British Land Co PLC British Land Cheques Metro Bank into Orpington

September 02 2014 - 2:01AM

RNS Non-Regulatory

TIDMBLND

British Land Co PLC

02 September 2014

2 September 2014

British Land Cheques Metro Bank into Orpington

British Land is pleased to announce that Metro Bank has signed

for a 5,300 sq ft unit on a 25 year lease at Nugent Shopping Park

in Orpington.

The bank, which is due to open in November, will be the

company's second in Kent and the first in British Land's current

portfolio. The deal makes good use of the relaxation in planning

policy earlier in the year permitting change of use from retail A1

to A2.

The signing follows recent lettings at the park to Card Factory

and pop up restaurant concept Pizza1889.

Edward Cree, Senior Asset Manager for British Land, said: "Metro

Bank is an excellent addition to Nugent Shopping Park's mix and

will be a welcome community amenity, providing consumers with a

seven day banking facility to meet their busy schedules. The

letting is part of our continued focus on creating well managed

environments with a broad, convenient and high quality tenant line

up."

Nugent Shopping Park is a 115,000 sq ft purpose-built 22-unit

scheme with 363 car park spaces. Occupiers include Debenhams,

M&S, Next, Clarks, Hobbycraft, Waterstones, Nando's and

Costa.

British Land was represented by Wilkinson Williams. Metro Bank

represented itself.

ENDS

Enquiries:

Investor Relations

Sally Jones, British Land 020 7467 2942

Media

Jackie Whitaker, British Land 020 7467 3449

Emma Hammond, FTI Consulting 020 3727 1227

Pip Wood, British Land 020 7467 2942

Gordon Simpson, Finsbury Group 020 7251 3801

Notes to Editors

About British Land

We are one of Europe's largest publicly listed real estate

companies. We own, manage, develop and finance a portfolio of high

quality commercial property, focused on retail locations around the

UK and London Offices & Residential. We have total assets in

the UK, owned or managed of GBP17.8 billion (British Land share of

which is GBP12.0 billion), as valued at 31 March 2014. Our

properties are home to over 1,000 different organisations and

receive over 300 million visits each year. Our objective is to

deliver long-term and sustainable total returns to our shareholders

and we do this by focusing on Places People Prefer. People have a

choice where they work, shop and live and we aim to create

outstanding places which make a positive difference to people's

everyday lives. Our customer orientation enables us to develop a

deep understanding of the people who use our places. We employ a

lean team of experts, who have the skills to translate this

understanding into creating the right places, and we have an

efficient capital structure which is able to effectively finance

these places.

UK Retail assets account for 53% of our portfolio. As the UK's

largest listed owner and manager of retail space, our portfolio is

well matched to the different ways people shop today, from major

regional shopping centres to single occupier locations. We are

focused on being the destination of choice for retailers and their

customers by being the best provider of spaces and services.

Comprising around 25 million sq ft of retail space across 66 retail

parks, 85 superstores, 15 shopping centres, 12 department stores

and 77 leisure assets, the retail portfolio is modern, flexible and

adaptable to a wide range of formats.

Our Office and Residential portfolio, which accounts for 47% of

our portfolio is focused on London, We have an attractive mix of

high--quality buildings in well--managed environments and a

pipeline of development projects which will add significantly to

our portfolio. Increasingly, our offices are in mixed-use

environments which include retail and residential elements. Our 7.3

million sq ft of high quality office space includes Regent's Place

and Paddington Central in the West End and Broadgate, the premier

City office campus (50% share).

Our size and substance demands a responsible approach to

business. We believe leadership on issues such as sustainability

helps drive our performance and is core to the delivery of our

overall objective of driving shareholder value and creating Places

People Prefer.

Further details can be found on the British Land website at

www.britishland.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAEFLFBZKFZBBD

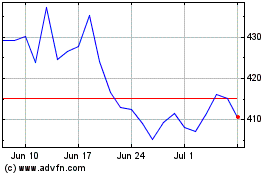

British Land (LSE:BLND)

Historical Stock Chart

From Mar 2024 to Apr 2024

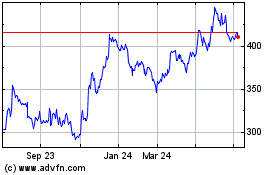

British Land (LSE:BLND)

Historical Stock Chart

From Apr 2023 to Apr 2024