Can the Run Continue for Silver Mining ETFs? - ETF News And Commentary

March 04 2014 - 10:00AM

Zacks

Taking many investors by surprise, natural resource investing has

dominated the headlines this year thanks to the global growth

worries following the initiation of the taper. Both gold and silver

have followed this trend, and while both types of bullion

have performed well, the surge was more intense in the mining ETF

space, as the latter often trades as a leveraged play on the

underlying metal.

Notably, between gold and silver mining ETFs, the second has seen

more gains this year and its Zacks Industry Rank is also more

favorable. Silver mining ETFs, which shed about 50% in 2013, gained

25% in contrast to 22.48% gain seen in gold mining ETFs. To add to

this, junior silver ETFs crushed the commodity producers’ ETF space

surging about 42% in the time frame (read: The Best Gold Mining ETF

for 2014).

Inside the Recent Surge

Vagueness in the pace of the Fed’s QE taper and the resultant

volatility in the dollar, some downbeat U.S. economic data and

geopolitical tension over Ukraine and Russia have sapped the demand

for risky assets and bolstered the need to invest in safe havens.

This flight to safety has sharpened the safe haven status of gold

and silver and resulted in such enormous gains.

In fact, the silver mining industry, at least in terms of its Zacks

Industry Rank, has really been delivering a decent show of late

with most companies carrying a Zacks Rank #3 (Hold). The segment is

now ranked in the top 37% overall, which is a solid move in the

right direction in a very short time frame. In fact, the space has

moved northward by 66 spots in just a week indicating analysts’

slowly building hopes over this investing territory, at least from

an earnings estimate perspective.

Also, many investors have started to view silver as a leveraged

play of gold. As per ETF securities, since 2000, silver prices

increased 1.4 times the increase in gold prices on average. In

2013, silver price declined about 1.3 times more than that of the

gold price.

Global X Silver Miners ETF

(SIL), iShares MSCI Global Silver

Miners Fund (SLVP) and

FactorShares PureFunds ISE Junior Silver ETF

(SILJ) soared 24.73%,

26.07% and 43.0% respectively, this year. Investors should note

that silver mining ETFs managed to get places in top-10 YTD

performers lists (read

: 2 ETFs Riding High on

Q4 Earnings Results

).

Can Silver Continue Shining Same?

We expect the road ahead for silver mining ETFs to be bumpy, at

least for the short term. The metal is hugely used in industrial

activity with about 50% of the metal’s total demand coming from

industrial applications. With China, the biggest industrial

fabricator after the U.S., recording lackluster manufacturing

output of a seven-month low, silver mining ETFs might struggle in

the coming days (read: 5 Silver ETFs Surging on Commodity

Strength).

Sooner or later, the Fed will wind down its massive QE stimulus

program which in turn should push up the dollar against a basket of

various currencies marring the prospect for silver investing. Also,

these metals are often considered as a hedge against rising

inflation. But, at present, inflation rate in many developed

nations in the world remain stubbornly low which poses a threat to

silver investing with a mid-term view.

Silver Lining of Silver Mining ETFs

Though we all know taper is an inevitable fate in the U.S., much of

the taper concerns have been priced in by now and these mining ETFs

probably saw their worst days last year. Thus, we don’t expect

anything more terrible for silver mining products in taper-stricken

2014, though the journey might be pretty rough The Comprehensive

Guide to Silver ETF Investing).

Also, a faster taper means a faster U.S. economic growth which in

turn hints at a pickup in industrial activity in the U.S. This

should boost the demand for silver. China is also striving hard to

boost its growth profile. There has also been solid demand for

silver from the key Indian market, arranging a solid scenario for

silver from an international perspective.

Mixed Technical View

The biggest silver mining ETF,

SIL, is currently hovering

a near the middle of its 52-week range. Its short-term

moving average is higher than the long-term average thus indicating

bullishness in the space. The relative strength index for SIL is

presently 58.47, indicating that the fund is creeping into

overbought territory

.

Thus, we believe, investors that have a strong stomach for risks

can consider buying silver mining products. These products

presently carry a mixed-bad outlook and might offer a good entry

point now on the buy side thanks to its low valuation. Even if this

year proves to be a hard one for silver mining ETFs with each

measured taper announcement, the year ahead should shine for

investors.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

GLBL-X SILVER (SIL): ETF Research Reports

PF ISE-JS SC ME (SILJ): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

ISHARS-M GL SLV (SLVP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

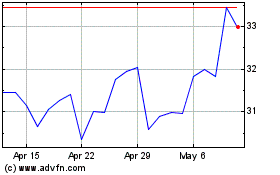

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

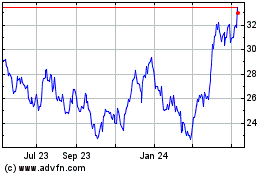

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Apr 2023 to Apr 2024