CEMI: DPP Products Driving Revenue - Analyst Blog

November 08 2011 - 9:10AM

Zacks

Q3 2011 Financial Results:

DPP Products Driving Revenue

Brian Marckx, CFA

Chembio Diagnostics (CEMI)

reported financial results for the third quarter ending September

30, 2011 on November 3rd. Revenue of $5.92 million crushed

our $4.61 million estimate, the ~ $1.3 million difference split

fairly equally between better than anticipated international sales

of the lateral flow products and much stronger than estimated DPP

product sales to FIOCRUZ. Q3 revenue was a record high for

Chembio, surpassing their previous best quarterly sales of $5.67

million which came in Q4 2010.

Total product sales were $5.53 million, up 46% y-o-y and well ahead

of our $4.14 million estimate. Product sales were highlighted

by $1.71 million in revenue from DPP products sold to FIOCRUZ -

this is an increase from about $50k in Q1 and $850k in Q2.

DPP FIOCRUZ related revenue is expected to be a significant

contributor to the top-line over the next few years and the big

jump in DPP FIOCRUZ sales during Q3 provides evidence that this

could ramp very quickly. It is also noteworthy that

DPP-related sales were the major impetus for the all-time high

quarterly revenue, marking a symbolic inflection point where DPP

product sales (i.e. - Chembio's long-term future) are now beginning

to drive top-line growth much more so than are their legacy lateral

flow products.

Q3 product sales also benefitted from an almost 200% sequential

increase in international HIV lateral flow sales, reflecting the

reversal of an inventory backlog that stunted international HIV

lateral flow sales in Q2.

Q3 EPS was $0.01 on net income of $476k, compared to our $0.00 and

$277k estimates. All of the beat on revenue did not flow

through to the bottom line as a result of slightly narrower gross

margin compared to our estimate and higher SG&A expense,

reflecting sales commissions paid on the higher-than-modeled DPP

FIOCRUZ revenue number.

Cash

Cash from operations was an inflow of $633k in Q3 and $1,559k for

the first three quarters of 2011. Excluding changes in

working capital, operating cash flow was $660k and $971k through

the three and nine months ending 9/30/2011. Investing

activities used $282k through the first nine months of 2011.

Chembio exited Q3 with $3.0 million in cash and equivalents, up

from $2.1 million at the end of Q2. Along with cash generated

from operations, cash balance was bolstered by a draw on one of the

company's loan facilities during the quarter. Total debt was

about $487k at Q3 quarter-end, all of which represents bank

loans. Chembio has significant liquidity and we continue to

expect the company will be able to manage to fund all operations

(including clinical trials, regulatory filings, SG&A, etc.)

through cash on hand and funds from operations.

Business / Pipeline

Update

DPP HIV, U.S.

The first FDA PMA module filing was made in April 2011.

Second module was filed in early October. Clinical trials are

about 90% done (~75% done at end of Q2). CEMI expects trials

to complete during Q4. Notable is that management now

believes that both the blood and oral fluid sample data may be

robust enough to meet FDA requirements. As a reminder, on the

Q2 call management mentioned that the trial data up to that period

indicated the oral fluid data may not meet FDA requirements - but

that they hoped to gain more insight as the data analysis

progressed. The most recent news, that the oral fluid data

may indeed get through the FDA and afford regulatory approval for

both blood and saliva, is very positive. We have again

adjusted our model - which now reflects an increased chance that

the test receives FDA approval for all sample types. We again

reiterate, however, that a worse-case scenario, where the claim for

oral fluid fails to get through FDA, would be far from a crushing

blow for Chembio as we expect there to be considerable demand for

the product with blood sampling alone.

DPP Syphilis (FIOCRUZ)

On May 3, 2011 Chembio announced that FIOCRUZ had received approval

of its DPP Syphilis Treponemal test from Brazilian regulatory

authorities. The Treponemal test is a single-parameter test

for the detection of antibodies specific to Syphilis. Chembio

and FIOCRUZ expect to submit a second Syphilis test for approval in

Brazil either later this year or early in 2012. This second

test is a multiplex screen and confirm assay that incorporates the

Treponemal as well as non-Treponemal parameters. Launch of

the multiplex test, which enables the detection and differentiation

of past versus active infections, will likely significantly broaden

the market for the DPP Syhpilis tests.

The agreement calls for minimum purchases of $5.7 million of these

two tests over three years.

Chembio began evaluating this multiplex Syphilis product in China

with a collaboration partner during Q1 2011 and noted on the Q2

call that results have looked encouraging.

DPP Syphilis Screen and Confirmation (U.S. /

Europe)

Clinical trials in support of 510(k) had been expected to start

during Q2 2011. This was slightly delayed but trials

commenced during Q3. Testing is expected to be completed and

a 510(k) application made in Q1 2012. This screen and

confirmation (Treponemal / Non-treoponemal) test will be the first

of its kind when approved. We expect the test to be a big

driver of Chembio's revenue over the next several years.

The test received CE Marking in early October and Chembio is

currently working to finalize distribution of the test in Europe -

launch is slated for early 2012.

HIV Lateral Flow Tests CE Mark

Study data to support CE Mark of Chembio's HIV 1/2 Stat Pak and

Sure Check HIV 1/2 lateral flow tests were filed in October.

HIV Lateral Flow Home Use Test

In June Chembio announced that it may pursue FDA approval of its

Sure Check HIV 1/2 test for home use (i.e. - OTC). In

September the FDA provided guidance that Chembio will need to

perform additional studies in order to submit for an

Investigational Device Exemption (IDE). Chembio noted on the

Q3 call that they believe they can have these studies completed by

the end of Q1 2012 and submit for an IDE at that time. If the

FDA grants an IDE, Chembio would then need to conduct more clinical

trials. Eventual approval is highly uncertain at this point

and not a near-term event. As such we do not yet model a

contribution from an OTC HIV test.

DPP Flu A/B Antigen

Chembio recently noted due to recent FDA updates to gaining

clearance for this type of test, that the company was evaluating

whether to continue to pursue development. At this point, we

do not expect that the company will continue pursue this test and

have removed all related revenue contribution from our model - this

is a very minor setback as we had only modeled a small contribution

from this test beginning in 2012.

DPP HCV Antibody

Chembio's Q2 10-Q notes that they are putting development of this

on hold. As management had previously indicated that demand

for such a test may not justify further development, the recent

news is not overly surprising. We had been modeling a

relatively insignificant revenue contribution from this product and

removed this from our model prior to Q3 2011 financial results.

DPP Leptospirosis (FIOCRUZ)

Approved in July 2011. Triggered a $100k milestone which was

recognized in Q3.

Battelle / CDC DPP Flu Test

In December 2009, Chembio entered into a $900k milestone-based

development agreement for the development and initial supply of a

multiplex, rapid POC influenza immunity test using the DPP

technology with Battelle Memorial Institute which has a contract

with the United States CDC. Chembio received the final

milestone payment for this agreement in late 2010. In October

2011 Chembio entered a subsequent, related development agreement

with Battelle/CDC to continue work on this project. This

supplemental agreement commences in November 2011 and is expected

to end in Q1 2012 - Chembio expects to receive approximately $250k

over that period related to this agreement. Our model

reflects a small portion of this total received in Q4, with the

remainder in Q1 2012.

OUR 2011

OUTLOOK

Revenue

We now look for 2011 revenue of $ 18.6 million - this is up from

$16.9 million prior to Q3 results and mostly reflects the revenue

beat in Q3. Our current 2011 revenue estimate implies growth

of 11% from 2010 and, more importantly, implies product sales (i.e.

- Chembio's fundamental business) growth of 23% - largely driven by

contribution from DPP products (to FIOCRUZ). Meanwhile, we

model revenue from licenses, grants and milestones (an ancillary

part of the company's operations) to fall 39%. The expected

drop in revenue from these ancillary sources is relatively

meaningless from a longer-term perspective, however, as product

sales (especially DPP) will be the ongoing driver of Chembio's

revenue.

Net Income / EPS

We model Chembio to post net income of $904k and EPS of $0.01 in

2011, up slightly from the $727k and $0.01 that we modeled prior to

Q3 results.

RECOMMENDATION /

VALUATION

Competitors (OSUR and TRIB) trade at an average of 4.0x and 3.5x

estimated 2011 and 2012 sales, respectively. We look for CEMI

to post 2011 and 2012 sales of $18.6 million and $23.6 million

which, based on competitor price/sales ratios, values CEMI at

between $1.09/share and $1.21/share - averaging the two results in

a value of $1.10/share. As a result, we are maintaining both

our Outperform rating $1.10 per share price

target.

Please email scr@zacks.com with CEMI as the subject to

request a free copy of the full research

report. To view our most recent research reports and

subscribe to our daily morning email alert, visit

http://scr.zacks.com/.

Follow Zacks Small Cap Research on Twitter at

Twitter.com/ZacksSmallCap

CHEMBIO DIAGNOS (CEMI): Free Stock Analysis Report

ORASURE TECH (OSUR): Free Stock Analysis Report

TRINITY BIOTECH (TRIB): Free Stock Analysis Report

Zacks Investment Research

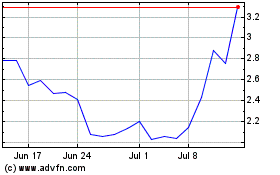

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024