TIDMCCP

RNS Number : 2339K

Celtic PLC

19 September 2016

Celtic PLC

Announcement of Results for the year ended 30 June 2016

SUMMARY OF THE RESULTS

Operational Highlights

-- Winner of the SPFL Premiership - 5 in a row

-- Participated in the UEFA Europa League playing 6 home European matches (2015: 6)

-- 28 home matches played at Celtic Park (2015: 29)

-- New shirt sponsorship with Dafabet and Magners

-- Unveiling of Billy McNeill statue

Financial Highlights

-- Group revenue increased by 1.8% to GBP52.0m

-- Operating expenses increased by 7.3% to GBP57.1m

-- Exceptional costs of GBP1.7m (2015: GBP0.7m)

-- Gain on sale of player registrations of GBP12.6m (2015: GBP6.8m)

-- Profit before taxation of GBP0.5m (2015: loss of GBP3.9m)

-- Year-end net cash at bank of GBP3.6m (2015: GBP4.7m)

-- Investment in football personnel of GBP8.8m (2015: GBP9.4m)

For further information contact:

Company

Ian Bankier, Celtic plc Tel: 0141 551 4235

Peter Lawwell, Celtic plc Tel: 0141 551 4235

Iain Jamieson, Celtic plc Tel: 0141 551 4235

Canaccord Genuity Limited, Nominated Adviser

Bruce Garrow Tel: 020 7523 8350

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

CHAIRMAN'S STATEMENT

These results, which show a profit before taxation of GBP0.5m

compared to loss before tax of GBP3.9m last year, in comparable

trading conditions, reflect in large part the increased

contribution during the year from the sale of player registrations.

Following two seasons in which the Club did not qualify for the

Group Stages of the UEFA Champions League, the increased

contribution from player trading enabled the Company to maintain

investment in football operations and to continue to build for the

future.

The Board continues to believe that the Company's self

sustaining financial model provides the necessary stability to

preserve the long term future of the Club and player trading

remains an important element of that model. Allied to player

trading is the creation of the next generation of Celtic stars in

our Youth Academy and I am glad to say that season 2015/16 saw a

great example of that Celtic tradition, with Kieran Tierney

establishing himself in the first team, being rewarded with his

first full international call up for Scotland and being named PFA

Scotland Young Player of the Year.

During the year, Ronny Deila decided to leave the Club at the

end of season 2015/16. Ronny signed off with success, as Celtic

were crowned champions of Scotland at the end of the season, making

it five in a row. On behalf of the Board, I would like to thank

Ronny for his contribution to the Club during his time here and to

wish him the best for the future.

Following an exhaustive recruitment process, the Club was

delighted to announce the appointment of Brendan Rodgers as manager

in May. The scenes at Celtic Park as Brendan was unveiled were

fantastic and created a real sense of optimism for the season

ahead. I am delighted to say that, so far, that optimism has been

realised this season, as the team has qualified for the Group

Stages of the UEFA Champions League and currently sits top of the

SPFL Premiership table playing attractive, attacking football. We

welcome Brendan and his staff to Celtic Park and congratulate them

and the team on the success to date. We will continue to support

them to deliver football success.

The Club remains committed to improving the football environment

in which Celtic plays. At a time of change, it is important that we

continue to be at the forefront of the development of the game.

Peter Lawwell, our Chief Executive, sits on the board of the SPFL,

the European Club Association and the Club Competition Committee of

UEFA. The Club continues to work with clubs and all those involved

in football governance to identify means in which to improve the

game in Europe.

During the year, Eric Riley resigned as Financial Director of

the Company with effect from 31 December 2015. On behalf of the

Board, I would like to thank Eric for his huge commitment to the

Company, his distinguished service over 20 years and his vital role

in the development of the Company and the promotion of the game in

Scotland. Eric remained as a non-executive director until 30 June

2016 to assist with the handover to his replacement, Chris McKay,

and remains a member of the board of The Celtic Football and

Athletic Company. The Board welcomes Chris, who joined from global

consultancy firm, Deloitte.

In closing, I am pleased to say that the year to June 2016 also

saw continued success for Celtic FC Foundation. I thank all those

involved in the operation of the Foundation and in donating time

and money to it, as it is such an important part of what our Club

is all about.

As we look forward with confidence to the year ahead, on behalf

of the Board I thank our supporters, shareholders, sponsors,

partners and colleagues. We all share the same desire - the best

for Celtic. We will continue to strive to deliver that.

Ian P Bankier

19 September 2016

Chairman

CHIEF EXECUTIVE'S REVIEW

On the pitch, the year to 30 June 2016 did not meet with our

expectations. Whilst the SPFL Premiership title was retained, our

performances in the domestic cup competitions and in European

competition were poor, as the Club failed to reach either domestic

cup final and failed to qualify for the Group Stages of the UEFA

Champions League for the second successive season. Off the pitch

the Company returned to profit, mainly as a result of the transfer

of certain player registrations during the period leading to a gain

on sale of player registrations of GBP12.6m (2015: GBP6.8m). This

enables us to continue to deliver long term sustainable football

success in a very challenging environment.

After a more successful first season, Ronny Deila decided to

leave the Club at the end of last season and goes with our best

wishes. His second league title, and the Club's fifth title in a

row, provided a good base for Brendan Rodgers to build on, which he

did by qualifying for the Group Stages of the UEFA Champions

League. In welcoming Brendan and his staff, I must congratulate

them and the team on that achievement, so soon after Brendan's

arrival at the Club. I know that Brendan is committed to bringing

success to the Club and the Board will support him in that effort.

Our objectives during this season remain success in all three

domestic competitions and in the UEFA Champions League.

For a club like Celtic, operating in a market where television

values have fallen significantly behind our neighbours across

Europe, qualification for the Group Stages of the UEFA Champions

League is of paramount importance. The financial rewards allow for

investment in the playing squad and physical assets, but moreover,

the prestige of participating in the premier club competition in

the world reinforces the reach and importance of the Club to so

many people around the world.

Fundamentally, Celtic is a Champions League club; our

infrastructure and continued investment reflect that. At a time

when the direction of travel in European football is towards elite

level clubs, we must remain at the forefront of developments in the

game domestically and across Europe. Celtic should be at the top of

the game in Europe and the Board and I have that objective as a

priority. We continue to work tirelessly on seeking to improve the

football environment in which the Club operates.

We remain of the opinion that our core strategy should remain

focussed on a football operation with a self sustaining financial

model, relying upon: the youth academy; player development with

world class coaching; player recruitment; management of the player

pool; and sports science and performance analysis. The Youth

Academy continues to form an important part of our strategy. This

year the investment made in the Academy and the partnership with St

Ninian's High School continued to deliver positive outcomes, as

Kieran Tierney became a regular in the first team and Aiden

Nesbitt, Joe Thompson, Anthony Ralston and Jack Aitchison all made

competitive first team debuts, with Jack becoming the youngest ever

first team debutant and the youngest player to score in his first

game for Celtic. The ultimate objective, for the players and the

Club, is to create Champions League players, playing the Celtic Way

and this year Kieran made his debut in the competition.

During the year, I was immensely proud to join Billy McNeill and

his family on the Celtic Way to unveil the magnificent statue of

Billy lifting the European Cup. Billy will always embody the Celtic

Way and the statue stands as a fitting tribute to a true Celtic

legend and as inspiration to the next generations of young players

who learn to love the game at Celtic Park.

Celtic supporters continue to support the Celtic FC Foundation

as it develops into one of the most successful club charitable

organisations in the world. That support is not surprising, but it

is not taken for granted. I thank everyone involved in the

continued success of the Foundation.

Nor is the continued success of Celtic to be taken for granted.

It requires hard work and commitment, both on and off the field. I

thank all of my colleagues, our supporters, shareholders and club

partners for all of their efforts in support of such an important

cause.

Peter Lawwell

19 September 2016

Chief Executive

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2016 2015

Operations Operations

excluding excluding

intangible Intangible intangible Intangible

asset asset asset asset

trading trading Total trading trading Total

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

CONTINUING

OPERATIONS:

Revenue 2 52,009 - 52,009 51,080 - 51,080

Operating expenses

(excluding

exceptional

operating expenses) 2 (57,143) - (57,143) (53,268) - (53,268)

_________ _________ _________ _________ _________ _________

Loss from trading

before asset

transactions

and exceptional

items (5,134) - (5,134) (2,188) - (2,188)

Exceptional

operating (expenses)

/ credit 3 (715) (1,006) (1,721) (1,001) 261 (740)

Amortisation

of intangible

assets - (4,953) (4,953) - (7,313) (7,313)

Profit on disposal

of intangible

assets - 12,644 12,644 - 6,773 6,773

Loss on disposal

of property,

plant and equipment (106) - (106) (102) - (102)

_________ _________ _________ _________ _________ _________

Operating (loss)

/ profit (5,955) 6,685 730 (3,291) (279) (3,570)

________ ________ _______ ________ ________ ________

Finance income 350 185

Finance expense (621) (562)

_________ _________

Profit / (loss)

before tax 459 (3,947)

Income tax

expense 5 - -

_________ _________

Profit / (loss)

and total comprehensive

income / (loss)

for the year 459 (3,947)

_________ _________

Profit / (loss)

attributable

to equity holders

of the parent 459 (3,947)

________ ________

Total comprehensive

income / (loss)

attributable

to equity holders

of the parent 459 (3,947)

________ ________

Basic earnings

per Ordinary

Share from

continuing

operations

and for the

year 6 0.49p (4.25p)

________ ________

Diluted earnings

per share from

continuing

operations

and for the

year 6 0.49p (4.25p)

________ ________

CONSOLIDATED BALANCE SHEET

2016 2015

GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 55,276 55,452

Intangible assets 9,798 8,356

Trade Receivables 3,966 2,291

69,040 66,099

========= =========

Current assets

Inventories 1,889 2,098

Trade and other receivables 14,682 12,449

Cash and cash equivalents 10,450 11,770

---------

27,021 26,317

========= =========

Total assets 96,061 92,416

========= =========

Equity

Issued share capital 24,316 24,294

Share premium 14,611 14,573

Other reserve 21,222 21,222

Capital reserve 2,781 2,781

Accumulated losses (12,460) (12,919)

---------

Total equity 50,470 49,951

========= =========

Non-current liabilities

Interest bearing liabilities/bank

loans 6,650 6,850

Debt element of Convertible

Cumulative Preference Shares 4,242 4,262

Provisions 1,105 907

Deferred income 1,343 2,600

---------

13,340 14,619

========= =========

Current liabilities

Trade and other payables 11,879 14,579

Current borrowings 304 308

Provisions 196 251

Deferred income 19,872 12,708

---------

32,251 27,846

========= =========

Total liabilities 45,591 42,465

========= =========

Total equity and liabilities 96,061 92,416

========= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Other Capital Retained

Group capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity shareholders'

funds

as at 1 July

2014 24,357 14,529 21,222 2,695 (8,972) 53,831

Share capital

issued 1 44 - - - 45

Transfer to capital

reserve (86) - - 86 - -

Reduction in

debt element

of convertible

cumulative preference

shares 22 - - - - 22

Loss and total

comprehensive

loss for the

year - - - - (3,947) (3,947)

Equity shareholders'

funds

as at 30 June

2015 24,294 14,573 21,222 2,781 (12,919) 49,951

Share capital

issued 1 38 - - - 39

Transfer to capital

reserve - - - - - -

Reduction in

debt element

of convertible

cumulative preference

shares 21 - - - - 21

Profit and total

comprehensive

income for the

year - - - - 459 459

Equity shareholders'

funds

as at 30 June

2016 24,316 14,611 21,222 2,781 (12,460) 50,470

======== ======== ======== ======== ========= =======

CONSOLIDATED CASH FLOW STATEMENT

2016 2015

GBP000 GBP000

Cash flows from operating activities

Profit / (loss) for the year 459 (3,947)

Depreciation 1,689 1,577

Amortisation of intangible assets 4,953 7,313

Impairment of intangible assets 1,294 378

Reversal of prior period impairment

charge (288) (639)

Profit on disposal of intangible

assets (12,644) (6,773)

Loss on disposal of property,

plant and equipment 106 102

Net finance costs 271 377

--------- ---------

(4,160) (1,612)

Decrease / (increase) in inventories 209 (402)

Decrease in receivables 212 540

Increase in payables and deferred

income 4,695 1,553

--------- ---------

Cash generated from operations 956 79

Net interest paid (91) (75)

--------- ---------

Net cash flow from operating

activities - A 865 4

--------- ---------

Cash flows from investing activities

Purchase of property, plant

and equipment (1,455) (2,656)

Purchase of intangible assets (10,933) (11,239)

Proceeds from sale of intangible

assets 13,261 12,861

--------- ---------

Net cash used in investing activities

- B 873 (1,034)

--------- ---------

Cash flows from financing activities

Repayment of debt (200) (3,169)

Dividends paid (458) (481)

--------- ---------

Net cash used in financing activities

- C (658) (3,650)

--------- ---------

Net increase / (decrease) in

cash equivalents A+B+C 1,080 (4,680)

Cash and cash equivalents at

1 July 2015 9,370 14,050

--------- ---------

Cash and cash equivalents at

30 June 2016 10,450 9,370

========= =========

NOTES TO THE FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

These Financial Statements have been prepared in accordance with

the recognition and measurement principles of IFRS as adopted by

the European Union. The accounting policies have been consistently

applied to both years presented.

2. REVENUE AND TOTAL OPERATING EXPENSES

REVENUE 2016 2015

GBP000 GBP000

The Group's revenue comprised:

Football and Stadium Operations 25,149 27,969

Merchandising 12,577 11,679

Multimedia and Other Commercial

Activities 14,283 11,432

-------- --------

52,009 51,080

======== ========

TOTAL OPERATING EXPENSES 2016 2015

GBP000 GBP000

The Group's operating expenses

comprised:

Football and Stadium Operations

(excluding exceptional items

and asset transactions) 47,173 43,951

Merchandising 7,836 6,995

Multimedia and Other Commercial

Activities 2,134 2,322

57,143 53,268

======== ========

3. EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP1.72m (2015: GBP0.74m)

can be analysed as follows:

Exceptional operating expenses 2016 2015

comprised GBP000 GBP000

Impairment of intangible assets 1,294 378

Reversal of prior period impairment

charges (288) (639)

Onerous employment contracts - 650

Compromise payments on contract

termination 715 351

1,721 740

======== ========

4. DIVIDENDS PAYABLE

A 6% (before tax credit deduction) non-equity dividend of

GBP0.52m (2015: GBP0.52m) was paid on 1 September 2016 to those

holders of Convertible Cumulative Preference Shares on the share

register at 29 July 2016. A number of shareholders elected to

participate in the Company's scrip dividend reinvestment scheme for

the financial year to 30 June 2016. Those shareholders have

received new Ordinary Shares in lieu of cash. No dividends were

payable or proposed to be payable on the Company's Ordinary

Shares.

During the year, the Company reclaimed GBP0.02m (2015: GBP0.09m)

in respect of statute barred preference dividends in accordance

with the Company's Articles of Association.

5. TAX ON ORDINARY ACTIVITIES

No provision for corporation tax or deferred tax is required in

respect of the year ended 30 June 2016. Estimated tax losses

available for set-off against future trading profits amount to

approximately GBP16.08m (2015: GBP16.40m) and, in addition, the

available capital allowances pool is approximately GBP10.25m (2015:

GBP11.25m). These estimates are subject to the agreement of the

current and prior years' corporation tax computations with H M

Revenue and Customs.

6. EARNINGS PER SHARE

2016 2015

GBP000 GBP000

Reconciliation of earnings to

basic earnings:

Net earnings / (loss) attributable

to equity holders of the parent 459 (3,947)

Basic earnings / (loss) 459 (3,947)

======== ========

Reconciliation of basic earnings

/ (loss) to diluted earnings:

Basic earnings / (loss) 459 (3,947)

Non-equity share dividend 521 523

Reclaim of statute barred non-equity

share dividends (19) (91)

Diluted earnings / (loss) 961 (3,515)

======== ========

No.'000 No.'000

Reconciliation of basic weighted

average number of ordinary shares

to

diluted weighted average number

of ordinary shares:

Basic weighted average number

of ordinary shares 93,120 92,774

Dilutive effect of convertible

shares 43,179 43,554

-------- --------

Diluted weighted average number

of ordinary shares 136,299 136,328

======== ========

Earnings per share has been calculated by dividing the profit

for the period of GBP0.46m (2015: loss of GBP3.95m) by the weighted

average number of Ordinary Shares of 93.1m (2015: 92.8m) in issue

during the year. Diluted earnings per share as at 30 June 2016 has

been calculated by dividing the profit for the period by the

weighted average number of Ordinary Shares, Preference Shares and

Convertible Preferred Ordinary Shares in issue, assuming conversion

at the balance sheet date, if dilutive, in accordance with IAS33

Earnings Per Share.

7. ANNUAL REPORT & ACCOUNTS

Copies of the Annual Report & Accounts together with the

Notice and Notes of the 2016 AGM will be issued to all shareholders

in due course.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 30 June 2016 or 30

June 2015. The Independent Auditors' Reports on the statutory

accounts for 2016 and 2015 were unqualified, did not draw attention

to any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006. The statutory

accounts for 2015 have been filed with the Registrar of Companies

and those for 2016 will be delivered to the Registrar of Companies

in due course.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFLFDUFMSEIU

(END) Dow Jones Newswires

September 19, 2016 10:00 ET (14:00 GMT)

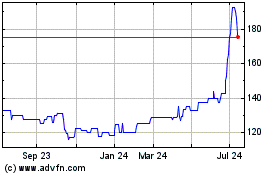

Celtic (LSE:CCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

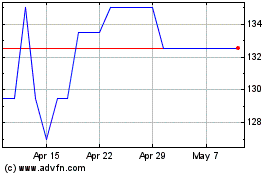

Celtic (LSE:CCP)

Historical Stock Chart

From Apr 2023 to Apr 2024