Bristol-Myers Results Boosted by Cancer Drugs -- Update

July 28 2016 - 1:26PM

Dow Jones News

By Jonathan D. Rockoff and Tess Stynes

Bristol-Myers Squibb Co. said its second-quarter revenue rose

17% and it raised its earnings forecast for the year as the

company's bet on cancer immunotherapies continues to pay off while

other drugs show gains.

The drugmaker was the first to bring to market an immunotherapy,

which aims to fight cancer by unshackling the body's immune system.

Sales of its newest immunotherapy, Opdivo, rose to $840 million in

the quarter, up $718 million from a year earlier and accounting for

much of Bristol's revenue gains in the quarter.

Sales of hepatitis C treatments and the blood thinner Eliquis,

which Bristol sells with Pfizer Inc., also increased

substantially.

"We just finished another good quarter," Bristol CEO Giovanni

Caforio said during a conference call Thursday.

For the three-month period ended June 30, Bristol's revenue rose

to $4.87 billion from $4.16 billion a year earlier. The company

reported profit of $1.17 billion, or 69 cents a share, compared

with a year-earlier loss of $130 million, or 8 cents a share.

Analysts expected per-share profit of 67 cents.

The year-earlier period included charges of 48 cents a share

related to the company's acquisition of biotechnology company

Flexus, which provided Bristol-Myers with a pipeline of

investigational immunotherapy treatments.

Per-share earnings and revenue both beat expectations, and

Bristol now expects per-share earnings of $2.55 to $2.65 for the

year, up from its previous estimate of $2.50 to $2.60.

Opdivo and Eliquis do face stiff competition, and Bristol

executives cautioned that the company's hepatitis C sales would

probably drop as a new rival regimen from Gilead Sciences Inc.

starts getting reimbursed in Europe.

Opdivo, also known as nivolumab, was first approved for sale in

December 2014 for advanced melanoma and has since received

approvals for other diseases, most recently for classical Hodgkin

lymphoma. Sales could rise even higher, according to analysts, if

the drug's development for front-line treatment of lung cancer pans

out; Bristol could report results from a pivotal clinical trial in

the third quarter.

Sales of Yervoy, Bristol's first skin-cancer immunotherapy drug,

declined again in the latest quarter, falling 19% to $241 million

globally. Opdivo's growth likely cannibalized Yervoy's sales and

contributed to the drop, analysts said. In the U.S., Yervoy sales

increased 32% to $179 million thanks to the drug's use in

combination with Opdivo.

Eliquis sales grew 78% to $777 million, and sales of hepatitis C

drugs increased 14% to $546 million.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

July 28, 2016 13:11 ET (17:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

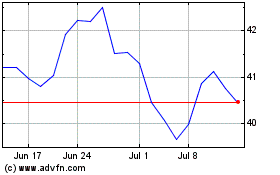

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

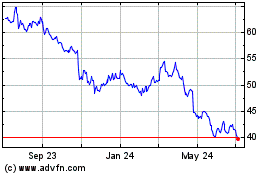

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024