TIDMCPP

RNS Number : 0449C

CPPGroup Plc

13 January 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO THE UNITED STATES, AUSTRALIA, CANADA OR THE REPUBLIC

OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT

JURISDICTION

CPPGROUP PLC

13 January 2015

Result of General Meeting & Board Changes

CPPGroup Plc (CPP or the Group) held its General Meeting for

shareholders this morning and is pleased to announce that all

resolutions proposed and set out in the Notice of General Meeting

were duly passed. Consequently, the Group will proceed with the

Proposals described in the announcement published on 23 December

2014, including (among other things) to: (i) cancel the admission

of the Ordinary Shares to the Official List (premium segment) and

to remove such Ordinary Shares from trading on the Main Market of

the London Stock Exchange; (ii) apply for the Ordinary Shares to be

admitted to trading on AIM; and (iii) raise in aggregate GBP20.0

million (approximately GBP17.9 million net of expenses) by way of a

non-preemptive placing of 666,666,667 Placing Shares at 3 pence per

Placing Share, conditional on admission to AIM. Additionally,

following the passing of the necessary resolutions, the

reorganisation of the Company's share capital to subdivide and

re-designate each of the existing ordinary shares of 10 pence each

into one new ordinary share of 1 penny each and one new deferred

share of 9 pence each becomes unconditionally effective today.

Duncan McIntyre, Non-Executive Chairman, commented:

"CPP has made significant progress to stabilise and strengthen

the Group and I am delighted by the support we have received which

will enable CPP to embark on the next stage of its development. As

I leave the Group, I want to express my thanks to the Board and the

management team for the strong support that I have received and

thank everyone at CPP for their hard work."

Brent Escott, Chief Executive Officer, commented:

"Today's positive outcome in favour of our proposals is

excellent news for CPP and completes another critical step to

secure our future. This is very positive for our customers, our

people and allows the Company to continue on its journey and invest

in future growth. The Board would like to thank new and existing

shareholders for their support and in particular our Business

Partners for their support and on-going commitment and also

Barclays Bank PLC as on-going senior lender. We would also like to

thank Duncan McIntyre and Les Owen, who are leaving the Board

today, for their dedication and support."

As previously announced, the net proceeds of the Placing of

approximately GBP17.9 million will be used for the prepayment in

part of the Group's Bank Facility (including certain prepayment

fees), satisfaction of the Group's obligations in relation to the

settlement of the Deferred Commission and interest thereon, to

invest in a modern, cost-effective IT infrastructure and system for

the Group and to provide additional capital to fund in part

elements of the Group's Business Transformation programme and

related costs of change, as set out in the Group's statement on 23

December 2014.

In addition, the Group is also pleased to announce the

appointment of Mr Eric Anstee as Non-Executive Chairman with

immediate effect. Mr Anstee succeeds Duncan McIntyre, who announced

his intention to step down on 29 August 2014. Duncan has provided

immense support to the Board during an important period to

stabilise and strengthen the Group for its future development. The

Board wishes to express its sincere thanks to Duncan for his

leadership and guidance, and to Mr Les Owen who has also stepped

down as an Independent Non-Executive Director; a process to

identify a suitable successor is currently underway.

A copy of the resolutions passed at the General Meeting has been

submitted to the National Storage Mechanism and will shortly be

available for inspection at www.hemscott.com/nsm.do or

www.morningstar.co.uk.

Details of the proxy votes cast for each resolution are below

and available on the Company's website www.cppgroupplc.com.

Resolution In Favour Against Withheld

+ Discretion

To approve the sub-division

and re-designation of the

ordinary share capital of

1 the Company. 133,791,014 14,111 3,000

----------------------------------- -------------- ---------- -----------

To authorise the amendment

of the articles of association

2 of the Company. 133,791,014 14,111 3,000

----------------------------------- -------------- ---------- -----------

To give the Directors authority

to allot shares pursuant

to section 551 of the Companies

3 Act 2006. 133,791,014 14,111 3,000

----------------------------------- -------------- ---------- -----------

To give the Directors authority

to allot shares as if s561(1)

of the Companies Act 2006

4 did not apply. 133,781,924 23,201 3,000

----------------------------------- -------------- ---------- -----------

To authorise the participation

of Mr Hamish Ogston in the

5 Placing. 37,448,300 15,946 12,090

----------------------------------- -------------- ---------- -----------

To authorise the participation

of Schroder Investment Management

6 Limited in the Placing. 111,478,635 15,946 15,878,291

----------------------------------- -------------- ---------- -----------

To authorise the Directors

to cancel the admission of

the Ordinary Shares to the

Official List and to the

LSE Main Market and to apply

for admission of said shares

and the Placing Shares to

7 AIM. 128,675,125 5,130,000 3,000

----------------------------------- -------------- ---------- -----------

To approve cancellation of

the admission of the Ordinary

Shares to the Official List

and to the LSE Main Market

and to apply for admission

of said shares and the Placing

8 Shares to AIM. 32,343,336 5,130,000 3,000

----------------------------------- -------------- ---------- -----------

To authorise the Directors

9 to issue the Placing Shares. 133,286,558 518,567 3,000

----------------------------------- -------------- ---------- -----------

To approve the waiver granted

by the Takeover panel of

the obligation that would

otherwise arise on Phoenix

pursuant to Rule 9 of the

10 City Code. 15,159,801 2,991 15,878,291

----------------------------------- -------------- ---------- -----------

To disapply the Remuneration

Policy set out in the Directors'

remuneration report for the

11 year ended 31 December 2013. 128,668,335 5,136,790 3,000

----------------------------------- -------------- ---------- -----------

In conjunction with the various resolutions voted on today in

the General Meeting and also other matters set out in the Circular

dated 24 December 2014, the following parties have provided

services and support to the Group during 2014, in addition to those

advisors already listed in the Circular: a) Fenchurch Advisory

Partners in relation to financial advice; b) KPMG LLP in relation

to financial and restructuring advice; c) Grant Thornton UK LLP as

reporting accountant; d) Ernst and Young LLP, Linklaters LLP and

PricewaterhouseCoopers LLP in relation to advising the Business

Partners in respect of the Business Partner Agreement; e) Hogan

Lovells LLP and Addleshaw Goddard LLP in relation to advising the

Senior Lenders in connection with the refinancing; and f) Isonomy

Limited in relation to restructuring services.

Next steps

It is expected that the last day of dealings in the Ordinary

Shares on the Main Market will be 10 February 2015. Cancellation of

the admission of the Ordinary Shares to the Official List (premium

segment) and to trading on the Main Market of the London Stock

Exchange plc is expected to take effect at 8.00 a.m. on 11 February

2015. Admission is expected to take place, and dealings in the

Ordinary Shares (including the Placing Shares) are expected to

commence on AIM, at 8.00 a.m. on 11 February 2015.

In connection with the application for the Ordinary Shares

(including the Placing Shares) to be admitted to trading on AIM,

the Company expects to submit to AIM for publication tomorrow a

pre-admission announcement in accordance with Rule 2 of the AIM

Rules for Companies and to publish on its website a document

containing all information that would be required to be included in

an AIM Admission Document which is not currently public.

Except as otherwisedefined herein, capitalised terms have the

same meanings as set out in the Circular dated 24 December

2014.

Enquiries

Investor Relations

CPPGroup Plc

Brent Escott, Chief Executive Officer

Craig Parsons, Chief Financial Officer

Tel: +44 (0)1904 544702

Helen Spivey, Head of Corporate and Investor Communications

Tel: +44 (0)1904 544387

Media

Tulchan Communications: Martin Robinson; David Allchurch

Tel: +44 (0)20 7353 4200

Sponsor and Broker

Numis Securities Limited: Robert Bruce; Stuart Skinner; Charles

Farquhar

Tel: +44 (0)20 7260 1000

Notes to Editors

CPPGroup Plc (CPP or the Group) is an international assistance

business operating in the UK and overseas within the financial

services, telecommunications and travel sectors. CPP primarily

operates a business-to-business-to-consumer (B2B2C) business model

providing services and retail, wholesale and packaged products to

customers through Business Partners and direct to consumer. The

Group's core assistance and travel service products help to provide

security and enhance the experience of travel for customers

worldwide, designed to make everyday life easier to manage.

For more information on CPP visit www.cppgroupplc.com

REGISTERED OFFICE

CPPGroup Plc

Holgate Park

York

YO26 4GA

Registered number: 07151159

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROMZXLFFEFFFBBE

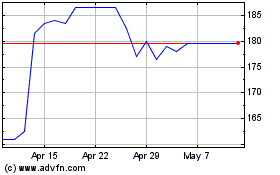

Cppgroup (LSE:CPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

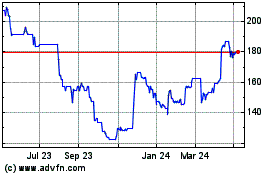

Cppgroup (LSE:CPP)

Historical Stock Chart

From Apr 2023 to Apr 2024