Cal-Maine Foods, Inc. (NASDAQ: CALM) today reported results for

the third quarter and thirty-nine weeks ended February 25,

2017.

Net sales for the third quarter of fiscal 2017 were $306.5

million, a 31.8 percent decrease, compared with $449.8 million for

the third quarter of fiscal 2016. The Company reported a net income

of $4.1 million, or $0.09 per basic and diluted share, for the

third quarter of fiscal 2017, compared with net income of $64.2

million, or $1.33 per basic and diluted share, for the third

quarter of fiscal 2016.

For the thirty-nine weeks ended February 25, 2017, net

sales were $799.9 million compared with $1,605.6 million for the

prior-year period. The Company reported a net loss of $49.8

million, or $1.03 per basic and diluted share, for the thirty-nine

weeks ended February 25, 2017, compared with net income of

$316.4 million, or $6.57 per basic share and $6.54 per diluted

share, for the year-earlier period.

Dolph Baker, chairman, president and chief executive officer of

Cal-Maine Foods, Inc., stated, “Our results for the third quarter

of fiscal 2017 reflect the volatile market conditions the egg

industry has experienced throughout this fiscal year. Our results

were affected by lower market prices and weaker demand trends

compared with the third quarter last year. Market prices moved

significantly higher after Thanksgiving, but dropped back down

after Christmas, and our average customer selling prices for the

third quarter of fiscal 2017 were down 27.9 percent from the same

period a year ago.

“The egg markets have remained under pressure, and we do not

expect to see any meaningful improvement until there is a better

balance of supply and demand. Following the 2015 avian influenza

(AI)-related laying hen losses, United States Department of

Agriculture (USDA) data showed that the egg industry repopulated

farms and laying hen numbers were reported to approach pre-AI

levels. The younger, more productive hen population has resulted in

a greater number of eggs. Additionally, in February 2017, the USDA

issued revised data that showed the size of the laying hen flock

for 2015 and 2016 was actually meaningfully higher in both years

than previously reported. Overall, market demand trends have not

kept pace with these higher production levels. According to Nielsen

data, retail customer demand for shell eggs has remained strong.

The USDA reports that egg export demand has improved since the

beginning of fiscal 2017; however, it has still not fully recovered

to levels prior to the AI outbreak. Additionally, we have

experienced reduced demand for egg products, as many of our

commercial customers reformulated their products to use fewer eggs

when prices spiked and have been slow to resume previous egg usage.

Together, these factors have created an oversupply of eggs, with

continued pressure on market prices. However, recent USDA reports

show the chick hatch has been trending down, suggesting there may

be a moderation in the size of the laying hen flock as the year

progresses.

“Specialty eggs, excluding co-pack sales, accounted for 23.6

percent of our total sales volume for the third quarter of fiscal

2017, the same proportion as the third quarter last year. Specialty

eggs revenue was 40.8 percent of total shell egg revenues, compared

with 31.0 percent for the third quarter of fiscal 2016. The average

selling price for specialty eggs, which is typically higher and

less volatile, was down 5.2 percent over the third quarter of last

year, while the average selling price for non-specialty eggs was

down 38.7 percent over the prior-year period.

“Our specialty egg business is a primary focus of our growth

strategy. We have continued to make significant investments across

our operations to meet anticipated demand for cage-free eggs, as

food service providers, national restaurant chains and major

retailers, including our largest customers, have stated objectives

to exclusively offer cage-free eggs by future specified dates.

While we expect the multi-year conversion to cage-free production

will present new challenges and higher costs for our industry, we

believe it also provides additional market opportunities for

Cal-Maine Foods. We are working with our customers to facilitate a

smooth transition to meet this demand. Our latest joint venture

with Rose Acre Farms in Texas is expected to reach full capacity in

the production of cage-free eggs during our fiscal 2018 first

quarter. In addition to cage-free eggs, our product mix provides a

wide variety of healthy choices for consumers including

conventional, nutritionally enhanced and organic eggs. As such, we

believe Cal-Maine Foods is well positioned to respond to future

demand trends and meet the needs of all of our customers.”

Baker continued, “Our operations ran well during the third

quarter as we continued to focus on efficient and responsible

management and respond to dynamic market conditions. For the third

quarter of fiscal 2017, our feed costs per dozen were down 4.3

percent compared with a year ago, and our overall farm production

costs were down 1.3 percent over the third quarter of fiscal

2016.

“Another key aspect of our growth strategy is to expand our

business through selective acquisitions. Importantly, we have a

strong balance sheet and the financial strength to support

this strategy. During the third quarter, we completed the

acquisition of substantially all of the assets of Happy Hen Egg

Farms, Inc., relating to their commercial production, processing,

distribution and sale of shell eggs. The acquired assets include

commercial egg production and processing facilities with current

capacity for approximately 350,000 laying hens and related

distribution facilities located near Harwood and Wharton, Texas.

Located near our other Texas locations, Happy Hen Egg Farms’

current site is designed for capacity of up to 1.2 million laying

hens, and we intend to capitalize on specific market opportunities

created by this additional production capacity. We look forward to

the opportunity to extend our market reach and deliver greater

value to both our customers and shareholders,” added Baker.

Over the past month, there have been reported outbreaks of AI in

certain poultry operations located in southeastern states. None of

these outbreaks has affected the commercial table egg layer flock,

and there have been no positive tests for AI at any Cal-Maine Foods

locations. Since the spring 2015 AI outbreaks, Cal-Maine Foods

significantly enhanced its biosecurity measures at all of its

locations, and its flocks are being monitored and tested according

to state and federal guidelines. The Company continues to work

closely with state and federal agencies and other interested

parties to monitor developments and seek to prevent the occurrence

of the disease at Cal-Maine Foods’ facilities.

Pursuant to Cal-Maine Foods’ variable dividend policy, for each

quarter for which the Company reports net income, the Company pays

a cash dividend to shareholders in an amount equal to one-third of

such quarterly income. Following a quarter for which the Company

does not report net income, the Company will not pay a dividend

with respect to that quarter or for a subsequent profitable quarter

until the Company is profitable on a cumulative basis computed from

the date of the last quarter for which a dividend was paid.

Therefore, the Company did not pay a dividend with respect to the

fourth quarter of fiscal 2016, or the first and second quarters of

fiscal 2017, and will not pay a dividend for the third quarter of

fiscal 2017. At February 25, 2017, cumulative losses that must

be recovered prior to paying a dividend were $50.2 million.

Selected operating statistics for the third quarter and

year-to-date period of fiscal 2017 compared with the prior-year

periods are shown below:

13 Weeks Ended 39

Weeks Ended

February 25,

2017

February 27,

2016

February 25,

2017

February 27,

2016

Dozen Eggs Sold (000) 263,613 277,574

758,114 800,520 Dozen Eggs Produced (000) 222,492

213,285 633,246 620,356 % Specialty Sales (dozen)* 23.6 % 23.6 %

23.0 % 22.8 % % Specialty Sales (dollars)* 40.8 % 31.0 % 44.1 %

27.0 % Net Average Selling Price (dozen) $ 1.130 $ 1.568 $ 1.020 $

1.919 Net Average Selling Price Specialty Eggs (dozen) $ 1.965 $

2.073 $ 1.980 $ 2.279 Feed Cost (dozen) $ 0.396 $ 0.414 $ 0.406 $

0.420

*Excludes co-pack specialty eggs

Cal-Maine Foods, Inc. is primarily engaged in the production,

grading, packing and sale of fresh shell eggs, including

conventional, cage-free, organic and nutritionally-enhanced eggs.

The Company, which is headquartered in Jackson,

Mississippi, is the largest producer and distributor of fresh shell

eggs in the United States and sells the majority of

its shell eggs in states across the southwestern, southeastern,

mid-western and mid-Atlantic regions of the United States.

Statements contained in this press release that are not

historical facts are forward-looking statements as that term

is defined in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements are based on management’s current

intent, belief, expectations, estimates and projections regarding

our company and our industry. These statements are not guarantees

of future performance and involve risks, uncertainties, assumptions

and other factors that are difficult to predict and may be

beyond our control. The factors that could cause actual results to

differ materially from those projected in the forward-looking

statements include, among others, (i) the risk factors set forth in

the Company’s SEC filings (including its Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K), (ii) the risks and hazards

inherent in the shell egg business (including disease, pests,

weather conditions and potential for recall),

(iii) changes in the demand for and market prices of shell

eggs and feed costs, (iv) our ability to predict and meet demand

for cage-free and other specialty eggs, (v) risks, changes or

obligations that could result from our future acquisition of

new flocks or businesses and risks or changes that may cause

conditions to completing a pending acquisition not to be met, and

(vi) adverse results in pending litigation matters. SEC

filings may be obtained from the SEC or the Company’s

website, www.calmainefoods.com. Readers are cautioned not to

place undue reliance on forward-looking statements because,

while we believe the assumptions on which the

forward-looking statements are based are reasonable, there can

be no assurance that these forward-looking statements will prove to

be accurate. Further, the forward-looking

statements included herein are only made as of the respective

dates thereof, or if no date is stated, as of the date

hereof. Except as otherwise required by law, we disclaim any

intent or obligation to publicly update these forward-looking

statements, whether as a result of new information, future

events or otherwise.

CAL-MAINE FOODS, INC. AND

SUBSIDIARIESFINANCIAL HIGHLIGHTS(Unaudited)(In

thousands, except per share amounts)

SUMMARY STATEMENTS OF

OPERATIONS

13 Weeks Ended

39 Weeks Ended

February 25,

2017

February 27,

2016

February 25,

2017

February 27,

2016

Net sales $ 306,540 $ 449,760 $ 799,929 $ 1,605,630 Gross profit

39,165 132,726 33,544 607,394 Operating income (loss) (4,573 )

85,771 (92,441 ) 472,038 Other income 8,738 11,744 11,298 14,143

Income (loss) before income taxes and noncontrolling interest 4,165

97,515 (81,143 ) 486,181 Income (loss) before income taxes

attributable to Cal-Maine Foods, Inc. 4,173 97,337 (81,134 )

484,256 Net income (loss) $ 4,139 $ 64,164 $ (49,807

) $ 316,417 Net income (loss) per share: Basic $ 0.09

$ 1.33 $ (1.03 ) $ 6.57 Diluted $ 0.09 $ 1.33 $ (1.03 ) $

6.54 Weighted average shares outstanding Basic 48,286 48,204

48,285 48,177 Diluted 48,417 48,367 48,285

48,359

SUMMARY BALANCE SHEETS

February 25, 2017

May 28, 2016 ASSETS Cash and short-term investments $

189,575 $ 389,545 Receivables 79,179 67,448 Income tax receivable

49,919 11,830 Inventories 163,818 154,799 Prepaid expenses and

other current assets 2,310 2,661 Current assets 484,801 626,283

Property, plant and equipment (net) 461,378 392,274 Other

noncurrent assets 139,096 93,208 Total assets $ 1,085,275 $

1,111,765 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts

payable and accrued expenses $ 77,128 $ 67,131 Current maturities

of long-term debt 15,449 16,320 Current liabilities 92,577 83,451

Long-term debt, less current maturities 7,302 9,250 Deferred

income taxes and other liabilities 117,034 101,703 Stockholders'

equity 868,362 917,361 Total liabilities and stockholders' equity $

1,085,275 $ 1,111,765

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170327005151/en/

Cal-Maine Foods, Inc.Timothy A. Dawson, 601-948-6813Vice

President and CFOorDolph Baker, 601-948-6813Chairman, President and

CEO

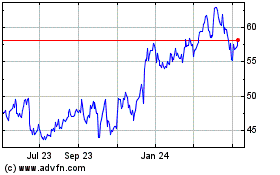

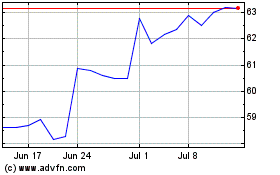

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Apr 2023 to Apr 2024