Brookdale Senior Living Up with Emeritus Deal - Analyst Blog

February 24 2014 - 6:00PM

Zacks

Shares of Brentwood, TN-based Brookdale Senior Living

Inc. (BKD) rose 1.5% to $30.55 on Feb 21 as the company

signed a definitive agreement to acquire Seattle-based senior

housing services company Emeritus Corp. (ESC) a

day before.

Under the agreement, shareholders of ESC will receive 0.95 shares

of BKD for each share, putting the value of ESC at about $28.59 a

share, representing about 33% premium to closing price on the day

the deal was signed. Including debt, the deal is valued at about

$2.8 billion.

The uptick in BKD’s price is likely given the expansion of

Brookdale’s presence in large population states. Further, a growing

number of citizens living in senior-housing communities will

support the merged entity’s growth. It is for this reason BKD’s

Chief Executive Officer (CEO) Andy Smith is confident about driving

long-term revenue growth, despite having only 10% post-merger

market share.

The deal is a major footstep for BKD, which became public not too

long ago, in 2005. It was New York-based private-equity firm

Fortress Investment Group which acquired the company in 2000 and

holds a 14% stake (largest) in BKD as of Dec 31, 2013.

The merged company will offer services such as assisted living,

dementia care, skilled nursing, outpatient therapy, home health and

hospice care in more than 1,100 locations. It will increase BKD’s

units by more than two-thirds to 112,700 as it expands into the

West and Northeast states. BKD’s units in California, New York, New

Jersey and Massachusetts will increase twofold due to the deal.

The merger deal is also favorable for BKD given the impressive

fourth quarter and full year 2013 results by ESC on Feb 20. ESC’s

community, ancillary services, and management fee revenues

escalated 24.6% to $101.2 million in the fourth quarter and rose

39% to $541.7 million in the year. Adjusted EBITDAR also spiked

25.6% to $29.8 million in the quarter and surged 36.3% to $141.6

million in 2013.

On the management front, Smith will be the CEO of the merged entity

while the CEO of ESC will join the board of directors and continue

in a consulting role. Currently, shareholder rights attorneys at

Robbins Arroyo LLP are investigating the proposed merger.

Currently, BKD sports a Zacks Rank #1 (Strong Buy), while ESC

carries a Zacks Rank #3 (Hold). Other players in the healthcare

industry, which look attractive at present, include

Enzymotec Ltd. (ENZY) and NuVasive,

Inc. (NUVA). Both of them carry a Zacks Rank #1 (Strong

Buy).

BROOKDALE SENR (BKD): Free Stock Analysis Report

ENZYMOTEC LTD (ENZY): Free Stock Analysis Report

EMERITUS CORP (ESC): Free Stock Analysis Report

NUVASIVE INC (NUVA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

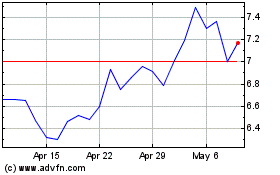

Brookdale Senior Living (NYSE:BKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

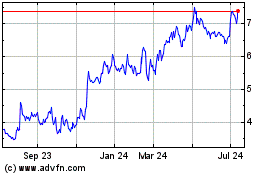

Brookdale Senior Living (NYSE:BKD)

Historical Stock Chart

From Apr 2023 to Apr 2024