercialisation.

In January, we announced a relationship with Honda R&D for

joint development of a stack which could be used in a variety of

Honda's power system products. Honda produces over six million

power products a year and is a world leader in small generators and

engine technologies - developing one of the world's first micro-CHP

products, the Honda ECOWILL. Our two-year programme with Honda

comes after several years of testing and evaluating the SteelCell

technology in Japan, and I believe it is one of the strongest

endorsements to date of the quality of the technology and our

team.

In June, we announced our first multi-kW customer programme for

developing a higher power stack, with Nissan, one of the world's

leading electric vehicle (EV) manufacturers. Nissan has a target of

2020 for launching an electric vehicle with a fuel cell

range-extender that can run on biofuels. We are working with Nissan

UK to develop a 5-kW stack for such a range extender. This could

enable the same range and refuelling time as a conventional

combustion engine vehicle, but with significantly lower carbon and

emissions. We were approached by Nissan due to the SteelCell

technology's robustness for coping with the multiple cycling and

rapid start-ups required for automotive applications. This could

open a huge new market for the SteelCell, as pressure on diesel

emissions is leading to more regulation globally, and as the cost

of EV ownership continues to fall to the point where EV sales are

predicted to reach 25% of all vehicles sold by 2025.

In September 2016, we finalised a contract with Cummins - backed

by the US Department of Energy (DoE), and working with Pacific

Northwest National Laboratory, a US DoE laboratory and University

of Connecticut - to develop a multi-kW power system for use in data

centres and other commercial and light industrial applications.

This is our first significant entry into the US market and our

first development of a multi-kW system, which will build on

synergies from the Nissan stack programme. The market for power for

data centres and other commercial applications is growing rapidly.

Data centres already account for around 2% of global electricity

consumption. Cummins is one of the leaders in supplying back-up and

temporary power systems to this market, and is an ideal partner for

us.

We have had significant commercial success in markets where the

benefits of fuel cells are well understood, such as Asia and now

the US. Therefore it was really pleasing to have the opportunity to

join the Europe-wide field testing programme of residential micro

CHP units, with the ene.field programme in partnership with British

Gas. We have had a unit on test at British Gas over the past six

months, and joining the ene.field programme is a great opportunity

for us to show the maturity of the technology, and the benefits for

the UK market, to some of the leading OEMs. This will be the first

significant trial of residential fuel cells in the UK in recent

years, and is a key step in the development of robust products we

can deploy commercially with our OEM partners.

Since Tony Cochrane joined us as CCO, we've moved up a gear

commercially, adding strength regionally to our business

development teams. In addition to the programmes highlighted, over

the year we have run test programmes at stack and system level in

Japan, Korea and Europe. We continue to have a healthy pipeline of

new opportunities to secure at least a further two OEM development

programmes to meet our original target of five by the end of 2017.

Furthermore, by the end of 2018 our intention is to take at least

two of these OEM partners through to programmes where the SteelCell

is selected as the technology to take through to full commercial

product launch.

Technology and Operations

Our significant commercial progress this year was made possible

by the commitment of the Technology and Operation teams, under the

leadership of Mark Selby, CTO, and James Falla, COO.

We achieved a key milestone with the recent release to customers

of our latest version of the SteelCell technology, version 4. This

has reduced manufacturing costs by removing processing steps and

through improved use of materials, and also by making high-speed

production possible.

Version 4 also brings in more performance enhancements from

R&D and Engineering, which further improve robustness and

lifetime.

In January, we announced the successful installation of our

high-speed print line, which has increased print-cycle processing

speed by a factor of ten. The success was made possible through

backing from an Innovate UK grant.

At a system level, our engineering teams have achieved a

significant milestone with the release of the latest system

architecture of the SteelGen. This is being tested for home use by

British Gas, in the Europe-wide ene.field programme. Field testing

will bring us real world operating experience of the technology and

help us understand and demonstrate the savings anticipated in

homes. Although we don't intend to make and sell the complete power

system units, this is a key step in securing OEM partners, by

helping them understand the maturity and suitability of the

technology for deployment in homes.

Additionally, at a multi-kW level we have built for the first

time a 5kW stack module and continue to test it in-house. This

feeds into the work we will do for Nissan, Cummins and other

multi-kW partners.

In the coming year, our R&D investment and efforts will

focus on further improving lifetime and reliability, working

closely with our customers to develop methodologies to predict

technology lifetime. This will increase confidence in the

robustness and readiness of the technology to be deployed, thus

reducing testing and development times for commercial launch

programmes.

Financial

As described above, our strategy for entering commercial

partnerships is becoming a reality and, for the financial year

ended 30 June 2016, this translated into revenue and other income

of GBP1.7 million (2015: GBP0.9 million). Of this, GBP1.1 million

was customer revenue (2015: GBP0.3 million) and GBP0.6 million was

other income, primarily from government grants (2015: GBP0.5

million). GBP0.6 million of revenue was due to the release of

deferred revenue as we demonstrated our prototype residential

system at British Gas during the second half of the year. We have

invested in people and capabilities to support our strategy of

developing high power systems. This year's equity free cash outflow

of GBP11.3 million will be the peak, as we anticipate seeing an

increasing contribution from commercial programmes offsetting our

operating costs.

We expect to continue to grow top line revenue and other

operating income as we bring through more pipeline opportunities.

Thanks to recently signed commercial agreements, today our customer

and government grant order book is already over GBP2 million.

As we increase our number of customers, and they progress from

evaluation to product development and then to commercial launch, we

anticipate each progression will increase the revenue contribution,

reducing our underlying cash burn year on year towards break

even.

The successful fundraising approved by shareholders on 14

October 2016 for the placing of 228.6 million shares has

contributed GBP19.4 million to the Group's cash and short term

investments, which at 30 June 2016 was GBP6.9 million. This stands

us in good stead for the next few years, during which we plan to

further our commercial opportunities.

People

Due to the quality of our OEM partners, it is important we

attract and retain talented people to work with them. We have hired

some key individuals this year, and continue to attract exceptional

people. We have added to the commercial, engineering and programme

delivery sides of the business to support our growing number of

customer programmes.

I'd personally like to thank everyone at Ceres Power for their

dedication and hard work over the past year, and I look forward to

an exciting year ahead.

Outlook

This is an exciting stage in the Company's growth. We are

targeting five global engineering companies as customers in joint

development agreements by the end of 2017 and aiming to be in two

launch programmes with OEM partners by the end of 2018. We have

made good progress towards these objectives and I am looking

forward to being able to announce further commercial progress in

the year ahead.

Phil Caldwell

Chief Executive Officer

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME

For the year ended 30 June 2016

Year Year

ended ended

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Revenue 1,113 324

Cost of sales (336) (191)

Gross profit 777 133

Other operating income 555 621

Operating costs 2 (14,026) (12,476)

Operating loss (12,694) (11,722)

Finance income 77 110

Loss before taxation (12,617) (11,612)

Taxation credit 2,157 1,571

Loss for the financial year

and total comprehensive

loss (10,460) (10,041)

========= =========

Losses per GBP0.01 ordinary

share expressed in pence

per share:

Basic and diluted loss per

share 3 (1.35)p (1.33)p

All activities relate to the Group's continuing operations and

the loss for the financial year is fully attributable to the owners

of the parent.

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2016

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 2,309 2,080

Total non-current assets 2,309 2,080

Current assets

Trade and other receivables 1,109 982

Derivative financial instrument 28 -

Current tax receivable 1,997 1,519

Short-term investments 6 1,000 6,000

Cash and cash equivalents 6 5,947 12,184

--------- ---------

Total current assets 10,081 20,685

Liabilities

Current liabilities

Trade and other payables (2,121) (1,708)

Derivative financial instrument (7) -

Provisions for other liabilities

and charges (78) (305)

--------- ---------

Total current liabilities (2,206) (2,013)

--------- ---------

Net current assets 7,875 18,672

Non-current liabilities

Accruals and deferred income (31) (1,121)

Provisions for other liabilities

and charges (866) (950)

--------- ---------

Total non-current liabilities (897) (2,071)

Net assets 9,287 18,681

========= =========

Equity

Share capital 4 7,779 7,725

Share premium account 90,120 90,120

Capital redemption reserve 3,449 3,449

Other reserve 7,463 7,463

Accumulated losses (99,524) (90,076)

Total equity 9,287 18,681

========= =========

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2016

Year Year

ended ended

30 June 30 June

2016 2015

Note GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 5 (11,773) (9,182)

Taxation received 1,679 1,218

--------- ---------

Net cash used in operating

activities (10,094) (7,964)

--------- ---------

Cash flows from investing

activities

Purchase of property, plant

and equipment (1,302) (1,243)

Movement in short-term investments 5,000 (6,000)

Finance income received 77 110

--------- ---------

Net cash generated from/(used

in) investing activities 3,775 (7,133)

--------- ---------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 54 20,035

Net expenses from of issuance

of ordinary shares - (466)

--------- ---------

Net cash generated from financing

activities 54 19,569

--------- ---------

Net (decrease)/increase in

cash and cash equivalents (6,265) 4,472

Exchange gains on cash and

cash equivalents 28 13

--------- ---------

(6,237) 4,485

Cash and cash equivalents

at beginning of year 12,184 7,699

--------- ---------

Cash and cash equivalents

at end of year 5,947 12,184

--------- ---------

The accompanying notes are an integral part of these

consolidated financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2016

Share Capital

Share premium redemption Other Accumulated

capital account reserve reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2014 5,369 72,907 3,449 7,463 (81,115) 8,073

Comprehensive

income

Loss for the

financial

year - - - - (10,041) (10,041)

--------- --------- ------------- --------- ------------ ---------

Total comprehensive

loss - - - - (10,041) (10,041)

--------- --------- ------------- --------- ------------ ---------

Transactions

with owners

Issue of shares,

net of costs 2,356 17,213 - - - 19,569

Share-based

payments charge - - - - 1,080 1,080

--------- --------- ------------- --------- ------------ ---------

Total transactions

with owners 2,356 17,213 - - 1,080 20,649

--------- --------- ------------- --------- ------------ ---------

At 30 June

2015 7,725 90,120 3,449 7,463 (90,076) 18,681

--------- --------- --------- ------------ ---------

Comprehensive

income

Loss for the

financial

year - - - - (10,460) (10,460)

Total comprehensive

loss - - - - (10,460) (10,460)

--------- --------- ------------- --------- ------------ ---------

Transactions

with owners

Issue of shares,

net of costs 54 - - - - 54

Share-based

payments charge - - - - 1,012 1,012

Total transactions

with owners 54 - - - 1,012 1,066

--------- --------- ------------- --------- ------------ ---------

At 30 June

2016 7,779 90,120 3,449 7,463 (99,524) 9,287

--------- --------- ------------- --------- ------------ ---------

The accompanying notes are an integral part of these

consolidated financial statements.

Notes to the financial statements for the year ended 30 June

2016

1. Basis of preparation

The consolidated financial statements of the Group have been

prepared on a going concern basis, in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union, the IFRS Interpretations Committee (IFRS-IC) interpretations

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The consolidated financial statements have

been prepared on a historical cost basis except that the following

assets and liabilities are stated at their fair value: derivative

financial instruments and financial instruments classified as fair

value through the profit or loss.

The financial information contained in this final announcement

does not constitute statutory financial statements as defined by in

Section 434 of the Companies Act 2006. The financial information

has been extracted from the financial statements for the year ended

30 June 2016 which have been approved by the Board of Directors,

and the comparative figures for the year ended 30 June 2015 are

based on the financial statements for that year.

The financial statements for 2015 have been delivered to the

Registrar of Companies and the 2016 financial statements will be

delivered after the Annual General Meeting.

The Auditor has reported on both sets of accounts without

qualification, did not draw attention to any matters by way of

emphasis without qualifying their report, and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

The accounting policies adopted are consistent with those of the

financial statements for the year ended 30 June 2015, as described

in those financial statements.

After having made appropriate enquiries and in light of the

placing which raised GBP19.4 million net of expenses in October

2016, the Directors have a reasonable expectation that the Group

and Company have adequate resources to progress their established

strategy for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis in preparing these

financial statements.

2. Operating costs

Operating costs are split

as follows:

Year

Year ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Research and development costs 10,588 9,146

Administrative expenses 3,714 3,330

----------- ---------

14,302 12,476

Reversal of provision relating

to onerous lease and property

dilapidations (276) -

----------- ---------

14,026 12,476

=========== =========

Notes to the financial statements for the year ended 30 June

2016 (continued)

3. Loss per share

Year ended Year ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Loss for the financial year

attributable to shareholders (10,460) (10,041)

============ ============

Weighted average number of

shares in issue 773,999,046 753,164,756

============ ============

Loss per GBP0.01 ordinary share

(basic & diluted) (1.35)p (1.33)p

============ ============

4. Share capital

Ceres Power Holdings plc has called-up share capital totalling

777,857,841 GBP0.01 ordinary shares as at 30 June 2016 (772,537,841

ordinary shares of GBP0.01 each at 30 June 2015).

During the period 5,320,000 ordinary shares of GBP0.01 each were

issued on the exercise of employee share options.

5. Cash used in operations

Year ended Year ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Loss before taxation (12,617) (11,612)

Adjustments for:

Other finance income (77) (110)

Depreciation of property, plant

and equipment 1,178 926

Share-based payments 1,012 1,080

Net foreign exchange gains (49) (13)

Operating cash flows before

movements in working capital (10,553) (9,729)

(Increase)/decrease in trade

and other receivables (134) 308

(Decrease)/increase in trade

and other payables (775) 150

(Decrease)/increase in provisions (311) 89

----------- -----------

(Increase)/decrease in working

capital (1,220) 547

Cash used in operations (11,773) (9,182)

=========== ===========

Notes to the financial statements for the year ended 30 June

2016 (continued)

6. Net cash, short-term investments and financial assets

Year

Year ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Cash at bank and in hand 805 1,135

Money market funds 5,142 11,049

Cash and cash equivalents 5,947 12,184

Short-term investments (bank

deposits > 3 months) 1,000 6,000

----------- ---------

6,947 18,184

----------- ---------

The Group typically places surplus funds into pooled money

market funds and bank deposits with durations of up to 12 months.

The Group's treasury policy restricts investments in short-term

sterling money market funds to those which carry short-term credit

ratings of at least two of AAAm (Standard & Poor's), Aaa/MR1+

(Moody's) and AAA V1+ (Fitch) and deposits with banks with minimum

long-term rating of A/A-/A3 and short-term rating of F-1/A-2/P-2

for banks which the UK Government holds less than 10% ordinary

equity.

7. Post balance sheet events

During October 2016 the Company completed a placing which raised

GBP20 million gross through the issue of 228,603,083 ordinary

shares.

- ENDS -

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FSEEFWFMSEEF

(END) Dow Jones Newswires

November 08, 2016 02:00 ET (07:00 GMT)

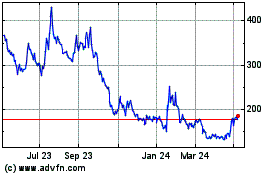

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

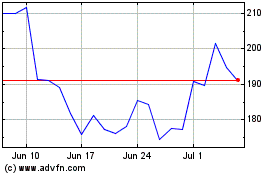

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024