Caesars Settles One Bondholder Lawsuit

August 17 2016 - 12:00PM

Dow Jones News

Caesars Entertainment Corp. has struck a deal to settle one of

several pending bondholder lawsuits, a key step toward peace in the

contentious bankruptcy case of the casino company's largest

operating unit.

The settlement, which Caesars disclosed Wednesday in a filing

with the Securities and Exchange Commission, resolves a

class-action lawsuit brought by the holders of unsecured bond debt

issued by its Caesars Entertainment Operating Co. unit. Like other

litigation pending against Caesars, the lawsuit sought to hold

Caesars to guarantees of the bankrupt CEOC unit's debt.

Under the settlement, which was reached Monday, lead plaintiff

Frederick Barton Danner agreed to drop the lawsuit in a New York

federal court and to support CEOC's chapter 11 restructuring, which

includes a broader settlement of potential legal claims against

Caesars and its private-equity backers, Apollo Global Management

and TPG.

In return, CEOC will pay the fees of Mr. Danner's lawyers and

will provide unsecured bondholders who vote in favor of its

restructuring plan with extra cash equal to at least 6.38% of the

bond debt they hold.

A lawyer for Mr. Danner couldn't immediately be reached for

comment Wednesday, and a Caesars spokesman declined comment beyond

the regulatory filing.

Mr. Danner sued Caesars in the U.S. District Court in Manhattan

in October 2014, several months before CEOC sought chapter 11

protection. The class-action suit claimed an August 2014 financing

transaction was improperly designed to release Caesars of its

guarantee of $750 million in unsecured debt due 2016. The suit

alleged that the deal was done without bondholders' consent,

violating their rights under the Trust Indenture Act.

Caesars has said that transaction, and others targeted in

similar lawsuits brought by holders of various CEOC bond debt, was

proper and necessary to shore up its troubled operating unit.

Caesars still faces several other bondholder lawsuits in federal

court in New York, and one in a Delaware state court, over billions

of dollars' worth of CEOC debt guarantees. By bankruptcy-court

order, however, those lawsuits are on hold until Aug. 29, although

CEOC is seeking an extension of the lawsuit shield now protecting

its parent.

Since filing for chapter 11 protection in January 2015, CEOC has

sought a broad settlement with its creditors and its parent, which

the bondholder litigation has complicated. At issue are a series of

prebankruptcy financing deals and asset transfers. Bondholders and

CEOC each say they have legal claims against Caesars, Apollo and

TPG in connection with the deals, which they allege were designed

to protect CEOC's owners at the expense of its creditors. Caesars

and its owners dispute the allegations.

Write to Jacqueline Palank at jacqueline.palank@wsj.com

(END) Dow Jones Newswires

August 17, 2016 11:45 ET (15:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

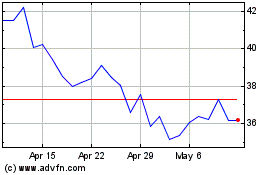

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

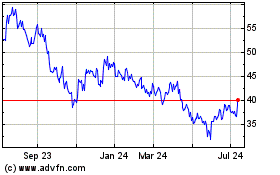

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024