Burberry's Christopher Bailey Replaced as CEO by Marco Gobbetti -- Update

July 11 2016 - 10:50AM

Dow Jones News

By Saabira Chaudhuri

Burberry Group PLC has named luxury veteran Marco Gobbetti as

its new chief executive, replacing Christopher Bailey who has

attracted strong criticism during his two-year tenure as the

British fashion label's CEO and creative head.

The company is also replacing its Chief Financial Officer Carol

Fairweather, who has worked closely with Mr. Bailey since he became

CEO in May 2014, with the CFO of global medical technology business

Smith and Nephew PLC, Julie Brown. Smith and Nephew said the search

for a new CFO is under way.

Burberry's surprise announcement--which comes after investors

have for months groused that the 45-year-old Mr. Bailey was

ill-equipped to juggle the dual roles of CEO and creative head of a

company Burberry's size--sent shares up 6.4% in afternoon trading

in London to GBP12.36 ($16).

Mr. Gobbetti, the CEO and chairman of Céline, the influential

LVMH-owned fashion and accessories brand, has worked in luxury for

the past 20 years on brands such as Givenchy, Moschino and Bottega

Veneta.

The company didn't name an exact date, only saying Mr. Gobbetti

will begin as soon as he is contractually able to do so. Ms. Brown

will start as CFO in early 2017.

Mr. Gobbetti's appointment comes as Burberry has seen sales

hammered in key markets such as Greater China and the U.S. for a

string of quarters, with little respite. The company's shares have

dropped 22% since Mr. Bailey replaced longtime CEO Angela Ahrendts

at the helm.

"This is a step forward for Burberry, where we perceived a need

of reinvention and stronger direction," said Exane BNP Paribas

analyst Luca Solca.

Mr. Bailey--who has been demoted to Burberry's president and

chief creative officer--recently announced a cost-cutting program

and a share buyback but the moves did little to quell disquiet

about the company's long-term prospects.

On Monday, analysts cautioned that the management changes aren't

a panacea.

The company's sales per square foot have generally lagged behind

those of peers while its store network has left it worse off than

rivals in recent months.

Burberry has a large store footprint in China where sales have

been hit by an anticorruption drive, and in Hong Kong where sales

have fallen following unfriendly visa policies that have

discouraged visitors from mainland China.

Relative to peers such as LVMH Moët Hennessy Louis Vuitton SE

and Prada SpA, Burberry is underrepresented in Europe and Japan,

which have seen an influx of Chinese shoppers.

While Mr. Gobbetti has a wealth of experience in the luxury

sector, Celine is a much smaller company than Burberry, logging

roughly EUR600 million ($664 million) in fiscal 2015 sales

according to Mr. Solca's estimates. Burberry last year reported

GBP2.51 billion ($3.26 billion) in sales.

Both Mr. Bailey and Mr. Gobbetti will report directly to

Burberry's Chairman John Peace. Monday's arrangement, should it

last, is something of a coup for Burberry since Mr. Bailey--who has

been with the company since 2001--is widely known as being the face

of the brand and losing him entirely would have been a significant

blow for the British trench coat maker.

The new arrangement will bring Burberry closer to the management

structure it followed under Ms. Ahrendts, where chief executive and

design responsibilities were handled separately.

While Mr. Bailey's background is largely in fashion--he

graduated with a BA in fashion design from the University of

Westminster in 1992--Mr. Gobbetti's background is more

business-focused.

Mr. Gobbetti has a degree in Business Administration from the

American University of Washington and a Masters in International

Management from the American Graduate School of International

Management in Phoenix, Arizona. He served as the CEO of Givenchy

from 2004 to 2008 and before that was the CEO of Moschino.

Burberry reports first-quarter sales on Wednesday and has its

annual shareholders meeting scheduled for Thursday in London.

The company in May said it would work to save at least GBP100

million a year by fiscal 2019 by reducing complexity, simplifying

processes and eliminating duplication in its operations. Burberry's

operating expenses are close to 500 basis points higher than its

peers according to UBS, with the company hiring about 15% more

sales staff.

Burberry on Monday highlighted Ms. Brown's experience in driving

cost-savings and restructuring programs at Smith and Nephew while

also pointing to her experience in growing revenue and profit

margins.

Ms. Brown, who will be Burberry's new finance and operations

head, takes up some of the duties of Chief Operating Officer John

Smith, who Burberry last month said was leaving the company next

summer to pursue other interests.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 11, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

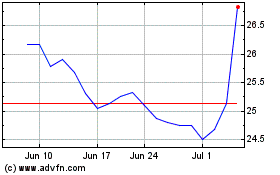

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Apr 2023 to Apr 2024