Brinker Profit Skids As Chili's Same-Restaurant Sales Fall

April 19 2016 - 10:50AM

Dow Jones News

Brinker International Inc. reported profit dropped 12% in the

most recent quarter as the casual-dining company's sales at

established stores were dented by a decline in customer traffic and

margins tightened.

Despite an adjusted earnings beat, shares slipped 5%

premarket—after a 1.2% decline over the past three months—to

$45.25.

"While we continue to deliver strong cash flow and positive

earnings growth through the year, we are disappointed in our recent

sales performance," said Chief Executive Wyman Roberts. "Our focus

going forward is to more aggressively invest in our brands to grow

comp sales and capture market share."

Sales, excluding newly opened and closed locations, fell 4.1% at

company-owned Chili's stores amid a 4.9% decline in customer

traffic. Chili's franchised stores saw a 1.7% decline, including

2.2% domestically and 0.7% abroad.

Company-owned same-restaurant sales edged a 0.2% increase at its

Maggiano's chain as traffic picked up 1.1% there.

Overall for the period ended March 23, Brinker reported a profit

of $57.5 million, or $1 a share, down from $65.4 million, or $1.02

a share, a year earlier. Excluding one-time items, adjusted

per-share earnings rose to $1 from 94 cents. Revenue climbed 5.1%

to $824.6 million.

Analysts polled by Thomson Reuters expected per-share earnings

of 98 cents on revenue of $843 million.

Restaurant operating margin fell to 17.4% from 18.9%.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 19, 2016 10:35 ET (14:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

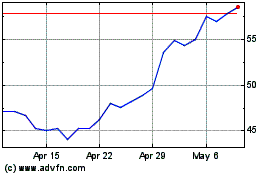

Brinker (NYSE:EAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brinker (NYSE:EAT)

Historical Stock Chart

From Apr 2023 to Apr 2024