TIDMCNA

RNS Number : 1941A

Centrica PLC

22 March 2017

22 March 2017

Centrica plc (the Company)

Annual Report and Accounts 2016

Further to the release of the Company's preliminary results

announcement on 23 February 2017, the Company announces that it has

today published its Annual Report and Accounts 2016 (Annual Report

2016).

The Company also announces that on 20 March 2017 it posted to

shareholders the Notice of Annual General Meeting to be held at

2.00pm on Monday 8 May 2017 at the QEII Centre, Broad Sanctuary,

Westminster, London, SW1P 3EE.

In accordance with Listing Rule 9.6.1, copies of the following

documents have been submitted to the UK Listing Authority and will

shortly be available for inspection from the National Storage

Mechanism:

- Annual Report and Accounts 2016

- Annual Review 2016

- Notice of Annual General Meeting 2017

The above documents are also available at centrica.com/ar16.

This information should be read in conjunction with the

Company's preliminary results announcement. A condensed set of the

Company's financial statements and information on important events

that have occurred during the financial year and their impact on

the financial statements, were included in the preliminary results

announcement released on 23 February 2017. That information,

together with the information set out below, which is extracted

from the Annual Report 2016, is provided in accordance with the

Disclosure and Transparency Rule 6.3.5, which requires it to be

communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full Annual Report 2016. Page and note

references in the text below refer to page numbers and note numbers

in the Annual Report 2016.

Our Principal Risks and Uncertainties

Managing our risks and uncertainties is key to achieving our

priorities.

LINKS TO STRATEGY

In line with our strategy we are concentrating more investment

on our customer-facing businesses organised into the two global

customer-facing divisions of Centrica Consumer and Centrica

Business. We are focused on delivering high levels of customer

service, improving customer engagement and loyalty, and developing

innovative products, offers and solutions for both residential and

business customers, underpinned by investment in technology. Our

asset businesses of Exploration and Production and Centrica Storage

continue to play an important role in our portfolio providing cash

flow diversity and balance sheet strength.

Our activities for near-term implementation and delivery of our

strategy are framed around the five priorities below. These

priorities are a lens through which we assess our risks and

discussions around risk appetite. Each priority has associated

risks, which are managed as part of our overall system of risk

management and internal control.

Our five priorities

Safety, compliance and conduct

Customer satisfaction and operational excellence

Cash flow growth and strategic momentum

Cost efficiency and simplification

People and building capability

Managing the Risks to the Delivery of our Priorities

Risk management is fundamental to the way the Group is governed

and managed. Our system of risk management and internal control

comprises the following elements that are assessed for

effectiveness annually:

-- Business Principles: sets our expected behaviours across the organisation.

-- Enterprise Risk Framework: incorporates the principal risks

within the Group Risk Universe, as outlined below.

-- Board and Committees' governance: committees are structured

to be aligned with the Principal Risks identified, as outlined

below.

-- Executive management oversight: establishing appropriate

executive processes to ensure appropriate planning and performance

management.

-- Operational management accountability and certification:

represents the first line accountability for the risk and control

environment.

-- Delegations of Authority: structure within which

accountability is delegated through the organisation in accordance

with identified risk appetite.

-- Management systems: the detailed Policies, Standards and

Procedures establishing the requirement for process level controls

that are monitored throughout the organisation.

-- Assurance providers: second and third line assurance provided

to ensure that Policies, Standards and Procedures are being

followed and that risks are being mitigated in line with risk

appetite.

The Group's strategic review in 2015 and its implementation in

2016 highlighted emerging risks and provided an opportunity to

simplify and standardise how significant risks are managed. We have

identified the differing nature of our risks including:

-- Risks that require standards where our tolerance for error is

generally very low. This will include Health, Safety, Environment

and Security, Legal and Regulatory Compliance, Financial Processing

and Reporting, Information Systems and Data Security, and Ethical

and Behavioural Standards. For these risks there will be management

systems providing clearly prescribed standards with ring-fenced

functional monitoring and assurance.

-- Risks where judgement is required within a range of

acceptable outcomes in order to deliver our priorities. This

includes areas where we need to take a certain level of risk such

as in commodity trading and our investment in the growth areas of

the business.

-- Risks resulting from external factors where we have limited

influence over their occurrence, but can influence the impact on

our business through our actions.

Assessing our Principal Risks in 2016

As in previous years we identified and assessed our risks within

the categories of Principal Risk overleaf to ensure appropriate

mitigating activities. During 2016 the risks that were prioritised

for leadership attention, and those that had most significant

impact in our assessment of the future viability of the

organisation, particularly related to:

-- ensuring we deliver a safe and compliant operating environment in all respects;

-- our strategic transformation and its impact on our people;

-- the changing political environment, and the potential for

further intervention, including Brexit;

-- the evolving regulatory requirements, particularly the

outcome of the Competition and Markets Authority (CMA)

investigation;

-- ongoing volatility in the commodity market with its impact on pricing; and

-- our commitment to our growth businesses and excellence in customer service.

We align our assessment of the extent of risk we wish to take

with our priorities and express our risk appetite in relation to

these priorities. For example, in relation to ensuring we have a

safe and compliant operating environment our appetite is very low,

whereas we are prepared to take risks in relation to delivering our

growth objectives.

The Principal Risks, and their related components, are allocated

oversight through the Board and its Committees as indicated

overleaf. The table also provides an indication of the risk

mitigation strategy for each risk category, reflecting our appetite

for risk, and our view on changes in the risk climate compared with

2015.

The Board retains overall non-executive responsibility for risk

across the Group. With the exception of certain risks that the

Board reserves to itself, oversight of specific Principal Risks

contained within the Group Risk Universe are delegated by the Board

to one or more of its Committees. The table below summarises each

Principal Risk with reference to oversight by the Board or its

Committee, its risk climate and the associated priority.

Description Potential Mitigation

impacts

--- -------------------- -------------------------- --------------------------------------------------------------

1 Strategy Following

delivery the conclusion * The Board approves the Group annual plan setting the

Failure to of the strategic strategic direction and confirming strategic choices

deliver Centrica review, the that are embedded in targets across the business.

strategy. delivery of

Governance our future

oversight strategy will * Quarterly performance reviews are held with all parts

Board involve growth of the business to monitor progress against these

Risk climate in a number targets.

- unchanged of business

Priority areas, implementing

substantial * We have a clear financial framework to ensure capital

Cash flow cost efficiencies is allocated in line with strategy and prioritised to

growth and and making deliver optimal business benefits.

strategic certain disposals.

momentum This is fundamental

to our future * We continue to strengthen our leadership team in

success and order to deliver in our growth areas, including the

incorporates appointment during the year of a Chief Information

both controllable Officer to support our digital strategy.

and uncontrollable

risk elements

which require * We apprise ourselves constantly of developments that

careful monitoring. are central to achieving our strategy.

--- -------------------- -------------------------- --------------------------------------------------------------

2 External Customer behaviour

market and demand * Events within the external market environment sit

Changes and can change largely outside of our direct control, but set the

events in due to improved tone for our future business.

the external energy efficiency,

market or climate change,

environment government * Regular analysis is undertaken on commodity price

that could initiatives, fundamentals and their potential impact on business

impact delivery long-term plans and expectations.

of Centrica's weather patterns

strategy. and the general

Governance economic outlook. * We continue to pursue a range of investment options

oversight In addition across the energy chain and in different markets and

Board we face competition geographies in response to external market

Risk climate in our upstream opportunities.

- increased businesses

Priority in uncertain

commodity * We are increasing our investment in connected homes

Cash flow markets and through smart meters, personalised customer energy

growth and we must respond usage reports, smart and time-of-use tariffs,

strategic appropriately. applications for remote heating control and US

momentum appliance rental programmes in order to respond to

market disruption and position us at the forefront of

new technology.

--- -------------------- -------------------------- --------------------------------------------------------------

3 Political We are subject

and regulatory to oversight * The Executive Committee members actively engage in

intervention from various discussions with all political parties, influencers

Changes, political and regulatory authorities.

intervention and regulatory

or a failure bodies in

to influence the UK, Republic * Following the decision to exit the European Union in

change to of Ireland, June we have been active in contributing our views on

the political US, Canada the development of the markets in which we operate.

or regulatory and elsewhere.

landscape. These bodies

Governance set and oversee * We are committed to an open, transparent and

oversight the terms competitive UK energy market that provides choice for

Board of our licences consumers.

Risk climate and the conduct

- increased of our operations.

Priority In particular * We accept that we may be the subject of focused

at present, regulatory scrutiny, with informal investigations

Cash flow as a consequence into one or more areas that could result in

growth and of the UK's stakeholder concerns and take measures to react as

strategic decision to quickly as possible.

momentum exit the European

Union and

wider political * We work with regulators to seek the right approach to

changes in intervention.

the markets

we operate

in, risks

relating to

changing policies

in relation

to energy

markets and

carbon emissions

are recognised.

--- -------------------- -------------------------- --------------------------------------------------------------

4 Brand, trust Our primary

and reputation focus is to * During the year a review of our brand positioning has

Competitive serve our been undertaken to ensure that this is aligned with

positioning customers our priorities.

and protection and satisfy

of the Centrica their changing

and subsidiary needs in all * The primary mechanism by which we review changes in

brands. of the markets our brand position is through NPS and other metrics

Governance we operate as described on page 19.

oversight in. We also

Board actively manage

Risk climate our brands * We are focused on providing affordable energy and

- unchanged and reputation, excellent service to deliver a fair, simplified and

Priority in order to transparent offering to all of our consumers.

protect and

Customer develop our

satisfaction competitive * We engage with NGOs, consumer and customer groups,

and operational position amongst political parties, regulators, charities and other

excellence a wide range stakeholders to identify solutions to help reduce

of stakeholders. bills and improve trust in the industry.

--- -------------------- -------------------------- --------------------------------------------------------------

5 Business We prioritise

planning, how we use * 2016 was the first full year of planning using a

forecasting our resources refreshed approach designed to underpin the delivery

and performance based on our of the priorities.

Business business plans

planning, and forecasts.

forecasting, Failure to * Group functions have adopted standardised planning

risk management accurately processes in support of the business priorities,

and achievement plan and forecast driving improved discussion and integration.

of anticipated taking into

benefits. account the

Governance changing business * Quarterly performance review meetings involving the

oversight environment Executive Committee enable the discussion of plans

Board could result and forecasts with revisions identified as necessary.

Risk climate in suboptimal

- unchanged decisions

Priority and failure * Constructive challenge is provided across each level

to realise of the business to ensure that the key assumptions

anticipated remain robust and appropriate.

Cash flow benefits.

growth and

strategic

momentum

--- -------------------- -------------------------- --------------------------------------------------------------

6 Customer The delivery

service of high quality * Great customer outcomes are at the heart of our

Failure to customer service strategy and their requirements shape our processes

provide good is central and interactions.

quality customer to our business

service through strategy.

the customer With the entry * Our risk appetite reflects the need to be innovative

lifecycle. of new competitors and to invest appropriately to deliver new products

Governance to the market, and service to our customers.

oversight customers

Board are increasingly

Risk climate likely to * We are wholly focused on providing affordable energy

- switch supplier and excellent service, working to deliver a fair,

Reduced in if they face simplified and transparent offering to consumers and

some parts an unacceptable protecting the most vulnerable, fuel-poor households

of the business, customer experience. through initiatives to improve energy efficiency or

but unchanged Remaining with financial advice and aid.

in others at the forefront

Priority of digital

developments * We continue to invest in connected home solutions and

Customer and innovating the development of digital platforms.

satisfaction to provide

and operational choice and

excellence control for * We have a sustained programme of simplification

our customers including the use of mobile apps, online service and

is critical. breakdown bookings, and electronic billing.

* Where we experience issues we invest to put them

right, including making substantial improvements in

our UK Business environment during 2016.

--- -------------------- -------------------------- --------------------------------------------------------------

7 People The attraction,

Attraction, retention, * We have an established People Committee that has

retention, development overseen the people related challenges inherent in

and succession and motivation our transformation programme.

of the right of our people

people with and leaders

the right are critical * We continue to evolve a clearly defined people

skills in factors in strategy based on culture and engagement, equality

the right the successful and wellbeing, talent development, training and

role at the execution reward and recognition.

right time. of our strategy.

Governance In addition,

oversight we require * Our Business Principles are currently under review to

Board and the right ensure they drive the right behaviours across our

Safety, Health, behaviours organisation, with a view to launching our new Code

Environment, from our leaders of Conduct in 2017.

Security and employees

and Ethics to deliver

Committee our business * We regularly review organisational capability in

Risk climate strategy in critical business areas, reward strategies for key

- increased accordance skills, talent management, and learning and

Priority with our values development programmes through external benchmarking.

and Business

People and Principles.

building * We engage with trade unions on restructuring and

capability issues that could impact terms and conditions with

clear and open processes to promote an environment of

trust and honesty.

* Feedback from our annual employee engagement survey

is acted upon by leadership teams.

--- -------------------- -------------------------- --------------------------------------------------------------

8 Change management The successful

Execution delivery of * Fortnightly transformation Steering Group meetings

of change business change are attended by the Executive Committee.

programmes is fundamental

and business to our future

restructuring. success, and * Change activity is managed through a structured

Governance includes organisational, network of programme offices providing oversight and

oversight cultural and governance at the appropriate level.

Board technical

Risk climate transformation.

- increased At the same * We have established a dedicated change capability at

Priority time, we must Group and business unit level to ensure benefits

continue to realisation, prioritisation of efforts and share best

Cost efficiency focus on maintaining practice.

and simplification our systems

of internal

control throughout. * Our people capability has continued to be developed

through 2016 to ensure we have the right skills to

deliver our future plans.

* We have a clear controls transition framework

underpinning our system of internal control.

--- -------------------- -------------------------- --------------------------------------------------------------

9 Asset development, Failure to

availability invest in * Capital allocation and investment decisions governed

and performance the maintenance through the Investment Committee with the decision

Investment, and development right remaining with the Group Chief Executive.

development of our assets

and integrity could result

of operated in underperformance, * Group-wide minimum standards applied to all assets,

and non-operated assets being whether operated or non-operated, in order to have

assets. out of service confidence in their integrity.

Governance or significant

oversight safety issues,

Board particularly * Issues related to the integrity of our assets are

Risk climate given the responded to quickly, resulting in a number of

- unchanged aging nature unplanned shut downs during 2016 to ensure that

Priority of a number appropriate investigations could be undertaken and

of our assets. remediation performed.

Customer Operational

satisfaction integrity

and operational is critical * The leadership teams in our asset-based businesses

excellence to be able have been refreshed to ensure that there is

to deliver appropriate experience to provide oversight of this

performance critical area.

in line with

the strategic

objectives.

--- -------------------- -------------------------- --------------------------------------------------------------

10 Sourcing Our business

and supplier operations * All suppliers are required to sign up to our 'Ethical

management rely on products Procurement' policies and procedures.

Dependency and services

on, and management provided through

of, third third parties, * Financial health, risk and anti-bribery and

parties to including corruption due diligence and monitoring is

deliver the outsourced implemented in supplier selection and contract

products activities, renewal processes.

and services infrastructure

for which and operating

they are responsibility * Joint venture audits are conducted in relation to

contracted for some assets. third party operation of critical assets.

to the agreed We rely on

time, cost these parties

and quality. to comply * We review the ethical conduct of our suppliers and

Governance with not only are currently implementing a programme of supplier

oversight contractual visits to provide additional assurance over practices

Board and terms, but employed.

Safety, Health, also legal,

Environment, regulatory

Security and ethical * We appointed a new Chief Procurement Officer in 2016

and Ethics business requirements. and are implementing a programme of activities to

Committee ensure consistent Group-wide practices are

Risk climate implemented in line with our policies.

- unchanged

Priority

Customer

satisfaction

and

operational

excellence

--- -------------------- -------------------------- --------------------------------------------------------------

11 Health, safety, Our operations

environment have the potential * HSES remains our highest priority with a continued

and security to result focus across all our assets and operations.

(HSES) in personal

HSES hazards or environmental

and regulations harm, or operational * We undertake regular reviews and have thorough

associated loss. Significant assurance processes in place in relation to these

with HSES events risks, with reporting to the HSES Committee on a

Centrica's could also monthly basis and full discussion of all issues

operations. have regulatory, arising.

Governance legal, financial

oversight and reputational

Board and impacts that * Third line of defence responsibility for HSES has

Safety, Health, would adversely been transferred into Internal Audit to ensure

Environment, affect some appropriate objectivity and reinforce our assurance

Security or all of provision.

and Ethics our brands

Committee and businesses.

Risk climate * We have strengthened our controls through the

- unchanged development of the HSES management system, focusing

Priority on areas including process safety, driving and

working at heights.

Safety, compliance

and conduct

* We continue to invest in training to ensure we

maintain safe operating practices, including HSES

leadership programmes.

* Security intelligence and operating procedures, as

well as crisis management and business continuity

plans are regularly evaluated and tested.

--- -------------------- -------------------------- --------------------------------------------------------------

12 Information Our substantial

systems and customer base * Our information security strategy seeks to integrate

security and strategic information systems, personnel and physical aspects

Effectiveness, requirement in order to prevent, detect and investigate threats

availability, to be at the and incidents.

integrity forefront

and security of technology

of IT systems development, * We engage with key technology partners and suppliers,

and data means that to ensure potentially vulnerable systems are

essential it is critical identified.

for Centrica's our technology

operations. is robust,

Governance our systems * We regularly evaluate the adequacy of our

oversight are secure infrastructure and IT security controls, undertake

Board, Audit and our data employee awareness and training, and test our

Committee protected. contingency and recovery processes.

and Safety, Sensitive

Health, data faces

Environment, the threat * We test our cyber security crisis management and

Security of misappropriation business continuity plans recognising the evolving

and Ethics from hackers, nature and pace of the threat landscape.

Committee viruses and

Risk climate other sources,

- unchanged including * The appointment of a new Group Chief Information

Priority disaffected Officer during 2016 has provided additional focus on

employees. ensuring that all information systems and security

Safety, compliance risks are managed appropriately.

and conduct

--- -------------------- -------------------------- --------------------------------------------------------------

13 Legal, regulatory Our operations

and ethical are the subject * Following the completion of the CMA investigation

standards of intense into our UK ES&S business we have established a

compliance regulatory programme to implement its recommendations in full.

Compliance focus and

with legal we seek to

regulatory deliver the * We have similarly responded to changing regulatory

and ethical highest standards requirements in a number of our NA ES&S markets

standards in compliance. during 2016.

requirements. This is part

Governance of our operating

oversight commitment * We have moved our regulatory compliance monitoring

Board and to conduct activities to a single function to drive Group-wide

Safety, Health, our business consistency and quality.

Environment, in an ethical

Security and compliant

and Ethics manner. We * We have a programme of improvement activities in

Committee recognise place to align our practices in areas including our

Risk climate any real or Business Principles, financial crime and Speak Up

- unchanged perceived with our operating model.

failure to

Priority follow our

Safety, compliance Business Principles * Our Business Principles and Values have been subject

and conduct or comply to review in 2016 with the involvement of many of our

with legal employees.

or regulatory

obligations

would undermine

trust in our

business.

Non-compliance

could also

result in

fines, penalties

or other intervention.

--- -------------------- -------------------------- --------------------------------------------------------------

14 Financial Our financial

market performance * The Audit Committee regularly assesses the

Exposure and price effectiveness of control mechanisms within EM&T.

to market competitiveness

movements, is dependent

including upon our ability * Following a review undertaken during the year, weekly

commodity to manage meetings have been introduced within EM&T involving

prices and exposure to our specialist financial risk team and operational

volumes, wholesale management.

inflation, commodity

interest prices for

rates and gas, oil, * The Group Financial Risk Management Committee meets

currency coal, carbon monthly to review Group financial exposures and

fluctuations. and power, assess compliance with risk limits.

Governance interest rates

oversight for our long

Board and term borrowing, * We have an active hedging programme to mitigate

Audit Committee fluctuations exposure to commodity and financial market volatility,

Risk climate in various which has enabled British Gas to freeze prices on the

- Overall foreign currencies, standard tariff until August 2017.

unchanged, and environmental

but differing factors.

drivers * As we move into new trading arrangements, including

Priority expanding our LNG business and as a result of the

acquisition of Neas Energy, we are focused on

Cash flow ensuring that our financial risk policies remain

growth and appropriate to the risks we face.

strategic

momentum

* We are investing in our systems to further automate

our control environment.

--- -------------------- -------------------------- --------------------------------------------------------------

15 Balance sheet Certain events

strength and activities * We assess available resources on a monthly basis and

and credit have a direct this analysis underpins our going concern assumption

position impact on and viability analysis as described on page 64.

Group balance our credit

sheet management ratings and

and credit liquidity * Significant committed facilities are maintained with

position. which could sufficient cash held on deposit to meet fluctuations

Governance increase the as they arise.

oversight cost of, and

Board and access to,

Audit Committee financing. * Our private placement, (see note 25), has

Risk climate In a changing strengthened our balance sheet.

- Overall external environmental

unchanged, we need to

but differing be able to * Counterparty exposures are restricted by setting

drivers respond to credit limits for each counterparty, where possible

Priority macro-economic with reference to published credit ratings.

or political

Cash flow influences.

growth and In particular, * Wholesale credit risks associated with commodity

strategic the lower trading and treasury positions are managed in

momentum interest rate accordance with Group policy.

adversely

impacts our

pension liabilities. * We continue to seek to repair the pension deficit and

have responded with a number of actions implemented

during 2016 (see note 22).

* We consider accounting assumptions impacting on our

balance sheet carefully, including decommissioning

and impairment, as described on page 76.

--- -------------------- -------------------------- --------------------------------------------------------------

16 Financial We must be

processing able to maintain * The Audit Committee reviews carefully our compliance

and reporting robust financial with our internal policies and external requirements.

Accuracy systems to

and completeness produce accurate

of internal financial * As described above, we maintain a robust control

and external statements framework with a focus on our financial controls and

financial underpinned management self-assessment compliance.

information. by appropriate

Governance accounting

oversight judgements * Our dedicated Group Controls function monitors our

Board and and the right critical financial risks and mitigating controls and

Audit Committee information reports to the Financial Risk, Assurance and Controls

Risk climate to support Committee quarterly.

- unchanged optimal business

Priority decisions.

Our obligation * We maintain an effective working relationship with

Safety, compliance includes maintaining our external auditors, listening to their advice and

and conduct processes recommendations, and they rely on our internal

to avoid misstatement assurance and monitoring activities where

through fraud appropriate.

or error so

that the confidence

of our customers,

investors

and regulators

is not undermined

and they can

rely on available

information.

--- -------------------- -------------------------- --------------------------------------------------------------

Related Party Transactions

The Group's principal related parties include its investments in

wind farms and the existing EDF UK nuclear fleet. During the year,

the Group entered into the following arm's length transactions with

related parties who are not members of the Group, and had the

following associated balances:

2016 2015

Sale Purchase Amounts Sale Purchase

of goods of goods owed Amounts of goods of goods Amounts Amounts

and and from owed and and owed owed

services services (i) to services services from to

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- --------- --------- ------- ------- --------- --------- ------- -------

Joint ventures:

Wind farms (as

defined in note

6) 7 (80) 120 (43) 14 (123) 232 (113)

Associates:

Nuclear (as defined

in note 6) - (617) - (57) - (639) - (61)

Other 4 (5) - - 3 (9) 2 -

---------------------- --------- --------- ------- ------- --------- --------- ------- -------

11 (702) 120 (100) 17 (771) 234 (174)

---------------------- --------- --------- ------- ------- --------- --------- ------- -------

(i) Amounts owed from Lincs Wind Farm Limited include a

shareholder loan of GBP113 million classified as held for sale, as

shown in note 12(c).

Investment and funding transactions for joint ventures and

associates are disclosed in note 14. Shareholder loan interest

income for wind farm joint ventures in the period was GBP13 million

(2015: GBP17 million). The terms of the outstanding balances

related to trade receivables from related parties are typically 30

to 120 days. The balances are unsecured and will be settled in

cash. No provision against amounts receivable from related parties

was recognised during the year through the Group Income Statement

(2015: nil). The balance of the provision at 31 December 2016 was

nil (2015: nil).

At the balance sheet date, there were back-to-back committed

facilities with Lake Acquisition Limited's facilities to EDF Energy

Nuclear Generation Group Limited totalling GBP120 million at

Centrica's share, but nothing has been drawn down at 31 December

2016.

Key management personnel comprise members of the Board and

Executive Committee, a total of 18 individuals at 31 December 2016

(2015: 16).

Remuneration of key management personnel 2016 2015

Year ended 31 December GBPm GBPm

----------------------------------------- ----- -----

Short-term benefits 15.8 12.3

Post employment benefits 1.1 1.9

Share-based payments 7.8 5.4

----------------------------------------- ----- -----

24.7 19.6

----------------------------------------- ----- -----

Remuneration of the Directors of Centrica

plc 2016 2015

Year ended 31 December GBPm GBPm

--------------------------------------------- ----- -----

Total emoluments (i) 9.8 6.4

Gains made by Directors on the exercise of

share options - -

Amounts receivable under long-term incentive

schemes - -

Contributions into pension schemes 0.8 0.7

--------------------------------------------- ----- -----

(ii) These emoluments were paid for services performed on behalf

of the Group. No emoluments related specifically to services

performed for the Company.

Directors' responsibilities statement

The Directors, who are named on pages 66 and 67, are responsible

for preparing the Annual Report, the Remuneration Report, the

Strategic Report and the Financial Statements in accordance with

applicable law and regulations.

Company law requires the Directors to prepare Financial

Statements for each financial year. Accordingly, the Directors have

prepared the Group Financial Statements in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU) and have elected to prepare the Company

Financial Statements in accordance with United Kingdom Generally

Accepted Accounting Practice including FRS 101 'Reduced Disclosure

Framework' (United Kingdom Accounting Standards and applicable

law). Under company law, the Directors must not approve the

Financial Statements unless they are satisfied that they give a

true and fair view of the state of affairs of the Group and the

Company and of the profit or loss of the Group for that period. In

preparing these Financial Statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether IFRS as adopted by the EU and applicable UK

Accounting Standards have been followed, subject to any material

departures disclosed and explained in the Group and Company

Financial Statements respectively; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and the Group and enable them to

ensure that the Financial Statements and the Remuneration Report

comply with the Act and, as regards the Group Financial Statements,

Article 4 of the IAS Regulation. They are also responsible for

safeguarding the assets of the Company and the Group and hence for

taking reasonable steps for the prevention and detection of fraud

and other irregularities.

Furthermore, the Directors are responsible for the maintenance

and integrity of the Company's website. Legislation in the UK

governing the preparation and dissemination of Financial Statements

may differ from legislation in other jurisdictions.

The Directors consider that the Annual Report and Accounts 2016,

when taken as a whole, is fair, balanced and understandable and

provides the information necessary for shareholders to assess the

Group's performance, business model and strategy.

Each of the Directors confirm that to the best of their

knowledge:

-- the Group Financial Statements, which have been prepared in

accordance with IFRS as adopted by the EU, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Group;

-- the Strategic Report contained on pages 2 to 64 together with

the Directors' and Corporate Governance Report on pages 65 to 99,

includes a fair review of the development and performance of the

business and the position of the Group, together with a description

of the principal risks and uncertainties that it faces;

-- as outlined on page 75, there is no relevant audit information of which PwC are unaware; and

-- they have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

ENDS

Enquiries:

Investors and Analysts:

Tel: +44 (0)1753 494900 Email: ir@centrica.com

Media:

Tel: +44 (0)1784 843000 Email: media@centrica.com

Centrica plc is listed on the London Stock Exchange (CNA)

Registered Office: Millstream, Maidenhead Road, Windsor,

Berkshire SL4 5GD

Registered in England & Wales number: 3033654

Legal Entity Identifier number: E26EDV109X6EEPBKVH76

ISIN number: GB00B033F229

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSKLLBLDXFZBBL

(END) Dow Jones Newswires

March 22, 2017 07:00 ET (11:00 GMT)

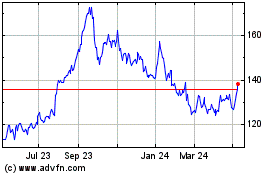

Centrica (LSE:CNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

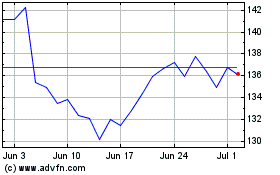

Centrica (LSE:CNA)

Historical Stock Chart

From Apr 2023 to Apr 2024