Canadian Dollar Extends Rally After Upbeat GDP, Jobs Data

December 01 2017 - 4:28AM

RTTF2

The Canadian dollar extended its early rally against its major

counterparts in the European session on Friday, following the

release of nation's robust jobs data for November and better than

forecast GDP for September. Data from Statistics Canada showed that

the employment increased for the second consecutive month in

November. The employment rose by 79,500 jobs, following an increase

of 35,300 jobs in September. Economists had forecast an uptick of

10,000 jobs. The unemployment rate fell by 0.4 percentage

points to 5.9 percent, the lowest rate since

February 2008. This beats forecast for a drop to 6.2 percent

and follows a reading of 6.3 percent in the preceding month.

Separate data from the same agency showed that nation's economic

growth improved more than forecast in September. On a seasonally

adjusted monthly basis, the GDP rose 0.2 percent in September

after edging down 0.1 percent in August. Economists were

looking for a gain of 0.1 percent. On an annualized basis, the GDP

improved 1.7 percent on the third quarter, exceeding forecasts for

an increase of 1.6 percent. The second quarter estimate was revised

to 4.3 percent, which has been initially reported as a 4.5 percent

rise. Oil prices are higher after OPEC agreed to extend its supply

quota plan with Russia through 2018. Crude for January delivery

rose $0.49 to $57.89 per barrel. The currency rose against its most

major counterparts in the Asian session, as oil prices rose after

the OPEC and Russia decided to extend their oil production cuts to

the end of 2018. The loonie hit a 9-day high of 0.9652 against the

aussie, off its previous low of 0.9768. On the upside, 0.95 is

possibly seen as the next resistance for the loonie. The loonie

climbed to 88.45 against the yen, its strongest since November 17.

The pair closed Thursday's trading at 87.25. If the loonie rises

further, 90.00 is likely seen as its next resistance level. Survey

from Nikkei showed that Japan's manufacturing sector continued to

expand in November, and at a faster pace with a 44-month high PMI

score of 53.6.

That's up from 52.8 in October, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The loonie that closed Thursday's trading at 1.2895 against the

greenback strengthened to a 4-day high of 1.2741. The loonie is

seen finding resistance around the 1.26 mark. The loonie spiked up

to a 1-week high of 1.5127 against the euro, from a low of 1.5357

hit at 7:45 pm ET. The next possible resistance for the loonie is

seen around the 1.50 mark.

Survey data from IHS Markit showed that Eurozone manufacturing

activity expanded notably in November underpinned by production and

new orders.

The final factory Purchasing Managers' Index rose to 60.1 in

November, its best reading apart from April 2000's series-record

high. The score improved from 58.5 in October.

Looking ahead, U.S. ISM manufacturing index for November and

construction spending for October are due shortly.

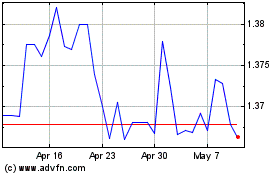

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024