TIDMCCP

RNS Number : 3376E

Celtic PLC

06 February 2015

CELTIC plc (the "Company")

INTERIM REPORT FOR THE SIX MONTHS TO 31 DECEMBER 2014

Operational Highlights

-- Progression to the knock-out stages of the UEFA Europa League

-- Currently top of the SPFL Premiership

-- Continued participation in the Scottish Cup and Scottish League Cup

-- Successful hosting of the Commonwealth Games opening ceremony and SFA International matches

-- Completion of the final phase of development of The Celtic Way

-- 18 home fixtures (2013: 16)

Financial Highlights

-- Revenue decreased by 30.1% to GBP31.3m (2013: GBP44.8m)

-- Operating expenses decreased by 18.2% to GBP28.1m (2013: GBP34.3m)

-- Profit from trading of GBP3.2m(2013: GBP10.5m)

-- Profit on disposal of intangible assets GBP7.1m(2013: GBP16.5m)

-- Profit before taxation of GBP6.6m(2013: GBP21.3m)

-- Period end net cash at bank of GBP5.3m (2013: GBP5.7m)

-- Investment in football personnel of GBP5.7m (2013: GBP5.0m).

-- New long term bank facility agreement.

Celtic plc

CHAIRMAN'S STATEMENT

I am pleased to report on our financial results for the six

months ended 31 December 2014. The introductory page to these

interim results summarises the main highlights.

Since the appointment of our new football management team led by

Ronny Deila, we have embarked upon a period of transition, with the

implementation of new ideas, methods and processes. We moved on

from the disappointment of failing to qualify for the group stages

of the UEFA Champions League to qualify for the last 32 of the UEFA

Europa League and a tie against Inter Milan. As the football team

develops on and off the field, we are pleased to be competing in

four competitions.

The Opening Ceremony of the Commonwealth Games took place at

Celtic Park with great success, leading to worldwide exposure for

our brand, while the stadium also played host to the Scottish

national team in two high profile international matches.

A key factor influencing these results is the participation in

the UEFA Europa League, as opposed to the UEFA Champions League.

Revenue dropped for the period to GBP31.3m (2013: GBP44.8m).

Operating expenses for the period decreased to GBP28.1m (2013:

GBP34.3m), leading to a profit from trading, before asset

transactions and exceptional operating expenses of GBP3.2m (2013:

GBP10.5m). This trading performance, together with a lower gain on

disposal of player registrations of GBP7.1m from GBP16.5m in 2013

are the main causes of the reduction in Profit before Taxation for

the half year to GBP6.6m from GBP21.3m last year.

Given the difficult economic climate and the challenging sector,

it is pleasing that our business model allows us to report net cash

of GBP5.3m as at 31 December 2014, compared to GBP5.7m in 2013,

especially given the capital investment in projects including the

Celtic Way.

Each season, our overwhelming priorities are to win the SPFL

Premiership and to qualify for the group stages of the UEFA

Champions League. The strategy of the Board is to aim to achieve

this objective with prudent investment in the playing squad and by

the continued creation of value through development of players,

both from our youth academy and those identified by our football

development operations.

During the period under review, the registrations of Fraser

Forster and Tony Watt were transferred, while the registrations of

Craig Gordon and Stefan Scepovic were acquired permanently to build

the first team squad, in addition to the loan signings of John

Guidetti, Aleksandar Tonev, Mubarak Wakaso, Jason Denayer and Jo

Inge Berget.

During the January transfer window (after the period end), the

Company successfully attracted three exciting young international

players, Stuart Armstrong, Gary Mackay-Steven and Michael Duffy. In

addition, Beram Kayal, Jo Inge Berget and Filip Twardzik left us

during the window and in thanking them for their service we wish

them well for the future.

In addition to the transfer activity, the contracts of first

team players Scott Brown, Callum McGregor and Darnell Fisher were

all extended during the period, with the contracts of Kris Commons

and Eoghan O'Connell being extended after the period end.

As in previous years, the second half is expected to be more

challenging in terms of financial performance with fewer home

matches scheduled and no certainty on any further gains on the

disposal of player registrations.

Our strategy remains to live within our means. The football

environment in Scotland continues to be challenging and we must

operate within it in a fashion that does not unduly risk the long

term future of this great Club.

Our key focus for the remainder of the year will be to build on

the progress we have made in the first half of the season and to

deliver silverware from competing in the three domestic

competitions and remain competitive in the UEFA Europa

League. Furthermore, we will continue to develop our squad for

the challenges of qualifying for European competition in the

summer.

After another busy spell for the Club, I extend my thanks and

appreciation to Ronny Deila and his backroom staff, all of the

players, executive management and staff, who, together, are

committed to the success of Celtic. Above all, I thank our fans on

whose support the Club relies.

Ian P Bankier 6 February 2015

Chairman

Celtic plc

INDEPENDENT REVIEW REPORT TO CELTIC PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 December 2014 which comprises the Consolidated

Statement of Comprehensive Income, the Consolidated Balance Sheet,

the Consolidated Statement of Changes in Equity, the Consolidated

Cash Flow Statement and the related notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

December 2014 is not prepared, in all material respects, in

accordance with the rules of the London Stock Exchange for

companies trading securities on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

Glasgow

United Kingdom

Date 6 February 2015

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Celtic plc

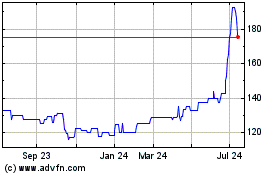

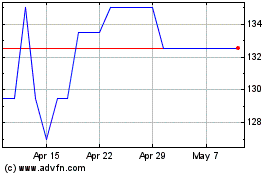

Celtic (LSE:CCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celtic (LSE:CCP)

Historical Stock Chart

From Apr 2023 to Apr 2024