Canadian Dollar Falls Amid Oil Prices Slide

May 26 2016 - 10:25PM

RTTF2

The Canadian dollar weakened against the other major currencies

in the Asian session on Friday amid oil prices slide, due to global

oversupply concerns.

Crude oil for July delivery are currently down $0.37 to $49.11 a

barrel.

Meanwhile, investors waited for clues about the next U.S.

interest rate hike from Federal Reserve Chair Janet Yellen's speech

later in the day.

Thursday, the Canadian dollar rose 0.31 percent against the U.S.

dollar, 0.60 percent against the yen, 0.03 percent against the euro

and 0.05 percent against the Australian dollar.

In the Asian trading, the Canadian dollar fell to a 2-day low of

0.9389 against the Australian dollar, from yesterday's closing

value of 0.9376. The loonie may test support near the 0.96

area.

Against the U.S. dollar and the euro, the loonie dropped to

1.2999 and 1.4544 from yesterday's closing quotes of 1.2977 and

1.4526, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.33 against the greenback and 1.50

against the euro.

The loonie edged down to 84.54 against the yen, from an early

high of 84.77. On the downside, 82.00 is seen as the next support

level for the loonie.

Looking ahead, the second estimate of U.S. GDP data for the

first quarter, U.S. University of Michigan's final consumer

sentiment index for May and U.S. Baker Hughes rig count data are

due to be released in the New York session.

At 1:15 pm ET, Federal Reserve Chair Janet Yellen is due to

speak at an event hosted by the Harvard University Radcliffe

Institute for Advanced Study.

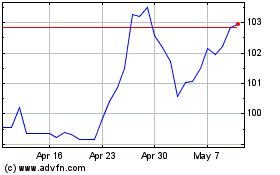

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

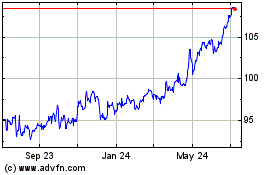

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024