Celtic PLC Interim Report -4-

February 06 2015 - 12:00PM

UK Regulatory

The decrease of GBP4.56m in the level of receivables from 31

December 2013 to GBP15.49m is primarily a result of a reduction in

amounts due from player sales in addition to a fall in accrued

income arising from participation in the UEFA Europa League in

2014/15 compared with UEFA Champions League participation in

2013/14.

8. SHARE CAPITAL

Authorised Allotted, called up and fully

31 December 30 paid

June 31 December 30 June

2014 2013 2014 2014 2014 2013 2013 2014 2014

No No No No GBP000 No GBP000 No GBP000

000 000 000 000 000 000

Equity

Ordinary Shares

of 1p each 221,914 221,126 221,393 92,818 928 91,487 915 91,754 918

Deferred Shares

of 1p each 611,787 550,769 563,589 611,787 6,118 550,769 5,508 563,589 5,636

Non-equity

Convertible

Preferred

Ordinary Shares

of GBP1 each 15,171 15,738 15,620 13,184 13,184 13,751 13,751 13,633 13,633

Convertible

Cumulative

Preference

Shares of

60p each 18,645 18,738 18,716 16,145 9,686 16,238 9,742 16,216 9,729

Less reallocated

to debt under

IAS 32:

Initial debt

Capital reserve - - - - (2,845) - (2,922) - (2,864)

- - - - (2,780) - (2,672) - (2,695)

--------- --------- ----------

867,517 806,371 819,318 733,934 24,291 672,245 24,322 685,192 24,357

========= ========= =========== ========= ========== ========= ========== ========= ==========

9. NON - CURRENT LIABILITIES

Non-current liabilities reflect the non-current element of bank

loans of GBP6.8m (December 2013: GBP10.0m, June 2014: GBP9.8m)

drawn down at the end of the period as part of the Company's bank

facility of GBP20.4m (December 2013: GBP32.8m, June 2014: GBP32.4m)

and GBP4.3m (December 2013: GBP4.3m, June 2014: GBP4.3m) as a

result of the reallocation of non-equity share capital from equity

to debt following the introduction of IAS 32, GBP0.03m (December

2013: GBP0.1m, June 2014: GBP0.1m) of deferred income and

provisions of GBP1.0m (December 2013: GBP0.8m, June 2014:

GBP1.0m).

10. ANALYSIS OF NET CASH AT BANK

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net cash is as follows:

31 December 31 December 30 June

2014 2013 2014

GBP000 GBP000 GBP000

Bank Loans due after more

than one year (6,775) (10,031) (9,844)

Bank Loans due within one

year (375) (375) (375)

Cash and cash equivalents:

Overdrafts due within

one year - (557) (689)

Cash at bank 12,433 16,649 14,739

------------ ------------ --------

Net cash at bank at period

end 5,283 5,686 3,831

============ ============ ========

Total net cash, including other loans of GBP0.1m (2013: GBP0.1m)

and that arising from the reclassification of equity to debt

following the adoption of IAS32 of GBP4.3m (2013: GBP4.3m) amounted

to GBP0.9m (2013: GBP1.2m).

11. POST BALANCE SHEET EVENTS

Since the balance sheet date, we acquired the permanent

registrations of Stuart Armstrong, Gary Mackay-Steven and Michael

Duffy. The permanent registrations of Beram Kayal and Filip

Twardzik were transferred to Brighton & Hove Albion and Bolton

Wanderers respectively.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFSRFLIRIIE

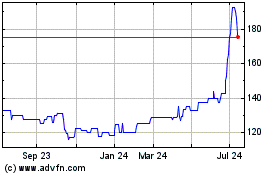

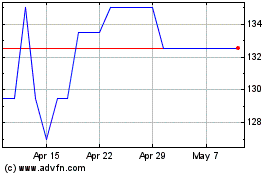

Celtic (LSE:CCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celtic (LSE:CCP)

Historical Stock Chart

From Apr 2023 to Apr 2024