By Nicole Friedman

Warren Buffett intensified his attacks on Wall Street money

managers Saturday, saying that investors wasted more than $100

billion over the last decade on expensive advice.

The billionaire devoted a large section of his widely read

Berkshire Hathaway shareholder letter to arguments against stock

pickers that charge high management fees and fail to beat the

broader market.

He also declared victory in his $1 million bet with another

asset manager that low-cost index funds would out earn hedge funds

over the span of a decade.

"The bottom line," Mr. Buffett wrote, is that "when trillions of

dollars are managed by Wall Streeters charging high fees, it will

usually be the managers who reap outsized profits, not the

clients."

The 86-year-old Mr. Buffett, whose shrewd investments have

earned him the nickname "the Oracle of Omaha," returned to several

favorite topics with trademark folksiness in his 27-page letter. He

reiterated his optimism about the future of America, rebuffed

criticisms of share buybacks and declared that he has not committed

to holding any of Berkshire's stock investments forever.

His goal, he said, is to deliver significant earnings growth

over time and predicted that will come in fits and starts. "Every

decade or so," he writes, "dark clouds will fill the economic

skies, and they will briefly rain gold. When downpours of that sort

occur, it's imperative that we rush outdoors carrying washtubs, not

teaspoons. And that we will do."

Berkshire's net earnings rose nearly 15% in the fourth quarter,

boosted in part by the stock market's end-of-year gains, but the

conglomerate's results were roughly flat for the full year. Net

earnings were $24.07 billion in 2016 as compared with $24.08

billion in 2015.

Book value, a measure of assets minus liabilities that is Mr.

Buffett's preferred yardstick for measuring net worth, rose 10.7%

in 2016, compared with a 12% total return in the S&P 500,

including dividends.

One big reason for the flat performance was a decline in

earnings for Berkshire's BNSF railroad subsidiary. Net earnings at

Berkshire's railroad fell 16% in 2016 due largely to a drop in coal

demand. Mr. Buffett didn't mention BNSF's top executives by name,

as he has in past letter. Mr. Buffett tends to only name managers

when he is praising them.

He did tout the performance of his insurance chief, Ajit Jain,

widely considered to be one of the leading candidates to take the

Berkshire CEO job when Mr. Buffett is no longer on the scene, and

noted that "float" from the conglomerate's insurance operations

exceeded $100 billion for the first time in 2017. Berkshire can

invest that money and keep any profits.

Investment gains declined for the year, partly because Berkshire

recorded such a large one-time gain in 2015 due to holdings in

Kraft Heinz Co. One of the biggest investments made by Berkshire

over the past year was the amassing of a stake in tech giant Apple

Inc., which then soared to a record high on better-than-expected

iPhone sales and building anticipation for the next edition of the

phone.

Mr. Buffett has long said his preferred time period for holding

a stock is "forever" but he noted in the letter that there can be

exceptions.

"It is true that we own some stocks that I have no intention of

selling for as far as the eye can see," he wrote. "But we have made

no commitment that Berkshire will hold any of its marketable

securities forever."

Mr. Buffett took on the subject of share repurchases and

dismissed arguments that buybacks are diverting funds from more

worthwhile expenditures. Berkshire, he said, is still willing to

buy back its shares if prices fall below 120% of book value. Based

on his latest estimate of book value, the buyback threshold stands

at roughly $207,000 per Class A share. Class A shares closed Friday

at $255,040.

Mr. Buffett praised some companies, including Bank of America

Corp., for buying back shares. "Some people have come close to

calling [buybacks] un-American -- characterizing them as corporate

misdeeds that divert funds needed for productive endeavors," Mr.

Buffett said. "That simply isn't the case."

Berkshire has warrants to buy 700 million shares of Bank of

America at $7.14 apiece. The stock closed Friday at $24.23, so Mr.

Buffett is looking at a paper gain of about $12 billion. Mr.

Buffett in his letter said he would consider exercising the

warrants if Bank of America raises its dividend to 44 cents from

30, and would exchange Berkshire's Bank of America preferred shares

to fund the transaction. A Bank of America spokesman declined to

comment.

There were a few topics Mr. Buffett avoided in his annual

letter. He said nothing about potential successors or when he might

step down as chief executive. The longtime Democrat also refrained

from directly commenting on politics despite his criticism of

President Donald Trump during last year's campaign. He attributed

America's "miraculous" economic growth to "human ingenuity, a

market system, a tide of talented and ambitious immigrants, and the

rule of law."

He instead saved his sharpest comments for pricey money managers

who pledge to beat the market, saying that in his lifetime he has

identified "ten or so professionals" who can do so successfully.

Mr. Buffett became one of the world's richest people by investing

in undervalued stocks and buying companies.

"If 1,000 managers make a market prediction at the beginning of

a year, it's very likely that the calls of at least one will be

correct for nine consecutive years," he wrote. "Of course, 1,000

monkeys would be just as likely to produce a seemingly all-wise

prophet. But there would remain a difference: The lucky monkey

would not find people standing in line to invest with him."

Invariably, he wrote, management fees eat into investors'

returns. He took aim at a popular target, the hedge fund "two and

twenty" structure, where a manager charges an annual 2% of assets

plus 20% of profits earned.

In 2007 Mr. Buffett bet $1 million that his chosen index fund,

the Vanguard 500 Index Fund Admiral Shares, would outperform hedge

funds over the next decade. The firm that took the other side of

that bet, Protégé Partners, chose five funds of hedge funds. Such

funds charge an additional layer of fees on top of those charged by

each hedge fund.

None of those five funds outperformed the S&P 500 since the

start of the bet, Mr. Buffett said in his letter. There is "no

doubt" he will win the contest when it concludes Dec. 31, he added.

The proceeds will go to the winner's chosen charity.

More investors are heeding Mr. Buffett's advice as they lose

faith in traditional money managers. Investors pulled a net $342.4

billion from U.S.-based actively managed funds last year, according

to Morningstar, while pouring a record $505.6 billion into

U.S.-based passively managed funds.

The biggest beneficiary of this shift is Vanguard Group, which

started the first index fund for individual investors 40 years ago.

At the end of January its assets reached a record $4 trillion,

following a year when Vanguard's funds pulled in more new money

than all rivals combined.

Mr. Buffett in his letter Saturday praised Vanguard founder Jack

Bogle as a "hero."

"If a statue is ever erected to honor the person who has done

the most for American investors, the handsdown choice should be

Jack Bogle."

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

February 25, 2017 13:48 ET (18:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

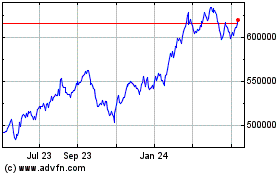

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

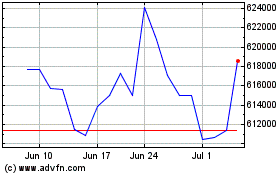

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024