Canadian Dollar Falls As Oil Price Slide On OPEC Uncertainty

November 29 2016 - 1:04AM

RTTF2

The Canadian dollar declined against its most major counterparts

in early European trading on Tuesday, as oil prices declined amid

uncertainty over possibility of an agreement in reducing oil

production at the OPEC meeting on Wednesday.

Crude for January delivery declined $0.47 to $46.61 per

barrel.

A preliminary meeting on Monday ended without a concrete deal on

quota of production cuts for member nations amid internal discord

among the OPEC members.

Non-OPEC member Russia said it would not participate in the

Vienna talks tomorrow, as it want the OPEC members to reach a deal

on proposed production cuts. While Iraq and other nations such as

Libya and Nigeria sought exemptions from output cuts, Saudi Arabia

said that oil markets would stabilise despite any reductions.

European stocks are trading mixed, as traders became cautious

ahead of Wednesday's OPEC meeting and as Italian Prime Minister

Matteo Renzi faces a key referendum on Sunday that could lead to

more political instability on the continent.

The loonie showed mixed performance in the Asian session. While

the loonie held steady against the euro and the aussie, it declined

against the greenback. Against the yen, it rose.

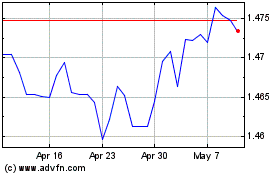

The loonie edged down to 1.4264 against euro, after having

advanced to 1.4213 at 8:00 pm ET. Continuation of the loonie's

downtrend may see it challenging support around the 1.44 mark.

Survey data from the European Commission showed that Eurozone

economic confidence improved to a 11-month high in November.

The economic sentiment index came in at 106.5, up from 106.4 in

October but below the expected score of 106.8. This was the highest

since December 2015 when the reading was 106.6.

The loonie weakened to 1.0062 against the aussie and 1.3458

against the greenback, from its early highs of 1.0017 and 1.3400,

respectively. The next possible support levels for the loonie may

be found around 1.36 against the greenback and 1.03 against the

aussie.

On the flip side, the loonie climbed to 83.79 against the

Japanese yen, from a low of 83.26 hit at 6:45 pm ET. If the loonie

extends rise, 85.00 is likely seen as its next resistance

level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's jobless rate stood at a seasonally adjusted 3.0

percent in October, in line with forecasts and unchanged from the

previous month.

The job-to-applicant ratio came in at 1.40, beating forecasts

for 1.39 and up from 1.38 in the previous month.

Looking ahead, preliminary German CPI data for November, Canada

current account data for the third quarter, U.S. second estimate

GDP data for the third quarter, U.S. S&P Case-Shiller home

price index for September, and U.S. consumer confidence index for

November are set to be published in the New York session.

At 9:15 am ET, Federal Reserve Bank of New York President

William Dudley is expected to speak about the opportunities for

economic growth, in Puerto Rico.

At 12:40 pm ET, Federal Reserve Governor Jerome Powell is

expected to speak about the economic outlook at the Economic Club

of Indiana Luncheon, in Indianapolis.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024