Canadian Dollar Recovers After GDP Data

September 01 2015 - 5:11AM

RTTF2

The Canadian dollar edged up against its major rivals in

European deals on Tuesday, trimming early losses, after data showed

that the economy grew at a faster pace in June, following a decline

in five consecutive months.

Data from Statistics Canada showed that real gross domestic

product rose 0.5 percent in June. The increase in June was broad

based, led by mining, quarrying, and oil and gas extraction and, to

a lesser extent, wholesale trade, the finance and insurance sector

as well as arts and entertainment.

This was up from forecasts for an increase of 0.2 percent,

following a 0.2 percent decline in May.

Meanwhile, the decline in oil prices kept the currency's gains

in check.

Crude for October delivery declined $1.99 to $47.21 a

barrel.

The oil prices fell sharply, as weak Chinese manufacturing data

for August reinforced concerns over the world's second-largest

economy.

An official gauge of Chinese manufacturing activity slumped to a

three-year low in August and Caixin's final August PMI number

indicated that activity in China's vast factory sector shrank at

its fastest pace in almost six-and-a-half years in the month,

raising fears of a hard landing for the world's second largest

economy.

The American Petroleum Institute will release weekly crude oil

inventories report later in the day, while the Energy Information

Administration will publish official crude inventories data

tomorrow.

The loonie showed mixed performance in the previous session.

While the loonie held steady against the greenback and the aussie,

it fell against the yen and the euro.

The loonie bounced off to 91.37 against the yen, from its

previous 5-day low of 90.39. The loonie is likely to challenge

resistance around the 93.5 mark.

The loonie climbed to 0.9257 against the aussie, a level not

seen since August 2013. On the upside, the loonie may possibly find

resistance around the 0.90 level. At yesterday's close, the pair

was valued at 0.9343.

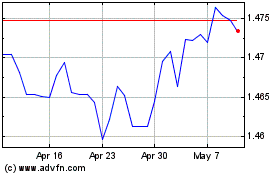

The loonie recovered to 1.3117 against the greenback and 1.4754

against the euro, off its early lows of 1.3232 and 1.4962,

respectively. If the loonie extends rise, it is likely to challenge

resistance around 1.30 against the greenback and 1.46 against the

euro.

Looking ahead, Markit's final U.S. manufacturing PMI for August,

the Institute for Supply Management's manufacturing PMI for August

and construction spending data for July are slated for release

shortly.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024