CME Group Suspends Euro-Denominated Cocoa Contract

January 24 2017 - 9:29AM

Dow Jones News

By Katherine Dunn

LONDON--CME Group will suspend its euro-denominated cocoa

contract, two years after the contract was launched as an

alternative to the incumbent sterling contract run by

Intercontinental Exchange.

The current March 2017 contract will be the last that is traded,

CME said.

"Though the initial launch of this innovative product had very

strong market support, its performance decreased over time," a CME

representative said. "As a result, we have decided to suspend all

cocoa futures and options contracts beyond April 2017."

The euro contract was launched in March 2015 after feedback from

the European cocoa industry, Jeffry Kuijpers, executive director

for agricultural commodities at CME Group, said in an interview

with the Wall Street Journal last year.

Traders said the industry initially supported a euro-denominated

contract as an alternative to the London-based sterling contract,

because the euro is the main currency for trading between cocoa

hubs in West Africa and Europe. The contract's structure also

addressed some traders' concerns about issues with delivery and

settlement of the ICE sterling contract.

However, trading volumes never took off, highlighting the

difficulty many commodities exchanges face when attempting to lure

liquidity from incumbent markets.

By early 2016, European cocoa traders said the liquidity was too

low for the contract to be usable, and many expected that the

contract would eventually be suspended.

A rival euro-denominated cocoa contract, launched by ICE in

March 2015, also failed to take off. That contract still exists,

but it has also seen only very low volumes.

Write to Katherine Dunn at katherine.dunn@wsj.com.

(END) Dow Jones Newswires

January 24, 2017 09:14 ET (14:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

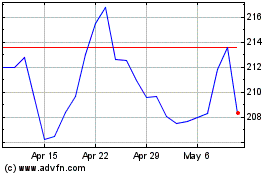

CME (NASDAQ:CME)

Historical Stock Chart

From Mar 2024 to Apr 2024

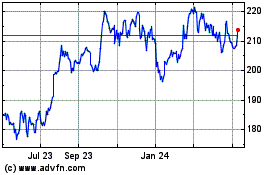

CME (NASDAQ:CME)

Historical Stock Chart

From Apr 2023 to Apr 2024