By Robert Wall

LONDON -- There is no Plan B.

That is what many companies across Europe have been telling

investors since Britain voted to leave the European Union. The exit

and its timing are so uncertain, executives say, that few companies

had any meaningful contingency plans to either defend against the

fallout or take advantage of the opportunity.

"I can't even assess the impacts this could have on us in

operational terms," says Maurizio Focchi, chief executive of

Focchi, a family-controlled Italian construction company with about

90% of its revenue in the U.K. Almost 70% of German firms surveyed

by the Federation of German Industries, or BDI, ahead of the vote

said they didn't know how they would react to a Brexit vote.

Vodafone Group PLC says the vote means it might have to move its

headquarters from Newbury, England, to somewhere else in Europe. It

also might not. It is "not yet possible to draw any firm

conclusions," the company said last week.

"My message to my investors," says Michael O'Leary, chief

executive of Ryanair Holdings PLC, Europe's biggest airline by

passengers flown, "is don't ask me for what this means, because we

don't know."

Any big election brings uncertainty for businesses. None in

recent years has raised so many questions for corporations, over

such a broad swath of industries and geography, as last month's

vote by Britain to leave the EU. In the short term at least, that

has paralyzed planning and investment in boardrooms across the

continent.

Negotiations about how Britain will disentangle itself from the

EU could last as long as two years and might not start until next

year. The talks could maintain the status quo or radically alter

Britain's relationship with the European common market.

Cie. de Saint-Gobain SA, a French maker of construction

materials with large operations in the U.K., hadn't made plans for

a possible Brexit because the timing and scope of any impact are

impossible to pin down, said Chief Executive Pierre-André de

Chalendar.

While many bigger firms opposed Brexit, many smaller British

business owners said a break from Brussels would allow them to

thrive unencumbered by EU regulations.

Emma Pullen, chief executive of British Hovercraft Co., a

manufacturer of small hovercrafts near Sandwich, England, said

there will be short-term uncertainties, but the vote was great news

longer term. Her own contingency plan: She gave all 15 of her

employees a paid holiday to celebrate.

In the immediate aftermath, no sector outside of finance has

been convulsed more than airlines.

More than 70% of flights taking off or landing at British

airports are international ones, with 53% of those on average bound

for other EU countries, according to consultant Oliver Wyman.

Ryanair and rivals with major hubs in Britain, including easyJet

PLC and British Airways parent International Consolidated Airlines

Group SA, are especially vulnerable.

Investors have punished the sector. On Monday, Ryanair shares in

London were down 15.6% since the June 23 vote. EasyJet was off

29.5% and IAG was down 29%.

The falling pound threatens to boost costs of new planes and

fuel, which are usually purchased in dollars. Most airlines hedge

currency exposure, though that would only defer the pain if the

pound's weakness is prolonged. The biggest long-term worry for the

industry is how a split might affect years of harmonized rules and

regulation governing civil aviation across Europe.

Mr. O'Leary, Ryanair's chief executive since 1994, called it the

worst industry shock since the terror attacks of Sept. 11, 2001.

Before going to bed the night of the vote, he authorized one of the

steepest, recent fare sales at Ryanair.

Mr. O'Leary said the question of future traffic rights -- where

and how frequently Ryanair can land at British airports -- is a big

uncertainty. That makes planning for U.K. expansion impossible.

Shortly after the vote he said he was unlikely to move any of the

50 new jets Ryanair is putting into service next year in the

U.K.

As an Irish-based company, Ryanair may need to get a new air

operator certificate, or AOC, from Britain, should the country

leave the EU. The certificate is an internationally recognized

permit granted to an airline that demonstrates it can fly safely.

Airlines need a second license certifying they are financially

healthy.

The British government last week postponed a politically charged

decision on how to address a looming airport-capacity shortage in

London. It cited the Brexit vote.

At rival easyJet, Chief Executive Carolyn McCall had a slightly

more detailed Plan B. The budget carrier is based at a small

airport in Luton, England, about an hour's drive from London. It is

the hub of a sprawling European network. About 43% of its flights

are outside the U.K.

Early Friday after the vote, Ms. McCall reached out to staff and

made calls to investors. She had prewritten letters ready to ship

off to European and British aviation regulators, urging them to

quickly draft air regulations that a split would require.

Minutes after British Prime Minister David Cameron announced his

plans to resign, Ms. McCall issued a statement aimed at easing

investor concern.

British Airways' parent IAG took more drastic action. Ahead of

the vote, Chief Executive Willie Walsh had avoided staking out a

public position for the airline. Privately, he said, Brexit would

be bad for business generally, but wouldn't materially affect IAG

operations.

That changed June 24. Midmorning, IAG warned earnings growth

would fall short of forecasts. Business travel, one of IAG's

biggest profit drivers, had slowed significantly in the run-up to

the referendum, the airline said. The vote's outcome made an

expected recovery uncertain.

The following Monday, easyJet issued its own profit warning. For

months, Ms. McCall had been talking informally to several other EU

member countries about the airline's biggest problem in the event

of a Brexit: It may need to set up an additional European

headquarters somewhere besides Britain to allow it to hold on to

its EU traffic rights.

In recent days, the company said, Ms. McCall's informal talks

over a new European home have become formal ones.

--Manuela Mesco, Inti Landauro and Alex MacDonald contributed to

this article.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

July 04, 2016 17:10 ET (21:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

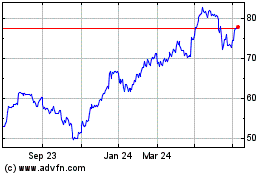

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Apr 2023 to Apr 2024