Canadian Dollar Falls Sharply As Economy Contracts Unexpectedly

May 29 2015 - 10:38AM

RTTF2

The Canadian dollar fell sharply against its major rivals on

Friday, after data showed that Canadian economy contracted

unexpectedly in the first quarter.

Data from Statistics Canada showed that Canadian economy

contracted a seasonally adjusted 0.6 percent on an annualised basis

in the first quarter, compared to a 0.3 percent growth expected by

economists. The fourth quarter economic growth was revised down to

2.2 percent.

The gross domestic product decreased 0.1 percent on quarter in

the first quarter, following a growth of 0.6 percent in the fourth

quarter of 2014. This was the first negative growth rate of real

GDP since the second quarter of 2011.

The loonie rose against the greenback, but held steady against

the euro, aussie and the yen in the Asian session.

In European deals, the loonie slipped to a 2-day low of 99.01

against the yen, off early high of 99.75. Continuation of the

loonie's downtrend may lead to a support around the 98.00 level.

The pair was trading at 99.65 when it closed Thursday's

trading.

Pulling away from an early 2-day high of 1.2410 against the

greenback, the loonie declined to 1.2526.The pair was quoted at

1.2433 at yesterday's close. The loonie may possibly find support

around the 1.26 mark.

The loonie fell to a 10-day low of 1.3750 against the euro,

after advancing to 1.3592 at 1:15 am ET. The next possible downside

target for the loonie may be eyed around the 1.38 area. At

Thursday's close, the pair traded at 1.3611.

The loonie, having advanced to more than a 3-week high of 0.9496

against the aussie at 9:00 pm ET, reversed direction with pair

trading at 0.9572. The pair finished Thursday's trading at 0.9508.

If the loonie extends slide, it may find support around the 0.96

region.

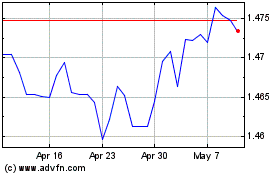

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024