By Paul Ziobro and Jacquie McNish

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 16, 2017).

CSX Corp. lost about $4 billion in market value Friday after

Chief Executive Hunter Harrison was placed on medical leave, a

stark reversal for investors who had shrugged off concerns earlier

this year about the health of the renowned railroad turnaround

artist.

Mr. Harrison, 73 years old, became ill last week after one of

his regular, multiday pep-talks with management, known as Hunter

Camps, according to acting CEO Jim Foote. The illness "led to

medical complications," he told investors on a call Friday.

Mr. Foote, who was appointed to his new role Thursday, declined

to discuss details of Mr. Harrison's condition or when he might

return. The railroad maverick, who has struggled with respiratory

issues, has been using an oxygen tank in recent months and was

largely working from his home in Wellington, Fla.

"I expected to be working for Hunter for four years, and, God, I

hope he comes back and we can continue to work together some more,"

Mr. Foote said in an interview.

Mr. Harrison's absence leaves an executive team that is still in

the process of rebuilding after the exodus last month of three

senior executives, including chief operating officer Cindy Sanborn.

Mr. Foote, only recently hired as operating chief, was a marketing

executive at Canadian National Railway Co. when Mr. Harrison led a

turnaround of the Canadian company.

Several analysts said they were worried Mr. Harrison wouldn't

return, while some investors and governance experts called on the

company to disclose more about the CEO's health condition.

CSX had a tough decision in hiring Mr. Harrison.

Activist investor Mantle Ridge earlier this year pushed to

replace five of CSX's directors and install Mr. Harrison as the

company's CEO. The board initially resisted the change, citing, in

part, concerns about Mr. Harrison's health. But members ultimately

reached a deal with Mantle Ridge after CSX shares surged on news of

Mr. Harrison's potential appointment, adding about $10 billion in

market value to CSX in January.

The company awarded -- and investors approved -- Mr. Harrison a

four-year contract, including an $84 million payment.

Since his appointment, shares have traded at a higher multiple

versus other railroads. The shares, which were trading around $35

in January before Mr. Harrison was involved, fell 7.6% to $52.93 in

trading on Friday.

"Given that Harrison's presence is obviously significant to the

share value, the board of directors ought to be highly transparent

at this point," said Charles Elson, head of the Weinberg Center for

Corporate Governance at the University of Delaware. CSX board

members should tell investors "what's wrong with him."

CSX's board chairman, Ned Kelly, didn't respond to requests for

comment. Mantle Ridge, whose founder Paul Hilal is also a CSX

director, declined to comment.

At the time of his medical leave, Mr. Harrison was eight months

into a turnaround strategy he called "precision railroading." The

plan, which included new train schedules, cost-cutting and terminal

closures, was beset with a number of traffic congestion problems

and other issues that triggered an outpouring of customer

complaints.

Mr. Foote said the company has recently made progress with the

"disruptive" strategy and he didn't see "any reason to diminish our

expectations." He said Mr. Harrison had already made the most

significant structural changes to how CSX operates, including

shutting eight of the 12 yards that sort trains and closing

numerous lanes where CSX operates intermodal trains.

"The real, real, real heavy lifting has already been done," he

said.

CSX continues to face scrutiny over shipping problems. On

Thursday, the Surface Transportation Board sent a letter to Mr.

Harrison saying shippers are still raising concerns about service

challenges and inadequate service. The agency asked the railway for

more information about the current state of the network and

information on any other significant changes planned for next

year.

Loop Capital told investors Friday it is skeptical that Mr.

Harrison will return from his medical leave. The investment and

brokerage firm predicts a murky future for CSX, as Mr. Harrison's

abrupt exit has left the railroad with a network and culture that

is "only partially transformed."

Mr. Foote, 63, declined to comment on longer-term succession

planning at CSX. "My only conversation with the board was coming in

as the chief operating officer and doing everything I could to help

CSX and Hunter in running the company," he said in an

interview.

John Fishwick, an individual CSX shareholder, publicly opposed

Mr. Harrison's pay package at the June meeting, and continues to

believe the board shouldn't have reimbursed Mr. Harrison for

compensation he earned at Canadian Pacific.

"When you put that much compensation for one person for what

they did before they got to you, then you certainly put the company

in a position to be second-guessed," said Mr. Fishwick, a Roanoke,

Va., attorney.

Corrections & Amplifications Acting CEO Jim Foote said CSX's

operations are improving every day. An earlier version of this

article incorrectly stated Mr. Foote was referring to CEO Hunter

Harrison's health. (Dec. 15)

--Joann S. Lublin and David Benoit contributed to this

article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com and Jacquie McNish

at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

December 16, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

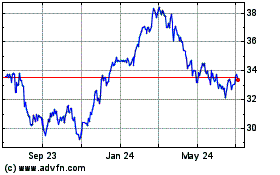

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

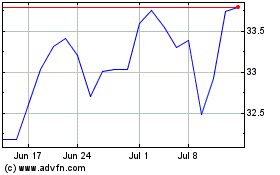

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024