Revenues Rise 7% to

$521.2 Million for the Quarter;

GAAP Net Earnings Decline 19%; Adjusted

Net Earnings Rise 36%

CDK Global, Inc. (Nasdaq:CDK) today announced its second quarter

fiscal 2015 financial results for the period ended December 31,

2014. Highlights are below:

| Second Quarter Fiscal 2015 Results |

|

As Reported |

|

As Adjusted |

| |

|

|

|

|

| Revenues |

|

7% to $521.2 million |

|

7% to $521.2 million |

| Earnings before income taxes |

|

(10)% to $75.2 million |

|

35% to $94.1 million |

| Net earnings |

|

(19)% to $42.5 million |

|

36% to $59.4 million |

| Diluted earnings per share |

|

(21)% to $0.26 per share |

|

37% to $0.37 per share |

"CDK reported strong financial results for the second quarter,

with positive contributions from each of our business segments,"

said Steve Anenen, President and Chief Executive Officer, CDK. "I

am also delighted by the interest in our new innovations showcased

at the recent National Automobile Dealers Association ("NADA") Expo

which we expect will drive future revenue growth. In addition, we

recently initiated a systematic analysis and review of our business

operations and announced an initial share repurchase authorization,

putting us solidly on the path to enhance long-term shareholder

value."

"Our performance and momentum have allowed us to raise our full

year earnings growth and margin forecasts representing the strength

in our business model, although we anticipate challenges in the

year-over-year comparisons for the second half of the year," said

Al Nietzel, Chief Financial Officer, CDK.

Growth in revenues and adjusted earnings before income taxes

were negatively impacted by about 1.5 and 2 percentage points,

respectively, due to unfavorable foreign exchange rates. Also

included in the above results is a $6.4 million pretax true-up of

the vacation accrual as of December 31, 2014 as this is a calendar

year employee benefit. On the "As Adjusted" basis, this contributed

9 points of adjusted earnings before income taxes and adjusted net

earnings growth, and over $0.02 cents per share. This item is

reported within "Selling, general, and administrative expenses" and

"Other" in segment financial data.

The above "As Adjusted" results exclude in fiscal 2015:

- $15.6 million pretax accelerated amortization of the Cobalt

trademark related to a change in useful life;

- $3.3 million of incremental costs incurred during the second

quarter of fiscal 2015 that are directly attributable to the

separation from ADP® (Nasdaq:ADP); and

- $4.6 million increase to income tax expense related to the tax

law change for bonus depreciation which ADP is entitled to

claim.

In order to present both periods on a comparable basis, the

above "As Adjusted" results include in fiscal 2014 amounts

representing certain incremental costs related to being an

independent public company in fiscal 2015 including interest

expense, stand-alone public company costs, and stock-based

compensation. Please refer to the tables at the end of this release

for a reconciliation of the "As Reported" results to the "As

Adjusted" results. All comparisons throughout the remainder of this

release are on an "As Adjusted" basis.

Automotive Retail North America

Automotive Retail North America revenues grew 7% for the second

quarter compared to last year's second quarter. Pretax earnings

increased 13% and pretax margin improved 140 basis points due to

increased operating efficiencies, partially offset by a favorable

legal settlement in last year's second quarter.

Automotive Retail International

Automotive Retail International revenues increased 3% for the

second quarter compared to last year's second quarter. Pretax

earnings increased 20% and pretax margin improved 245 basis points

for the quarter due to the impact of expenses in last year's second

quarter to right-size the operations that did not recur this year

as well as increased operating efficiencies.

Digital Marketing

Digital Marketing revenues grew 17% for the second quarter

compared to last year's second quarter. Pretax earnings more than

doubled and pretax margin expanded over 500 basis points excluding

the $15.6 million accelerated amortization of the Cobalt trademark.

Pretax margin benefited from a favorable revenue mix, increased

operating efficiencies, and lower employee benefit costs compared

with a year ago.

Separation from ADP

CDK Global, Inc. began operating as a public company on October

1, 2014 following its spin-off from ADP on September 30,

2014.

Fiscal 2015 Forecast

CDK's fiscal 2015 forecast excludes the accelerated amortization

of the Cobalt trademark and costs in connection with the spin-off.

For comparability, fiscal 2014 results have also been adjusted to

exclude spin-off related one-time costs and include certain

incremental costs related to being an independent public company.

The reconciliations to GAAP measures are included in the schedules

within this press release.

As a result of expected pressure from unfavorable foreign

exchange rates, CDK has lowered its revenue growth forecast;

however, earnings growth and margin forecasts have been raised

based on the results through the first six months of the year. On

this adjusted basis, the forecast is as follows:

- Revenues – 6% to 7% growth from $1,973.6 million in fiscal

2014

- Adjusted earnings before income taxes – 13% to 14% growth from

the adjusted $303.7 million in fiscal 2014

- Adjusted pretax margin – approximately 100 basis points of

expansion from the adjusted 15.4% in fiscal 2014

- Adjusted EBITDA margin – approximately 100 basis points of

expansion from the adjusted 20.2% in fiscal 2014

- Adjusted net earnings – 9% to 10% growth from the adjusted

$205.9 million in fiscal 2014

- Adjusted diluted earnings per share – 8% to 9% growth from the

adjusted $1.28 in fiscal 2014

Effective Tax Rate

There is no change to CDK's anticipated adjusted effective tax

rate for fiscal 2015 of 34.5% to 35.0% compared to 32.2% in fiscal

2014. This is lower than fiscal 2015's anticipated normalized

effective tax rate of 36.5% to 37.0% due to a first quarter fiscal

2015 nonrecurring income tax benefit primarily related to foreign

operations. The higher adjusted effective tax rate for the year

compared to fiscal 2014 is anticipated to negatively impact

adjusted net earnings and adjusted diluted earnings per share by

approximately $8.5 million and $0.05, respectively, or about 4

percentage points of growth. The fiscal 2015 anticipated adjusted

effective tax rate and normalized effective tax rate both exclude

the impact of the $4.6 million increase to income tax expense in

the second quarter fiscal 2015 related to the tax law change for

bonus depreciation which ADP is entitled to claim.

Website Schedules

Other financial information, including financial statements and

supplementary schedules presented on an "As Reported" and "As

Adjusted" basis for all quarters of fiscal 2014, and the schedule

of quarterly revenues and pretax earnings by reportable segment

have been updated for the second quarter of fiscal 2015 and will be

posted to the CDK Investor Relations website

http://investors.cdkglobal.com in the "Financial Information"

section.

Webcast and Conference Call

An analyst conference call will be held today, Thursday,

February 5, 2015 at 7:30 a.m. CT. A live webcast of the call will

be available on a listen-only basis. To listen to the webcast go to

CDK's Investor Relations website, http://investors.cdkglobal.com

and click on the webcast icon. Please note, this webcast will be

broadcast in two streams: Windows Media and Flash. Please check

your system at least 10 minutes prior to the webcast. A

presentation will be available to download and print about 60

minutes before the webcast at the CDK Investor Relations website at

http://investors.cdkglobal.com. CDK's news releases, current

financial information, SEC filings and Investor Relations

presentations are accessible at the same website.

About CDK Global

With nearly $2 billion in revenues, CDK GlobalTM is

the largest global provider of integrated information technology

and digital marketing solutions to the automotive retail industry

and adjacencies. CDK Global provides solutions in more than

100 countries around the world, serving more than 26,000 retail

locations and most automotive manufacturers. CDK Global's

solutions automate and integrate critical workflow processes from

pre-sale targeted advertising and marketing campaigns to the sale,

financing, insurance, parts supply, repair and maintenance of

vehicles, with an increasing focus on utilizing data analytics and

predictive intelligence. Visit cdkglobal.com.

| CDK Global,

Inc. |

|

|

|

|

| Statements of

Consolidated and Combined Earnings |

|

| (In millions,

except per share amounts) |

|

|

|

|

(Unaudited) |

|

|

|

|

| |

|

|

| |

Three Months Ended

December 31, |

Six Months Ended December

31, |

| |

|

|

|

|

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Revenues |

$ 521.2 |

$ 487.3 |

$ 1,037.2 |

$ 968.8 |

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Cost of revenues |

326.9 |

297.9 |

636.7 |

594.8 |

| Selling, general &

administrative expenses |

107.8 |

105.4 |

220.2 |

210.5 |

| Separation costs |

3.3 |

-- |

34.0 |

-- |

| Total

expenses |

438.0 |

403.3 |

890.9 |

805.3 |

| |

|

|

|

|

| Operating earnings |

83.2 |

84.0 |

146.3 |

163.5 |

| |

|

|

|

|

| Interest expense |

(9.0) |

(0.3) |

(10.1) |

(0.5) |

| Other income (expense),

net |

1.0 |

(0.1) |

1.7 |

-- |

| |

|

|

|

|

| Earnings before income

taxes |

75.2 |

83.6 |

137.9 |

163.0 |

| |

|

|

|

|

| Provision for income

taxes |

(32.7) |

(31.4) |

(56.3) |

(57.3) |

| |

|

|

|

|

| Net earnings |

$ 42.5 |

$ 52.2 |

$ 81.6 |

$ 105.7 |

| |

|

|

|

|

| |

|

|

|

|

| Net earnings per common

share: |

|

|

|

| Basic |

$ 0.26 |

$ 0.33 |

$ 0.51 |

$ 0.66 |

| Diluted |

$ 0.26 |

$ 0.33 |

$ 0.51 |

$ 0.66 |

| |

|

|

|

|

| Weighted-average common shares

outstanding |

|

|

| Basic (a) |

160.7 |

160.6 |

160.7 |

160.6 |

| Diluted (a) |

161.8 |

160.6 |

161.2 |

160.6 |

| |

|

|

|

|

| (a) On

September 30, 2014, ADP shareholders of record as of the close

of business on September 24, 2014 received one share of our

common stock for every three shares of ADP common stock held as of

the record date. For periods ended September 30, 2014 and

prior, basic and diluted earnings per share were computed using the

number of shares of our stock outstanding on September 30,

2014, the date on which our common stock was distributed to the

shareholders of ADP. The same number of shares was used to

calculate basic and diluted earnings per share because there were

no dilutive securities in those periods. |

| |

|

|

| CDK Global,

Inc. |

|

|

| Consolidated

and Combined Balance Sheets |

|

|

| (In

millions) |

|

|

|

(Unaudited) |

|

|

| |

|

|

| |

December 31, 2014 |

June 30, 2014 |

| Assets |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 402.2 |

$ 402.8 |

| Accounts receivable, net of

allowance for doubtful accounts |

319.5 |

299.1 |

| Notes receivable from ADP and

its affiliates |

-- |

40.6 |

| Other current assets |

170.4 |

164.6 |

| Total current assets |

892.1 |

907.1 |

| |

|

|

| Property, plant and equipment, net |

106.5 |

109.9 |

| Other assets |

221.5 |

205.5 |

| Goodwill |

1,189.3 |

1,230.9 |

| Intangible assets, net |

105.8 |

133.8 |

| Total assets |

$ 2,515.2 |

$ 2,587.2 |

| |

|

|

| Liabilities and Stockholders' Equity |

|

|

| Current liabilities: |

|

|

| Current maturities of long-term

debt |

$ 12.5 |

$ -- |

| Accounts payable |

15.7 |

17.2 |

| Accrued expenses and other

current liabilities |

185.5 |

154.2 |

| Accrued payroll and

payroll-related expenses |

82.9 |

105.6 |

| Short-term deferred

revenues |

183.1 |

194.8 |

| Notes payable to ADP and its

affiliates |

-- |

21.9 |

| Total current

liabilities |

479.7 |

493.7 |

| |

|

|

| Long-term debt |

984.4 |

-- |

| Long-term deferred revenues |

184.3 |

182.8 |

| Deferred income taxes |

71.3 |

76.6 |

| Other liabilities |

44.7 |

43.9 |

| Total liabilities |

1,764.4 |

797.0 |

| |

|

|

| Stockholders' equity: |

|

|

| Preferred stock |

-- |

-- |

| Common stock |

1.6 |

-- |

| Additional paid-in-capital |

657.3 |

-- |

| Retained earnings |

23.1 |

-- |

| Net parent company

investment |

-- |

1,704.6 |

| Accumulated other comprehensive

income |

68.8 |

85.6 |

| Total stockholders' equity |

750.8 |

1,790.2 |

| |

|

|

| Total liabilities and stockholders'

equity |

$ 2,515.2 |

$ 2,587.2 |

| |

|

|

|

|

|

|

|

|

|

|

|

| CDK Global,

Inc. |

|

|

|

|

|

|

|

|

|

|

|

| Segment

Financial Data |

|

|

|

|

|

|

|

|

|

|

|

| (In

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| We use certain

adjusted results, among other measures, to evaluate our operating

performance in the absence of certain items for planning and

forecasting purposes. We believe that adjusted results provide

relevant and useful information because they allow investors to

view performance in a manner similar to the method used by us and

they improve our ability to understand our operating

performance. Adjusted earnings before income taxes for the

three and six months ended December 31, 2014 excludes

incremental costs incurred that were directly attributable to our

separation from ADP and accelerated trademark

amortization. Additionally, adjusted earnings before income

taxes for the three and six months ended December 31, 2013

reflects adjustments related to separation costs, stand-alone

public company costs, trademark royalty fee, stock-based

compensation, and interest expense, as further described in the

footnotes below, in order to show these amounts on a comparable

basis with the three and six months ended December 31,

2014. Because adjusted earnings before income taxes is not a

measure of performance that is calculated in accordance with

accounting principles generally accepted in the United States

("GAAP"), it should not be considered in isolation from, or as a

substitute for, other metrics that are calculated in accordance

with GAAP. |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Segment Revenues |

Adjusted Segment

Earnings before Income Taxes |

Adjusted Segment Margin |

| |

Three Months Ended

December 31, |

Change |

Three Months Ended

December 31, |

Change |

Three Months Ended

December 31, |

Change |

| |

2014 |

2013 |

$ |

% |

2014 |

2013 |

$ |

% |

2014 |

2013 |

BPS |

| Automotive Retail North America (a) |

$ 335.2 |

$ 313.7 |

$ 21.5 |

7% |

$ 90.5 |

$ 80.3 |

$ 10.2 |

13% |

27.0% |

25.6% |

140 |

| Automotive Retail International |

87.7 |

84.8 |

2.9 |

3% |

15.9 |

13.3 |

2.6 |

20% |

18.1% |

15.7% |

245 |

| Digital Marketing (b) |

105.3 |

89.7 |

15.6 |

17% |

11.4 |

4.8 |

6.6 |

138% |

10.8% |

5.4% |

548 |

| Other (c) |

-- |

-- |

-- |

n/a |

(22.4) |

(28.9) |

6.5 |

(22)% |

n/m |

n/m |

n/m |

| Foreign exchange |

(7.0) |

(0.9) |

(6.1) |

n/m |

(1.3) |

0.3 |

(1.6) |

n/m |

n/m |

n/m |

n/m |

| Total |

$ 521.2 |

$ 487.3 |

$ 33.9 |

7% |

$ 94.1 |

$ 69.8 |

$ 24.3 |

35% |

18.1% |

14.3% |

373 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

Segment

Revenues |

Adjusted Segment

Earnings before Income Taxes |

Adjusted Segment

Margin |

| |

Six Months Ended December

31, |

Change |

Six Months Ended December

31, |

Change |

Six Months Ended December

31, |

Change |

| |

2014 |

2013 |

$ |

% |

2014 |

2013 |

$ |

% |

2014 |

2013 |

BPS |

| Automotive Retail North America (a) |

$ 662.9 |

$ 626.2 |

$ 36.7 |

6% |

$ 183.5 |

$ 156.8 |

$ 26.7 |

17% |

27.7% |

25.0% |

264 |

| Automotive Retail International |

174.1 |

169.8 |

4.3 |

3% |

28.5 |

24.5 |

4.0 |

16% |

16.4% |

14.4% |

194 |

| Digital Marketing (b) |

209.0 |

176.7 |

32.3 |

18% |

19.6 |

12.1 |

7.5 |

62% |

9.4% |

6.8% |

253 |

| Other (c) |

-- |

-- |

-- |

n/a |

(42.4) |

(46.6) |

4.2 |

n/m |

n/m |

n/m |

n/m |

| Foreign exchange |

(8.8) |

(3.9) |

(4.9) |

126% |

(1.7) |

0.5 |

(2.2) |

n/m |

n/m |

n/m |

n/m |

| Total |

$1,037.2 |

$ 968.8 |

$ 68.4 |

7% |

$ 187.5 |

$ 147.3 |

$ 40.2 |

27% |

18.1% |

15.2% |

287 |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (a) The following

table provides a reconciliation of the most directly comparable

GAAP measure to adjusted earnings before income taxes for the

Automotive Retail North America segment: |

| |

Segment Earnings

before Income Taxes |

Segment Earnings

before Income Taxes |

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

Six Months Ended December

31, |

|

|

|

|

|

|

|

| |

2014 |

2013 |

2014 |

2013 |

|

|

|

|

|

|

|

| Earnings before income taxes |

$ 90.5 |

$ 83.3 |

$ 183.5 |

$ 159.8 |

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Stand-alone public company costs (d) |

-- |

(3.0) |

-- |

(3.0) |

|

|

|

|

|

|

|

| Adjusted earnings before income taxes |

$ 90.5 |

$ 80.3 |

$ 183.5 |

$ 156.8 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (b) The following

table provides a reconciliation of the most directly comparable

GAAP measure to adjusted earnings before income taxes for the

Digital Marketing segment: |

| |

Segment Earnings

before Income Taxes |

Segment Earnings

before Income Taxes |

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

Six Months Ended December

31, |

|

|

|

|

|

|

|

| |

2014 |

2013 |

2014 |

2013 |

|

|

|

|

|

|

|

| Earnings before income taxes |

$ (4.2) |

$ 4.8 |

$ 4.0 |

$ 12.1 |

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Accelerated trademark amortization

(e) |

15.6 |

-- |

15.6 |

-- |

|

|

|

|

|

|

|

| Adjusted earnings before income taxes |

$ 11.4 |

$ 4.8 |

$ 19.6 |

$ 12.1 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (c) The following

table provides a reconciliation of the most directly comparable

GAAP measure to adjusted earnings before income taxes for the Other

segment: |

| |

Segment Loss

before Income Taxes |

Segment Loss

before Income Taxes |

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

Six Months Ended December

31, |

|

|

|

|

|

|

|

| |

2014 |

2013 |

2014 |

2013 |

|

|

|

|

|

|

|

| Loss before income taxes |

$ (25.7) |

$ (18.1) |

$ (76.4) |

$ (33.9) |

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Separation costs (f) |

3.3 |

-- |

34.0 |

-- |

|

|

|

|

|

|

|

| Stand-alone public company costs (d) |

-- |

(5.1) |

-- |

(6.0) |

|

|

|

|

|

|

|

| Trademark royalty fee (g) |

-- |

5.4 |

-- |

5.4 |

|

|

|

|

|

|

|

| Stock-based compensation (h) |

-- |

(2.4) |

-- |

(2.4) |

|

|

|

|

|

|

|

| Interest expense (i) |

-- |

(8.7) |

-- |

(9.7) |

|

|

|

|

|

|

|

| Adjusted loss before income taxes |

$ (22.4) |

$ (28.9) |

$ (42.4) |

$ (46.6) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| (d) Represents

recurring costs that are expected to be incurred as a stand-alone

company incremental to the allocations of ADP costs included within

the historical financial statements for FY2014. |

| (e) Represents

accelerated amortization recognized in the Digital Marketing

segment for the Cobalt trademark related to the change in useful

life. |

|

| (f) Represents the

removal of separation costs incurred during FY2015 that were

directly related to our separation from ADP. |

|

|

| (g) Represents the

elimination of the royalty paid to ADP for the utilization of the

ADP trademark during the three months ended December 31, 2013 as

there was no comparable royalty paid in the three months ended

December 31, 2014 due to our separation from ADP. |

| (h) Represents

additional stock-based compensation expenses for staff additions to

build out corporate functions and director compensation costs. |

| (i) Represents

interest expense incurred in FY2015 related to long-term debt

issued in conjunction with the separation. |

|

|

|

| |

|

|

|

|

|

|

|

|

| CDK Global,

Inc. |

|

|

|

|

|

|

|

|

| Consolidated

and Combined Adjusted Financial Information |

| (In millions,

except per share amounts) |

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| We use certain

adjusted results, among other measures, to evaluate our operating

performance in the absence of certain items for planning and

forecasting purposes. We believe that adjusted results provide

relevant and useful information because they allow investors to

view performance in a manner similar to the method used by us and

they improve our ability to understand our operating

performance. Adjusted earnings before income taxes, adjusted

net earnings, adjusted basic and diluted earnings per share,

EBITDA, and adjusted EBITDA for the three and six months ended

December 31, 2014 exclude incremental costs incurred that were

directly attributable to our separation from ADP, accelerated

trademark amortization, the related income tax effect of the

pre-tax adjustments, and income tax expense associated with the tax

law change for bonus depreciation. Additionally, adjusted

earnings before income taxes, adjusted net earnings, adjusted basic

and diluted earnings per share, and adjusted EBITDA for the three

and six months ended December 31, 2013 reflect adjustments

related to separation costs, stand-alone public company costs,

trademark royalty fee, stock-based compensation, interest expense,

and the related tax benefit of these pre-tax adjustments, as

further described in the footnotes below, in order to show these

amounts on a comparable basis with the three and six months ended

December 31, 2014. EBITDA is calculated as earnings

before income taxes adjusted to exclude interest expense,

depreciation, and amortization. Because adjusted earnings

before income taxes, adjusted net earnings, adjusted basic and

diluted earnings per share, EBITDA, and adjusted EBITDA are not

measures of performance that are calculated in accordance with

accounting principles generally accepted in the United States

("GAAP"), they should not be considered in isolation from, or as a

substitute for, other metrics that are calculated in accordance

with GAAP. |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

Change |

Six Months Ended December

31, |

Change |

| |

2014 |

2013 |

$ |

% |

2014 |

2013 |

$ |

% |

| |

|

|

|

|

|

|

|

|

| Earnings before income taxes |

$ 75.2 |

$ 83.6 |

$ (8.4) |

(10)% |

$ 137.9 |

$ 163.0 |

$(25.1) |

(15)% |

| Adjustments: |

|

|

|

|

|

|

|

|

| Separation costs (a) |

3.3 |

-- |

|

|

34.0 |

-- |

|

|

| Accelerated trademark

amortization (b) |

15.6 |

-- |

|

|

15.6 |

-- |

|

|

| Stand-alone public company

costs (c) |

-- |

(8.1) |

|

|

-- |

(9.0) |

|

|

| Trademark royalty fee (d) |

-- |

5.4 |

|

|

-- |

5.4 |

|

|

| Stock-based compensation

(e) |

-- |

(2.4) |

|

|

-- |

(2.4) |

|

|

| Interest expense (f) |

-- |

(8.7) |

|

|

-- |

(9.7) |

|

|

| Adjusted earnings before income taxes |

$ 94.1 |

$ 69.8 |

$24.3 |

35% |

$ 187.5 |

$ 147.3 |

$ 40.2 |

27% |

| Adjusted margin percentage |

18.1% |

14.3% |

|

|

18.1% |

15.2% |

|

|

| |

|

|

|

|

|

|

|

|

| Provision for income taxes |

$ 32.7 |

$ 31.4 |

$ 1.3 |

4% |

$ 56.3 |

$ 57.3 |

$ (1.0) |

(2)% |

| Adjustments: |

|

|

|

|

|

|

|

|

| Tax effect of adjustments above

(g) |

6.6 |

(5.4) |

|

|

10.3 |

(6.0) |

|

|

| Tax law change - bonus

depreciation (h) |

(4.6) |

-- |

|

|

(4.6) |

-- |

|

|

| Adjusted provision for income taxes |

$ 34.7 |

$ 26.0 |

$ 8.7 |

33% |

$ 62.0 |

$ 51.3 |

$ 10.7 |

21% |

| Adjusted effective tax

rate |

36.9% |

37.2% |

|

|

33.1% |

34.8% |

|

|

| |

|

|

|

|

|

|

|

|

| Net earnings |

$ 42.5 |

$ 52.2 |

$ (9.7) |

(19)% |

$ 81.6 |

$ 105.7 |

$(24.1) |

(23)% |

| Adjustments: |

|

|

|

|

|

|

|

|

| Separation costs (a) |

3.3 |

-- |

|

|

34.0 |

-- |

|

|

| Accelerated trademark

amortization (b) |

15.6 |

-- |

|

|

15.6 |

-- |

|

|

| Stand-alone public company

costs (c) |

-- |

(8.1) |

|

|

-- |

(9.0) |

|

|

| Trademark royalty fee (d) |

-- |

5.4 |

|

|

-- |

5.4 |

|

|

| Stock-based compensation

(e) |

-- |

(2.4) |

|

|

-- |

(2.4) |

|

|

| Interest expense (f) |

-- |

(8.7) |

|

|

-- |

(9.7) |

|

|

| Tax effect of adjustments above

(g) |

(6.6) |

5.4 |

|

|

(10.3) |

6.0 |

|

|

| Tax law change - bonus

depreciation (h) |

4.6 |

-- |

|

|

4.6 |

-- |

|

|

| Adjusted net earnings |

$ 59.4 |

$ 43.8 |

$15.6 |

36% |

$ 125.5 |

$ 96.0 |

$ 29.5 |

31% |

| |

|

|

|

|

|

|

|

|

| Adjusted net earnings per common share: |

|

|

|

|

|

|

|

|

| Basic |

$ 0.37 |

$ 0.27 |

|

37% |

$ 0.78 |

$ 0.60 |

|

30% |

| Diluted |

$ 0.37 |

$ 0.27 |

|

37% |

$ 0.78 |

$ 0.60 |

|

30% |

| |

|

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

| Basic (i) |

160.7 |

160.6 |

|

|

160.7 |

160.6 |

|

|

| Diluted (i) |

161.8 |

160.6 |

|

|

161.2 |

160.6 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended

December 31 |

Change |

Six Months Ended December

31 |

Change |

| |

2014 |

2013 |

$ |

% |

2014 |

2013 |

$ |

% |

| |

|

|

|

|

|

|

|

|

| Earnings before income taxes |

$ 75.2 |

$ 83.6 |

$ (8.4) |

(10)% |

$ 137.9 |

$ 163.0 |

$(25.1) |

(15)% |

| Adjustments: |

|

|

|

|

|

|

|

|

| Interest expense (j) |

9.0 |

0.3 |

|

|

10.1 |

0.5 |

|

|

| Depreciation and amortization

(k) |

33.6 |

17.0 |

|

|

51.7 |

33.5 |

|

|

| EBITDA |

$ 117.8 |

$ 100.9 |

$16.9 |

17% |

$ 199.7 |

$ 197.0 |

$ 2.7 |

1% |

| Adjustment: |

|

|

|

|

|

|

|

|

| Separation costs (a) |

3.3 |

-- |

|

|

34.0 |

-- |

|

|

| Stand-alone public company

costs (c) |

-- |

(8.1) |

|

|

-- |

(9.0) |

|

|

| Trademark royalty fee (d) |

-- |

5.4 |

|

|

-- |

5.4 |

|

|

| Stock-based compensation

(e) |

-- |

(2.4) |

|

|

-- |

(2.4) |

|

|

| Adjusted EBITDA |

$ 121.1 |

$ 95.8 |

$25.3 |

26% |

$ 233.7 |

$ 191.0 |

$ 42.7 |

22% |

| Adjusted margin % |

23.2% |

19.7% |

|

|

22.5% |

19.7% |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| (a) Represents the

removal of separation costs incurred during FY2015 that were

directly related to our separation from ADP. |

| (b) Represents

accelerated amortization recognized in the Digital Marketing

segment for the Cobalt trademark related to the change in useful

life. |

| (c) Represents

recurring costs that are expected to be incurred as a stand-alone

company incremental to the allocations of ADP costs included within

the historical financial statements for FY2014. |

| (d) Represents the

elimination of the royalty paid to ADP for the utilization of the

ADP trademark during the three months ended December 31, 2013 as

there was no comparable royalty paid in the three months ended

December 31, 2014 due to our separation from ADP. |

| (e) Represents

additional stock-based compensation expenses for staff additions to

build out corporate functions and director compensation costs. |

| (f) Represents

interest expense incurred in FY2015 related to long-term debt

issued in conjunction with the separation. |

| (g) Represents the

tax effect of adjustments using the statutory rate of 38.4% for

FY2014 for U.S. transactions, which represent the majority of the

adjustments recorded. The separation costs (described in (a)

above) were partially tax deductible. The tax adjustment

included for the three and six months ended December 31, 2014

relates only to the tax deductible portion of separation

costs. |

| (h) Represents an

adjustment to deferred taxes related to the bonus depreciation to

which ADP is entitled under the tax law and in accordance with the

tax matters agreement to claim additional tax depreciation for

assets associated with our business for tax periods prior to the

separation. |

| (i) On

September 30, 2014, ADP shareholders of record as of the close

of business on September 24, 2014 received one share of our

common stock for every three shares of ADP common stock held as of

the record date. For periods ended September 30, 2014 and

prior, basic and diluted earnings per share were computed using the

number of shares of our stock outstanding on September 30,

2014, the date on which our common stock was distributed to the

shareholders of ADP. The same number of shares was used to

calculate basic and diluted earnings per share because there were

no dilutive securities in those periods. |

| (j) Represents

interest expense included within the financial statements for the

periods presented above. |

| (k) Represents

depreciation and amortization included within the financial

statements for the periods presented above, which includes the

accelerated amortization attributable to the Cobalt trademark. |

| |

|

|

|

| CDK Global,

Inc. |

|

|

|

| Combined

Adjusted FY2014 Financial Information |

| (In millions,

except per share amounts) |

|

|

|

(Unaudited) |

|

|

|

| |

|

|

|

| We use certain

adjusted results, among other measures to evaluate our operating

performance in the absence of certain items for planning and

forecasting purposes. We believe that adjusted results provide

relevant and useful information because they allow investors to

view performance in a manner similar to the method used by us and

they improve our ability to understand our operating

performance. Adjusted earnings before income taxes, adjusted

provision for income taxes, adjusted effective tax rate, adjusted

net earnings, adjusted basic and diluted earnings per share, and

adjusted EBITDA reflect adjustments related to separation costs,

stand-alone public company costs, trademark royalty fee,

stock-based compensation, interest expense, and the related tax

benefit of these pre-tax adjustments, as further described in the

footnotes below. EBITDA is calculated as earnings before income

taxes adjusted to exclude interest expense, depreciation, and

amortization. Because adjusted earnings before income taxes,

adjusted provision for income taxes, adjusted effective tax rate,

adjusted net earnings, adjusted basic and diluted earnings per

share, EBITDA, and adjusted EBITDA are not measures of performance

that are calculated in accordance with GAAP, they should not be

considered in isolation from, or as a substitute for, other metrics

that are calculated in accordance with GAAP. |

| |

|

|

|

| |

FY2014 |

(a) |

FY2015E |

| |

|

|

|

| Revenues |

1,973.6 |

(b) |

|

| Growth % |

|

|

6 - 7% |

| |

|

|

|

| Earnings before income taxes |

343.6 |

(b) |

|

| Adjustments: |

|

|

|

| Stand-alone public company

costs |

(33.0) |

(c) |

|

| Trademark royalty fee |

16.6 |

(d) |

|

| Stock-based

compensation |

(6.6) |

(e) |

|

| Separation costs |

9.3 |

(f) |

|

| Interest expense |

(26.2) |

(g) |

|

| |

|

|

|

| |

|

|

|

| Adjusted earnings before income

taxes |

303.7 |

|

|

| Growth % |

|

|

13 - 14% |

| |

|

|

|

| Adjusted margin % |

15.4% |

|

|

| Growth |

|

|

100 bps |

| |

|

|

|

| Provision for income taxes |

116.7 |

(b) |

|

| Adjustments: |

|

|

|

| Tax benefit of adjustments

above |

(18.9) |

(h) |

|

| Adjusted provision for income taxes |

97.8 |

|

|

| Adjusted effective tax rate |

32.2% |

|

|

| |

|

|

|

| |

|

|

|

| Net earnings |

226.9 |

(b) |

|

| Adjustments: |

|

|

|

| Stand-alone public company

costs |

(33.0) |

(c) |

|

| Trademark royalty fee |

16.6 |

(d) |

|

| Stock-based

compensation |

(6.6) |

(e) |

|

| Separation costs |

9.3 |

(f) |

|

| Interest expense |

(26.2) |

(g) |

|

| Tax benefit of adjustments

above |

18.9 |

(h) |

|

| |

|

|

|

| |

|

|

|

| Adjusted net earnings |

205.9 |

|

|

| Growth % |

|

|

9 - 10% |

| |

|

|

|

| Adjusted basic and diluted earnings

per share |

1.28 |

(i)(j) |

|

| Total basic and diluted shares

outstanding |

160.6 million |

(j) |

|

| |

|

|

|

| Growth % |

|

|

8 - 9% |

| |

|

|

|

| Earnings before income taxes |

343.6 |

(b) |

|

| Adjustments: |

|

|

|

| Interest expense |

1.0 |

(b) |

|

| Depreciation and

amortization |

67.9 |

(b) |

|

| |

|

|

|

| EBITDA |

412.5 |

|

|

| Adjustments: |

|

|

|

| Stand-alone public company

costs |

(33.0) |

(c) |

|

| Trademark royalty

fee |

16.6 |

(d) |

|

| Stock-based

compensation |

(6.6) |

(e) |

|

| Separation costs |

9.3 |

(f) |

|

| |

|

|

|

| |

|

|

|

| Adjusted EBITDA |

398.8 |

|

|

| Adjusted margin % |

20.2% |

|

100 bps |

| |

|

|

|

| (a) Amounts in this

column have been adjusted to be presented on a comparable basis

with the FY2015 estimate. |

| (b) Amounts presented

in CDK's historical combined financial statements for the fiscal

year ended June 30, 2014 which were included in the Company's Form

10 filing dated September 18, 2014. |

| (c) Represents

recurring costs that are expected to be incurred as a stand-alone

company incremental to the allocations of ADP costs included within

the historical financial statements for FY2014. |

| (d) Represents the

elimination of the royalty paid to ADP for the utilization of the

ADP trademark during the period from October 1, 2013 through June

30, 2014 as there will be no comparable royalty paid in the same

period in FY2015 due to our separation from ADP. |

| (e) Represents

additional stock-based compensation expenses for staff additions to

build out corporate functions and director compensation costs. |

| (f) Represents the

removal of separation costs incurred during FY2014 that are

directly related to our separation from ADP. |

| (g) Represents

interest expense CDK will incur in FY2015 related to long-term debt

issued in conjunction with the separation. |

| (h) Represents the

tax effect of adjustments using the statutory tax rate of 38.4% for

FY2014 for U.S. transactions, which represent the majority of the

adjustments recorded. The separation costs (described in (f) above)

are not tax deductible and therefore there is no provision for

income taxes included for this adjustment. |

| (i) Computed using

adjusted net earnings shown above and total shares outstanding

described in (j) below. |

| (j) On

September 30, 2014, ADP shareholders of record as of the close

of business on September 24, 2014 received one share of our

common stock for every three shares of ADP common stock held as of

the record date. Basic and diluted earnings per share above

for FY2014 was computed using the number of shares of our stock

outstanding on September 30, 2014, the date on which our

common stock was distributed to the shareholders of ADP. The

same number of shares was used to calculate basic and diluted

earnings per share because there were no dilutive securities in

FY2014. |

| |

|

|

|

|

|

|

| CDK Global,

Inc. |

|

|

|

|

|

|

| Performance

Metrics |

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| CDK management

regularly reviews the following key performance measures in

evaluating our business results, identifying trends affecting our

business and making operating and strategic decisions. The

following table summarizes these measures for recurring

subscription revenues: |

| |

|

|

|

|

|

|

| |

|

| |

For the three

months ended |

| |

September 30,

2013 |

December 31,

2013 |

March 31, 2014 |

June 30, 2014 |

September 30,

2014 |

December 31,

2014 |

| ARNA |

|

|

|

|

|

|

| Automotive |

|

|

|

|

|

|

| DMS Client Sites (a) |

8,806 |

8,862 |

8,905 |

8,978 |

9,039 |

9,136 |

| Avg Revenue Per Site (b) |

6,285 |

6,379 |

6,586 |

6,447 |

6,640 |

6,691 |

| |

|

|

|

|

|

|

| Adjacencies |

|

|

|

|

|

|

| DMS Client Sites (a) |

4,462 |

4,503 |

4,571 |

4,600 |

4,653 |

4,831 |

| Avg Revenue Per Site (b) |

1,464 |

1,478 |

1,521 |

1,520 |

1,556 |

1,536 |

| |

|

|

|

|

|

|

| Total ARNA |

|

|

|

|

|

|

| DMS Client Sites (a) |

13,268 |

13,365 |

13,476 |

13,578 |

13,692 |

13,967 |

| Avg Revenue Per Site (b) |

4,669 |

4,741 |

4,881 |

4,789 |

4,915 |

4,914 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| ARI |

|

|

|

|

|

|

| DMS Client Sites (a) |

13,496 |

13,573 |

13,459 |

13,501 |

13,437 |

13,420 |

| Avg Revenue Per Site (b) |

1,179 |

1,181 |

1,183 |

1,208 |

1,235 |

1,228 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Digital Marketing |

|

|

|

|

|

|

| Websites (c) |

7,665 |

7,732 |

7,951 |

7,783 |

7,828 |

7,789 |

| Avg Revenue Per Website

(d) |

2,983 |

3,046 |

2,972 |

3,095 |

3,219 |

3,322 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| (a) Dealer Management

System (DMS) Client Sites -- We track the number of client sites

that have an active DMS. Consistent with our strategy of

growing our Automotive Retail client base, we view the number of

client sites purchasing our DMS solutions as an indicator of market

penetration for our Automotive Retail segments. Our DMS client

site count includes retailers with an active DMS that sell vehicles

in the automotive and adjacent markets. Adjacent markets

include heavy truck dealerships that provide vehicles to the

over-the-road trucking industry; recreation dealerships in the

motorcycle, marine and recreational vehicle industries; and heavy

equipment dealerships in the agriculture and construction equipment

industries. We consider a DMS to be active if we have billed a

subscription fee for that solution during the most recently ended

calendar month. |

| (b) Average

Revenue Per DMS Client Site -- Average revenue per Automotive

Retail DMS client site is an indicator of the adoption of our

solutions by DMS clients, and we monitor changes in this metric to

measure the effectiveness of our strategy to deepen our

relationships with our current client base through upgrading and

expanding solutions and increasing transaction volumes. We

calculate average revenue per DMS client site by dividing the

monthly applicable revenue generated from our solutions in a period

by the average number of DMS client sites in the period. |

| (c) Websites -- For

the Digital Marketing segment, we track the number of websites that

we host and develop for our OEM and automotive retail clients as an

indicator of business activity. The number of websites as of a

specified date is the total number of full function dealer websites

or portals that are currently accessible. |

| (d) Average Revenue

Per Website -- We monitor changes in our average revenue per

website as an indicator of the relative depth of our relationships

in our Digital Marketing segment. We calculate average revenue per

website by dividing the monthly revenue generated from our Digital

Marketing solutions in a period, excluding OEM advertising

revenues, by the average number of client websites in the

period. |

Forward-Looking Statements

This document contains "forward-looking statements," including

forecasts for CDK Global's fiscal year ending June 30, 2015 and CDK

Global's intention to make share repurchases, within the meaning of

the Private Securities Litigation Reform Act of 1995. Statements

that are not historical in nature and which may be identified by

the use of words like "expects," "assumes," "projects,"

"anticipates," "estimates," "we believe," "could be" and other

words of similar meaning, are forward-looking statements. These

statements are based on management's expectations and assumptions

and are subject to risks and uncertainties that may cause actual

results to differ materially from those expressed or implied by

these forward-looking statements.

Factors that could cause actual results to differ materially

from those contemplated by the forward-looking statements include:

CDK Global's success in obtaining, retaining and selling additional

services to clients; the pricing of products and services; changes

in overall market and economic conditions, technology trends, and

auto sales and advertising trends; competitive conditions; changes

in regulations; changes in technology; security breaches,

interruptions, failures and/or other errors involving CDK Global's

systems or networks; availability of skilled technical personnel

and the impact of new acquisitions and divestitures. The statements

in this press release are made as of the date of this press

release, even if subsequently made available by CDK Global on its

website or otherwise. CDK Global disclaims any obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise. These risks and

uncertainties, along with the risk factors discussed in CDK

Global's reports filed with the Securities and Exchange Commission

(SEC), including those discussed under "Item 1A. Risk Factors" in

CDK Global's Registration Statement on Form 10 for the fiscal year

ended June 30, 2014 and its Form 10-Q for the fiscal quarter ended

September 30, 2014, should be considered in evaluating any

forward-looking statements contained herein. These filings can be

found on CDK Global's website at www.cdkglobal.com and the SEC's

website at www.sec.gov.

CONTACT: Investor Relations Contacts:

Elena Rosellen

973.588.2511

elena.rosellen@cdk.com

Jennifer Gaumond

847.485.4424

jennifer.gaumond@cdk.com

Media Contact:

Michelle Benko

847.485.4389

michelle.benko@cdk.com

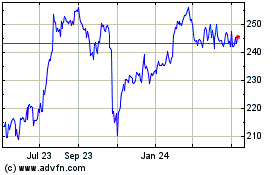

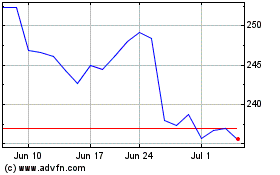

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024