Potential successors made $1 billion wager, a rare foray into

tech for Berkshire Hathaway

Anupreeta Das

Warren Buffett's Berkshire Hathaway Inc. disclosed Monday that

it had made a $1 billion bet on Apple Inc. stock earlier this year,

boosting the iPhone maker's market value by more than $18

billion.

But to the cottage industry that fervently follows the world's

most famous investor, it just didn't seem like a move Mr. Buffett

would make.

It wasn't, as it turns out. Instead, it was among the largest

investments yet by the two former hedge-fund managers that Mr.

Buffett brought on board as potential successors to run his

company's $129 billion stock portfolio.

Mr. Buffett has long voiced his aversion to investing in

technology companies. Four years ago, he specifically ruled out

investing in Apple.

But Todd Combs, who joined Berkshire in 2011, and Ted Weschler,

who arrived a year later, have shown a willingness to wade into

corners of the market that Mr. Buffett won't touch, including the

tech sector.

The investment shows the amount of rope Mr. Buffett is willing

to give his protégés, as the legendary stock picker, who turns 86

years old in August, prepares Berkshire for a future without him at

the helm. In an email Monday, Mr. Buffett didn't say whether Mr.

Combs or Mr. Weschler made the call. But he said they each make

investment decisions without consulting him first.

The Apple position gives Berkshire a rare sizable stake in a

technology company. Its first was Mr. Buffett's $11 billion

investment in International Business Machines Corp. Mr. Buffett

made that investment in 2011 and has expanded it, most recently

early this year. IBM shares have dropped roughly 20% since

Berkshire disclosed its stake, as the company tries to turn itself

around.

The IBM investment left many Berkshire shareholders, analysts

and others scratching their heads. Mr. Buffett had long expressed

caution when it comes to tech companies. In his 1996 annual letter

to shareholders, he wrote that "many companies in high-tech

businesses or embryonic industries will grow much faster in

percentage terms...But I would rather be certain of a good result

than hopeful of a great one."

His opinion hadn't changed much as of Berkshire's annual

shareholder meeting in 2012, where Mr. Buffett said he wouldn't

invest in Google Inc. or Apple. "I just don't know how to value

them," he said.

That position changed sometime in the first quarter for

Berkshire, when Mr. Combs or Mr. Weschler bought the stock. Apple's

shares were trading in the mid-90s for much of that time. They

closed Monday up 3.7% at $93.88 but are still down nearly 11% this

year.

The tech giant's stock has been battered partly because of a

slowdown in iPhone sales, as Apple struggles to keep up the strong

growth that followed the introduction of its larger-screen

smartphones in late 2014. The 2015 successors to those initial

big-display models haven't garnered as much enthusiasm from

consumers. Last month, Apple reported its first quarterly revenue

decline since 2003.

In an interview with The Wall Street Journal at the time, Apple

Chief Executive Tim Cook said it was "a challenging quarter," but

he dismissed concerns that the company was in decline. He

attributed the slump to short-term factors such as the strong

dollar, difficult economic conditions and difficult comparisons for

iPhone sales. "It's a tough bar to hurdle, but it doesn't change

the future," he said. "The future is very bright."

Berkshire's investment managers, each of whom manages around $9

billion, appeared to agree. The Omaha, Neb., conglomerate said in a

securities filing it owned 9.81 million shares of Apple as of March

31, valued at roughly $1.07 billion. Those shares are now valued at

around $920 million.

Despite Mr. Buffett's concerns about technology, they are buying

into a company with many of the traits the billionaire investor

likes. Apple arguably has a durable "economic moat" -- or

competitive advantage -- in its more than one billion devices in

active use and constellation of services like iTunes and the App

Store that keep users tied to its devices. It also has a

predictable cash flow, and the share-price plunge likely presented

a buying opportunity.

On the other hand, Apple, like all technology companies, faces

the risk that a competitor with a more compelling product could

arise out of nowhere and reshape the industry -- as Apple did over

the past decade, devastating once powerful companies like Motorola

and Nokia.

"It appears to be a low-risk investment with considerable upside

potential...however, I do not think this is an investment that

Buffett would make," said David Kass, a Berkshire shareholder and

finance professor at the University of Maryland business school.

"Todd Combs and/or Ted Weschler...perhaps have a better

understanding of the competitive advantages Apple possesses vis a

vis the technological challenges it might face in the years

ahead."

Berkshire's investment in Apple -- the firm's only new position

taken in the quarter -- follows the exits of well-known investors

Carl Icahn and David Tepper. Mr. Icahn said last month that he had

sold his big stake, telling CNBC at the time that Apple is a great

company but no longer a "no-brainer" as an investment choice. He

said he worried about the company's ability to succeed in

China.

Mr. Icahn made his initial investment, reported to be worth

about $1.5 billion, in 2013. He subsequently bought more shares and

called for the company to boost its stock buybacks.

Mr. Tepper's Appaloosa Management LP disclosed his sale in a

securities filing Friday.

Mr. Combs received an endorsement of his stock-picking skills

when Mr. Buffett closed a deal to buy aerospace company Precision

Castparts Corp. for $32 billion earlier this year. Mr. Combs began

buying shares of Precision in 2012, a year after he joined

Berkshire, but Mr. Buffett hadn't followed the company closely

until last year.

Although Mr. Combs didn't suggest the deal to his boss, many

Berkshire shareholders were reassured that the investment managers

were picking stocks that Mr. Buffett approved of. The two men are

part of a succession plan that Mr. Buffett has put in place at

Berkshire, where his roles as chief executive, chairman and

investment manager will be split into three. Mr. Buffett has said

his son, Howard Buffett, will be Berkshire's nonexecutive chairman.

He hasn't revealed who will replace him as CEO and oversee the

conglomerate's giant insurance, industrial, utility and other

operations.

Berkshire's two stock pickers, along with Mr. Buffett's

financial assistant Tracy Britt Cool -- he calls them the "three

T's" -- are closely involved with various aspects of Berkshire's

operations. Both Mr. Combs and Mr. Weschler have worked on deals

for the conglomerate, for no extra money, as Mr. Buffett likes to

say. Mr. Weschler flew to Germany several times in 2015 to

negotiate Berkshire's deal to buy motorcycle gear maker Detlev

Louis Motorradvertriebs GmbH.

The two managers also jointly bought DirecTV stock before it was

acquired by AT&T Inc. in 2015, having built up a position worth

nearly $3 billion to become the satellite company's second-largest

shareholder. Berkshire made a tidy profit from the deal, given that

they had bought DirecTV shares for much cheaper than what AT&T

paid for them.

Mr. Buffett has said that the big, multibillion-dollar stock

holdings are his picks, whereas his two investment managers

typically buy smaller positions of a few hundred million dollars.

Among picks thought to be theirs are companies such as Mastercard

Inc., Visa Inc. as well as tech companies like data-analytics firm

Verisk Analytics Inc. and Verisign Inc., an Internet domain name

provider.

"Hiring these two was one of my best moves," Mr. Buffett said in

his latest annual letter.

--Lauren Pollock and Erik Holm contributed to this article.

Corrections & Amplifications: Berkshire exchanged most of

its position in Procter & Gamble in the quarter to buy

Duracell. An earlier version of this article incorrectly stated the

firm sold off the shares. (May 16)

(END) Dow Jones Newswires

May 17, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

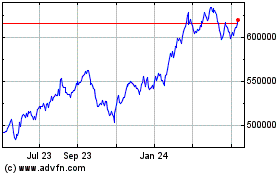

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

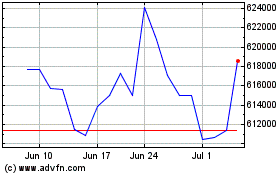

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024