- Achieves Accelerated U.S. Regulatory

Approval for Opdivo in Metastatic Melanoma

- Announces Early Stop of CheckMate

-017, a Phase 3 Study of Opdivo, After Data Demonstrates Superior

Overall Survival

- Posts Fourth Quarter GAAP EPS of

$0.01 and Non-GAAP EPS of $0.46

- Provides 2015 GAAP and Non-GAAP EPS

Guidance Range of $1.55 - $1.70

Bristol-Myers Squibb Company (NYSE:BMY) today reported results

for the fourth quarter and full year of 2014, which were

highlighted by strong global sales for priority brands and

important advances in the company’s immuno-oncology (I-O)

portfolio. The company received accelerated regulatory approval of

Opdivo in the U.S., presented encouraging clinical data for Opdivo

across several tumor types from its broad clinical program, and

announced positive results that led to the early stop of Opdivo’s

Phase 3 trial in squamous cell non-small cell lung cancer (NSCLC).

In addition, the company presented important clinical data for

Eliquis and daclatasvir and provided financial guidance for

2015.

“We had an excellent fourth quarter to close a strong year

financially and operationally, and made significant progress in our

I-O pipeline with the approval of Opdivo in the U.S. for patients

with advanced melanoma,” said Lamberto Andreotti, chief executive

officer, Bristol-Myers Squibb. “Our performance in 2014 across

brands and geographies, continued innovation and productivity in

R&D and investments in business development opportunities

reflect the strength and execution of our BioPharma strategy, and

positions us well for 2015,” Andreotti said.

Fourth Quarter $ amounts in

millions, except per share amounts

2014 2013

Change Total Revenues $4,258 $4,441 (4)% GAAP

Diluted EPS 0.01 0.44 (98)% Non-GAAP Diluted EPS 0.46 0.51 (10)%

Full Year $ amounts in millions,

except per share amounts 2014

2013 Change Total Revenues

$15,879 $16,385 (3)% GAAP Diluted EPS 1.20 1.54 (22)% Non-GAAP

Diluted EPS 1.85 1.82 2%

FOURTH QUARTER FINANCIAL

RESULTS

- Bristol-Myers Squibb posted fourth

quarter 2014 revenues of $4.3 billion, a decrease of 4% compared to

the same period a year ago. Excluding the divested Diabetes

Alliance, global revenues increased 6% or 9% adjusted for foreign

exchange impact.

- U.S. revenues decreased 8% to $2.1

billion in the quarter compared to the same period a year ago.

International revenues were flat.

- Gross margin as a percentage of

revenues was 77.3% in the quarter compared to 71.3% in the same

period a year ago. The increase is primarily attributable to the

diabetes divestiture.

- Marketing, selling and administrative

expenses increased 8% to $1.2 billion in the quarter.

- Advertising and product promotion

spending decreased 16% to $213 million in the quarter.

- Research and development expenses

increased 24% to $1.2 billion in the quarter, primarily due to

timing.

- The effective tax rate was 145% in the

quarter, compared to 15.4% in the fourth quarter last year. Income

taxes in the current quarter include net tax benefits attributed to

specified items and the R&D credit for the full year 2014.

- The company reported net earnings

attributable to Bristol-Myers Squibb of $13 million, or $0.01 per

share, in the quarter compared to $726 million, or $0.44 per share,

a year ago. The results in the quarter include an after-tax $0.28

per share impact of a non-cash charge resulting from the transfer

of $1.5 billion of U.S. pension obligations to Prudential.

- The company reported non-GAAP net

earnings attributable to Bristol-Myers Squibb of $771 million, or

$0.46 per share, in the fourth quarter, compared to $842 million,

or $0.51 per share, for the same period in 2013. An overview of

specified items, including the pension-related charge mentioned

above, is discussed under the “Use of Non-GAAP Financial

Information” section.

- Cash, cash equivalents and marketable

securities were $11.8 billion, with a net cash position of $4.0

billion, as of December 31, 2014.

FOURTH QUARTER PRODUCT AND PIPELINE

UPDATE

Bristol-Myers Squibb’s global sales in the fourth quarter

included Eliquis, which grew by $210 million, Yervoy, which grew

41%, Orencia, which grew 12%, Sprycel, which grew 9%, and Daklinza

and Sunvepra, which had combined sales of $207 million.

Opdivo

- In January, the company announced that

an open-label, randomized Phase 3 study evaluating Opdivo, a human

programmed death receptor-1 (PD-1) blocking antibody, versus

docetaxel in previously treated patients with advanced, squamous

cell NSCLC was stopped early because an assessment conducted by the

independent Data Monitoring Committee concluded that the study met

its endpoint, demonstrating superior overall survival in patients

receiving Opdivo compared to the control arm. The company will

share these data – which for the first time indicate a survival

advantage with an anti-PD-1 immune checkpoint inhibitor in lung

cancer – with health authorities.

- In December, the U.S. Food and Drug

Administration (FDA) approved Opdivo injection for intravenous use.

Opdivo is indicated for the treatment of patients with unresectable

or metastatic melanoma and disease progression following Yervoy

and, if BRAF V600 mutation positive, a BRAF inhibitor. Opdivo

received accelerated approval for this indication based on tumor

response rate and durability of response. Continued approval for

this indication may be contingent upon verification and description

of clinical benefit in the confirmatory trials.

- In December, at the American Society

for Hematology (ASH) annual meeting in San Francisco, the company

announced positive results from a cohort of patients in CheckMate

-039, its ongoing Phase 1b trial evaluating Opdivo in patients with

relapsed or refractory hematological malignancies (n=23). Results

showed high levels of response in patients with relapsed or

refractory classical Hodgkin lymphoma, with an overall response

rate of 87% (n=20) and stable disease in 13% (n=3). The findings

were published in The New England Journal of Medicine (NEJM).

- In November, at the Society for

Melanoma Research international congress in Zurich, Switzerland,

the company announced results from CheckMate -066, a Phase 3

randomized, double-blind study, comparing Opdivo to the

chemotherapy dacarbazine in patients with treatment-naïve BRAF

wild-type advanced melanoma (n=418). The study met the primary

endpoint of overall survival with the median overall survival not

reached for Opdivo vs. 10.8 months for dacarbazine. The one-year

survival rate was 73% for Opdivo vs. 42% for dacarbazine and there

was a 58% decrease in the risk of death for patients treated with

Opdivo (hazard ratio for death: 0.42, P<0.0001). This survival

advantage was also observed in Opdivo-treated patients who are

positive or negative for programmed death ligand-1 (PD-L1). The

findings were published in NEJM.

- In October, at the Chicago

Multidisciplinary Symposium on Thoracic Oncology, the company

announced results from CheckMate -063, a Phase 2 single-arm,

open-label study of Opdivo administered as a single agent in

patients with advanced squamous cell NSCLC who have progressed

after at least two prior systemic treatments. Sixty-five percent of

patients studied (n=117) received three or more prior therapies.

With approximately 11 months of minimum follow-up, the objective

response rate – the study’s primary endpoint – was 15% (95% CI =

8.7, 22.2) as assessed by an independent review committee using

RECIST 1.1 criteria and the median duration of response was not

reached. The estimated one-year survival rate was 41% (95% CI =

31.6, 49.7) and median overall survival was 8.2 months (95% CI =

6.05, 10.91).

Eliquis

- In December, at the ASH meeting in San

Francisco, the company and its partner, Pfizer, announced results

of the first human study evaluating the reversal of the

anticoagulant effect of Eliquis by 4-factor prothrombin complex

concentrates in healthy subjects. The study results demonstrated

that both Sanquin’s Cofact, a heparin-free formulation, and CSL

Behring’s Beriplex® P/N, a formulation containing heparin, reversed

the steady-state pharmacodynamic effects of Eliquis.

- In November, the company and its

partner, Pfizer, along with Portola Pharmaceuticals announced

results from the first part of the Phase 3 ANNEXA™-A studies for

Andexanet alfa, Portola’s investigational anti-Factor Xa agent to

reverse the anticoagulant effect of Eliquis. Andexanet alfa

produced rapid and nearly complete reversal (approximately 94%,

P<0.0001) of the anticoagulant effect of Eliquis in healthy

volunteers ages 50-75. The data were presented at the American

Heart Association Scientific Sessions in Chicago.

Daclatasvir

- In November, the FDA issued a Complete

Response Letter regarding the New Drug Application (NDA) for

daclatasvir, an NS5A complex inhibitor, in combination with other

agents for the treatment of hepatitis C (HCV). The initial

daclatasvir NDA focused on its use in combination with asunaprevir,

an NS3/4A protease inhibitor. Given the withdrawal of asunaprevir

in the U.S. by Bristol-Myers Squibb in October, the FDA is

requesting additional data about daclatasvir in combination with

other antiviral agents for the treatment of HCV. Daclatasvir is

marketed as Daklinza in Japan and the European Union.

- In November, the company announced

results from the landmark ALLY trial investigating a ribavirin-free

12-week regimen of daclatasvir in combination with sofosbuvir in

genotype 3 HCV patients, a patient population that has emerged as

one of the most difficult to treat. The data, which showed

sustained virologic response 12 weeks after treatment (SVR12) in

90% of treatment-naïve and 86% of treatment-experienced patients,

were presented at the annual meeting of the American Association

for the Study of Liver Diseases (AASLD) in Boston.

- In November, also at AASLD, the company

announced data from the UNITY trial program investigating a 12-week

regimen of its all-oral daclatasvir-based TRIO regimen – a

fixed-dose combination of daclatasvir with asunaprevir and

beclabuvir – in a broad range of patients with genotype 1 HCV. In

the UNITY-2 study, which evaluated cirrhotic patients, 98% of

treatment-naïve and 93% of treatment-experienced cirrhotic patients

receiving TRIO with ribavirin achieved SVR12 and 93% of

treatment-naïve and 87% of treatment-experienced cirrhotic patients

receiving TRIO without ribavirin achieved SVR12. In the open-label

UNITY-1 study, which evaluated the TRIO regimen without ribavirin

in treatment-naïve and treatment-experienced non-cirrhotic patients

for 12 weeks with 24 weeks of follow-up, 91% of patients achieved

SVR12 and 92% of treatment-naive patients and 89% of

treatment-experienced patients achieved cure without the use of

ribavirin.

Orencia

- In November, at the American College of

Rheumatology annual meeting in Boston, the company announced

results from several new sub-analyses of the Phase 3b AVERT trial

investigating the use of Orencia plus methotrexate (MTX) in

biologic and methotrexate-naïve citrullinated protein

(CCP)-positive early moderate to severe rheumatoid arthritis (RA)

patients. The subanalyses showed that first-line treatment with

Orencia plus MTX resulted in patients with early RA achieving

significantly higher rates of stringent measures of remission;

reduced the development of anti-CCP antibodies, an indicator of

more severe, persistent, and erosive disease in patients with early

rapidly progressing RA; improved synovitis and osteitis scores at

12 months; and improved joint erosion scores at both 12 and 18

months, compared to MTX alone.

FOURTH QUARTER BUSINESS DEVELOPMENT

UPDATE

- In January, the company announced a

clinical trial collaboration agreement with Seattle Genetics to

evaluate the investigational combination of Opdivo with Seattle

Genetics’ antibody drug conjugate Adcetris® (brentuximab vedotin)

in two planned Phase 1/2 clinical trials. The first trial will

evaluate the combination of Opdivo and Adcetris® as a potential

treatment option for patients with relapsed or refractory Hodgkin

lymphoma, and the second trial will focus on patients with relapsed

or refractory B-cell and T-cell non-Hodgkin lymphomas, including

diffuse large B-cell lymphoma.

- In January, the company announced a

clinical trial collaboration with Lilly to evaluate the safety,

tolerability and preliminary efficacy of Opdivo in combination with

Lilly’s galunisertib (LY2157299), a TGF beta R1 kinase inhibitor.

The Phase 1/2 trial will evaluate the investigational combination

of Opdivo and galunisertib as a potential treatment option for

patients with advanced (metastatic and/or unresectable)

glioblastoma, hepatocellular carcinoma and NSCLC.

- In January, the company announced a

worldwide research collaboration with the California Institute for

Biomedical Research (Calibr) to develop novel small molecule

anti-fibrotic therapies, and an exclusive license agreement that

allows Bristol-Myers Squibb to develop, manufacture and

commercialize Calibr’s preclinical compounds resulting from the

collaboration.

- In December, the company and its

partner, Ono Pharmaceutical Co., Ltd., along with Kyowa Hakko Kirin

Co., Ltd., announced a clinical trial collaboration agreement to

conduct a Phase 1 combination study of Opdivo and mogamulizumab, an

anti-CCR4 antibody. The study, which will be conducted in Japan,

will focus on evaluating the safety, tolerability and anti-tumor

activity of combining Opdivo and mogamulizumab as a potential

treatment option for patients with advanced or metastatic solid

tumors.

- In November, the company and Five Prime

Therapeutics, Inc., announced that they have entered into an

exclusive clinical collaboration agreement to evaluate the safety,

tolerability and preliminary efficacy of combining Opdivo with

FPA008, Five Prime’s monoclonal antibody that inhibits the colony

stimulating factor-1 receptor. The Phase 1a/1b study will evaluate

the combination of Opdivo and FPA008 as a potential treatment

option for patients with NSCLC, melanoma, head and neck cancer,

pancreatic cancer, colorectal cancer and malignant glioma.

- In November, the company announced

plans to construct a state-of-the-art, large-scale biologics

manufacturing facility in Cruiserath, County Dublin, Ireland. The

facility will produce multiple therapies for the company’s growing

biologics portfolio and significantly increase Bristol-Myers

Squibb’s biologics manufacturing capacity.

- In November, the company and Galecto

Biotech AB announced that the companies, together with Galecto’s

shareholders, have entered into an agreement that provides

Bristol-Myers Squibb the exclusive option to acquire Galecto

Biotech AB and gain worldwide rights to its lead asset TD139, a

novel inhaled inhibitor of galectin-3 in Phase 1 development for

the treatment of idiopathic pulmonary fibrosis and other pulmonary

fibrotic conditions.

- In October, the company and Lonza

announced a multi-year expansion of their existing biologics

manufacturing agreement. Lonza will produce commercial quantities

of a second Bristol-Myers Squibb biologic medicine at its mammalian

manufacturing facility in Portsmouth, New Hampshire.

- In October, the company and F-star

Alpha Ltd. announced that the companies, together with F-star

Alpha’s shareholders, have entered into an agreement that provides

Bristol-Myers Squibb the exclusive option to acquire F-star Alpha,

and gain worldwide rights to its lead asset, FS102. FS102 is a

novel, Phase 1-ready human epidermal growth factor receptor 2

(HER2)-targeted therapy in development for the treatment of breast

and gastric cancer among a well-defined population of HER2-positive

patients who do not respond or become resistant to current

therapies.

Adcetris® is a registered trademark of Seattle Genetics,

Inc.

ANNEXA™ is a trademark of Portola Pharmaceuticals, Inc.

Beriplex® P/N is a trademark of CSL Behring GmbH

2015 FINANCIAL GUIDANCE

Bristol-Myers Squibb is setting its 2015 GAAP and non-GAAP EPS

guidance range at $1.55 - $1.70. Both GAAP and non-GAAP guidance

assume current exchange rates. Key 2015 non-GAAP guidance

assumptions include:

- Worldwide revenues between $14.4

billion and $15.0 billion.

- Full-year gross margin as a percentage

of revenues of approximately 74%.

- Advertising and promotion expense

decreasing in the mid- to high-teen-digit range.

- Marketing, sales and administrative

expenses decreasing in the mid- to high-single-digit range.

- Research and development expenses

decreasing in the low-single-digit range.

- An effective tax rate of approximately

19%.

The financial guidance for 2015 excludes the impact of any

potential future strategic acquisitions and divestitures, and any

specified items that have not yet been identified and quantified.

The non-GAAP 2015 guidance also excludes other specified items as

discussed under “Use of Non-GAAP Financial Information.” Details

reconciling adjusted non-GAAP amounts with the amounts reflecting

specified items are provided in supplemental materials available on

the company’s website.

Use of Non-GAAP Financial

Information

This press release contains non-GAAP financial measures,

including non-GAAP earnings and related earnings per share

information. These measures are adjusted to exclude certain costs,

expenses, significant gains and losses and other specified items.

Among the items in GAAP measures but excluded for purposes of

determining adjusted earnings and other adjusted measures are:

restructuring and other exit costs; accelerated depreciation

charges; IPRD and asset impairments; charges and recoveries

relating to significant legal proceedings; upfront, milestone and

other payments for in-licensing of products that have not achieved

regulatory approval which are immediately expensed; net

amortization of acquired intangible assets and deferred income

related to Amylin; pension settlement charges; significant tax

events and additional charges related to the Branded Prescription

Drug Fee. This information is intended to enhance an investor’s

overall understanding of the company’s past financial performance

and prospects for the future. Non-GAAP financial measures provide

the company and its investors with an indication of the company’s

baseline performance before items that are considered by the

company not to be reflective of the company’s ongoing results. The

company uses non-GAAP gross profit, non-GAAP marketing, selling and

administrative expense, non-GAAP research and development expense,

and non-GAAP other income and expense measures to set internal

budgets, manage costs, allocate resources, and plan and forecast

future periods. Non-GAAP effective tax rate measures are primarily

used to plan and forecast future periods. Non-GAAP earnings and

earnings per share measures are primary indicators the company uses

as a basis for evaluating company performance, setting incentive

compensation targets, and planning and forecasting of future

periods. This information is not intended to be considered in

isolation or as a substitute for financial measures prepared in

accordance with GAAP.

Statement on Cautionary

Factors

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 regarding, among other things, statements relating to

goals, plans and projections regarding the company’s financial

position, results of operations, market position, product

development and business strategy. These statements may be

identified by the fact that they use words such as "anticipate",

"estimates", "should", "expect", "guidance", "project", "intend",

"plan", "believe" and other words and terms of similar meaning in

connection with any discussion of future operating or financial

performance. Such forward-looking statements are based on current

expectations and involve inherent risks and uncertainties,

including factors that could delay, divert or change any of them,

and could cause actual outcomes and results to differ materially

from current expectations. These factors include, among other

things, effects of the continuing implementation of governmental

laws and regulations related to Medicare, Medicaid, Medicaid

managed care organizations and entities under the Public Health

Service 340B program, pharmaceutical rebates and reimbursement,

market factors, competitive product development and approvals,

pricing controls and pressures (including changes in rules and

practices of managed care groups and institutional and governmental

purchasers), economic conditions such as interest rate and currency

exchange rate fluctuations, judicial decisions, claims and concerns

that may arise regarding the safety and efficacy of in-line

products and product candidates, changes to wholesaler inventory

levels, variability in data provided by third parties, changes in,

and interpretation of, governmental regulations and legislation

affecting domestic or foreign operations, including tax

obligations, changes to business or tax planning strategies which

take into account assumptions about the continued extension of the

R&D tax credit, difficulties and delays in product development,

manufacturing or sales including any potential future recalls,

patent positions and the ultimate outcome of any litigation matter.

These factors also include the company’s ability to execute

successfully its strategic plans, including its business strategy,

the expiration of patents or data protection on certain products,

including assumptions about the company’s ability to retain patent

exclusivity of certain products, and the impact and result of

governmental investigations. There can be no guarantees with

respect to pipeline products that future clinical studies will

support the data described in this release, that the compounds will

receive necessary regulatory approvals, or that they will prove to

be commercially successful; nor are there guarantees that

regulatory approvals will be sought, or sought within currently

expected timeframes, or that contractual milestones will be

achieved. For further details and a discussion of these and other

risks and uncertainties, see the company's periodic reports,

including the annual report on Form 10-K, quarterly reports on Form

10-Q and current reports on Form 8-K, filed with or furnished to

the Securities and Exchange Commission. The company undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or

otherwise.

Company and Conference Call Information

Bristol-Myers Squibb is a global biopharmaceutical company whose

mission is to discover, develop and deliver innovative medicines

that help patients prevail over serious diseases. For more

information, please visit www.bms.com or follow us on Twitter at

http://twitter.com/bmsnews.

There will be a conference call on January 27, 2015, at 9 a.m.

EST during which company executives will review financial

information and address inquiries from investors and analysts.

Investors and the general public are invited to listen to a live

webcast of the call at http://investor.bms.com or by dialing

647-788-4901, confirmation code: 23518879. Materials related to the

call will be available at the same website prior to the conference

call.

BRISTOL-MYERS SQUIBB COMPANY

SELECTED PRODUCTS

FOR THE THREE MONTHS ENDED DECEMBER 31,

2014 AND 2013

(Unaudited, dollars in millions)

Worldwide Revenues U.S. Revenues 2014 2013

%

Change

2014 2013 %

Change

Three Months Ended December 31, Key

Products

Virology Baraclude $ 341 $ 412 (17)% $ 21 $ 81

(74)% Hepatitis C Franchise 207 — N/A — — N/A Reyataz 318 384 (17)%

176 187 (6)% Sustiva Franchise 407 427 (5)% 340 307 11%

Oncology Erbitux(a) 181 180 1% 171 176 (3)% Opdivo 5 — N/A 1

— N/A Sprycel 398 365 9% 184 157 17% Yervoy 366 260 41% 199 148 34%

Neuroscience Abilify(b) 476 635 (25)% 423 435 (3)%

Immunoscience Orencia 443 397 12% 289 256 13%

Cardiovascular Eliquis 281 71 ** 136 48 ** Diabetes

Alliance 47 455 (90)% (4 ) 322 ** Mature Products and All

Other 788 855 (8)% 146 148 (1)% Total 4,258 4,441 (4)% 2,082

2,265 (8)% Total Excluding Diabetes Alliance 4,211 3,986 6%

2,086 1,943 7% ** In excess of 100% (a)

Erbitux is a trademark of ImClone LLC. ImClone LLC is a

wholly-owned subsidiary of Eli Lilly and Company. (b) Abilify is a

trademark of Otsuka Pharmaceutical Co., Ltd.

BRISTOL-MYERS SQUIBB COMPANY

SELECTED PRODUCTS

FOR THE TWELVE MONTHS ENDED DECEMBER 31,

2014 AND 2013

(Unaudited, dollars in millions)

Worldwide Revenues U.S. Revenues 2014 2013

%

Change

2014 2013 %

Change

Twelve Months Ended December 31, Key

Products

Virology Baraclude $ 1,441 $ 1,527 (6)% $ 215 $ 289

(26)% Hepatitis C Franchise 256 — N/A

—

— N/A Reyataz 1,362 1,551 (12)% 689 769 (10)% Sustiva Franchise

1,444 1,614 (11)% 1,118 1,092 2%

Oncology

Erbitux 723 696 4% 682 682

—

Opdivo 6 — N/A 1 — N/A Sprycel 1,493 1,280 17% 671 541 24% Yervoy

1,308 960 36% 709 577 23%

Neuroscience Abilify 2,020 2,289

(12)% 1,572 1,519 3%

Immunoscience Orencia 1,652 1,444 14%

1,064 954 12%

Cardiovascular Eliquis 774 146 ** 404 97 **

Diabetes Alliance 295 1,683 (82)% 110 1,242 (91)%

Mature Products and All Other 3,105 3,195 (3)% 481 556 (13)%

Total 15,879 16,385 (3)% 7,716 8,318 (7)% Total Excluding

Diabetes Alliance 15,584 14,702 6% 7,606 7,076 7%

** In excess of 100%

BRISTOL-MYERS SQUIBB COMPANY

CONSOLIDATED STATEMENTS OF EARNINGS

FOR THE THREE AND TWELVE MONTHS ENDED

DECEMBER 31, 2014 AND 2013

(Unaudited, dollars and shares in millions

except per share data)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013 Net product

sales $ 3,240 $ 3,298 $ 11,660 $ 12,304 Alliance and other revenues

1,018 1,143 4,219 4,081 Total Revenues

4,258 4,441 15,879 16,385 Cost

of products sold 966 1,273 3,932 4,619 Marketing, selling and

administrative 1,151 1,068 4,088 4,084 Advertising and product

promotion 213 254 734 855 Research and development 1,189 957 4,534

3,731 Other (income)/expense 799 20 210 205

Total Expenses 4,318 3,572 13,498

13,494 Earnings Before Income Taxes (60 ) 869 2,381

2,891 Provision for Income Taxes (87 ) 134 352 311

Net Earnings 27 735 2,029 2,580 Net Earnings

Attributable to Noncontrolling Interest 14 9 25

17 Net Earnings Attributable to BMS $ 13 $ 726

$ 2,004 $ 2,563 Earnings per Common

Share Basic $ 0.01 $ 0.44 $ 1.21 $ 1.56 Diluted $ 0.01 $ 0.44 $

1.20 $ 1.54 Average Common Shares Outstanding: Basic 1,660

1,648 1,657 1,644 Diluted 1,673 1,666 1,670 1,662 Other

(Income)/Expense Interest expense $ 53 $ 53 $ 203 $ 199 Investment

income (30 ) (28 ) (101 ) (104 ) Provision for restructuring 91 14

163 226 Litigation charges/(recoveries) 4 25 23 20 Equity in net

income of affiliates (26 ) (38 ) (107 ) (166 ) Out-licensed

intangible asset impairment 11 — 29 — Gain on sale of product

lines, businesses and assets 3 (1 ) (564 ) (2 ) Other alliance and

licensing income (50 ) (28 ) (404 ) (148 ) Pension curtailments,

settlements and special termination benefits 740 27 877 165 Other 3

(4 ) 91 15 Other (income)/expense $ 799

$ 20 $ 210 $ 205

BRISTOL-MYERS SQUIBB COMPANY

SPECIFIED ITEMS

FOR THE THREE AND TWELVE MONTHS ENDED

DECEMBER 31, 2014 AND 2013

(Unaudited, dollars in millions)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013 Accelerated

depreciation, asset impairment and other shutdown costs $ 31 $ 36 $

151 $ 36 Amortization of acquired Amylin intangible assets — 137 —

549 Amortization of Amylin alliance proceeds — (71 ) — (273 )

Amortization of Amylin inventory adjustment — — —

14

Cost of products sold 31 102 151 326

Additional year of Branded Prescription Drug Fee — — 96 — Process

standardization implementation costs 1 10 9 16

Marketing, selling and administrative 1 10 105 16

Upfront, milestone and other payments 50 16 278 16 IPRD

impairments — — 343 —

Research and

development 50 16 621 16 Provision for restructuring 91

14 163 226 Gain on sale of product lines, businesses and assets 3 —

(559 ) — Pension curtailments, settlements and special termination

benefits 740 25 877 161 Acquisition and alliance related items(a) —

— 72 (10 ) Litigation charges/(recoveries) 15 — 27 (23 )

Out-licensed intangible asset impairment 11 — 11 — Loss on debt

redemption — — 45 — Upfront, milestone and other licensing receipts

(10 ) — (10 ) (14 )

Other (income)/expense 850 39 626

340

Increase to pretax income 932 167 1,503 698

Income tax on items above (297 ) (51 ) (545 ) (242 )

Specified tax charge(b) 123 — 123 —

Income taxes (174 ) (51 ) (422 ) (242 )

Increase to net earnings

$ 758 $ 116 $ 1,081 $ 456

(a)

Includes $16 million of additional year of

Branded Prescription Drug Fee.

(b)

The 2014 specified tax charge relates to

transfer pricing matters.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF CERTAIN NON-GAAP LINE

ITEMS TO CERTAIN GAAP LINE ITEMS

FOR THE THREE MONTHS ENDED DECEMBER 31,

2014 AND 2013

(Unaudited, dollars in millions)

Specified Non Three Months Ended December 31, 2014 GAAP

Items* GAAP Gross Profit $ 3,292 $ 31 $ 3,323 Marketing, selling

and administrative 1,151 (1 ) 1,150 Research and development 1,189

(50 ) 1,139 Other (income)/expense 799 (850 ) (51 ) Effective Tax

Rate 145.0 % (135.0 )% 10.0 % Specified Non Three Months

Ended December 31, 2013 GAAP Items* GAAP Gross Profit $ 3,168 $ 102

$ 3,270 Marketing, selling and administrative 1,068 (10 ) 1,058

Research and development 957 (16 ) 941 Other (income)/expense 20

(39 ) (19 ) Effective Tax Rate 15.4 % 2.5 % 17.9 %

* Refer to the Specified Items schedule for further details.

Effective tax rate on the Specified Items represents the difference

between the GAAP and Non-GAAP effective tax rate.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF CERTAIN NON-GAAP LINE

ITEMS TO CERTAIN GAAP LINE ITEMS

FOR THE TWELVE MONTHS ENDED DECEMBER 31,

2014 AND 2013

(Unaudited, dollars in millions)

Specified Non Twelve Months Ended December 31, 2014 GAAP

Items* GAAP Gross Profit $ 11,947 $ 151 $ 12,098 Marketing, selling

and administrative 4,088 (105 ) 3,983 Research and development

4,534 (621 ) 3,913 Other (income)/expense 210 (626 ) (416 )

Effective Tax Rate 14.8 % 5.1 % 19.9 % Specified Non Twelve

Months Ended December 31, 2013 GAAP Items* GAAP Gross Profit $

11,766 $ 326 $ 12,092 Marketing, selling and administrative 4,084

(16 ) 4,068 Research and development 3,731 (16 ) 3,715 Other

(income)/expense 205 (340 ) (135 ) Effective Tax Rate 10.8 % 4.6 %

15.4 %

* Refer to the Specified Items schedule for further details.

Effective tax rate on the Specified Items represents the difference

between the GAAP and Non-GAAP effective tax rate.

BRISTOL-MYERS SQUIBB COMPANY

RECONCILIATION OF NON-GAAP EPS TO GAAP

EPS

FOR THE THREE AND TWELVE MONTHS ENDED

DECEMBER 31, 2014 AND 2013

(Unaudited, dollars and shares in millions

except per share data)

Three Months Ended Twelve Months Ended December 31, December

31, 2014 2013 2014 2013 Net Earnings

Attributable to BMS used for Diluted EPS Calculation - GAAP $ 13 $

726 $ 2,004 $ 2,563 Less Specified Items* 758 116

1,081 456 Net Earnings used for Diluted EPS Calculation –

Non-GAAP $ 771 $ 842 $ 3,085 $ 3,019

Average Common Shares Outstanding – Diluted 1,673 1,666 1,670 1,662

Diluted Earnings Per Share — GAAP $ 0.01 $ 0.44 $ 1.20 $

1.54 Diluted EPS Attributable to Specified Items 0.45 0.07

0.65 0.28 Diluted Earnings Per Share — Non-GAAP $

0.46 $ 0.51 $ 1.85 $ 1.82

* Refer to the Specified Items schedule for further details.

BRISTOL-MYERS SQUIBB COMPANY

NET CASH/(DEBT) CALCULATION

AS OF DECEMBER 31, 2014 AND SEPTEMBER 30,

2014

(Unaudited, dollars in millions)

December 31, 2014 September 30, 2014 Cash and cash

equivalents $ 5,571 $ 4,851 Marketable securities - current 1,864

2,370 Marketable securities - long term 4,408 4,328

Cash, cash equivalents and marketable securities 11,843

11,549 Short-term borrowings and current portion of long-term debt

(590 ) (401 ) Long-term debt (7,242 ) (7,267 )

Net cash

position $ 4,011 $ 3,881

Bristol-Myers Squibb CompanyKen Dominski,

609-252-5251ken.dominski@bms.comCommunicationsorJohn Elicker,

609-252-4611john.elicker@bms.comorRanya Dajani,

609-252-5330ranya.dajani@bms.comorRyan Asay,

609-252-5020ryan.asay@bms.comInvestor Relations

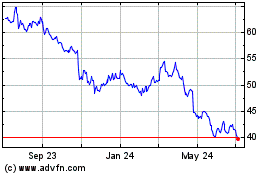

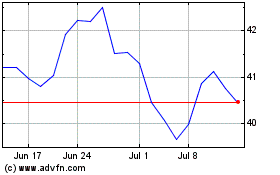

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024