TIDMCWR

RNS Number : 4565B

Ceres Power Holdings plc

07 October 2015

7 October 2015

Ceres Power Holdings plc

Final results for the year ended 30 June 2015

Ceres Power Holdings plc ("Ceres", "Ceres Power", "the Company"

or "the Group") (AIM: CWR.L) announces its final results for the

year ended 30 June 2015.

Highlights:

During the reporting period

-- Signed Joint Development Agreement with a

global Japanese power system company

-- Successful deployment of the technology at

customer sites in Japan and South Korea meeting

all test requirements

-- Fundraising of GBP20 million in July 2014

and GBP18 million net cash and short-term

investments at 30 June 2015 maintain the Group's

financial strength

-- Steel Cell power output improvement of 40%

and efficiency increase to 47% of the technology

- further validating the route to affordable

fuel cell products

-- Leadership team strengthened with the addition

of Aidan Hughes as Non-Executive Director,

and James Falla as Chief Operating Officer

After the year end

-- Formal release of latest V3 cell technology

to customers with degradation enabling 7 year

product life

-- Expansion of Commercial team with Tony Cochrane

appointed as Chief Commercial Officer based

in North America and opening of South Korean

office

-- Successful completion of the first year of

the Joint Development Agreement with global

Japanese power system company

Financial Highlights:

Year Ended 30 June 2015 Year Ended 30 June 2014

GBP'000 GBP'000

------------------------ ------------------------

Total revenue, comprising 324 1,224

Release of deferred revenue - 738

Underlying revenue (1) 324 486

Other operating income 621 581

Total underlying revenue and other operating income 945 1,067

Cost of sales and operating costs (12,667) (10,393)

Operating loss (11,722) (8,588)

Equity free cash flow (2) (9,084) (7,740)

Net cash and short term investments 18,184 7,699

Phil Caldwell, CEO, commented:

"We have successfully demonstrated the ability of the Steel Cell

technology to meet the most demanding performance requirements in

our partner programmes in Japan and South Korea. We continue to

focus on securing further agreements with key commercial partners

and I expect to announce progress on this in the near future."

Alan Aubrey, Chairman, added:

"Over the year our reputation has strengthened as one of the

leading technology companies in the industry. I am delighted that

we've been able to attract individuals with strong international

and operational experience to the leadership team in preparation

for the next phase of the Company's growth."

______________________________________

(1 Underlying revenue is total revenue less the release of

deferred revenue relating to historic agreements)

2 Equity free cash outflow (EFCF) is the net change in cash and

cash equivalents in the year less net cash generated from financing

activities less the movement in short term investments

Chairman's statement

Over the past 12 months we have witnessed the ongoing evolution

of the energy sector, marking the grand transition towards

distributed generation and the world market for distributed

generation is predicted to approximately double in the next eight

years(1) . Whilst the majority of this distributed generation

currently comprises a variety of technologies - including

renewables such as solar - fuel cells are increasingly becoming

part of this energy mix as an enabling technology for renewables

and allowing people to generate their own power cleanly and

efficiently at the point of use. This shift away from the

traditional business model of centralised power utilities is

helping to bring fuel cells closer to commercialisation.

Driven by cost reduction through technology innovation, the

stationary fuel cell market continues to grow with market revenues

of US$40bn forecast by 2022(2) . The fuel cell technologies that

dominate this growth are commercially available in Asia and the US

and run on widely available fuels such as Natural Gas, Biogas and

LPG. As a result, these technologies are not held back by a lack of

hydrogen infrastructure, as we have seen in automotive fuel cell

applications. With infrastructure not a limiting factor for

commercialisation and scale-up, widespread adoption of the Steel

Cell technology is directly achievable as long as we continue to

demonstrate we can hit the cost, lifetime and performance targets

required by the world's leading power system companies.

The Steel Cell technology is a relatively new and disruptive

technology compared to the established fuel cell offerings, but one

that is proving itself repeatedly against the most demanding

performance targets set by market leaders in the power sector. We

have met all customer testing requirements at sites in Japan and

South Korea and our latest V3 technology has been released to

customers after extensive in-house validation beyond 10,000 hours

of testing. We have also hit key technical milestones in our

development roadmap showing considerable uplifts in efficiency and

power density in early stage development. These achievements are

key to ensuring we have the best overall economic offering for our

customers and we intend to bring through some of these additional

benefits in our V4 release next year.

Strategically, we have positioned Ceres as one of the few

independent technology providers that is able to offer low-cost

solutions to a wide variety of players across different sectors and

geographies for different product applications. This breadth and

versatility enables the Company to benefit as the industry

continues to consolidate and markets mature. We have the capability

to support businesses operating at a range of different stages and

speeds of development: whether they might be aspiring power system

companies in need of reliable fuel cell technology to play catch-up

with existing players; or the established companies themselves,

struggling to realise the performance and cost targets needed for a

truly mass-market offering and so seeking next-generation

technology to transform existing products.

The latest development in the stack and system technology has

been brought together in the Steel Gen platform, a 1kW class power

only prototype comparable to the Japanese Ene-Farm products, which

is compact, highly efficient and meets the most stringent of global

emission standards. This will be released to customer programmes

early next year.

We are continuing to expand the reach and scope of our

technology and are developing a multi-kW system to operate at

electrical efficiencies above 50%, as we intend to extend our

offering beyond residential to the light-commercial and power only

applications in response to prospective customer enquiries.

In terms of developing the talent base at the Company essential

to future growth, we have further strengthened the team with the

appointment of James Falla as Chief Operating Officer and more

recently Tony Cochrane as Chief Commercial Officer. James joined

Ceres after 15 years establishing operations in Asia for leading

Tier 1 automotive companies. Tony joins us from Ballard Power

Systems, with over 17 years' direct experience in the fuel cell

sector, where he led the commercialisation of the stationary power

business. We also welcomed Aidan Hughes as a Non-Executive Director

who brings with him considerable experience of growing technology

companies throughout his career and is a significant addition to

the Board as Chair of the Audit Committee.

The ability to attract colleagues of the quality and experience

of Aidan, James and Tony shows the growing market appeal and

reputation of Ceres in the industry under the leadership of Phil

Caldwell as CEO.

I have been working with Phil now for two years and we have a

great team in place. We have invested in the core technology and

are demonstrating significant technical progress, both internally

and on customer sites worldwide. Initial evaluations at some of our

customer sites have taken longer than planned which has impacted

commercial progress and therefore we have not seen the anticipated

revenue growth in the year. However, as long as we continue to hit

our key technical milestones it is no longer a case of 'if' this

technology will come to market but just a matter of 'when'. As part

of the exciting energy evolution rolling out across the globe we

see Ceres now becoming established as one of the leading

independent technology companies in this rapidly growing

distributed generation sector.

Alan Aubrey

Chairman

______________________________________

1 'Global Distributed Generation Deployment Forecast', Navigant Research, 2014.

2 'Fuel Cells Annual Report 2014, Navigant Research

Chief Executive's statement

(MORE TO FOLLOW) Dow Jones Newswires

October 07, 2015 02:00 ET (06:00 GMT)

It has been an exciting year for us as well as a demanding one,

working with some of the world's best companies in Japan and South

Korea, which set extremely high standards for the performance of

fuel cell technology. As the energy sector evolves and the

distributed generation market matures, we have continued to invest

in process and technical innovation in pursuit of our commercial

aspirations, building the necessary capability, capacity and

competence to compete on the global stage. It is only in doing so

that we can meet the ambition we have for Ceres in establishing the

Steel Cell as the standard for Solid Oxide Fuel Cell (SOFC)

technology in the industry.

The market opportunity for our Steel Cell technology is greater

than ever as we see significant deployment of fuel cells in our

primary target markets in Japan, South Korea and the US. The Steel

Cell enables mass market adoption of fuel cells as it provides all

of the performance of the established older generation fuel cells

in the industry, but with a unique robustness to cycling and offers

customers a low-cost solution that can be manufactured using

standard techniques and commodity materials. The ability to

manufacture ceramics on Steel is unique to Ceres in the industry

and key to our licensing strategy.

We therefore find ourselves exclusively positioned in having a

disruptive low-cost next-generation Steel Cell technology, which is

available to all power system companies in the sector. This allows

us to embed the technology into as many applications and

geographies as possible with the common building block of the Steel

Cell at the core of future power systems.

Whilst we continue to demonstrate the low-cost potential to

existing partners for the residential market, we have also made

significant technical progress over the past year which will enable

us to widen the applicability of this technology to higher-power

systems for the light-commercial and power only sectors, broadening

our target markets and ultimately the value we can create for our

shareholders.

Commercial

Over the past year we have focused on two areas in our customer

engagements: Firstly demonstrating that this relatively new and

disruptive technology is mature enough for commercialisation by

leading power system companies; secondly, that it has the potential

to increase both in efficiency and power density to enable its

application to other product applications beyond our residential

platform.

We have reached a point now in the technology's maturity where

we are able to engage with more customers globally, across a range

of geographies, in response to increasing interest in the Steel

Cell for a variety of applications.

In order to best realise this market potential we are investing

in our commercial team globally and I am pleased to welcome Tony

Cochrane to the business as Chief Commercial Officer. Brought in to

spearhead our commercial activities, Tony has considerable

experience in the fuel cell sector from his time in Ballard Power

Systems, where he led the commercialisation of their Stationary

Power business. Tony is based in North America, further boosting

access to this market segment.

Expanding our presence and platform in Asia and building on the

progress made through our local office in Japan, we recently opened

an office in Seoul, South Korea. Forecast as having revenue

potential of US$15bn alone by 2022(1) , South Korea is a key target

market for us, both to support our existing business relationships

and to address further opportunities there.

'Progress on partnerships'

Working to the highest customer standards, we have seen

successful deployment this year of our technology across several

different markets, such that in Japan, South Korea and the UK, we

have met all of the technical requirements set for the technology

to date.

In Japan: In October last year, we announced a Joint Development

with a leading Japanese Power system company and I am pleased to

say we have met all our objectives after two years of working

together and we expect to broaden this relationship in the near

future.

We are also progressing further evaluations with several other

Japanese companies for both residential and light-commercial

applications and we have a healthy pipeline of new

opportunities.

In South Korea: We successfully completed all testing at KD

Navien's facility in Seoul, under the Technology Assessment

Agreement, including aggressive accelerated testing for

cycleability and steady state running. At KDN's request we have

provided an additional system to provide parallel testing for both

steady state and cycleability, as extended validation.

In the UK: IE CHP (a joint venture between SSE and Intelligent

Energy) completed system testing of the technology in a simulated

typical UK home environment, demonstrating the potential benefits

for a UK customer. We expect to undergo further assessments of the

technology in the UK this year.

Overall, I am satisfied with the commercial progress this year,

even though this has not translated into revenue growth yet, as

some of our customer evaluations have extended longer than

anticipated. In the coming year, I expect we shall see an

increasing number of these pipeline opportunities come through as

new commercial relationships, in addition to the continued progress

shown with our existing partners.

Technology

Internal and external validation of our technology has been a

key focus over the past year. It is important to our customers that

we can evidence lifetime and robustness equivalent to more

established, early generation fuel cell technologies, while

simultaneously demonstrating the significant uplift in performance

and low cost of the Steel Cell. This has been a Company-wide effort

and called for significant additional investment in our test and

operations capability.

(1 Stationary Fuel Cells: Global Market Analysis and Forecasts,

2014, Navigant Research)

The technical progress we have made resulted in the recent

release of our V3 technology to customers following extensive

internal testing and validation proving durability and lifetime

through accelerated and steady state testing. This validation

included multiple stack testing over 10,000 hours achieving

degradation rates equivalent to those required for product life of

over 7 years and comparable to fuel cell competitors in Japan.

Stack tests on earlier generations of the technology also surpassed

20,000 hours providing greater confidence in the long lifetime

potential of the Steel Cell technology.

With robustness to cycling representing another key

differentiator over conventional early generation SOFC, we have

also completed aggressive accelerated testing (including redox and

thermal cycling tests) equivalent to 10+ years of performance.

We are now working on our V4 release which is due to reach

customers in 2016 and serves two primary purposes: preparing the

technology for scale-up, as well as improving performance and

reducing cost further.

In terms of performance, high electrical efficiency relative to

other technologies, particularly at small scale, is a key driver

for the adoption of SOFC technology. We have already demonstrated

performance equivalent to the best available systems in Japan and

aim to achieve over 50% net electrical efficiency in the next

year.

Such performance not only enhances the already significant

benefit to the residential consumer, but more importantly, widens

the potential of the technology to other markets such as power-only

and back-up power applications for the commercial and

light-industrial business sectors.

The technology team has also been continuously improving the

power output of the Steel Cell. We have shown power density

improvements of 40% in the year and expect this to translate into

lower-cost product offerings to customers in future releases of our

technology.

At a system level we have also made great progress and expect to

release the latest version of our prototype system architecture,

the Steel Gen, which is fully compliant with all emission standards

and probably the most compact SOFC system design available. This

meets the key requirements to access the wider markets for

installations in high-rise apartments in Asia.

In response to customer interest in higher-power products for

light-commercial applications (such as the commercial market of

5-10kW power-only products), we have begun to develop multi-kW

systems and I anticipate further progress in this area during the

year.

All of the above improvements in performance, robustness and

cost result in an improved economic payback for the end user, at an

affordable price point and serve to strengthen our USP and

competitive position.

Operations and Manufacturing

We are competing with - and in some instances looking to partner

with - a number of the largest ceramics companies in the world,

hence the quality and scalability of our manufacturing processes is

key and represents a source of great commercial value. Accordingly,

we continue to invest in our manufacturing processes in Horsham

which are unique to Ceres and a valuable asset.

I am also very pleased to have strengthened our team with the

recent addition of James Falla as Chief Operating Officer. James

joins Ceres with a track record in establishing operations in Asia

for leading Tier 1 automotive companies.

Significant progress has been made on production scale-up

projects, designed to demonstrate and validate production processes

suitable for high-volume fuel cell manufacture. These are on track

for delivery early next year through the V4 programme.

A good example of progress is the development of a high-speed

screen print line which has been procured and part funded with an

Innovate UK grant. Print-cycle time will reduce from 30 seconds to

just 3 seconds.

(MORE TO FOLLOW) Dow Jones Newswires

October 07, 2015 02:00 ET (06:00 GMT)

In an example of innovation driving down costs still further,

the latest cell design release also incorporates a change to the

electrolyte deposition from spraying to screen printing. This key

technical advance serves to replace a cost-intensive process with a

faster, more economical and controllable printing process.

Looking ahead, we are in discussions with several manufacturing

partners to scale the business in line with OEM demand with a

particular focus on Asia as a first market.

Financial

Ceres is well financed to deliver its business plan, having

raised GBP19.6M in equity, mostly from new investors at the start

of the financial year, in an oversubscribed private placing. The

Company ends the year with GBP18.2M in cash and cash equivalents

and short-term investments (2014: GBP7.7M).

During the year equity free cash outflow (EFCF)(1) was GBP9.1M

(2014: GBP7.7M). This planned increase was driven predominantly by

the Company's investment in its people and technology development,

as it increased its average number of employees from 72 to 96 and

incurred recurring 'cash operating costs'(2) of GBP10.5M (2014:

GBP8.2M). EFCF was also influenced by additions to the Group's test

and manufacturing infrastructure as it incurred GBP1.2M capital

expenditure (2014: GBP0.5M).

The Company's commercial progress has not translated directly

into the revenue streams that we expected in the year. As a result

our underlying revenue, which is primarily generated from customer

evaluation and joint development agreements, and other operating

income, fell in the year from GBP1.1M to GBP0.9M.

We continue to make use of available government grants, which

remain flat at GBP0.6M, while underlying revenue fell from GBP0.5M

to GBP0.3M(3) . Overall revenue has declined to GBP0.3M (2014:

GBP1.2M) as in 2014 the Group released GBP0.7M of deferred revenue

to the income statement due to the ending of a legacy agreement

with Bord Gais Eirann.

1 Equity free cash outflow (EFCF) is the net change in cash and

cash equivalents in the year less net cash generated from financing

activities less the movement in short term investments.

2 Cash operating costs being operating costs less depreciation

and share based payments charge.

3 Underlying revenue is total revenue less the release of

deferred revenue relating to historic agreements

An important form of funding to the business comes in the form

of R&D tax credits. We received GBP1.2M of tax credit relating

to the prior year within the year (2014: GBP1.0M) and we aim to

increase this going forward in line with the R&D activity of

the business.

The Company's loss for the financial year rose from GBP7.4M in

2014 to GBP10.0M, in line with internal expectations as we have

invested significantly in test, validation and engineering

capability as we grow the business. As the weighted average number

of shares in issue increased from 537M to 753M, the loss per

ordinary share decreased from 1.38p to 1.33p.

Outlook

Over the past year we have deployed our technology in Japan,

South Korea and the UK, completing all testing to date

successfully, adding to our growing reputation in the industry.

This has required us to demonstrate considerable maturity as an

organisation in order to compete with some of the world-leading

ceramics companies and engage with global power systems

players.

We have hit and surpassed key technical milestones, with the

highlight being the release to customer programmes of the latest

version of our cell and system technology. In order to do this we

have invested in manufacturing and test capabilities in Horsham and

also significantly in key hires for the team, broadening and

deepening our capabilities and competences.

Looking ahead I expect to convert a number of our evaluation

initiatives into significant development programmes and increase

the number of partners we have in all stages of engagement. We

continue to build relationships with a focus on securing the right

strategic partners and I expect to announce further progress in our

key relationships in the near future.

In particular, we shall target securing partners for new

applications outside of our traditional residential market and plan

to demonstrate a multi-kW platform capability in the coming year

which will open up new markets based on the common platform of the

Steel Cell technology.

As a technology company we expect to continuously improve our

technology in accordance with our roadmap. Over the coming year I

expect to announce further improvements at both core technology and

system level with a focus on increasing power and efficiency as we

look to improve further the economic proposition to our

customers.

I should like to thank the whole team at Ceres for their

continued focus and hard work over the year, without which this

progress would not have been possible. I believe we now have a

great team in place and we are at a point where our investment in

the core technology will come through into our customer

programmes.

Philip Caldwell

Chief Executive Officer

For further information contact:

Ceres Power Holdings plc Tel. +44 (0)1403 273 463

Phil Caldwell, CEO

Richard Preston, Finance Director

Zeus Capital Ltd (Nominated Adviser and Broker) Tel: +44 (0)20 3829 5000

Phil Walker / Andrew Jones

Tavistock Tel: +44 (0)20 7920 3150

Mike Bartlett / James Collins

www.cerespower.com

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2015

Year Year

ended ended

30 June 30 June

2015 2014

Note GBP'000 GBP'000

Revenue 324 1,224

Cost of sales (191) (265)

Gross profit 133 959

Operating costs 2 (12,476) (10,128)

Other operating income 621 581

Operating loss (11,722) (8,588)

Interest receivable 110 73

Loss before income tax (11,612) (8,515)

Income tax credit 1,571 1,122

Loss for the financial year

and total comprehensive

loss (10,041) (7,393)

========= =========

Losses per GBP0.01 ordinary

share expressed in pence

per share:

Basic and diluted loss per

share 3 (1.33)p (1.38)p

All activities relate to the Group's continuing operations and

the loss for the financial year is fully attributable to the owners

of the Parent.

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2015

30 June 30 June

2015 2014

Note GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 2,080 1,657

Other receivables - 58

--------- ---------

Total non-current assets 2,080 1,715

Current assets

Trade and other receivables 982 1,219

Current tax receivable 1,519 1,166

Short-term investments 6 6,000 -

Cash and cash equivalents 6 12,184 7,699

--------- ---------

Total current assets 20,685 10,084

Liabilities

Current liabilities

Trade and other payables (1,708) (1,143)

Provisions for other liabilities

and charges (305) (242)

--------- ---------

Total current liabilities (2,013) (1,385)

--------- ---------

Net current assets 18,672 8,699

Non-current liabilities

Accruals and deferred income (1,121) (1,175)

Provisions for other liabilities

and charges (950) (1,166)

--------- ---------

Total non-current liabilities (2,071) (2,341)

Net assets 18,681 8,073

========= =========

Equity

Share capital 4 7,725 5,369

Share premium account 90,120 72,907

Capital redemption reserve 3,449 3,449

Other reserve 7,463 7,463

Profit and loss account

(deficit) (90,076) (81,115)

Total equity 18,681 8,073

========= =========

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(MORE TO FOLLOW) Dow Jones Newswires

October 07, 2015 02:00 ET (06:00 GMT)

For the year ended 30 June 2015

Profit

Capital and

Share Redemption loss

Share premium reserve Other account

capital account reserve (deficit) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2013 8,817 72,906 - 7,463 (74,578) 14,608

Comprehensive

loss

Loss for the

year - - - - (7,393) (7,393)

--------- --------- ------------- --------- ----------- ---------

Total comprehensive

loss - - - - (7,393) (7,393)

--------- --------- ------------- --------- ----------- ---------

Transactions

with owners

Issue of shares,

net of costs 1 1 - - - 2

Cancellation

of deferred

shares, net

of costs (3,449) - 3,449 - - -

Share-based

payments charge - - - - 856 856

--------- --------- ------------- --------- ----------- ---------

Total transactions

with owners (3,448) 1 3,449 - 856 858

--------- --------- ------------- --------- ----------- ---------

At 30 June

2014 5,369 72,907 3,449 7,463 (81,115) 8,073

--------- --------- --------- ----------- ---------

Comprehensive

loss

Loss for the

year - - - - (10,041) (10,041)

Total comprehensive

loss - - - - (10,041) (10,041)

--------- --------- ------------- --------- ----------- ---------

Transactions

with owners

Issue of shares,

net of costs 2,356 17,213 - - - 19,569

Share-based

payments charge - - - - 1,080 1,080

Total transactions

with owners 2,356 17,213 - - 1,080 20,649

--------- --------- ------------- --------- ----------- ---------

At 30 June

2015 7,725 90,120 3,449 7,463 (90,076) 18,681

--------- --------- ------------- --------- ----------- ---------

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2015

Year Year

ended ended

30 June 30 June

2015 2014

Note GBP'000 GBP'000

Cash flows from operating

activities

Cash used in operations 5 (9,182) (8,252)

Income tax received 1,218 1,000

--------- ---------

Net cash used in operating

activities (7,964) (7,252)

--------- ---------

Cash flows from investing

activities

Purchase of property, plant

and equipment (1,243) (520)

Movement in short-term investments (6,000) 6,207

Finance income received 110 75

--------- ---------

Net cash (used in)/generated

from investing activities (7,133) 5,762

--------- ---------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares 20,035 2

Net expenses of shares issued (466) -

--------- ---------

Net cash generated from financing

activities 19,569 2

--------- ---------

Net increase/(decrease) in

cash and cash equivalents 4,472 (1,488)

Exchange gains/(losses) on

cash and cash equivalents 13 (43)

--------- ---------

4,485 (1,531)

Cash and cash equivalents

at beginning of period 7,699 9,230

--------- ---------

Cash and cash equivalents

at end of period 12,184 7,699

--------- ---------

The accompanying notes are an integral part of these financial

statements.

Notes to the financial statements for the year ended 30 June

2015

1. Basis of preparation

The consolidated financial statements of the Group have been

prepared on a going concern basis, in accordance with International

Financial Reporting Standards ("IFRS") as adopted by the European

Union, the IFRS Interpretations Committee (IFRS-IC) interpretations

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The consolidated financial statements have

been prepared on a historical cost basis except for certain items

that have been measured at fair value as detailed in the individual

accounting policies.

The financial information contained in this final announcement

does not constitute statutory accounts as defined by in Section 434

of the Companies Act 2006. The financial information has been

extracted from the financial statements for the year ended 30 June

2015 which have been approved by the Board of Directors, and the

comparative figures for the year ended 30 June 2014 are based on

the financial statements for that year.

The accounts for 2014 have been delivered to the Registrar of

Companies and the 2015 accounts will be delivered after the Annual

General Meeting.

The Auditor has reported on both sets of accounts without

qualification, did not draw attention to any matters by way of

emphasis without qualifying their report, and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

The accounting policies adopted are consistent with those of the

financial statements for the year ended 30 June 2014, as described

in those financial statements.

The Directors have a reasonable expectation that the Group and

Company have adequate resources to progress their established

strategy for the foreseeable future. Accordingly, they continue to

adopt the going concern basis in preparing these financial

statements.

2. Operating costs

Operating costs are split

as follows:

Year Year

ended ended

30 June 30 June

2015 2014

GBP'000 GBP'000

Research and development costs 9,146 7,138

Administrative expenses 3,330 2,990

--------- ---------

12,476 10,128

========= =========

3. Loss per share

Year Year

ended ended

30 June 30 June

2015 2014

GBP'000 GBP'000

Loss for the financial year

attributable to shareholders (10,041) (7,393)

============ ============

Weighted average number of

shares in issue 753,164,756 536,831,883

============ ============

Loss per GBP0.01 ordinary share

(basic & diluted) (1.33)p (1.38)p

============ ============

4. Share capital

Ceres Power Holdings plc has called-up share capital totalling

772,537,841 GBP0.01 ordinary shares as at 30 June 2015 (536,831,973

ordinary shares of GBP0.01 each at 30 June 2014).

(MORE TO FOLLOW) Dow Jones Newswires

October 07, 2015 02:00 ET (06:00 GMT)

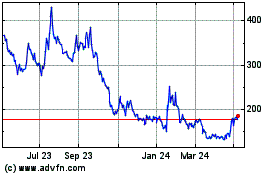

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

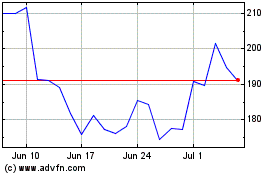

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024