Bristol-Myers Squibb Makes Moves to Reassure Investors

October 27 2016 - 1:26PM

Dow Jones News

By Jonathan D. Rockoff and Tess Stynes

Bristol-Myers Squibb Co. sought to convince investors Thursday

that its future was bright despite a major cancer drug setback by

unveiling an organizational revamp and $3 billion share buyback

while reporting better-than-expected quarterly results.

Shares in the New York-based drug company lost as much as a

third of their value after it announced in August that

immunotherapy Opdivo failed to meet the main goal of a critical

study exploring the drug's first-line use in advanced lung cancer

patients.

Investors and analysts feared the surprise setback would give a

competing drug from rival Merck & Co. a competitive advantage

in the multibillion-dollar immunotherapy market. That drug,

Keytruda, was approved Monday for use in first-line lung-cancer

patients.

In the third quarter, Opdivo sales rose to $920 million, up from

$305 million during the period a year earlier. That was less than

what many analysts had expected.

"The trends are good, and we feel optimistic about Opdivo in

both the short and long term," Bristol CEO Giovanni Caforio said in

a conference call.

Bristol shares rose more than 6% in morning trading on the New

York Stock Exchange after the company upped its financial outlook

for this year, offered a better-than-expected forecast for next

year and outlined its plans to stay atop the lung-cancer

immunotherapy market.

Bristol's share repurchases will come on top of $1.1 billion in

buybacks remaining under a previous program.

Mr. Caforio said the company's reorganization began earlier this

year and will streamline certain operations, such as its supply

chain for pills. Bristol didn't provide financial details, except

to say that excluding certain items, it expects operating expenses

through 2020 to remain at roughly this year's level.

Bristol pioneered cancer immunotherapy, which aims to fight

cancer by unshackling the body's immune system. Mr. Caforio said

Bristol still has bright prospects treating first-line lung cancer

patients by combining Opdivo with its other immunotherapy Yervoy,

which is under study.

"This will be a combination market," Mr. Caforio said.

Yervoy sales rose 19% to $285 million world-wide for the third

quarter. Revenue from another key Bristol product, the bloodthinner

Eliquis, jumped 90% to $884 million globally.

Overall, Bristol-Myers Squibb reported a profit of $1.2 billion,

or 72 cents a share, up from $706 million, or 42 cents a share, a

year earlier. Revenue increased 21%, to $4.92 billion.

For 2016, the company raised its per-share earnings estimate to

$2.80 to $2.90, from its previous estimate for per-share profit of

$2.55 to $2.65.

Looking ahead to 2017, Bristol-Myers gave preliminary guidance

for per-share earnings of $2.85 and $3.05, while analysts polled by

Thomson Reuters expected per-share profit of $2.19.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 27, 2016 13:11 ET (17:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

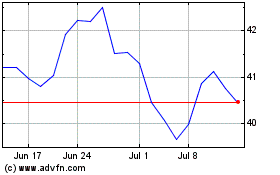

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

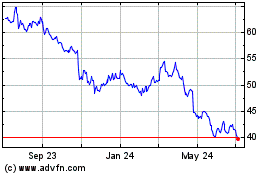

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024