British Turmoil Continues to Drain Risk From Asian Markets

June 27 2016 - 11:50PM

Dow Jones News

Shares in Asia were choppy Tuesday as uncertainty after the

U.K.'s decision to leave the European Union continued to unnerve

investors.

Stock markets across the region opened down, as a broad selloff

in U.S. and eurozone stocks overnight hit sentiment in early Asian

trade. But signs emerged that markets were stabilizing, which

reduced some losses.

Japan's Nikkei Stock Average fell as much as 1.9% in the

morning, but the benchmark then reversed losses to be about

flat.

Elsewhere in the region, Hong Kong's Hang Seng Index fell 0.9%,

Australia's S&P/ASX 200 was down 1.8%, and Korea's Kospi turned

up 0.2%. China's Shanghai Composite Index slid 0.1%.

The Australian shares of recently listed U.K. bank CYBG PLC have

fallen by more than a third since Friday, when it was clear that

Britain had chosen to leave the European Union. The firm is the

holding company for the British institutions Clydesdale Bank PLC

and Yorkshire Bank, which National Australia Bank Ltd. spun off in

an Australian listing in early February.

"It's general risk-off sentiment until there's going to be more

clarity surrounding Europe," said Alex Furber, senior client

services executive at CMC Markets in Singapore. "We just need to

see how it pans out. The selloff seems to be indiscriminate."

Traders and investors were focusing on whether the Bank of Japan

would intervene to counteract the yen's strength against the U.S.

dollar. The yen, like gold, is a traditional safe-haven asset amid

times of market turmoil, but its strength hurts the competitiveness

of Japanese exporters. The currency was recently stable at 101.79

to one U.S. dollar.

"It might dominate the behavior of the Bank of Japan, which

obviously is going to have a fairly significant effect on what we

see in Asia," Mr. Furber said.

Other havens drew investors Tuesday. In Hong Kong, the only

positive sector so far this week is a Hang Seng subindex comprised

of telecom stocks. It's up 1% this week.

Meanwhile, the price of gold was last trading at $1,324 per troy

ounce. And the yield on the newest 20-year Japanese government bond

fell to a fresh record low of 0.04%.

A small recovery could emerge this week as investors

bargain-hunt for oversold stocks, says Jacob Rappaport, managing

director and head of equity capital markets at INTL FCStone

Financial Inc.

Brent crude oil was recently trading up 0.9% at $47.59 per

barrel.

Robb Stewart contributed to this article.

Write to Dominique Fong at Dominique.Fong@wsj.com

(END) Dow Jones Newswires

June 27, 2016 23:35 ET (03:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

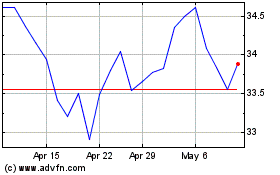

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024