Cal-Maine Foods, Inc. (NASDAQ: CALM) today reported

results for the fourth quarter and fiscal year ended May

30, 2015.

Net sales for the fourth quarter of fiscal 2015 were $403.0

million, compared with net sales of $371.6 million for the fourth

quarter of fiscal 2014. The Company reported net income of

$46.1 million, or $0.96 per basic share and $0.95 per diluted

share, for the fourth quarter of fiscal 2015, compared with

$31.5 million, or $0.66 per basic share and $0.65 per diluted

share, for the fourth quarter of fiscal 2014.

For the fiscal year 2015, net sales were $1,576.1 million,

compared with net sales of $1,440.9 million for the prior-year

period. The Company reported net income of $161.3 million, or

$3.35 per basic share and $3.33 per diluted share, for

fiscal 2015, compared with net income of $109.2 million, or

$2.27 per basic share and $2.26 per diluted share, for

the same period in fiscal 2014.

The net income per share numbers for the fourth quarter and year

to date periods for fiscal 2015 and fiscal 2014 reflect the

two-for-one stock split for shares of the Company’s common stock

and Class A common stock, effective October 31, 2014.

Dolph Baker, chairman, president and chief executive officer of

Cal-Maine Foods, Inc., stated, “Our financial and operating

performance for the fourth quarter of fiscal 2015 marked a strong

finish to another record year for Cal-Maine Foods. Sales for the

fourth quarter were up 8.5 percent over the prior year, reflecting

a 6.2 percent increase in total dozen shell eggs sold and 2.6

percent higher average selling prices compared with the fourth

quarter of fiscal 2014.

“Throughout fiscal 2015, we have demonstrated consistent

execution of our growth strategy with favorable results. Our sales

for the year surpassed the previous year’s record by 9.4 percent,

supported by strong customer demand from three major market sectors

- retail, egg products and exports. We sold 1,063 million dozen

shell eggs in fiscal 2015, up 4.9 percent over the prior year and a

new annual record for Cal-Maine Foods. We also reported the highest

annual net income in the Company’s history.

“Specialty egg sales were a key driver of our performance for

the year as we continued to expand our market reach. For fiscal

2015, sales of specialty eggs accounted for 19.8 percent of our

total number of shell eggs sold and 27.2 percent of our shell eggs

revenue. With the growing consumer demand for specialty eggs, we

have also pursued additional opportunities to further enhance our

product mix and offer a wide variety of healthy choices. In April,

we announced a new production joint venture in Texas with Rose Acre

Farms to build a state of the art shell egg production complex with

capacity for approximately 1.8 million cage-free laying hens.

Construction of the complex has commenced, and the initial flocks

are now expected to be placed in November 2015. This joint venture,

Red River Valley Egg Farm, LLC, provides a unique opportunity to

capitalize on the growing demand for specialty eggs and better

serve customers who are looking for a trusted supplier of cage-free

eggs.”

Baker added, “Overall, our operations ran very well in fiscal

2015 as we were able to benefit from more favorable market

conditions for most of the year. We reported operating income of

$235.3 million, compared with $146.1 million for the prior year.

Our management team did an exceptional job in managing the critical

areas of our operations that make Cal-Maine Foods an efficient,

low-cost producer. Additionally, our average feed costs for the

year declined 10.9 percent due to an abundant supply of grain from

the record harvest of corn and soybean crops last fall. Looking

ahead, we should have an adequate supply of our primary feed

ingredients, but expect that prices will be volatile in the year

ahead.

“The recent outbreaks of Avian Influenza (AI) in the upper

Midwestern United States this spring have had a significant impact

on our industry. Due to the outbreaks, it is estimated that the

national flock has been reduced by over 40 million laying hens and

pullets, or approximately 13 percent. As a result of the reduced

supply, egg prices have moved significantly higher in recent

months. While the warmer summer months seem to have reduced further

transmission of AI, egg prices are expected to remain high until

the national laying hen flock can be replenished.

“There have been no positive tests for AI at any of the

Cal-Maine Foods locations. However, we have significantly increased

our biosecurity measures at every location, and we continue to

monitor the situation every day. We are also working closely with

the egg industry associations and government health officials to

identify ways to mitigate the risk of future outbreaks.”

Baker concluded, “While AI has created uncertain market

conditions for our industry, we remain focused on managing our

operations as efficiently and safely as possible. We are pleased

with our execution to date, and believe we have a proven strategy

for continued success in the year ahead. We are well positioned to

leverage the additional capacity from our recent joint ventures and

other expansion projects underway in Florida, Kansas, Kentucky and

Texas. Our strong balance sheet also provides the flexibility to

pursue new growth opportunities that will improve our operations.

And, we will continue to execute our growth strategy to enhance our

product mix, including additional opportunities to market and sell

specialty eggs. Above all, we will work hard to meet the changing

demands of our customers with outstanding service. We look forward

to the opportunities ahead for Cal-Maine Foods in fiscal 2016.”

For the fourth quarter of fiscal 2015, Cal-Maine Foods will pay

a cash dividend of approximately $0.317 per share to holders of its

common and Class A common stock. Pursuant to Cal-Maine Foods’

variable dividend policy, in each quarter for which the Company

reports net income, the Company pays a cash dividend to

shareholders in an amount equal to one-third of such quarterly

income. No dividends are paid in a quarter for which the Company

does not report net income. The amount paid could

vary slightly based on the amount of outstanding

shares on the record date. The dividend is payable August

18, 2015, to shareholders of record on August 3, 2015.

Selected operating statistics for the fourth quarter and year to

date periods of fiscal 2015 compared with the prior year periods

are shown below:

13 Weeks

Ended 52 Weeks Ended May 30, 2015 May 31,

2014 May 30, 2015 May 31, 2014 Dozen Eggs Sold

(000) 264,883 249,439 1,063,086 1,013,696 Dozen Eggs Produced (000)

201,763 195,630 798,842 750,302 % Specialty Sales (dozen)

21.0% 18.7% 19.8% 17.2% % Specialty Sales (dollars) 28.2% 25.2%

27.2% 24.3%

Net Average Selling Price (dozen)

$ 1.471 $ 1.433 $ 1.429 $ 1.362 Feed Cost (dozen) $ 0.406 $ 0.485 $

0.439 $ 0.493

Cal-Maine Foods, Inc. is primarily engaged in the production,

grading, packing and sale of fresh shell eggs, including

conventional, cage-free, organic and nutritionally-enhanced eggs.

The Company, which is headquartered in Jackson,

Mississippi, is the largest producer and distributor of fresh shell

eggs in the United States and sells the majority of

its shell eggs in approximately 29 states across the

southwestern, southeastern, mid-western and mid-Atlantic regions of

the United States.

Statements contained in this press release that are not

historical facts are forward-looking statements as that term

is defined in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements are based on management’s current

intent, belief, expectations, estimates and projections regarding

our company and our industry. These statements are not guarantees

of future performance and involve risks, uncertainties, assumptions

and other factors that are difficult to predict and may be

beyond our control. The factors that could cause actual results to

differ materially from those projected in the forward-looking

statements include, among others, (i) the risk factors set forth in

the Company’s SEC filings (including its Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K), (ii) the risks and hazards

inherent in the shell egg business (including disease, pests,

weather conditions and potential for recall),

(iii) changes in the demand for and market prices of shell

eggs and feed costs, (iv) risks, changes or obligations that could

result from our future acquisition of new flocks or

businesses, and (v) adverse results in pending litigation

matters. SEC filings may be obtained from the SEC or the

Company’s website, www.calmainefoods.com. Readers are

cautioned not to place undue reliance on forward-looking

statements because, while we believe the assumptions

on which the forward-looking statements are based are

reasonable, there can be no assurance that these

forward-looking statements will prove to be accurate.

Further, the forward-looking statements included herein

are only made as of the respective dates thereof, or if

no date is stated, as of the date hereof. Except as

otherwise required by law, we disclaim any intent or

obligation to update publicly these forward-looking

statements, whether as a result of new information, future

events or otherwise.

CAL-MAINE FOODS, INC. AND

SUBSIDIARIES

FINANCIAL HIGHLIGHTS

SUMMARY STATEMENTS OF INCOME

(Unaudited)

(In thousands, except per share

amounts)

13 Weeks Ended 52 Weeks Ended

May 30,2015

May 31,2014

May 30,2015

May 31,2014

Net sales $ 403,011 $ 371,582 $ 1,576,128 $ 1,440,907 Gross profit

109,394 91,291 395,721 302,764 Operating income 66,550 47,528

235,335 146,052 Other income 3,629 1,018 11,214 15,790 Income

before income taxes and noncontrolling interest 70,179 48,546

246,549 161,842 Income before income taxes attributable to

Cal-Maine Foods, Inc. 70,017 48,332 245,522 161,242 Net

income $ 46,114 $ 31,492 $ 161,254 $ 109,207 Net income per

share: Basic $ 0.96 $ 0.66 $ 3.35 $ 2.27 Diluted $ 0.95 $ 0.65 $

3.33 $ 2.26 Weighted average shares outstanding Basic 48,142

48,116 48,136 48,095 Diluted 48,495

48,403 48,437 48,297

SUMMARY BALANCE SHEETS

May 30,2015

May 31,2014

ASSETS Cash and short-term investments $ 258,628 $ 209,259

Receivables 101,977 87,516 Inventories 146,260 146,117 Prepaid

expenses and other current assets 2,099 2,501 Current

assets 508,964 445,393 Property, plant and equipment (net)

358,790 314,935 Other noncurrent assets 60,899 51,333

Total assets $ 928,653 $ 811,661 LIABILITIES AND

STOCKHOLDERS' EQUITY Accounts payable and accrued expenses $ 91,481

$ 80,434 Current maturities of long-term debt 10,047 10,216

Deferred income taxes 30,391 30,451 Current

liabilities 131,919 121,101 Long-term debt, less current

maturities 40,813 50,877 Deferred income taxes and other

liabilities 51,359 44,938 Stockholders' equity 704,562

594,745 Total liabilities and stockholders' equity $ 928,653

$ 811,661

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150720005284/en/

Cal-Maine Foods, Inc.Dolph Baker, Chairman, President and CEO,

601-948-6813orTimothy A. Dawson, Vice President and CFO,

601-948-6813

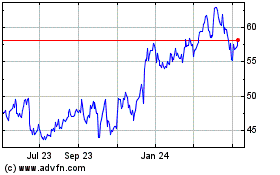

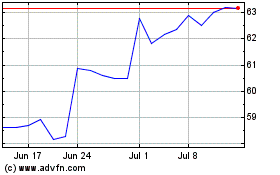

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cal Maine Foods (NASDAQ:CALM)

Historical Stock Chart

From Apr 2023 to Apr 2024