Bristol-Myers Squibb Cuts Guidance on Cancer Drug Problems

January 26 2017 - 7:30AM

Dow Jones News

By Anne Steele

Bristol-Myers Squibb Co. slashed its guidance for the year as

the drugmaker contends with dimmed prospects for its top cancer

drug after major setbacks during the final quarter of the year.

For 2017, the company now expects adjusted earnings of $2.70 to

$2.90 a share, down from its previous guidance of $2.85 to

$3.05.

Bristol pioneered cancer immunotherapy, treatment that aims to

fight cancer by harnessing the body's immune system, but it has

been losing ground to competitors in recent months, including Merck

& Co.'s Keytruda.

After Bristol announced in August that its immunotherapy Opdivo

failed to meet the main goal of a critical study exploring the

drug's first-line use in advanced lung cancer patients, the company

sought to convince investors it still had bright prospects treating

first-line lung cancer patients by combining Opdivo with its other

immunotherapy Yervoy, which is under study.

But last week, Bristol said it won't pursue speedy U.S.

regulatory approval to market that combination as a first-line

treatment for lung cancer. That announcement fed fears the company

is losing ground in the race for this all-important patient

group.

During the fourth quarter, Opdivo sales rose to $1.3 billion, up

from $475 million during the period a year earlier. Yervoy sales

edged 0.4% lower to $264 million world-wide. Revenue from another

key Bristol product, the blood thinner Eliquis, jumped 57% to $948

million globally.

In all for the December period, Bristol-Myers Squibb posted

earnings of $894 million, or 53 cents a share, compared with a loss

of $197 million, or 12 cents a share, a year earlier. The 2015

results included after-tax charges of 24 cents a share from the

Five Prime Therapeutics Inc. and Cardioxyl Pharmaceuticals Inc.

business development transactions and 8 cents a share for the

transfer of the Erbitux business in North America to Eli Lilly

& Co.

Excluding certain items, adjusted earnings rose to 63 cents a

share from 38 cents. Revenue surged 22%, to $5.24 billion.

Analysts polled by Thomson Reuters had predicted earnings of 67

cents a share on $5.13 billion in revenue.

In the previous quarter, Bristol said it had begun a

reorganization to streamline certain operations, such as its supply

chain for pills. The company provided no update on the

reorganization in Thursday's report.

Also last week, Merck agreed to pay $625 million plus royalties

on Keytruda sales to Bristol and Ono Pharmaceutical Co. to settle a

suit alleging the cancer drug violates their patent for

immunotherapy.

Bristol and Ono filed suit in federal court in Delaware in 2014,

the same day that Merck received U.S. Food and Drug Administration

approval to market Keytruda as a treatment for the deadly skin

cancer melanoma.

Bristol and Ono, who discovered and developed the PD-1 antibody

Opdivo, had asserted in litigation that Merck's sale of Keytruda

infringed the companies' patents relating to the use of PD-1

antibodies to treat cancer in the U.S., Europe, Australia and

Japan.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 26, 2017 07:15 ET (12:15 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

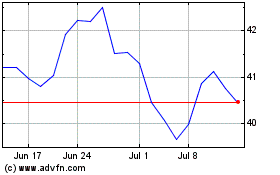

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

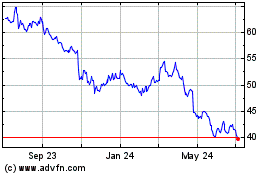

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024