British Land Co PLC Regents Place fully occupied

September 01 2014 - 2:00AM

RNS Non-Regulatory

TIDMBLND

British Land Co PLC

01 September 2014

1 September 2014

Regent's Place fully occupied following letting of 30 Brock

Street

British Land announces today that Regent's Place, its 13 acre

mixed-use campus in the West End, is fully let with The Guinness

Partnership agreeing terms for the final remaining accommodation at

30 Brock Street. The campus was completed in the summer of 2013,

with the delivery of 10 - 30 Brock Street adding 500,000 sq ft of

office, retail and residential space.

The Guinness Partnership, a charitable housing association, have

signed a ten year lease for the accommodation at 30 Brock Street.

The letting means the completed campus of 1.5m sq ft is now

fully-occupied - a significant milestone in British Land's 30 year

journey at Regent's Place.

Regent's Place has emerged as a premier London office location,

attracting a diverse mix of occupiers including Santander, JP

Morgan, Gazprom, Aegis and Facebook.

The success of Regent's Place has been built on the quality and

quantity of office space available and the larger floorplates

offered compared to other West End locations. Currently 15

companies each occupy offices of over 20,000 sq ft across the

campus. 10 Brock Street, the largest West End office building

delivered since 2010, was fully let just three months after

completion in 2013 and was selected as the UK headquarters for both

Facebook and Debenhams.

As well as delivering the office space required by modern

occupiers, British Land has transformed Regent's Place into a rich

and diverse environment. It is home to The Triton Building; a 26

storey tower with 94 residential apartments. In addition an

extensive collection of public art is also located on the campus

along with the New Diorama Theatre, and centred around Regent's

Place Plaza, an acre of public space that plays host to an array of

events, it serves as a place for people to meet, eat and spend

time.

Formerly one of Central London's most underprivileged

communities, the area surrounding Regent's Place has been boosted

by the success of the campus. The area is now in the top 1% in

London for reductions in deprivation, with the 6,400 full time jobs

created during the construction of 10 - 30 Brock Street a key

factor for the area being ranked in the top 5% in London for

improvements to employment from 2004 - 2010.

Tim Roberts, Head of Offices at British Land, said: "This deal,

which sees Regent's Place fully-let, represents another milestone

in what has been an incredible journey over the past 30 years.

Regent's Place is a great example of how British Land creates the

right spaces and environments to attract occupiers, and where

people want to work, live and visit. It has been a huge success,

and will help inform what we do at our other campuses, notably

Paddington Central."

Enquiries:

Investor Relations

Sally Jones, British Land 020 7467 2942

Media

Giles Barrie, FTI Consulting 020 3727 1042

Andrew Scorgie, FTI Consulting 020 3727 1458

Pip Wood, British Land 020 7467 2942

Gordon Simpson, Finsbury Group 020 7251 3801

About British Land

We are one of Europe's largest publicly listed real estate

companies. We own, manage, develop and finance a portfolio of high

quality commercial property, focused on retail locations around the

UK and London Offices & Residential. We have total assets in

the UK, owned or managed of GBP17.6 billion (British Land share of

which is GBP11.9 billion), as valued at 31 March 2014. Our

properties are home to over 1,000 different organisations and

receive over 300 million visits each year. Our objective is to

deliver long-term and sustainable total returns to our shareholders

and we do this by focusing on Places People Prefer. People have a

choice where they work, shop and live and we aim to create

outstanding places which make a positive difference to people's

everyday lives. Our customer orientation enables us to develop a

deep understanding of the people who use our places. We employ a

lean team of experts, who have the skills to translate this

understanding into creating the right places, and we have an

efficient capital structure which is able to effectively finance

these places.

UK Retail assets account for 53% (pro forma for developments at

estimated end value) of our portfolio. As the UK's largest listed

owner and manager of retail space, our portfolio is well matched to

the different ways people shop today, from major regional shopping

centres to single occupier locations. We are focused on being the

destination of choice for retailers and their customers by being

the best provider of spaces and services. Comprising around 25

million sq ft of retail space across 63 retail parks, 82

superstores, 14 shopping centres, 12 department stores and 77

leisure assets, the retail portfolio is modern, flexible and

adaptable to a wide range of formats.

Our Office and Residential portfolio, which accounts for 47%

(pro forma for developments at estimated end value) of our

portfolio is focused on London. We have an attractive mix of

high--quality buildings in well--managed environments and a

pipeline of development projects which will add significantly to

our portfolio. Increasingly, our offices are in mixed-use

environments which include retail and residential elements. Our 7.3

million sq ft of high quality office space includes Regent's Place

and Paddington Central in the West End and Broadgate, the premier

City office campus (50% share).

Our size and substance demands a responsible approach to

business. We believe leadership on issues such as sustainability

helps drive our performance and is core to the delivery of our

overall objective of driving shareholder value and creating Places

People Prefer.

Further details can be found on the British Land website at

www.britishland.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRADMGZRZLKGDZM

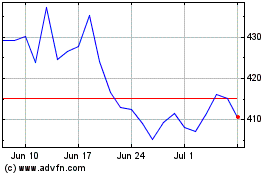

British Land (LSE:BLND)

Historical Stock Chart

From Mar 2024 to Apr 2024

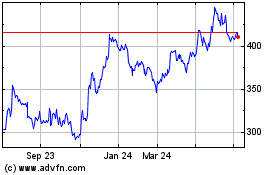

British Land (LSE:BLND)

Historical Stock Chart

From Apr 2023 to Apr 2024