Caesars Entertainment Soars on Funding Plan - Analyst Blog

May 08 2014 - 3:54PM

Zacks

Caesars Entertainment Corporation (CZR)

recently announced a comprehensive financing plan designed to aid

independent stock listing and significant de-leveraging of its

subsidiary, Caesars Entertainment Operating Co. (CEOC). Following

the announcement, share price of Caesars Entertainment surged 14.0%

on May 7, 2014.

Caesars has undertaken a few steps to achieve its goal, which

include amendment of CEOC’s credit facility; raising $1.75 billion

of first lien debt to redeem all of CEOC's existing 2015 maturities

and repay the latter’s existing bank debt, sell its 5.0% stake in

CEOC to institutional investors, which would curtail $23.0 billion

of debt; and expand CEOC's board of directors. Also, these include

the sale of CEOC’s three Las Vegas properties to Caesars Growth

Partners.

These actions are part of Caesars constant efforts to improve its

financial condition after the leverage buyout in 2008. In 2008,

Caesars Entertainment was purchased in a leveraged buyout valued at

$30.7 billion and led by Apollo Global Management

LLC (APO) and TPG Capital.

Since then, the company has undertaken a series of actions to

improve its financial situation and has already lowered debt by

$5.0 billion. As of Mar 31, 2014, Caesars' total long-term debt

stood at $21.0 billion, approximately flat sequentially.

Also, the move comes in the wake of a decline in gambling revenues

in Atlantic City and Tunica, Caesars Entertainment’s largest

markets. Yesterday after the market closed, Caesars Entertainment

posted dismal first quarter results with a loss of $1.96 per share,

which was wider than the Zacks Consensus Estimate of a loss of

$1.16 and the year-ago loss of $1.41. Revenue came in at $2.10

billion, down 1.9% year over year and missed the consensus mark of

$2.16 billion.

The downside reflects continued softness in the domestic gaming

market mainly in the Atlantic coast region, increased regional

competition and impact of severe weather.

Caesars Entertainment is working on a number of expansion efforts

and has centralized its operations to increase efficiency and

curtail expenses. The refinancing actions and expansion initiatives

would help the company to restructure its heavy debt and strengthen

its core businesses, going forward.

Caesars Entertainment Corp. presently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the gaming industry include

MGM Resorts International (MGM) and Wynn

Resorts Ltd. (WYNN). Both these stocks carry a Zacks Rank

#2 (Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

APOLLO GLOBAL-A (APO): Free Stock Analysis Report

CAESARS ENTERTN (CZR): Free Stock Analysis Report

MGM RESORTS INT (MGM): Free Stock Analysis Report

WYNN RESRTS LTD (WYNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

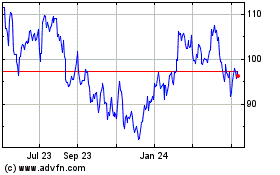

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024