British Land Co PLC Sale of 52 Poland Street

August 20 2014 - 2:01AM

RNS Non-Regulatory

TIDMBLND

British Land Co PLC

20 August 2014

20 August 2014

British Land announces the sale of 52 Poland Street

British Land announces today that it has exchanged on the sale

of 52 Poland Street, to Amazon Property for GBP26 million

reflecting a capital value of nearly GBP1,300psf.

52 Poland Street is a 20,500 sq ft multi-let building over

basement, ground and seven upper office floors. The total passing

rent of GBP693,373 equates to GBP33.84 psf. The ground and basement

floors are occupied by Yo! Sushi and Lucky Voice karaoke bar.

Located in Soho, the building is 300 metres from the new

Crossrail Station at Tottenham Court, and a short walk from Oxford

Street. Amazon Property in a JV will acquire the freehold of the

building at 51% ahead of the March 2014 book value, at a Net

Initial Yield of 2.5%.

Tim Roberts, Head of Offices, British Landsaid: "The expiry

profile at 52 Poland Street means there is potential for vacant

possession of upper parts in June 2015. The site attracted very

strong interest, reflecting the strength and depth of the WE

investment market. It is an opportune time to sell and focus on

projects elsewhere in our portfolio."

Chris Lanitis, Partner, Amazon Property said "This is a

strategic acquisition to add to our growing portfolio in an area

where we see considerable growth prospects"

CBRE and Irwin Mitchell advised British Land. Amazon Property

was unrepresented.

Enquiries:

Investor Relations

Sally Jones, British Land 020 7467 2942

Media

Andrew Scorgie, FTI Consulting 020 3727 1458

Pip Wood, British Land 020 7467 2942

About British Land

We are one of Europe's largest publicly listed real estate

companies. We own, manage, develop and finance a portfolio of high

quality commercial property, focused on retail locations around the

UK and London Offices & Residential. We have total assets in

the UK, owned or managed of GBP17.6 billion (British Land share of

which is GBP11.9 billion), as valued at 31 March 2014. Our

properties are home to over 1,000 different organisations and

receive over 300 million visits each year. Our objective is to

deliver long-term and sustainable total returns to our shareholders

and we do this by focusing on Places People Prefer. People have a

choice where they work, shop and live and we aim to create

outstanding places which make a positive difference to people's

everyday lives. Our customer orientation enables us to develop a

deep understanding of the people who use our places. We employ a

lean team of experts, who have the skills to translate this

understanding into creating the right places, and we have an

efficient capital structure which is able to effectively finance

these places.

UK Retail assets account for 53% (pro forma for developments at

estimated end value) of our portfolio. As the UK's largest listed

owner and manager of retail space, our portfolio is well matched to

the different ways people shop today, from major regional shopping

centres to single occupier locations. We are focused on being the

destination of choice for retailers and their customers by being

the best provider of spaces and services. Comprising around 25

million sq ft of retail space across 63 retail parks, 82

superstores, 14 shopping centres, 12 department stores and 77

leisure assets, the retail portfolio is modern, flexible and

adaptable to a wide range of formats.

Our Office and Residential portfolio, which accounts for 47%

(pro forma for developments at estimated end value) of our

portfolio is focused on London. We have an attractive mix of

high--quality buildings in well--managed environments and a

pipeline of development projects which will add significantly to

our portfolio. Increasingly, our offices are in mixed-use

environments which include retail and residential elements. Our 7.3

million sq ft of high quality office space includes Regent's Place

and Paddington Central in the West End and Broadgate, the premier

City office campus (50% share).

Our size and substance demands a responsible approach to

business. We believe leadership on issues such as sustainability

helps drive our performance and is core to the delivery of our

overall objective of driving shareholder value and creating Places

People Prefer.

Further details can be found on the British Land website at

www.britishland.com

About Amazon Property

Amazon Property is a multi-disciplinary investment and

development group, with an impressive track record in the real

estate sectors, in particular the prime central London luxury

residential market. To date Amazon Property has acquired well in

excess of 2 million square feet comprising investments,

developments and trading assets. Amazon Property specialises in

transforming once office/commercial spaces into stunning luxury

apartments all across Zone 1.

The company currently has a development pipeline of circa

GBP800million in GDV over 15 projects.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRASFLFIUFLSEDA

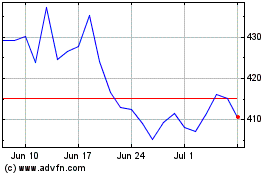

British Land (LSE:BLND)

Historical Stock Chart

From Mar 2024 to Apr 2024

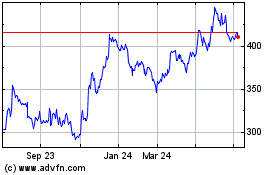

British Land (LSE:BLND)

Historical Stock Chart

From Apr 2023 to Apr 2024