CaixaBank's Attempt to Gain Control of Banco BPI Stalled

July 22 2016 - 11:58AM

Dow Jones News

By Patricia Kowsmann

LISBON--Uncertainty over the future of Banco BPI SA looks set to

continue after an attempt by key shareholder CaixaBank SA to gain

control of the lender was stalled.

CaixaBank, which owns around 45% of BPI, has offered its fellow

shareholders EUR1.113 ($1.23) a share for the rest of the company,

in an offer which values the Portuguese bank at EUR1.62 billion.

The offer is conditional upon the removal of BPI's 20%

voting-rights limit.

Shareholders were scheduled to vote on a motion to remove the

cap at a meeting on Friday. However in a statement following the

meeting, BPI said Violas Ferreira Financial SA, which owns 2.7% of

the lender, had disclosed that it had a temporary court order

forbidding the vote to take place. The meeting has been rescheduled

for Sept. 6.

The reason why Violas made the court request wasn't clear. The

shareholder has publicly complained CaixaBank's offer for BPI is

too low. A representative for Violas Ferreira Financial couldn't be

immediately reached for comment.

Shares of BPI, Portugal's largest lender by market value, were

trading up 1% at EUR1.12 Friday afternoon.

CaixaBank, Spain's third-largest lender by market value, is

locked in a battle with fellow shareholder Isabel dos Santos over

the future of BPI and its Angolan unit. BPI's exposure to Angola's

debt exceeds a limit imposed by the European Central Bank, which

has told the lender to either raise a prohibitive amount of capital

or shed the unit.

Because of the company's rights cap, CaixaBank has little more

say over BPI's direction than Ms. dos Santos, an Angolan investor,

who owns 18.6% of BPI.

Approval for the cap removal became more likely after the

Portuguese government passed a law that lifts the voting-rights

limit in certain shareholder votes. That means CaixaBank will be

allowed to use its entire 45% stake on the Sept. 6 vote.

For Portugal, handing BPI over to a larger lender would be a

relief amid a struggling banking sector. While Portugal didn't face

a property bubble like eurozone peers Spain and Ireland, its

companies have been hard hit by a sovereign-debt crisis that led

the country to request a EUR78 billion bailout in 2011. A portfolio

of souring company loans, along with low interest rates, are

hurting lenders' profitability and eating up their capital

cushion.

The government is currently negotiating with the European

Commission and the ECB a capital injection in state-owned lender

Caixa Geral de Depositos SA. Banco Comercial Português SA,

meanwhile, has seen its shares fall sharply over the past months on

fears it, too, needs more capital.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

July 22, 2016 11:43 ET (15:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

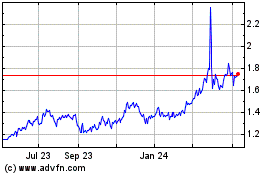

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024