By Anupreeta Das

As other investors bail out of IBM, Warren Buffett keeps piling

in.

Berkshire Hathaway Inc. bought more shares of International

Business Machines Corp. in the third quarter, according to a

securities filing, taking advantage of the stock's slide to load up

on an already large position in the technology company.

Mr. Buffett's continuing support for IBM has left many Berkshire

shareholders, analysts and others scratching their heads about what

the billionaire investor sees in the stock. Famously averse to

technology stocks, the Berkshire chairman and chief executive

officer had never made a big tech bet before IBM.

Berkshire owned about 81 million IBM shares valued at $11.75

billion as of Sept. 30, making it IBM's largest shareholder with an

8.3% stake. It first bought IBM in 2011, paying nearly $11 billion

for 5.5% of the company. Berkshire increased its ownership in

recent years through a mix of additional purchases and share

buybacks by IBM.

During this time, IBM shares have slipped about 28%, with sales

falling for the past 14 quarters. It has invested heavily in cloud

computing, security and big data as its traditional hardware and

related businesses falter. Some investors said they have soured on

the stock mainly because they are uncertain IBM's turnaround

strategy will work.

Mr. Buffett didn't respond to a request for comment.

Berkshire in the third quarter took a $2 billion book loss on

the value of its IBM stake. The amount was equivalent to 15% of its

cost to accumulate the stake, Berkshire said in its earnings report

this month. It said it has no intention of selling the stock and

expects the value of its investment not just to recover but to

eventually exceed its cost.

Mr. Buffett's moves appear to have little to do with a new

appreciation for the tech industry. Rather, as he wrote in his 2011

annual letter to shareholders, Mr. Buffett was attracted to IBM

because of its "brilliant" financial management.

"Indeed, I can think of no major company that has had better

financial management, a skill that has materially increased the

gains enjoyed by IBM shareholders," he wrote. "The company has used

debt wisely, made value-adding acquisitions almost exclusively for

cash and aggressively repurchased its own stock."

According to a survey of 23 analysts by Thomson One, only four

agree with Mr. Buffett that it makes sense to buy more shares.

"My guess is he has confidence in the management team and he

believes it should be able to add value" over the long term, said

Bernstein analyst Toni Sacconaghi. He said that in speaking with

other investors, the "profile of the investor who is interested in

owning IBM now fits the profile of the classic value investor" in

the mold of Mr. Buffett. Mr. Sacconaghi has a "hold" rating on the

stock.

IBM has long been one of the most active buyers of its own

shares. It repurchased nearly $4 billion of shares in the first

nine months of 2015. Stock buybacks are sometimes seen as a way to

return cash to shareholders, similar to dividends but without the

tax hit. By reducing the number of shares available for sale,

buybacks also boost per-share earnings for existing

shareholders.

In theory, the buybacks are supposed to increase the stock price

by shrinking the supply of shares, although in IBM's case the share

price has continued to decline in recent years. Analysts said the

company has cut back on the number of buybacks recently.

In the 2011 letter, Mr. Buffett wrote that Berkshire and other

long-term IBM shareholders benefit when the company's stock price

falls because IBM buys back more shares than it would if its stock

price was rising. They also continue to collect regular dividends

from IBM.

The most formidable challenge for IBM is coming from

cloud-computing companies that are simultaneously threatening its

hardware, services and software businesses. In response, IBM has

sold its unprofitable chip-manufacturing and Intel-based server

businesses and invested heavily in cloud-computing services,

security and products that can sift through large amounts of

data.

These new businesses, which CEO Virginia Rometty has dubbed

IBM's "strategic imperatives," haven't expanded fast enough to

match declines in the company's core businesses. The new businesses

accounted for 27% of IBM's total revenue in 2014, but their growth

rate slowed slightly in the company's most-recent quarter.

"We're going to continue to drive that transformation, but we're

not as far along as we would have thought," IBM Chief Financial

Officer Martin Schroeter said in an interview last month.

At Berkshire Hathaway's annual meeting in May, Vice Chairman

Charlie Munger acknowledged that recent advances in cloud computing

have proved a mixed bag for IBM. However, he said it was still an

enormous enterprise, and it helped that Berkshire bought the stock

at a reasonable price.

IBM is one of Berkshire's four biggest holdings in a stock

portfolio of more than $120 billion. Berkshire's positions in the

other three-- American Express Co., Coca-Cola Co. and Wells Fargo

& Co.--remained unchanged during the third quarter.

Berkshire cut its stakes in Goldman Sachs Group Inc. and

Wal-Mart Stores Inc. Mr. Buffett said in a television interview

Monday that he sold those stocks to help pay for the pending $32

billion acquisition of Precision Castparts Corp.

Robert McMillan contributed to this article.

Write to Anupreeta Das at anupreeta.das@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 16, 2015 19:14 ET (00:14 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

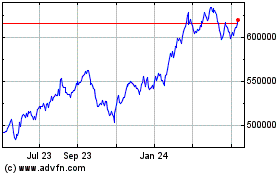

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

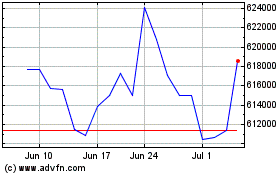

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024