Canadian Dollar Falls As Oil Prices Slide

January 26 2015 - 5:34AM

RTTF2

The Canadian dollar declined against its most major rivals in

European deals on Monday, as oil prices plunged following the

victory of anti-austerity Syriza party in the general election in

Greece, raising concerns about Greek debt default and a possible

exit from the Eurozone.

Oil for March delivery fell $0.64 to $44.95 a barrel.

Syriza got 149 seats in the 300-seat parliament, just 2 seats

short of an absolute majority. Syriza leaders reportedly struck a

deal for coalition with a Right-wing, conservative party called

Independent Greeks.

Syriza party leader Alexis Tsipras is against Greece's painful

austerity measures and wants to renegotiate the terms of bailout

with troika leaders, which they oppose.

Traders await weekly crude oil inventories data from the

American Petroleum Institute on Tuesday and official data on

Wednesday for further indications about supply.

The loonie closed Friday's New York trading lower against its

most major rivals. A strengthening dollar and continuing concerns

about oversupply had hit hard on oil prices, driving down the

currency.

The loonie hit 1.2475 against the greenback, its lowest since

March 2009. The pair ended last week's trading at 1.2412. The next

possible downside target for the loonie is seen around the 1.255

zone.

The loonie fell to 1.4041 against the euro and 0.9871 against

the aussie, from an early high of 1.3825 and a multi-day high of

0.9780, respectively. If the loonie extends decline, 1.41 and 0.99

are seen as its next support levels against the euro and the

aussie, respectively. The loonie ended Friday's trading at 1.3920

against the euro and 0.9826 against the aussie.

On the flip side, the loonie recovered to 95.02 against the yen,

from an early 3-1/2-month low of 94.10, and held steady thereafter.

At last week's close, the pair was valued at 94.76.

The minutes of the Bank of Japan's December meeting showed that

majority of bank's policymakers believe that the drop in oil prices

will affect the economy and inflation positively in the long-term,

though it is expected to weigh on inflation in the short-term.

However, one member said that the primary focus should be on the

underlying trend in prices when considering the future conduct of

monetary policy, and that the key was developments in inflation

expectations in a broad context, the minutes said.

Looking ahead, at 9:00 am ET, Eurozone finance ministers hold a

meeting to discuss a range of financial issues in Brussels.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

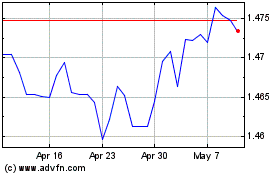

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024