Carter’s, Inc. Acquires Skip Hop Holdings, Inc.

February 23 2017 - 6:10AM

Business Wire

- Acquires rapidly growing global

lifestyle brand for families with young children

- Complements Carter’s leading market

share in young children’s apparel

Carter’s, Inc. (NYSE:CRI), the largest branded marketer in the

United States and Canada of apparel exclusively for babies and

young children, today announced that it has acquired Skip Hop

Holdings, Inc. (“Skip Hop”), a global lifestyle brand for families

with young children, from Fireman Capital Partners, a

consumer-focused private equity firm.

Skip Hop offers families with young children essential products

that are differentiated from a design and function perspective. Its

product portfolio includes distinctive offerings across multiple

categories, including diaper bags, kid’s backpacks, travel

accessories, home gear, and hardlines for playtime, mealtime, and

bathtime. Skip Hop products are distributed in more than 5,000

doors in the United States and more than 60 countries.

“Skip Hop has built a strong reputation for innovative,

essential core products for families with young children,” said

Michael D. Casey, Carter’s Chairman and Chief Executive Officer.

“Its product offering nicely complements our Carter’s brand. We

believe we have a wonderful opportunity to leverage our marketing,

distribution, and supply chain capabilities to enable significant

growth for the Skip Hop brand. We look forward to working with Skip

Hop founders, Michael and Ellen Diamant, and their team to build on

their long track record of success.”

The acquisition of Skip Hop is expected to be accretive to

Carter’s fiscal 2017 adjusted earnings per share, excluding the

impact of non-recurring transaction or integration-related

expenses.

“We are very excited to join the Carter’s team,” said Michael

and Ellen Diamant, founders of Skip Hop. “We believe Carter’s is a

terrific cultural fit for Skip Hop, and we look forward to working

with Carter’s to drive Skip Hop to its full potential.”

The transaction has been structured as an acquisition of all of

the outstanding equity of Skip Hop. The total purchase price is

$140 million in cash consideration, subject to a working capital

adjustment, plus a potential future payment of up to $10 million

contingent upon the achievement of certain fiscal targets in

2017.

J.P. Morgan Securities LLC acted as financial advisor and King

& Spalding LLP acted as legal counsel to Carter’s in connection

with the transaction. Harris Williams & Co. served as exclusive

financial advisor and McDermott Will & Emery LLP acted as legal

advisor to Skip Hop.

About Carter’s, Inc.

Carter’s, Inc. is the largest branded marketer in the United

States and Canada of apparel and related products exclusively for

babies and young children. The Company owns the Carter’s and

OshKosh B'gosh brands, two of the most recognized brands in the

marketplace. These brands are sold in leading department stores,

national chains, and specialty retailers domestically and

internationally. They are also sold through nearly 1,000

Company-operated stores in the United States and Canada and online

at www.carters.com, www.oshkoshbgosh.com, and

www.cartersoshkosh.ca. The Company’s Just One You, Precious Firsts,

and Genuine Kids brands are available at Target, and its Child of

Mine brand is available at Walmart. Carter’s is headquartered in

Atlanta, Georgia. Additional information may be found at

www.carters.com.

Cautionary Language

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 relating to the Company’s future

performance, including, without limitation, statements with respect

to the Company's acquisition of Skip Hop, as well as the Company’s

strategies and future operating results for the Skip Hop business

and the Company. Such statements are based on current expectations

only, and are subject to certain risks, uncertainties, and

assumptions. Should one or more of these risks or uncertainties

materialize or not materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

anticipated, estimated, or projected. Factors that could cause

actual results to materially differ include: various risks relating

to the Skip Hop business, including the Company's ability to manage

its growth, to develop and grow the Skip Hop business in terms of

revenue and profitability, and its ability to realize any benefits

from Skip Hop; the ability to integrate Skip Hop into the Company

with no substantial adverse effects on Skip Hop’s or the Company's

existing operations, employee relationships, vendor relationships,

customer relationships or financial performance; the acceptance of

the Company's products in the marketplace; changes in consumer

preference and fashion trends; seasonal fluctuations in the

children's apparel and accessory business; negative publicity; the

breach of the Company's consumer databases; increased production

costs; deflationary pricing pressures and customer acceptance of

higher selling prices; a continued decrease in the overall level of

consumer spending; the Company's dependence on its foreign supply

sources; failure of its foreign supply sources to meet the

Company's quality standards or regulatory requirements; the impact

of governmental regulations and environmental risks applicable to

the Company's business; the loss of a product sourcing agent;

increased competition in the baby and young children's apparel and

accessories market; the ability of the Company to adequately

forecast demand, which could create significant levels of excess

inventory; failure to achieve sales growth plans, cost savings, and

other assumptions that support the carrying value of the Company's

intangible assets; and the ability to attract and retain key

individuals within the organization. Many of these risks are

further described in the most recently filed Annual Report on Form

10-K and other reports filed with the Securities and Exchange

Commission from time to time under the headings “Risk Factors” and

“Forward-Looking Statements.” The Company undertakes no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223005656/en/

Carter’s, Inc.Sean McHugh, 678-791-7615Vice President &

Treasurer

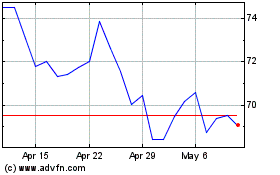

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

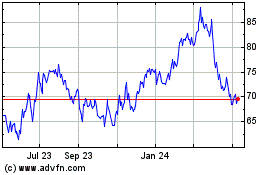

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024