Canadian Dollar Weakens On Falling Oil Prices

November 28 2017 - 1:16AM

RTTF2

The Canadian dollar slipped against its major counterparts in

early European deals on Tuesday amid falling oil prices, as

Keystone pipeline resumed operation and investors awaited OPEC

meeting in Vienna to discuss the extension of cartel's oil

production cuts.

Crude for January delivery fell $0.51 to $57.60 per barrel.

Oil shipments through Keystone pipeline began today, after an

outage for nearly two weeks. The pipeline will resume operations at

a reduced pressure "to ensure a safe and gradual increase in the

volume of crude oil moving through the system, the company said in

a statement.

OPEC/non-OPEC members are scheduled to meet in Vienna on

Thursday, at which they discuss whether to extend last year's

landmark production deal beyond its expiry next March.

The American Petroleum Institute releases its crude inventory

data later in the day, while the Energy Information Administration

will publish its official data on Wednesday.

Investors also awaited developments on U.S. tax reform bills

ahead of a crucial Senate vote and the confirmation hearing for

incoming Federal Reserve Governor Jerome Powel.

The loonie held steady against its major rivals in the Asian

session, with the exception of the yen.

The loonie retreated to a 3-month low of 86.91 versus the

Japanese yen, from a high of 87.24 hit at 8:45 pm ET. The loonie is

seen finding support around the 85.00 mark.

The loonie weakened to a 1-week low of 1.2794 against the

greenback and a 5-1/2-month low of 1.5230 against the euro, off its

early highs of 1.2754 and 1.5176, respectively. If the loonie falls

further, it may target support around 1.29 against the greenback

and 1.54 against the euro.

Reversing from an early high of 0.9700 against the aussie, the

loonie dropped to a 2-week low of 0.9726. Continuation of the

loonie's downtrend may see it challenging support around the 0.99

area.

Weekly survey compiled by the ANZ bank and Roy Morgan Research

showed that Australia's consumer confidence eased during the weak

ended November 28, after strengthening in the previous two

weeks.

The consumer confidence index dropped to 115.0 from 116.4 in the

preceding month.

Looking ahead, German GfK consumer sentiment for December is due

shortly.

In the New York session, Canada industrial product and raw

materials price indices for October, U.S. wholesale inventories for

October, S&P Case/Shiller home price index and FHFA's house

price index for September and consumer confidence index for

November are set for release.

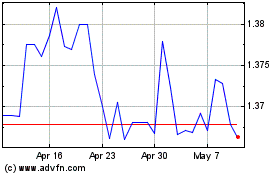

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024